Investor Concerns About Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on Overvaluation

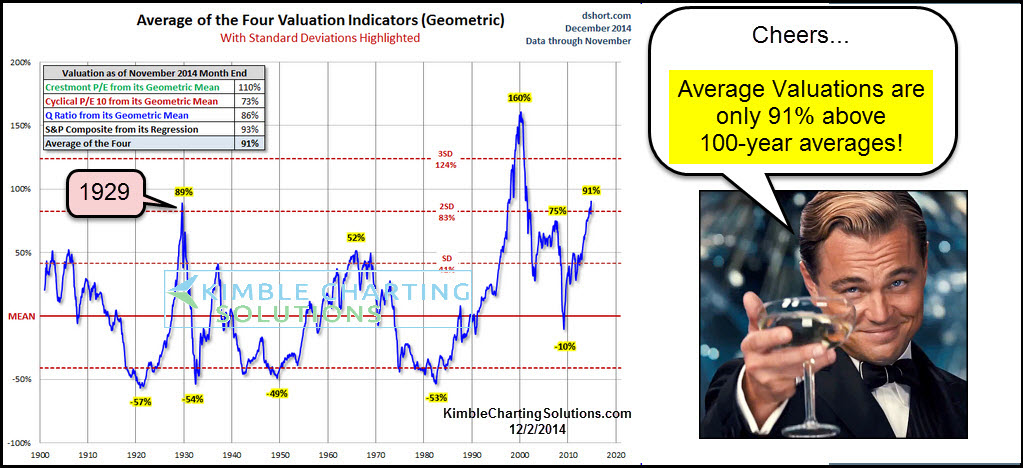

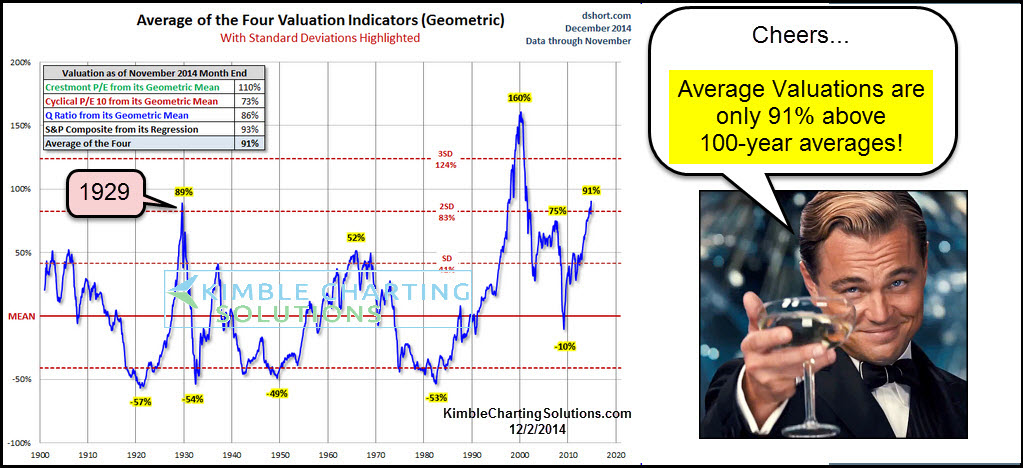

BofA's recent report highlights significant concerns regarding current stock market valuations, suggesting that certain sectors might be significantly overvalued. Their analysis centers on the argument that current market prices don't fully reflect underlying risks and potential future economic downturns.

-

Specific metrics used: BofA utilized several key metrics to assess valuations, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), and various other valuation multiples, comparing them to historical averages and industry benchmarks. Understanding these ratios is critical to assessing whether a stock or sector is appropriately priced relative to its earnings potential.

-

Key sectors identified as potentially overvalued: The report pinpointed specific sectors, such as technology and consumer discretionary, as exhibiting particularly high valuations compared to their historical averages and future earnings projections. This highlights the sector-specific risks within the broader market.

-

Comparison to historical averages: BofA's analysis compared current valuation multiples to their historical averages, revealing a significant divergence. This comparison offers valuable context, showing how current valuations stand against long-term trends and suggesting the possibility of a market correction. High market capitalization in certain sectors further reinforces this concern.

-

Specific stock examples: While the report didn't explicitly name individual stocks, the analysis implicitly highlighted certain high-growth technology companies as potential candidates for overvaluation based on their market capitalization and projected earnings.

Impact of Interest Rate Hikes on Stock Market Valuations

Rising interest rates significantly impact stock market valuations. The Federal Reserve's monetary policy plays a crucial role in shaping the investment landscape.

-

Inverse relationship between bond yields and stock valuations: Higher interest rates increase bond yields, making bonds a more attractive investment compared to stocks. This inverse relationship leads to a decrease in the demand for stocks, putting downward pressure on their valuations. The increased discount rate applied to future cash flows also plays a significant role.

-

Impact on discounted cash flow models: Discounted cash flow (DCF) models are commonly used to value stocks. Rising interest rates increase the discount rate in these models, lowering the present value of future cash flows and thus reducing the perceived worth of a company's stock. This means a higher cost of capital for businesses.

-

Effects on company profitability and investment decisions: Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing investment in growth opportunities. This can negatively affect future earnings and consequently stock valuations. The equity risk premium also increases during such periods.

Other Factors Contributing to Investor Anxiety

Beyond BofA's valuation concerns, several other factors fuel investor anxiety and contribute to market volatility.

-

Geopolitical risks: Ongoing geopolitical tensions, such as the war in Ukraine and trade disputes between major economies, introduce uncertainty into the market, impacting investor sentiment and stock prices. This uncertainty is often reflected in market volatility.

-

Inflation and its impact on corporate earnings: Persistent inflation increases production costs for companies, potentially squeezing profit margins and negatively affecting corporate earnings. This can lead to lower stock prices and increased market uncertainty.

-

Supply chain disruptions: Ongoing supply chain disruptions can negatively affect production, leading to increased costs and reduced availability of goods. This impacts corporate earnings and increases economic uncertainty.

-

Potential recessionary pressures: Concerns about a potential recession further exacerbate investor anxiety, leading to increased risk aversion and decreased stock valuations. Market participants actively assess the probability of a recession, directly impacting stock prices.

Strategies for Navigating Uncertain Stock Market Valuations

Despite the challenges, investors can employ strategies to navigate the current market environment and mitigate risk associated with stock market valuations.

-

Diversification strategies: Diversifying investments across different asset classes (stocks, bonds, real estate) and sectors helps reduce the impact of any single investment's underperformance. A well-diversified portfolio is crucial for managing risk.

-

Importance of long-term investment horizons: Focusing on long-term investment goals and maintaining a disciplined investment strategy can help weather short-term market fluctuations. A longer time horizon often allows for recovery from market downturns.

-

Considering value investing approaches: Value investing focuses on identifying undervalued companies with strong fundamentals. This strategy can provide protection against market overvaluation and generate attractive returns over the long term.

-

Importance of due diligence and fundamental analysis: Thorough due diligence and fundamental analysis are crucial for making informed investment decisions. Understanding a company's financials, business model, and competitive landscape is essential for assessing its intrinsic value.

Conclusion

BofA's analysis highlights significant concerns about stock market valuations, suggesting potential overvaluation in certain sectors. Coupled with rising interest rates, geopolitical risks, inflation, and supply chain issues, investors face a challenging environment. However, by employing diversification strategies, focusing on long-term horizons, considering value investing, and performing thorough due diligence, investors can better manage their risk exposure related to stock market valuations. Understanding the complexities of stock market valuations is crucial for informed investment decisions. By carefully considering BofA's analysis and exploring the strategies outlined above, investors can better navigate the current market and manage their risk exposure. Remember to conduct your own thorough research and seek professional financial advice before making any investment decisions. (Link to BofA's original report would go here if available)

Featured Posts

-

The Carrie Underwood Taylor Swift Drama What Really Happened

May 18, 2025

The Carrie Underwood Taylor Swift Drama What Really Happened

May 18, 2025 -

Cassie Speaks Out After Diddy Assault Video Claims Reveals Good News

May 18, 2025

Cassie Speaks Out After Diddy Assault Video Claims Reveals Good News

May 18, 2025 -

Are Universities Facing A Financial Meltdown Examining Pay Cuts And Layoffs

May 18, 2025

Are Universities Facing A Financial Meltdown Examining Pay Cuts And Layoffs

May 18, 2025 -

No Fortnite On I Os A Deep Dive Into The Reasons Behind The Ban

May 18, 2025

No Fortnite On I Os A Deep Dive Into The Reasons Behind The Ban

May 18, 2025 -

Snl Censorship Debate Bowen Yangs Take On On Air Profanity

May 18, 2025

Snl Censorship Debate Bowen Yangs Take On On Air Profanity

May 18, 2025

Latest Posts

-

Analyzing Mlb Home Run Props May 8th Betting Preview And Schwarbers Chances

May 18, 2025

Analyzing Mlb Home Run Props May 8th Betting Preview And Schwarbers Chances

May 18, 2025 -

Best Mlb Home Run Prop Bets For May 8th Focusing On Kyle Schwarber

May 18, 2025

Best Mlb Home Run Prop Bets For May 8th Focusing On Kyle Schwarber

May 18, 2025 -

May 8th Mlb Baseball Home Run Prop Bets And Analysis

May 18, 2025

May 8th Mlb Baseball Home Run Prop Bets And Analysis

May 18, 2025 -

Mlb Home Run Prop Bets May 8th Predictions And Best Odds

May 18, 2025

Mlb Home Run Prop Bets May 8th Predictions And Best Odds

May 18, 2025 -

Dodgers Bet On Conforto A Hernandez Esque Revival

May 18, 2025

Dodgers Bet On Conforto A Hernandez Esque Revival

May 18, 2025