Investing In 2025: MicroStrategy Stock Vs. Bitcoin - A Comprehensive Analysis

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy, a publicly traded business intelligence company, has made headlines for its audacious and significant investment in Bitcoin. Its core business involves providing software and services for data analytics and business intelligence. However, its bold embrace of Bitcoin has dramatically reshaped its investment strategy and public perception.

- Rationale for Bitcoin Adoption: MicroStrategy's CEO, Michael Saylor, is a vocal Bitcoin advocate, viewing it as a superior store of value compared to traditional assets like cash and gold. The company's strategy is centered around long-term Bitcoin accumulation, aiming to profit from its anticipated future price appreciation.

- Size and Value of Bitcoin Holdings: MicroStrategy holds a substantial amount of Bitcoin, making it one of the largest corporate holders of the cryptocurrency. The value of these holdings fluctuates significantly with the price of Bitcoin, directly impacting the company's financial statements and market capitalization.

- Impact of Bitcoin Price Fluctuations: MicroStrategy's stock price is intrinsically linked to Bitcoin's performance. A rise in Bitcoin's price typically boosts MicroStrategy's stock value, and conversely, a drop in Bitcoin's price negatively affects its stock. This creates both significant upside potential and considerable downside risk for investors.

- Potential Risks: The significant investment in Bitcoin exposes MicroStrategy to regulatory changes affecting cryptocurrencies, potential security breaches related to Bitcoin holdings, and the inherent volatility of the cryptocurrency market.

Bitcoin's Potential in 2025

Bitcoin's Technological Advantages and Limitations

Bitcoin, the world's first cryptocurrency, boasts several key advantages:

- Decentralized Nature: Bitcoin operates on a decentralized network, making it resistant to censorship and single points of failure.

- Scarcity: A fixed supply of 21 million Bitcoins ensures its scarcity, potentially driving its long-term value.

- Potential for Future Adoption: Growing institutional adoption and increasing mainstream awareness could further propel Bitcoin's price.

However, Bitcoin also faces limitations:

-

Scalability Issues: The Bitcoin network's transaction processing speed can be slow and costly.

-

Energy Consumption: Bitcoin mining requires significant energy consumption, raising environmental concerns.

-

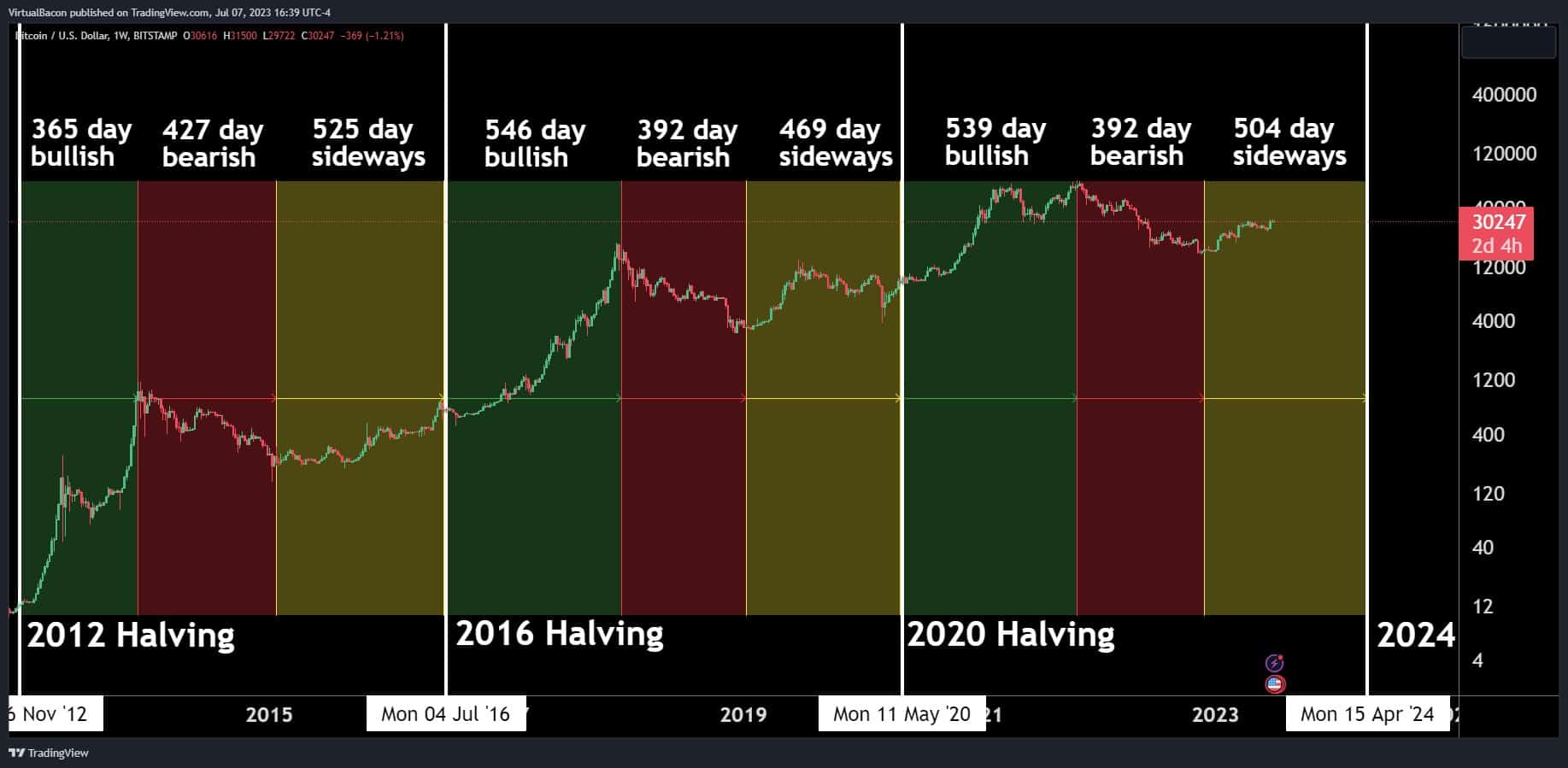

Factors Influencing Bitcoin's Price in 2025: Several factors could significantly influence Bitcoin's price in 2025, including:

- Regulatory Landscape: Government regulations regarding cryptocurrencies will play a crucial role.

- Institutional Adoption: Increased adoption by large financial institutions could drive price appreciation.

- Technological Advancements: Improvements in Bitcoin's scalability and efficiency could boost its appeal.

-

Risks of Investing Directly in Bitcoin: Investing directly in Bitcoin carries significant risks due to its high volatility, security concerns (e.g., exchange hacks), and potential for regulatory crackdowns.

-

Potential Rewards: Despite the risks, the potential for long-term price appreciation remains a significant incentive for investors.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison

Risk Tolerance and Investment Goals

The risk profiles of MicroStrategy stock and Bitcoin differ considerably. MicroStrategy, being a publicly traded company, offers a degree of stability compared to the highly volatile nature of Bitcoin.

- Risk, Reward, and Liquidity Comparison:

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Risk | Moderate (influenced by Bitcoin price) | High |

| Reward Potential | Moderate to High (dependent on Bitcoin) | High (but also high risk of loss) |

| Liquidity | High (easily traded on stock exchanges) | High (though trading fees can vary) |

- Suitability for Different Investor Profiles: Risk-averse investors might prefer MicroStrategy stock, while risk-tolerant investors might consider Bitcoin.

- Diversification Strategies: Diversifying a portfolio by including both MicroStrategy stock and Bitcoin can potentially mitigate risk while capturing potential rewards from both asset classes.

Factors to Consider Before Investing

Due Diligence and Market Research

Before investing in either MicroStrategy stock or Bitcoin, thorough due diligence and market research are crucial.

- Conducting Independent Research: Consult reputable financial news sources, research reports, and analytical platforms to gather information.

- Understanding the Fundamentals: Gain a comprehensive understanding of MicroStrategy's business model and Bitcoin's technology and underlying principles.

- Consulting a Financial Advisor: Seeking advice from a qualified financial advisor can provide personalized guidance based on your specific circumstances and risk tolerance.

Conclusion

Investing in 2025 presents a unique opportunity to consider both MicroStrategy stock and Bitcoin. While MicroStrategy offers exposure to Bitcoin through its significant holdings, providing a potentially less volatile entry point, direct Bitcoin investment carries higher risks and rewards. The choice depends heavily on individual risk tolerance, investment goals, and a thorough understanding of each asset’s inherent characteristics. Remember to conduct thorough research, consider professional advice, and develop a diversified investment strategy aligned with your personal financial objectives. To further enhance your understanding of Investing in 2025: MicroStrategy Stock vs. Bitcoin, explore additional resources like financial news websites and independent market analysis reports. Make informed decisions about your investment strategy.

Featured Posts

-

506 Million Canadas Reduced Trade Deficit And Tariff Implications

May 08, 2025

506 Million Canadas Reduced Trade Deficit And Tariff Implications

May 08, 2025 -

Inter Milans 2026 Contract Situation Which Players Are Leaving

May 08, 2025

Inter Milans 2026 Contract Situation Which Players Are Leaving

May 08, 2025 -

Bitcoin Price Rebound What To Expect Next

May 08, 2025

Bitcoin Price Rebound What To Expect Next

May 08, 2025 -

Us China Trade Deal Spurs Bitcoin Price Increase Bullish Crypto Market

May 08, 2025

Us China Trade Deal Spurs Bitcoin Price Increase Bullish Crypto Market

May 08, 2025 -

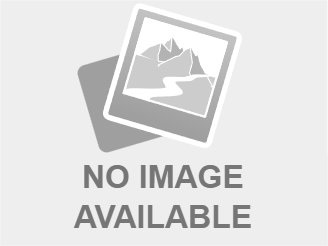

Anchor Brewing Companys Closure A Legacy Lost After 127 Years

May 08, 2025

Anchor Brewing Companys Closure A Legacy Lost After 127 Years

May 08, 2025