Investing In Ripple (XRP): Understanding The Risks And Rewards After A 15,000% Increase

Table of Contents

XRP's Meteoric Rise and Subsequent Correction

The 15,000% Surge: A Look Back

XRP's phenomenal growth wasn't accidental. Several factors contributed to its meteoric rise. Early adoption by financial institutions, attracted by RippleNet's potential to streamline cross-border payments, played a significant role. Strategic partnerships with major banks and payment providers further fueled investor confidence and increased demand for XRP. The promise of faster, cheaper, and more efficient international transactions created a powerful narrative that resonated with the market.

The Market Correction: Navigating the Downside

However, the cryptocurrency market is notoriously volatile. Following its impressive surge, XRP, like many other cryptocurrencies, experienced a substantial correction. This price drop serves as a stark reminder of the inherent risks associated with investing in digital assets. Understanding the reasons behind these fluctuations is crucial for any potential XRP investor.

- Key dates and price points: Tracking XRP's price history, from its initial surge to its subsequent corrections, reveals periods of extreme volatility. Analyzing these periods helps identify potential patterns and assess risk tolerance. (Include chart/graph here visualizing price fluctuations)

- Market events influencing XRP's price: Significant market events, such as regulatory announcements, technological advancements, and overall market sentiment, profoundly impacted XRP's price. Understanding these influences is essential for informed decision-making.

- Ripple's SEC lawsuit: The ongoing SEC lawsuit against Ripple Labs significantly impacted XRP’s price and stability, highlighting the regulatory uncertainty surrounding the asset.

Understanding the Ripple Technology and its Potential

RippleNet and its Functionalities

RippleNet is a real-time gross settlement system (RTGS), currency exchange, and remittance network created by Ripple Labs. It's designed to facilitate seamless cross-border payments for financial institutions, drastically reducing transaction times and costs compared to traditional methods. This technology has the potential to revolutionize the global financial landscape.

XRP's Role in RippleNet

XRP acts as a bridge currency within the RippleNet ecosystem. It enables faster and more cost-effective transactions between different currencies. Its unique design allows for near-instantaneous settlements, minimizing delays and fees often associated with traditional banking systems.

- Key features and benefits of RippleNet: Features like its speed, security, and low transaction costs are key advantages over traditional banking systems, contributing to its potential widespread adoption.

- Partnerships and collaborations: Ripple's strategic alliances with major financial institutions worldwide demonstrate its growing acceptance and potential for mainstream adoption. This network effect significantly strengthens its position in the market.

- Comparison with other payment technologies: Comparing RippleNet with other payment technologies, such as SWIFT, highlights its competitive advantages and potential to disrupt the existing financial infrastructure.

Assessing the Risks of Investing in XRP

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a significant shadow over XRP's future. The outcome of this lawsuit could profoundly impact XRP's price and regulatory status, creating uncertainty for investors.

Market Volatility

The cryptocurrency market is inherently volatile. XRP's price is susceptible to significant fluctuations influenced by market sentiment, news events, and regulatory changes. This volatility poses a considerable risk to investors, particularly those with a lower risk tolerance.

Technological Risks

While RippleNet boasts impressive technology, it's not immune to technological risks. Potential vulnerabilities in the network's infrastructure or security could lead to disruptions or losses, impacting investor confidence and XRP's price.

- Summary of the SEC lawsuit: Understanding the key arguments and potential outcomes of the SEC lawsuit is crucial for assessing the risks associated with XRP investment.

- Examples of significant price swings: Analyzing historical price data highlights the extreme volatility inherent in XRP, emphasizing the importance of risk management strategies.

- Potential threats to RippleNet's infrastructure or security: While Ripple has a strong track record, investors need to be aware of the potential for technological failures or security breaches that could affect the platform's functionality.

Diversification and Risk Management Strategies for XRP Investors

Portfolio Diversification

Never put all your eggs in one basket. Diversifying your investment portfolio across various asset classes, including stocks, bonds, and other cryptocurrencies, is crucial for mitigating risk. This approach helps to reduce the impact of potential losses in any single asset.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a valuable strategy for managing risk in volatile markets. By investing a fixed amount of money at regular intervals, regardless of price fluctuations, you reduce the impact of buying high and selling low.

Setting Realistic Expectations

Avoid unrealistic expectations of quick riches. Investing in cryptocurrencies, including XRP, requires a long-term perspective. Understand that prices can fluctuate significantly, and patience and discipline are essential for successful long-term investment.

- Examples of other investment assets: Including examples of other asset classes, such as stocks, bonds, and real estate, will help diversify your investment portfolio.

- Detailed explanation of how dollar-cost averaging works: Provide a step-by-step guide to help readers implement this valuable risk management strategy.

- Realistic return expectations: Encourage investors to set realistic return expectations, considering the inherent volatility of the cryptocurrency market.

Conclusion

Investing in Ripple (XRP) presents both significant potential rewards and considerable risks. The technology behind RippleNet is undeniably innovative and could revolutionize the global payments landscape. However, regulatory uncertainty, market volatility, and inherent technological risks must be carefully considered. Before investing in Ripple (XRP), carefully weigh the potential rewards against the inherent risks. Conduct your own thorough due diligence and consider consulting with a financial advisor. Remember that responsible investment practices are crucial, and a deep understanding of the intricacies of Ripple (XRP) investment is essential before committing your funds.

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For Technology And Politics

May 02, 2025

The Zuckerberg Trump Dynamic Implications For Technology And Politics

May 02, 2025 -

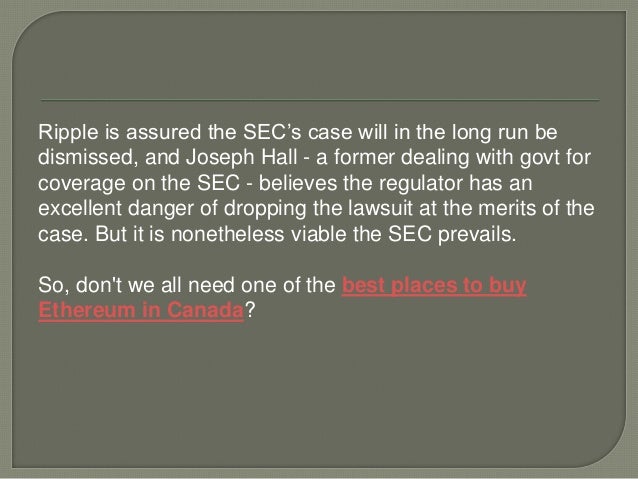

Disappointment In The Fortnite Item Shop Players React To New Update

May 02, 2025

Disappointment In The Fortnite Item Shop Players React To New Update

May 02, 2025 -

Death Of Dallas And Carrie Legend Amy Irving Shares Emotional Tribute

May 02, 2025

Death Of Dallas And Carrie Legend Amy Irving Shares Emotional Tribute

May 02, 2025 -

Post Sec Lawsuit A Comprehensive Xrp Price Prediction

May 02, 2025

Post Sec Lawsuit A Comprehensive Xrp Price Prediction

May 02, 2025 -

15 April 2025 Daily Lotto Results Check

May 02, 2025

15 April 2025 Daily Lotto Results Check

May 02, 2025

Latest Posts

-

Can A Smart Ring Really Prove You Re Not A Cheater

May 03, 2025

Can A Smart Ring Really Prove You Re Not A Cheater

May 03, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025 -

Would A Smart Ring Enhance Or Destroy Trust In Relationships

May 03, 2025

Would A Smart Ring Enhance Or Destroy Trust In Relationships

May 03, 2025 -

A Smart Rings Promise Ending Infidelity Or Threatening Privacy

May 03, 2025

A Smart Rings Promise Ending Infidelity Or Threatening Privacy

May 03, 2025 -

The Ethics Of Smart Rings And Relationship Trust

May 03, 2025

The Ethics Of Smart Rings And Relationship Trust

May 03, 2025