Investing In Palantir Stock Before May 5th: A Prudent Approach?

Table of Contents

1. Introduction: Should You Invest in Palantir Stock Before May 5th?

Palantir Technologies is a prominent player in the big data analytics market, offering sophisticated software platforms to government and commercial clients. Its business model centers on providing powerful data integration and analysis tools, helping organizations make better-informed decisions. While Palantir has carved a significant niche for itself, the question of whether a Palantir stock investment before May 5th represents a prudent approach requires a careful examination of its recent performance and future outlook. The potential impact of any events scheduled around May 5th further complicates this decision, necessitating a thorough assessment of the associated risks and rewards.

2. Main Points:

H2: Palantir's Recent Performance and Financial Outlook:

Palantir's stock performance has been characterized by periods of both significant growth and substantial decline. While the company has shown impressive revenue growth in recent years, its profitability remains a key area of focus for investors. Analyzing key financial metrics is crucial for determining the long-term viability of a Palantir stock investment.

- Recent quarterly earnings reports and key takeaways: A detailed analysis of recent earnings reports is vital, considering revenue growth, operating expenses, and net income or loss. (Note: Replace this with actual data and analysis from recent reports).

- Analysis of revenue streams (government vs. commercial): Palantir's revenue is split between government and commercial contracts. Understanding the growth trajectory of each segment is crucial for evaluating its future performance and the diversification of its income sources. (Note: Include data comparing government and commercial revenue).

- Debt-to-equity ratio and its implications: The debt-to-equity ratio offers insights into Palantir's financial leverage and its ability to manage its debt obligations. A high ratio may indicate higher risk. (Note: Include the current debt-to-equity ratio and its interpretation).

- Future projections based on analyst reports and company guidance: Consulting analyst reports and the company's official guidance provides a broader perspective on the expected financial performance in the coming quarters. (Note: Include information from reputable analyst reports and official Palantir guidance).

H2: Assessing Palantir's Long-Term Growth Potential:

Palantir's long-term growth potential hinges on several key factors, including its technological innovation, market position, and ability to expand into new sectors.

- Discussion of Palantir's Foundry platform and its capabilities: Palantir's Foundry platform is a crucial component of its success. Analyzing its capabilities and potential for future development is essential to understanding the company's competitive edge.

- Analysis of the competitive landscape and Palantir's position within it: The big data analytics market is highly competitive. A comprehensive analysis of Palantir's competitive advantages and disadvantages is necessary for evaluating its market share and future growth prospects.

- Potential for growth in specific sectors (e.g., healthcare, finance): Palantir's platform has applications across various sectors. Evaluating its potential for expansion into new markets, such as healthcare and finance, can provide valuable insights into its future growth trajectory.

- Long-term projections for Palantir's market share and revenue: Based on various factors, including technological advancements, market demand, and competitive dynamics, long-term projections provide a crucial perspective on Palantir's future potential.

H2: Understanding the Risks Associated with Palantir Stock:

Investing in Palantir stock, like any other investment, carries inherent risks.

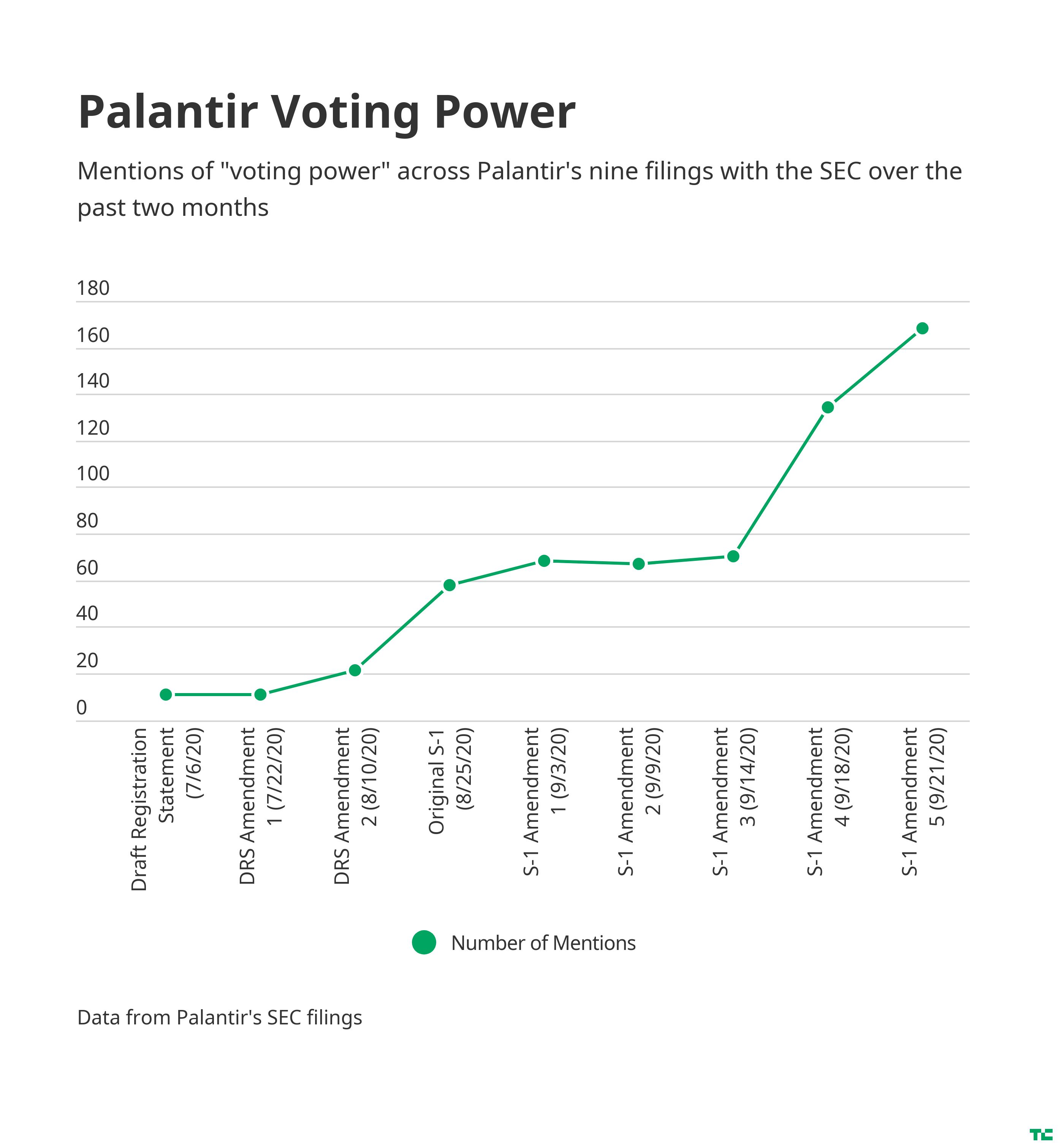

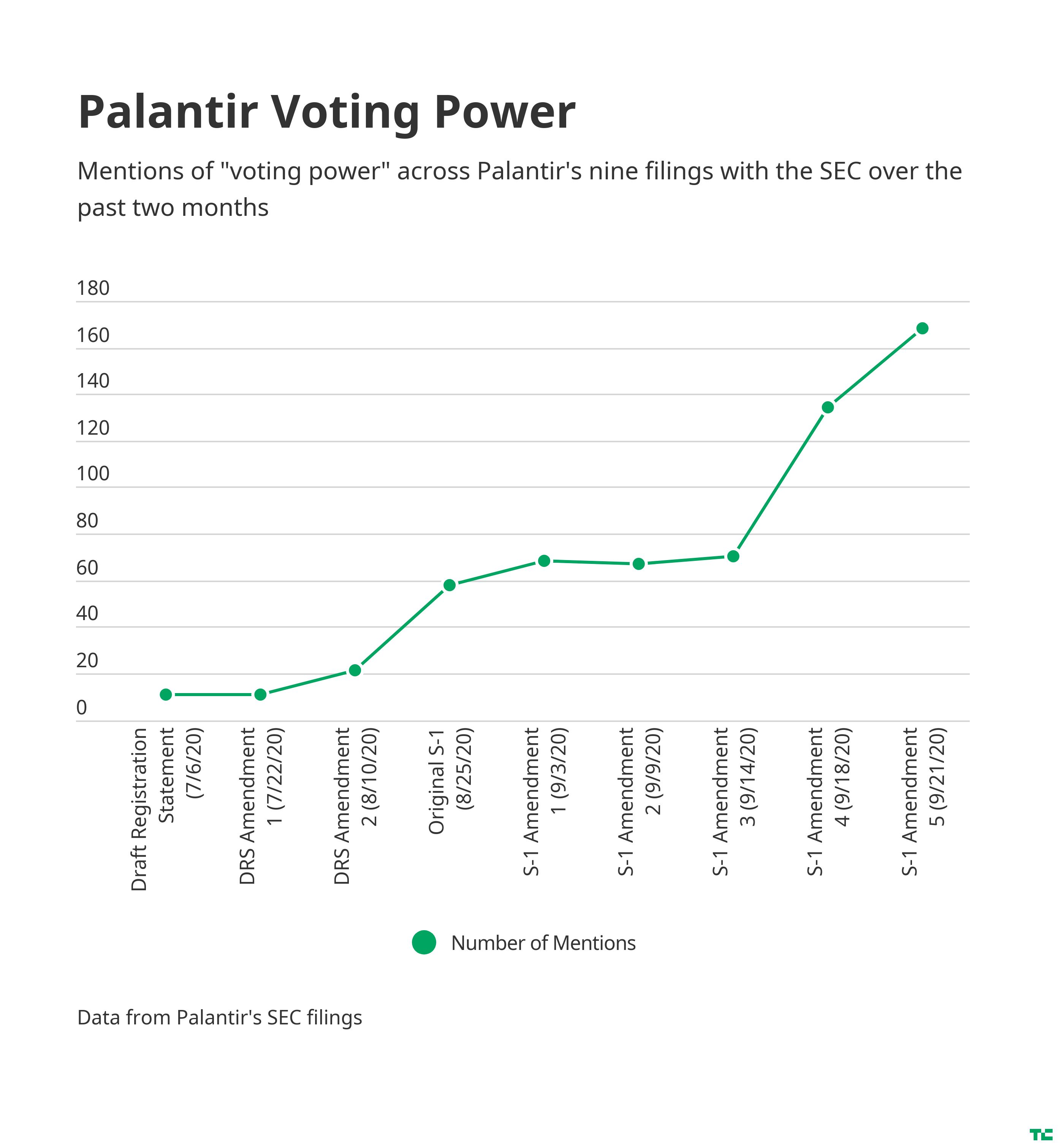

- Explanation of the volatility of Palantir's stock price: Palantir's stock price has demonstrated significant volatility. Understanding the reasons for this volatility and its potential impact on investment returns is crucial.

- Potential impact of geopolitical events on Palantir's government contracts: Palantir's reliance on government contracts makes it susceptible to geopolitical events and potential changes in government spending priorities.

- Analysis of the risks associated with investing in a growth stock: Investing in growth stocks like Palantir carries higher risk compared to more established companies. Understanding these risks, including the potential for lower short-term returns, is important.

- Discussion of potential regulatory hurdles or competitive threats: Regulatory changes and increased competition can negatively impact Palantir's growth and profitability. This needs careful consideration.

H2: Considering the May 5th Deadline (if applicable):

The proximity of May 5th to a potential earnings report, product launch, or other significant announcement warrants special consideration. Waiting until after May 5th might provide a clearer picture of Palantir's financial performance and future outlook.

- Specific events scheduled around May 5th and their anticipated influence: Clearly identify any relevant events scheduled around May 5th and their potential impact on Palantir's stock price.

- Potential market reactions to those events: Analyze how the market is likely to react to these events, considering both positive and negative scenarios.

- Advantages and disadvantages of waiting versus investing before May 5th: Weigh the benefits of waiting for more information against the potential risk of missing out on a price increase.

3. Conclusion: Making a Prudent Decision on Palantir Stock

Investing in Palantir stock before May 5th requires a careful evaluation of its recent performance, future growth potential, and associated risks. While Palantir offers compelling technology and a significant market presence, the inherent volatility and reliance on government contracts necessitate a cautious approach. The potential impact of any events scheduled around May 5th adds another layer of complexity to the investment decision. Therefore, conducting thorough due diligence, understanding your personal risk tolerance, and consulting with a qualified financial advisor are crucial steps before making any investment decisions. A prudent approach to investing in Palantir stock, whether before or after May 5th, emphasizes careful consideration and informed decision-making. For further research and resources, consider consulting reputable financial websites such as [Insert Link to a Reputable Financial Resource Here].

Featured Posts

-

Is The Us Attorney Generals Daily Fox News Strategy Effective A Critical Analysis

May 09, 2025

Is The Us Attorney Generals Daily Fox News Strategy Effective A Critical Analysis

May 09, 2025 -

Frantsiya Polsha Strategicheskoe Partnerstvo I Podpisanie Vazhnogo Oboronnogo Soglasheniya

May 09, 2025

Frantsiya Polsha Strategicheskoe Partnerstvo I Podpisanie Vazhnogo Oboronnogo Soglasheniya

May 09, 2025 -

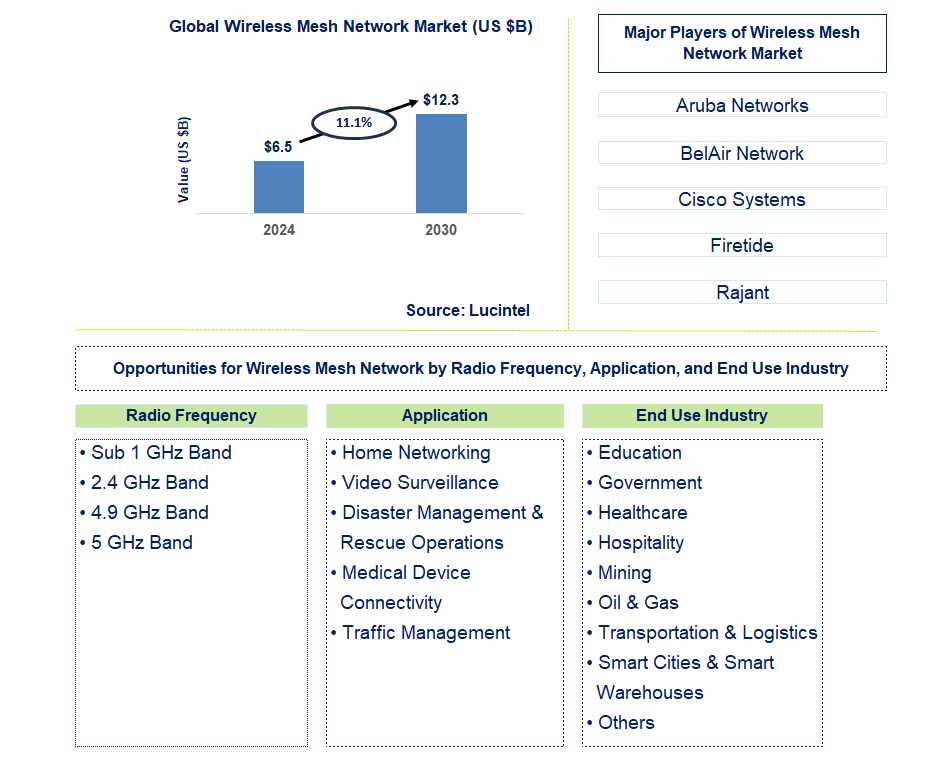

Wireless Mesh Network Market To Expand Significantly A 9 8 Cagr Prediction

May 09, 2025

Wireless Mesh Network Market To Expand Significantly A 9 8 Cagr Prediction

May 09, 2025 -

Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025

Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025 -

Inters Stunning Champions League Victory Over Bayern Munich

May 09, 2025

Inters Stunning Champions League Victory Over Bayern Munich

May 09, 2025