Investment Guide: Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Definition and Calculation

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. Essentially, it's the per-share value of the ETF. A simple formula is:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

- Components of NAV Calculation: The total assets include the market value of all the stocks, bonds, and other securities held within the ETF's portfolio. Liabilities encompass expenses such as management fees and other operational costs. The Amundi Dow Jones Industrial Average UCITS ETF, mirroring the Dow Jones Industrial Average, primarily holds a portfolio of 30 large-cap US stocks. Therefore, its NAV calculation heavily relies on the daily market fluctuations of these underlying assets.

- Daily Calculation Process: The NAV is typically calculated at the close of each trading day, reflecting the end-of-day market prices of the assets within the ETF’s portfolio. This daily calculation ensures that the NAV accurately represents the current value of the investment.

- NAV vs. Market Price: It's important to distinguish between NAV and market price. While NAV represents the intrinsic value of the ETF, the market price is the actual price at which the ETF is being traded on the exchange. These prices can differ slightly due to market supply and demand.

NAV and the Amundi Dow Jones Industrial Average UCITS ETF

Tracking the Dow Jones Industrial Average

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the Dow Jones Industrial Average (DJIA). Its NAV closely mirrors the index's movement, offering investors exposure to the 30 major US companies included in the DJIA. Therefore, understanding the NAV allows you to directly assess the performance of the underlying index.

- Replication Strategy: The ETF likely uses a full replication strategy, meaning it holds all 30 stocks in the DJIA in approximately the same weighting as the index itself. This method aims to minimize tracking error, ensuring the ETF's performance closely matches that of the DJIA.

- Impact of Dividends and Corporate Actions: Dividends paid by the companies in the DJIA are distributed to ETF shareholders, affecting the NAV. Corporate actions like stock splits or mergers also influence the NAV recalculation. These adjustments are crucial factors in the daily NAV calculation.

- Expense Ratios and NAV: The ETF's expense ratio, representing the annual cost of managing the fund, is deducted from the assets and impacts the NAV. A lower expense ratio generally leads to a higher NAV, all else being equal.

Using NAV for Investment Decisions

Monitoring Performance

Regularly monitoring the NAV allows investors to track the Amundi Dow Jones Industrial Average UCITS ETF's performance over time. This helps gauge the effectiveness of the investment strategy.

- Comparison with Other Investments: By tracking the NAV, investors can compare the performance of the Amundi Dow Jones Industrial Average UCITS ETF against other investments in their portfolio or against benchmark indices. This comparative analysis assists in optimizing the overall investment strategy.

- Long-Term Investment: Regular NAV checks are especially important for long-term investors. Tracking the NAV provides valuable insights into the investment’s growth trajectory and aids in evaluating long-term financial goals.

- Buy and Sell Decisions: While NAV is a significant factor to consider, it should not be the sole determinant for buy or sell decisions. Investors should consult a financial advisor to make informed decisions based on their individual risk tolerance and financial objectives.

Where to Find the NAV

Accessing NAV Information

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward.

- ETF's Official Website: The most reliable source is the official website of Amundi. Look for sections dedicated to fund information or fact sheets.

- Financial News Websites and Brokerage Platforms: Reputable financial news websites and most brokerage platforms provide real-time or end-of-day NAV data for ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

- Interpreting NAV Data: NAV data is typically presented in tables or charts showing the NAV for each trading day. Understanding how to interpret these charts is crucial for tracking the ETF's performance.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for informed investment decisions. By understanding its calculation, its relation to the Dow Jones Industrial Average's performance, and its role in tracking your investment's growth, you can make more effective investment choices. Remember to regularly monitor the NAV of your Amundi Dow Jones Industrial Average UCITS ETF. Stay informed about the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF, and consult a financial advisor for personalized investment advice. Further research into the ETF's holdings and the Dow Jones Industrial Average itself will also enhance your investment understanding.

Featured Posts

-

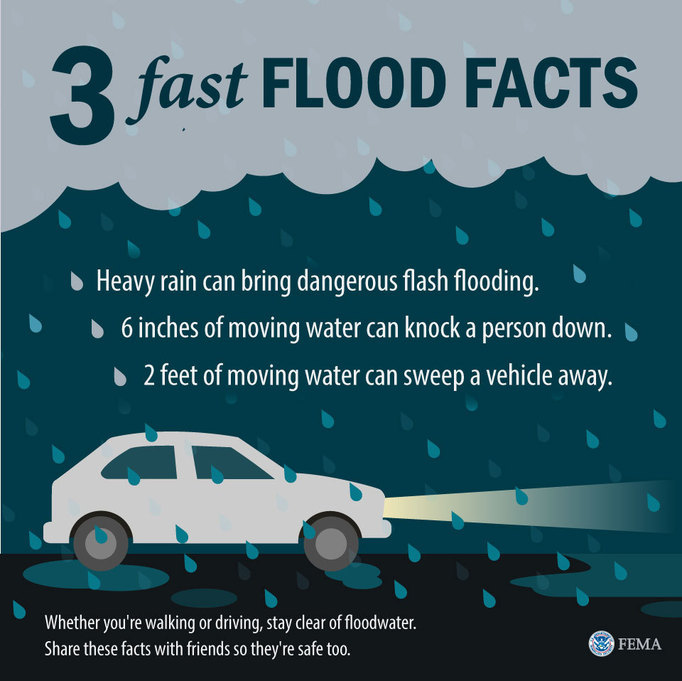

Preparing For Flash Floods Essential Information On Flood Warnings And Alerts

May 25, 2025

Preparing For Flash Floods Essential Information On Flood Warnings And Alerts

May 25, 2025 -

Recognizing And Responding To A Flash Flood Emergency

May 25, 2025

Recognizing And Responding To A Flash Flood Emergency

May 25, 2025 -

Maximize Your Ai And Automation Investments With Orchestration Camunda Con 2025 Amsterdam

May 25, 2025

Maximize Your Ai And Automation Investments With Orchestration Camunda Con 2025 Amsterdam

May 25, 2025 -

Kapitaalmarktrentes Stijgen Verder Euro Boven 1 08

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Euro Boven 1 08

May 25, 2025 -

Legendas F1 Motor Porsche Koezuti Autokban

May 25, 2025

Legendas F1 Motor Porsche Koezuti Autokban

May 25, 2025

Latest Posts

-

Dominant Performances From Alcaraz And Sabalenka In Rome

May 25, 2025

Dominant Performances From Alcaraz And Sabalenka In Rome

May 25, 2025 -

Italian Open Alcaraz And Sabalenka Secure Opening Wins

May 25, 2025

Italian Open Alcaraz And Sabalenka Secure Opening Wins

May 25, 2025 -

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025 -

Hells Angels And The Mandarin Killings Shifting Business Tactics

May 25, 2025

Hells Angels And The Mandarin Killings Shifting Business Tactics

May 25, 2025 -

Strong Starts For Alcaraz And Sabalenka At Italian Open

May 25, 2025

Strong Starts For Alcaraz And Sabalenka At Italian Open

May 25, 2025