Investment Insights: Why CoreWeave (CRWV) Experienced A Stock Price Surge

Table of Contents

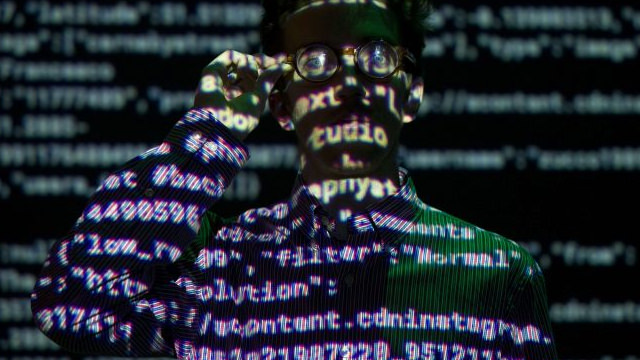

Strong Market Demand for AI and GPU Computing

The unprecedented demand for AI and machine learning applications is a primary catalyst behind the CoreWeave (CRWV) stock price surge. The rise of generative AI models, particularly large language models, requires immense computational power, significantly increasing the need for high-performance computing (HPC) resources. CoreWeave's specialized infrastructure, built around Graphics Processing Units (GPUs), perfectly addresses this burgeoning need. Their strategic positioning within this rapidly expanding market is a key factor driving their success.

- Increased adoption of generative AI models: The popularity of tools like ChatGPT and DALL-E 2 is fueling exponential demand for GPU-based computing.

- Growing demand for GPU-accelerated computing in various industries: Sectors like finance (high-frequency trading, risk modeling), healthcare (drug discovery, medical imaging), and research (scientific simulations, data analysis) are increasingly relying on GPU-accelerated computing solutions.

- Shortage of GPU resources: The limited availability of high-end GPUs is creating a bottleneck, and CoreWeave is effectively addressing this scarcity by providing scalable and accessible GPU cloud computing resources.

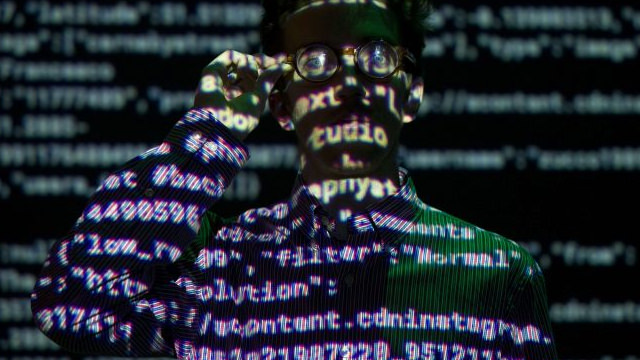

CoreWeave's Competitive Advantages and Business Model

CoreWeave's success isn't just about being in the right market; it's about having a superior business model. Their cloud computing platform is specifically designed to leverage the power of GPUs, offering a highly scalable and efficient solution for AI and HPC workloads. This focus on GPU-centric infrastructure sets them apart from general-purpose cloud providers.

- Focus on sustainability and energy efficiency: CoreWeave utilizes innovative techniques to optimize energy consumption, reducing environmental impact and operational costs.

- Competitive pricing strategy: Their pricing model aims to offer cost-effective access to high-performance GPU computing, making it more accessible to a wider range of users.

- Strong partnerships with key players: Collaborations with leading technology companies and AI developers enhance their market reach and reinforce their credibility.

- Innovative use of recycled hardware: CoreWeave's commitment to utilizing refurbished hardware demonstrates a dedication to sustainability and cost efficiency, which resonates with environmentally conscious investors.

Positive Investor Sentiment and Market Speculation

The CoreWeave (CRWV) stock price jump is also fueled by significant positive investor sentiment and market speculation. Recent announcements, positive analyst ratings, and increasing media coverage have all contributed to a surge in investor confidence. The perception of CoreWeave's potential for future growth and market dominance plays a significant role.

- Positive analyst ratings and price targets: Favorable analyst reports and upward revisions of price targets signal strong belief in the company's future performance.

- Increased media coverage and attention: Positive media attention and features in prominent financial publications increase brand awareness and attract further investor interest.

- Potential for future growth and market dominance: The market anticipates CoreWeave's continued expansion and potential to become a leading player in the rapidly growing GPU cloud computing sector.

- Comparison to competitors and market leadership potential: Investors are increasingly comparing CoreWeave's performance and potential to established competitors, fueling speculation about its future market share.

Potential Risks and Considerations for Future Growth

While the outlook for CoreWeave is positive, it's crucial to acknowledge potential risks. Maintaining a balanced perspective is vital for informed investment decisions. The CRWV stock price, while currently high, is subject to market fluctuations and unforeseen challenges.

- Competition from established cloud providers: Major players like AWS, Azure, and GCP pose significant competition, constantly evolving their services to remain competitive.

- Dependence on specific hardware and technology: CoreWeave's reliance on particular GPU hardware and technologies exposes them to potential supply chain disruptions and technological obsolescence.

- Economic downturn and its potential impact on spending on cloud services: A broader economic downturn could reduce spending on cloud services, impacting CoreWeave's revenue.

- Regulatory hurdles or compliance issues: Navigating regulatory landscapes and ensuring compliance with data privacy regulations are ongoing challenges.

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Rally and Future Outlook

The CoreWeave (CRWV) stock price surge is a result of a confluence of factors: high demand for AI and GPU computing, CoreWeave's competitive advantages and efficient business model, and positive investor sentiment. However, understanding potential risks is equally important. The company's strategic position in a rapidly growing market, coupled with its innovative approach, presents a compelling investment proposition. Before making any investment decisions, however, it's vital to conduct thorough due diligence. Further research into CoreWeave investment opportunities, CRWV stock analysis, and the overall CoreWeave stock outlook is recommended. Consider conducting your own in-depth CoreWeave stock analysis to form your own informed opinion.

Featured Posts

-

Bruins Offseason Espn Highlights Crucial Moves And Franchise Implications

May 22, 2025

Bruins Offseason Espn Highlights Crucial Moves And Franchise Implications

May 22, 2025 -

Succession Planning Protecting Ultra High Net Worth Families Legacies

May 22, 2025

Succession Planning Protecting Ultra High Net Worth Families Legacies

May 22, 2025 -

Nato Genel Sekreteri Rutte Ispanyol Basbakan Sanchez Ile Enerji Guevenligi Uezerine Goeruestue

May 22, 2025

Nato Genel Sekreteri Rutte Ispanyol Basbakan Sanchez Ile Enerji Guevenligi Uezerine Goeruestue

May 22, 2025 -

Lehigh Valley Burn Center Pilots Son Released Following Crash

May 22, 2025

Lehigh Valley Burn Center Pilots Son Released Following Crash

May 22, 2025 -

Sydney Sweeneys Busy Post Echo Valley And The Housemaid Schedule A New Movie Role

May 22, 2025

Sydney Sweeneys Busy Post Echo Valley And The Housemaid Schedule A New Movie Role

May 22, 2025

Latest Posts

-

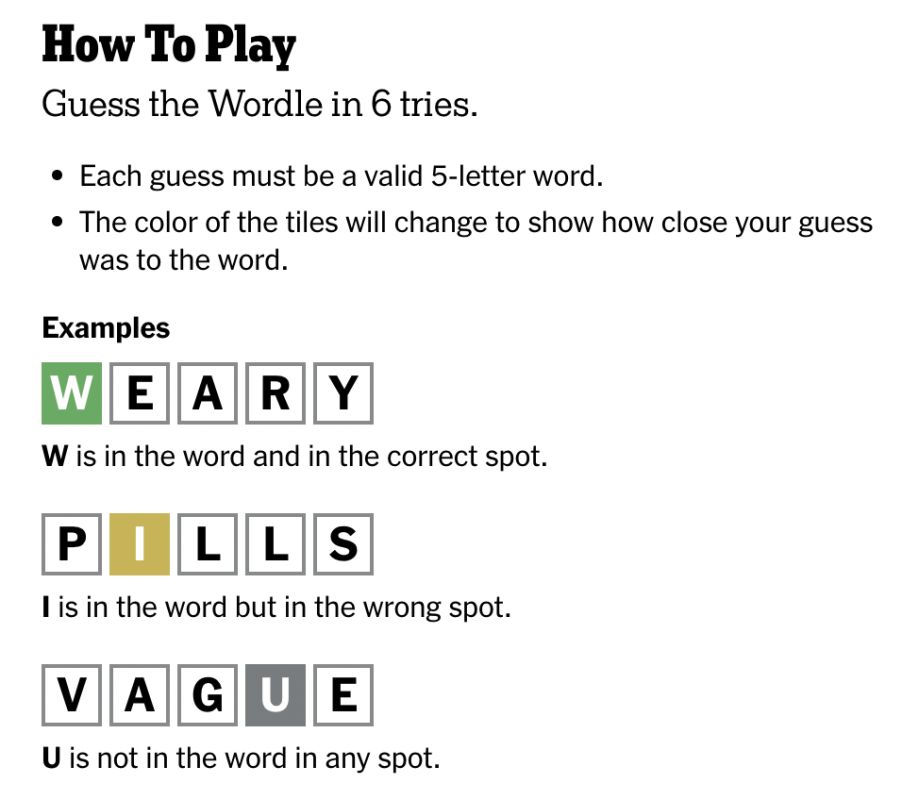

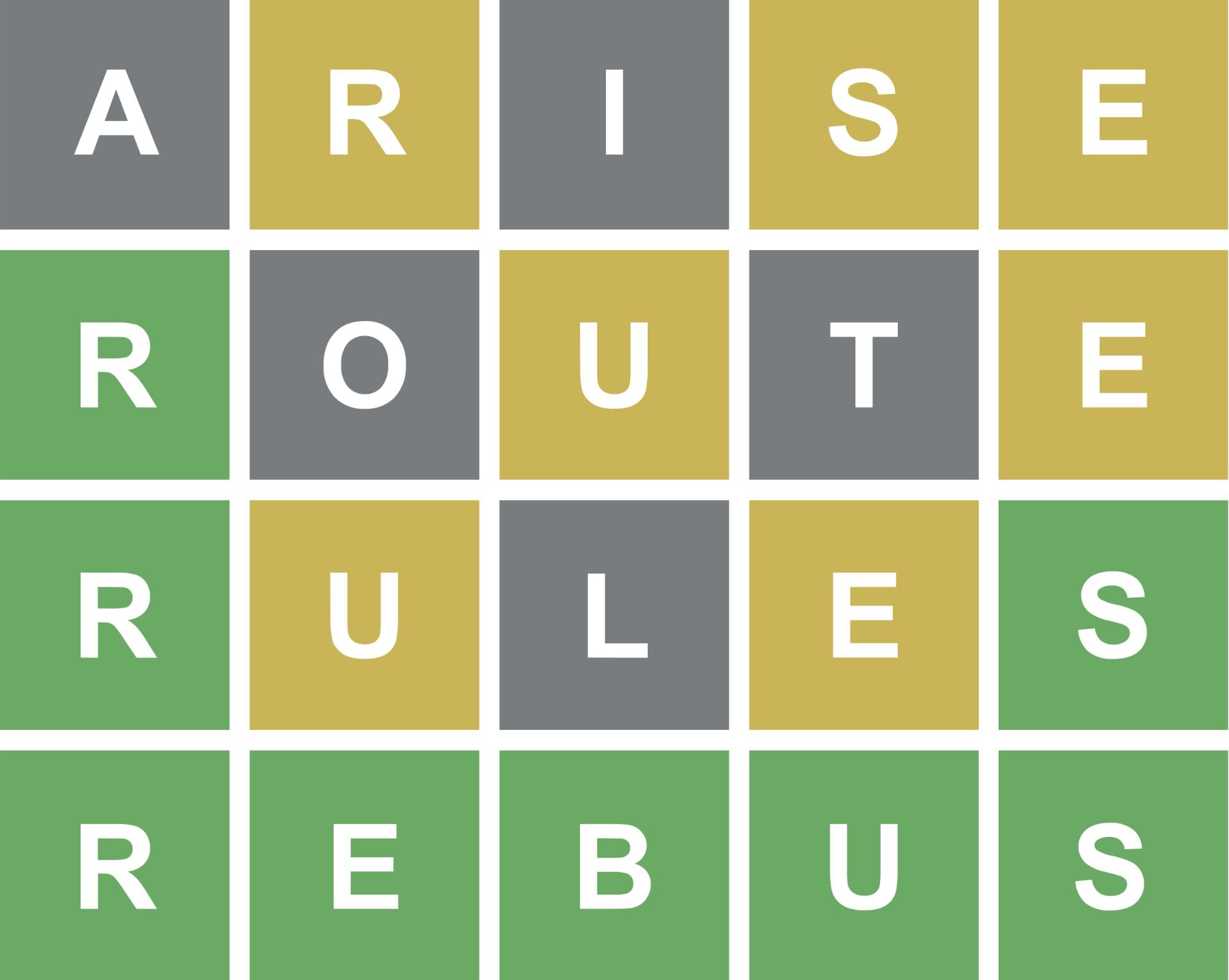

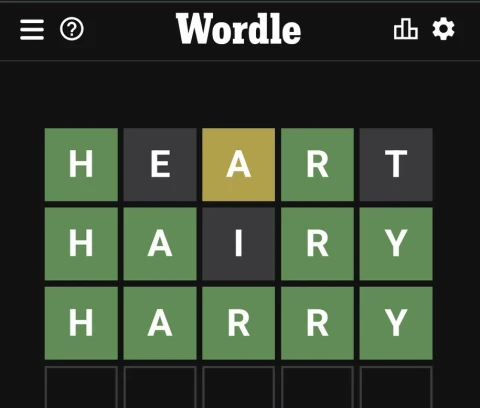

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025 -

Wordle Hints And Answer March 6th Puzzle 1356

May 22, 2025

Wordle Hints And Answer March 6th Puzzle 1356

May 22, 2025 -

Get The Wordle 1356 Answer Hints For March 6th Game

May 22, 2025

Get The Wordle 1356 Answer Hints For March 6th Game

May 22, 2025 -

Solve Wordle 1356 Hints And Answer For Thursday March 6

May 22, 2025

Solve Wordle 1356 Hints And Answer For Thursday March 6

May 22, 2025