Investing In Riot Platforms: Assessing The Risks And Rewards At Current Levels

Table of Contents

Understanding Riot Platforms' Business Model and Recent Performance

Riot Platforms' core business revolves around Bitcoin mining. They operate large-scale mining facilities, leveraging significant computing power (hash rate) to solve complex cryptographic problems and earn Bitcoin rewards. Efficiency is key; Riot focuses on optimizing its mining operations to maximize Bitcoin production per unit of energy consumed. This includes utilizing advanced ASIC miners and negotiating favorable energy contracts.

Recent financial performance has been mixed, reflecting the volatility of the cryptocurrency market. While revenue is directly tied to Bitcoin's price and mining output, profitability fluctuates with energy costs and the difficulty of Bitcoin mining. Analyzing Riot's financial reports (e.g., quarterly earnings) reveals key metrics such as revenue per terahash, operating margins, and overall profitability. Data visualization through charts would effectively showcase these trends.

- Current mining capacity: Riot continually expands its capacity through the acquisition of new miners and the construction of new facilities.

- Recent Bitcoin production figures: Tracking Riot's monthly Bitcoin production provides insight into its operational efficiency and the impact of factors like Bitcoin's difficulty adjustment.

- Key partnerships and collaborations: Strategic partnerships with energy providers and technology suppliers can significantly impact Riot's cost structure and efficiency.

- Operational efficiency compared to competitors: Benchmarking Riot's performance against other publicly traded Bitcoin miners allows for a comparative analysis of its competitive position.

Assessing the Risks Associated with Investing in Riot Platforms

Investing in Riot Platforms carries inherent risks, primarily stemming from the volatility of the cryptocurrency market.

-

Market volatility: Bitcoin's price is notoriously volatile, directly impacting Riot's revenue and profitability. A significant price drop can severely reduce profits, even leading to losses.

-

Regulatory risks: The regulatory landscape for cryptocurrencies is constantly evolving, posing potential challenges to Bitcoin mining operations. Changes in regulations could impact Riot's ability to operate efficiently or legally.

-

Energy costs and sustainability concerns: Bitcoin mining is energy-intensive. Fluctuations in energy prices directly affect Riot's profitability, while growing concerns about the environmental impact of Bitcoin mining could lead to increased regulatory scrutiny or negative public perception.

-

Technological disruption: The Bitcoin mining industry is subject to technological advancements. The development of more efficient mining hardware could render Riot's existing equipment obsolete, impacting its competitive advantage and profitability.

-

Geopolitical risks: Global events and geopolitical tensions can significantly impact Bitcoin's price and the overall cryptocurrency market, impacting Riot's performance.

-

Increased competition: The Bitcoin mining industry is becoming increasingly competitive, with new players entering the market constantly. This increased competition can put downward pressure on profitability.

-

Environmental, Social, and Governance (ESG) factors: Growing investor focus on ESG factors means that Riot's sustainability practices and corporate governance will influence investor sentiment.

Analyzing Riot Platforms' Competitive Advantages

Despite the risks, Riot Platforms possesses certain competitive advantages. Access to low-cost energy sources, strategic partnerships with equipment manufacturers, and a focus on operational efficiency allow them to maintain a competitive edge. Comparing Riot's hash rate, mining efficiency, and cost structure against competitors helps assess its relative strength in the market. A thorough analysis of their technological advancements and expansion strategies is also crucial for assessing their competitive positioning.

Evaluating the Rewards of Investing in Riot Platforms

Despite the risks, the potential rewards of investing in Riot Platforms are significant.

-

Potential for high returns: If Bitcoin's price appreciates significantly, Riot's profits will increase substantially, resulting in high returns for investors.

-

Growth potential: Riot's expansion plans, including increasing mining capacity and exploring new geographical locations, suggest a significant growth trajectory.

-

Dividend potential: While not currently paying dividends, the possibility of future dividend payouts to shareholders could further enhance returns.

-

Long-term growth prospects for Bitcoin: Many analysts believe Bitcoin has long-term growth potential, making Riot a potential beneficiary of this growth.

-

Strategic acquisitions or mergers: Acquisitions of smaller mining operations or technological companies could further enhance Riot's market share and efficiency.

-

Opportunities for diversification: Expansion into other areas within the cryptocurrency ecosystem could diversify Riot's revenue streams and reduce reliance on Bitcoin mining alone.

Determining Fair Value and Investment Strategy

Determining the fair value of Riot Platforms requires a comprehensive analysis using various valuation methods such as discounted cash flow analysis and comparable company analysis. Considering Riot's future growth prospects, potential risks, and the current market valuation is crucial. Investment strategies should consider an investor's risk tolerance and time horizon. A long-term investor with a high-risk tolerance might find Riot Platforms attractive, whereas a risk-averse investor might prefer a more diversified portfolio.

Conclusion

Investing in Riot Platforms offers significant potential rewards but also carries considerable risks. The company's success is intrinsically linked to Bitcoin's price and the broader cryptocurrency market's performance. Thorough due diligence, including a comprehensive analysis of financial statements, competitive landscape, and regulatory risks, is crucial before making any investment decisions. By understanding the inherent volatility and assessing Riot Platforms’ competitive advantages and growth potential, investors can make informed decisions about whether investing in Riot Platforms stock aligns with their risk tolerance and investment goals. Consider this article a starting point for your research; continue exploring Riot Platforms investment analysis and ask yourself, "Should you invest in Riot Platforms?" The answer depends on your individual circumstances and investment strategy.

Featured Posts

-

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025 -

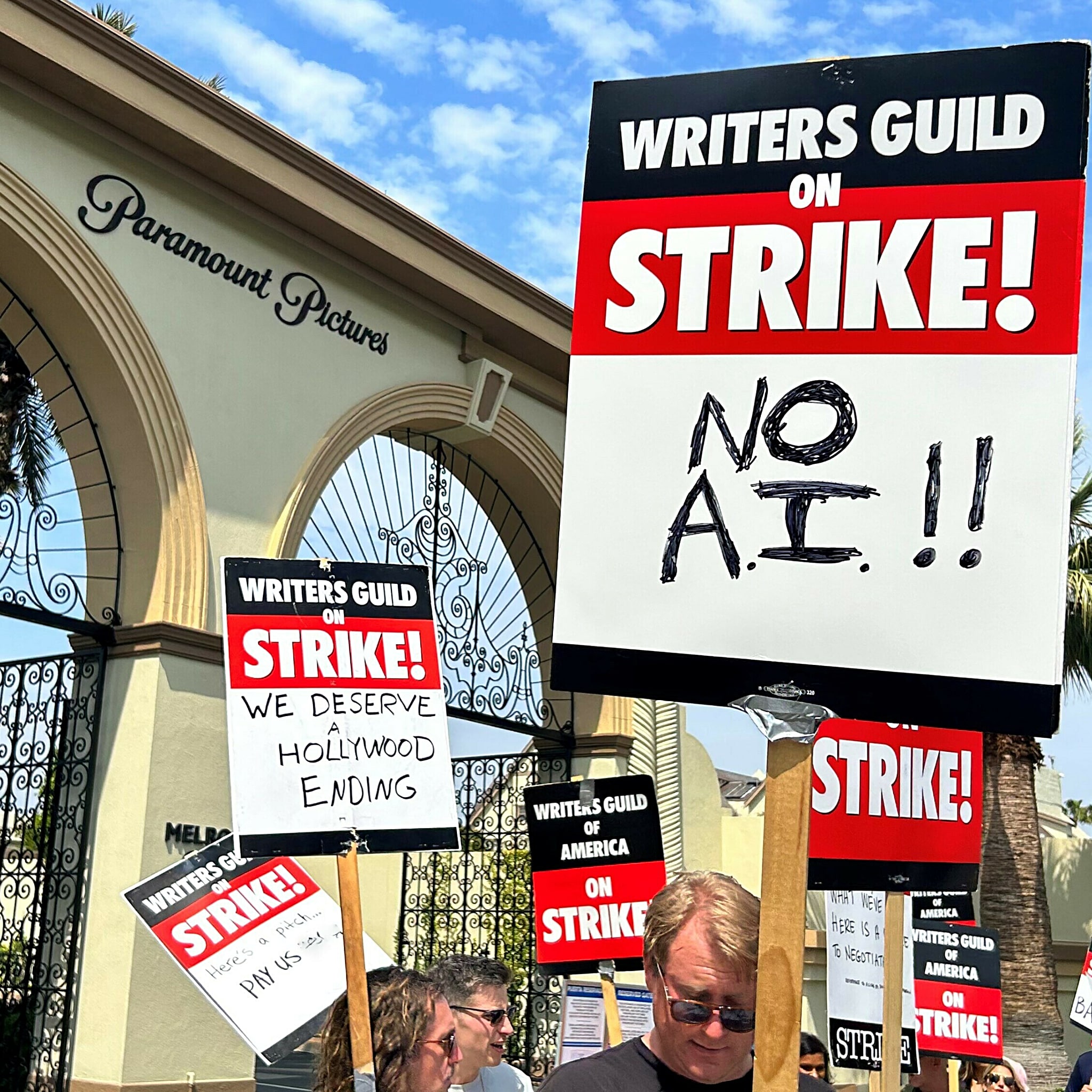

Actors And Writers Strike What It Means For Hollywood

May 02, 2025

Actors And Writers Strike What It Means For Hollywood

May 02, 2025 -

Warri Itakpe Train Service An Nrc Update

May 02, 2025

Warri Itakpe Train Service An Nrc Update

May 02, 2025 -

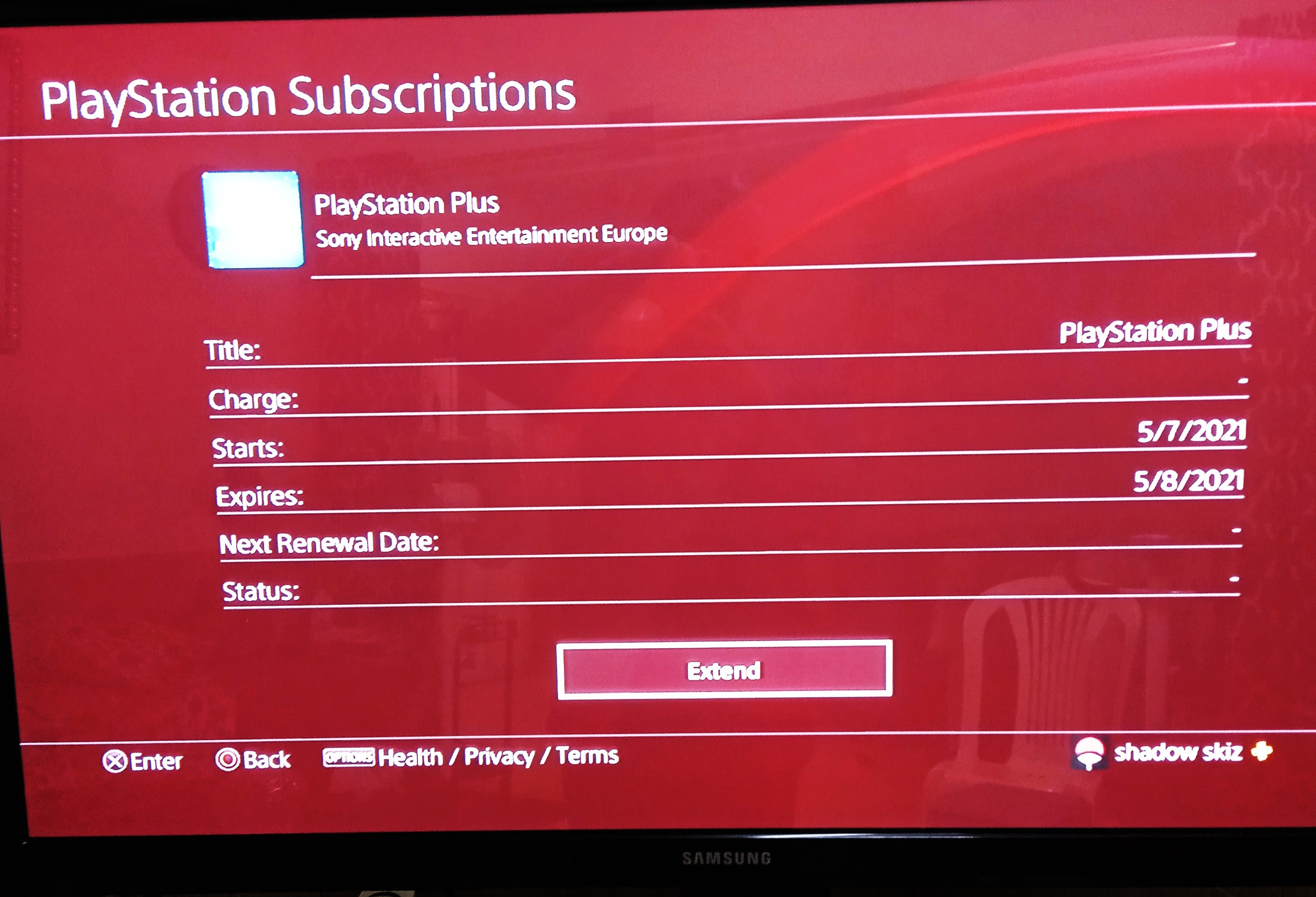

Sony Compensates Play Station Users For Christmas Voucher Glitch With Free Credit

May 02, 2025

Sony Compensates Play Station Users For Christmas Voucher Glitch With Free Credit

May 02, 2025 -

Voyage A Velo Trois Jeunes Du Bocage Ornais Traversent 8000 Km

May 02, 2025

Voyage A Velo Trois Jeunes Du Bocage Ornais Traversent 8000 Km

May 02, 2025

Latest Posts

-

Reakcja Zacharowej Na Sytuacje Wokol Emmanuela I Brigitte Macron This Uses A Slightly Different Language Polish But Is Included As A Potential Option If There Was A Misunderstanding Of The Language Request

May 03, 2025

Reakcja Zacharowej Na Sytuacje Wokol Emmanuela I Brigitte Macron This Uses A Slightly Different Language Polish But Is Included As A Potential Option If There Was A Misunderstanding Of The Language Request

May 03, 2025 -

Zakharova Prokommentirovala Otnosheniya Emmanuelya I Brizhit Makron

May 03, 2025

Zakharova Prokommentirovala Otnosheniya Emmanuelya I Brizhit Makron

May 03, 2025 -

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 03, 2025

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 03, 2025 -

Pozitsiya Zakharovoy Po Situatsii S Prezidentom Frantsii I Ego Suprugoy

May 03, 2025

Pozitsiya Zakharovoy Po Situatsii S Prezidentom Frantsii I Ego Suprugoy

May 03, 2025 -

Position De Macron Sur L Etat Palestinien La Condamnation Ferme De Netanyahu

May 03, 2025

Position De Macron Sur L Etat Palestinien La Condamnation Ferme De Netanyahu

May 03, 2025