Investing In Palantir After A 30% Market Correction

Table of Contents

Analyzing Palantir's Recent Performance and the Market Correction

The 30% correction in Palantir's stock price warrants a thorough examination. Several factors likely contributed to this market volatility. Understanding these factors is crucial before considering any investment in PLTR stock. Let's dive into a detailed analysis of Palantir's recent performance and the broader market conditions.

-

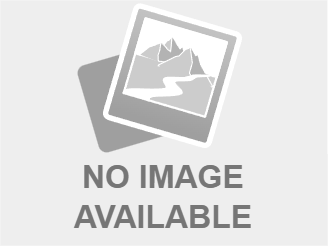

Review of Palantir's Q[Insert Latest Quarter] Earnings Report: [Insert a summary of the latest earnings report, highlighting key figures like revenue growth, net income, and any surprises. Mention any changes in guidance for future quarters]. A careful review of these numbers helps determine if the market correction is justified by the company's financial performance or if it represents an overreaction.

-

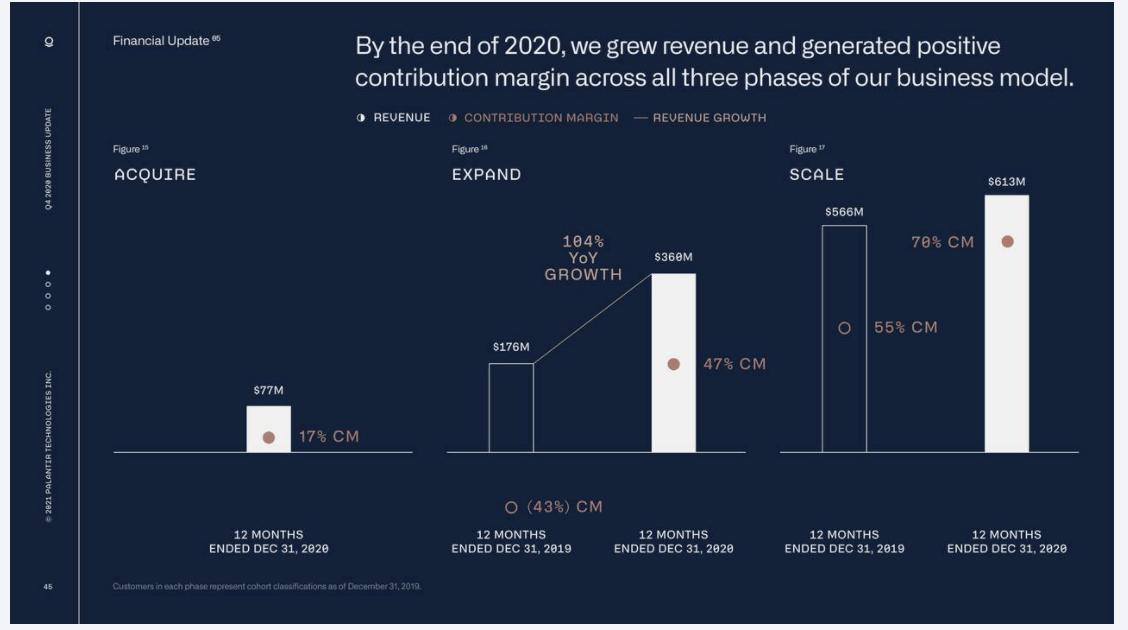

Analysis of Key Financial Metrics (Revenue, Net Income, Operating Margin): [Provide a detailed analysis of these key metrics. Are these numbers trending upward or downward? Compare them to previous quarters and industry averages. Highlight any significant changes and explain their possible implications.] Understanding these metrics provides a clearer picture of Palantir's financial health.

-

Discussion of Any Significant Contract Wins or Losses: [Discuss any major contract wins or losses impacting the company's revenue stream. Government contracts play a significant role in Palantir's revenue. Highlight any impact from changes in government spending or competition in this sector.] This section is critical for assessing the future trajectory of Palantir's revenue.

-

Mention of Analyst Ratings and Price Targets: [Summarize the opinions of leading financial analysts on Palantir stock. Mention their price targets and any changes in their ratings. Are they bullish, bearish, or neutral on the stock? ] Consider analyst opinions, but remember they are not a guarantee of future performance.

-

Overview of the Broader Market Conditions and Their Impact on Tech Stocks: [Discuss the overall state of the stock market, particularly focusing on the technology sector. Are there broader macroeconomic factors contributing to the downturn? Is there a general sell-off in tech stocks, or is Palantir facing unique challenges? ] This provides context for Palantir's performance within a larger market trend.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent market correction, Palantir boasts significant long-term growth potential. The company operates within the rapidly expanding data analytics market, a sector poised for substantial growth fueled by the increasing adoption of artificial intelligence (AI) and machine learning (ML).

-

Discussion of the Market Size and Growth Rate for Data Analytics: [Present statistics and forecasts on the growth of the data analytics market. This demonstrates the large potential market Palantir can tap into.]

-

Analysis of Palantir's Competitive Advantages: [Highlight Palantir's unique strengths, such as its proprietary technology, strong government relationships, and its expanding commercial client base. What differentiates Palantir from its competitors?]

-

Examination of Palantir's Expansion into New Markets and Applications: [Discuss any strategic moves Palantir is making to expand into new markets or applications of its technology. This demonstrates its ability to adapt and grow.]

-

Assessment of the Company's Innovation and Technological Capabilities: [Discuss Palantir's ongoing investment in research and development (R&D) and its ability to innovate and adapt to changing technological landscapes. This shows its potential for future growth.]

-

Consideration of Potential Risks and Challenges: [Acknowledge potential risks, such as competition, dependence on government contracts, and the challenges of navigating a rapidly evolving technological landscape. This provides a balanced perspective.]

Assessing the Risk and Reward

Investing in any stock involves risk, and PLTR stock is no exception. The volatility of tech stocks, especially those with high growth potential, can lead to significant price swings.

-

Discussion of the Volatility of Tech Stocks: [Explain the inherent volatility of tech stocks and its impact on investment decisions. Emphasize the importance of considering risk tolerance.]

-

Analysis of Potential Risks Associated with Palantir's Business Model: [Discuss potential risks specific to Palantir, such as dependence on government contracts, competition, and the potential for technological disruption.]

-

Explanation of the Importance of Diversification in a Portfolio: [Highlight the importance of diversification to mitigate risk and ensure a balanced investment portfolio.]

-

Advice on Conducting Proper Due Diligence: [Encourage thorough research and due diligence before making any investment decisions. This includes reviewing financial reports, analyst opinions, and understanding the company's business model.]

Developing an Investment Strategy for Palantir

Choosing the right investment strategy is crucial when considering Palantir stock. Your approach should align with your risk tolerance and investment goals.

-

Explanation of Dollar-Cost Averaging: [Explain the dollar-cost averaging strategy, where investors invest a fixed amount at regular intervals, regardless of the stock price. This mitigates risk associated with market timing.]

-

Discussion of the Buy-and-Hold Strategy: [Explain the buy-and-hold strategy, where investors buy and hold the stock for the long term, regardless of short-term price fluctuations. This is suitable for long-term investors with a high-risk tolerance.]

-

Analysis of Potential Trading Strategies (with caveats about risk): [Briefly mention more active trading strategies, such as day trading or swing trading, but strongly emphasize the significant risks involved and the need for expertise. This is not recommended for novice investors.]

-

Importance of Setting Stop-Loss Orders: [Explain the use of stop-loss orders to limit potential losses if the stock price drops below a certain level. This is a crucial risk management tool.]

-

Advice on Aligning Investment Strategy with Individual Financial Goals and Risk Tolerance: [Reiterate the importance of aligning investment strategy with personal financial goals and risk tolerance.]

Conclusion

Palantir's recent 30% market correction presents a potential buying opportunity for long-term investors. However, it's crucial to carefully analyze the company's financial performance, assess its long-term growth potential, and understand the inherent risks involved before making any investment decisions. Different investment strategies, such as dollar-cost averaging or buy-and-hold, can help mitigate risk and align with individual investor goals. Remember, thorough due diligence is paramount. Is investing in Palantir after this market correction right for your portfolio? Do your research and make an informed decision. For more information, visit Palantir's investor relations page [insert link] and consult reputable financial news sources.

Featured Posts

-

Ajaxs Brobbey Strength And Power Key To Europa League Success

May 10, 2025

Ajaxs Brobbey Strength And Power Key To Europa League Success

May 10, 2025 -

Municipales 2026 A Dijon Les Ecologistes Ambitieux

May 10, 2025

Municipales 2026 A Dijon Les Ecologistes Ambitieux

May 10, 2025 -

Hundreds Of Caravans Is This Uk City Becoming A Ghetto

May 10, 2025

Hundreds Of Caravans Is This Uk City Becoming A Ghetto

May 10, 2025 -

Millions In Losses Federal Case Details Office365 Executive Account Compromise

May 10, 2025

Millions In Losses Federal Case Details Office365 Executive Account Compromise

May 10, 2025 -

Remembering Americas Pioneer Non Binary Person A Life Cut Short

May 10, 2025

Remembering Americas Pioneer Non Binary Person A Life Cut Short

May 10, 2025