Invesco And Barings Democratize Private Credit Investing

Table of Contents

Invesco's Approach to Democratizing Private Credit

Invesco has implemented several key strategies to make private credit investing more accessible to a wider audience, including retail investors and smaller institutions.

Lowering the Investment Barrier

Invesco has significantly lowered the minimum investment requirements for several of its private credit funds. This allows participation from investors who previously lacked the capital to access this asset class.

- Creation of smaller-sized funds: Invesco has launched funds with significantly lower minimum investment thresholds compared to traditional private credit offerings.

- Innovative fund structures: The use of feeder funds and other innovative structures enables participation with smaller capital commitments.

- Access through platforms: Invesco offers access to private credit opportunities through various platforms, streamlining the investment process and reducing administrative hurdles.

Enhanced Transparency and Reporting

Invesco prioritizes transparency, providing clear and regular reporting to investors, regardless of their size or sophistication. This fosters trust and confidence, crucial for attracting a wider investor base.

- Regular investor updates: Investors receive frequent updates on portfolio performance, market trends, and investment strategies.

- User-friendly reporting tools: Invesco utilizes intuitive online portals and reporting tools, making it easier for investors to access key information.

- Educational resources: Invesco provides educational materials and webinars designed to help investors understand the nuances of private credit investing.

Diversification Opportunities

Invesco's private credit offerings provide diversification benefits. Instead of concentrating investments in a single asset or strategy, investors gain access to a diversified portfolio across different asset classes and strategies, mitigating risk.

- Broad range of strategies: Invesco offers exposure to various private credit strategies, such as direct lending, mezzanine financing, and distressed debt.

- Diversification across sectors: Investments are spread across diverse industries, reducing exposure to any single sector's performance volatility.

- Geographic diversification: Invesco’s portfolio includes assets from various geographies, further mitigating risk.

Barings' Strategies for Wider Private Credit Access

Barings, another industry leader, employs a range of strategies to broaden access to private credit investing.

Innovative Fund Structures

Barings utilizes innovative fund structures designed to attract a diverse investor base, including smaller institutional investors and high-net-worth individuals.

- Open-ended funds: These funds offer greater liquidity compared to traditional closed-end private credit vehicles.

- Subscription-based funds: These structures provide more flexibility for investors with varying capital commitments.

- Co-investment opportunities: Barings enables co-investment opportunities, allowing investors to participate in select transactions alongside the firm.

Focus on Specific Market Niches

Barings strategically targets specific market niches within private credit, providing investors with unique opportunities that may not be readily available through traditional channels.

- Focus on specific industries: Barings has specialized funds focused on sectors like renewable energy or healthcare, offering investors specialized exposure.

- Targeting underserved markets: Barings actively seeks opportunities in underserved markets, offering potentially higher returns with appropriate risk management.

- Strategic partnerships: Collaborations with other firms help expand access to unique and valuable opportunities.

Technological Advancements

Barings leverages technology to streamline the investment process and enhance accessibility for a broader investor audience.

- Online investment platforms: Barings offers online platforms for investors to manage their investments and access information.

- Automated reporting tools: Technology is used to generate accurate and timely reports, improving transparency.

- Data analytics and AI: The use of data analytics and AI helps to identify attractive investment opportunities and manage risk more effectively.

Unlocking the Potential of Private Credit: A Call to Action

Invesco and Barings are at the forefront of democratizing private credit investing, significantly lowering barriers to entry and increasing transparency. Their innovative strategies are making this lucrative asset class accessible to a wider range of investors, including retail investors and smaller institutions. The benefits of this increased accessibility include diversification, potentially higher returns, and the opportunity to participate in a previously exclusive market.

To learn more about the exciting opportunities in private credit investing and how Invesco and Barings are shaping the future of this asset class, we encourage you to explore their respective websites and discover how you can participate in this transformative shift in the investment landscape. Start exploring the potential of democratizing private credit investing today! [Link to Invesco Private Credit] [Link to Barings Private Credit]

Featured Posts

-

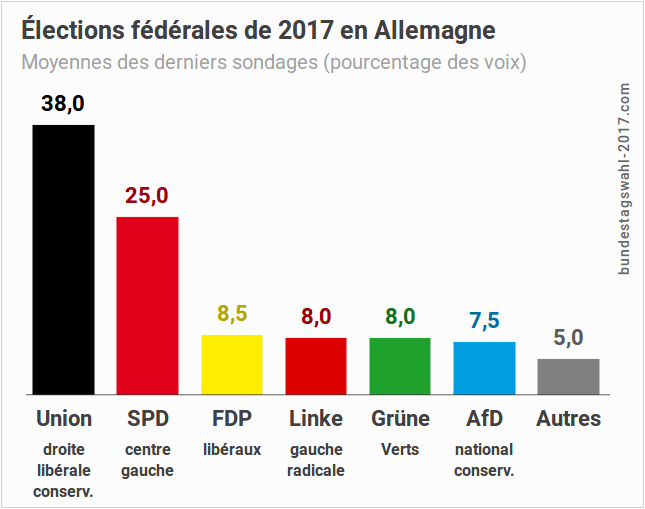

Elections Legislatives Allemandes Decryptage A J 6

Apr 23, 2025

Elections Legislatives Allemandes Decryptage A J 6

Apr 23, 2025 -

Yankees Smash Team Record With 9 Home Runs Judge Leads With 3 In 2025 Opener

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Judge Leads With 3 In 2025 Opener

Apr 23, 2025 -

Pavel Pivovarov I Ovechkin Detali Novoy Kollektsii Mercha

Apr 23, 2025

Pavel Pivovarov I Ovechkin Detali Novoy Kollektsii Mercha

Apr 23, 2025 -

Impact Of Tariffs Walmart And Target Executives In Meeting With President Trump

Apr 23, 2025

Impact Of Tariffs Walmart And Target Executives In Meeting With President Trump

Apr 23, 2025 -

Istanbul Da Pazartesi Guenue Okullar Kapali Mi

Apr 23, 2025

Istanbul Da Pazartesi Guenue Okullar Kapali Mi

Apr 23, 2025