InterRent REIT: Executive Chair And Sovereign Wealth Fund Offer

Table of Contents

The Executive Chair's Role in the Offer

The Executive Chair's involvement is crucial to understanding this offer. Their extensive experience in real estate and financial markets lends significant weight to the proposal.

- Extensive Background: (Insert details about the Executive Chair's background, including previous roles, achievements, and relevant expertise in REIT management and strategic partnerships). This deep understanding of the REIT sector is key to their strategic vision for InterRent REIT.

- Motivation: The Executive Chair's motivation likely stems from a long-term vision for InterRent REIT's growth and strengthening its competitive position within the Canadian market. This could involve consolidating market share, expanding into new geographical areas, or pursuing innovative real estate development strategies. The offer could be seen as a catalyst for achieving these ambitious goals.

- Addressing Conflicts of Interest: It's essential to transparently address any potential conflicts of interest. (Detail how any potential conflicts are being handled, perhaps through independent board review and disclosures). This transparency builds investor confidence and ensures ethical corporate governance.

Keywords: InterRent REIT Executive Chair, leadership, corporate governance, strategic decision, REIT management, real estate expertise.

The Sovereign Wealth Fund's Involvement

The participation of a Sovereign Wealth Fund (SWF) adds another layer of complexity and potential to this offer. Identifying the specific SWF involved is critical to understanding their investment strategy and rationale.

- SWF Investment Strategy: (Identify the SWF and describe their typical investment approach – are they focused on long-term growth, diversification, or specific sectors?). Understanding their investment philosophy sheds light on their interest in InterRent REIT.

- Rationale for Investment: The SWF's interest in InterRent REIT could be driven by several factors: access to a stable, high-yield asset class within the Canadian real estate market; diversification of their portfolio; and a belief in InterRent REIT's long-term growth potential.

- Financial Benefits for InterRent REIT: The injection of capital from the SWF could provide InterRent REIT with significant financial advantages. This could include:

- Funding for acquisitions and expansions.

- Strengthened financial stability and reduced reliance on debt financing.

- Opportunities to pursue larger, more strategic projects.

- Implications of Foreign Investment: The involvement of a foreign investor, especially a SWF, will need careful consideration regarding regulatory compliance and potential impacts on InterRent REIT’s operations and the broader Canadian real estate market.

Keywords: Sovereign Wealth Fund investment, foreign investment, REIT market trends, capital investment, financial stability, Canadian real estate market, diversification.

Details of the Offer and its Potential Impact

The specifics of the offer are crucial to assess its potential impact. (If publicly available, clearly outline the terms of the offer – e.g., price per share, proposed ownership structure, conditions).

- Benefits for Shareholders: The offer's benefits for InterRent REIT shareholders will depend on the terms. Potential advantages include:

- Higher share price.

- Increased dividend payouts.

- Access to a wider range of investment opportunities.

- Risks and Challenges: Potential risks and challenges associated with the offer could include:

- Regulatory hurdles.

- Integration challenges between InterRent REIT and the SWF.

- Potential dilution of existing shareholder ownership.

- Comparison to Other Transactions: (Compare this offer to similar transactions in the REIT sector to gauge its competitiveness and potential success. Include examples of successful and unsuccessful mergers or acquisitions).

Keywords: InterRent REIT acquisition, share price, shareholder value, REIT mergers and acquisitions, investment risks, due diligence.

Market Reaction and Analyst Opinions

The market's response to the offer is an important indicator of its reception. (Summarize the market's reaction, including any changes in InterRent REIT’s share price, investor sentiment, and trading volume).

- Analyst Opinions: Include quotes and analyses from reputable financial analysts covering InterRent REIT. (Provide a balanced perspective of bullish and bearish viewpoints).

- Long-Term Implications: (Analyze the long-term implications of the offer on InterRent REIT’s performance and future growth. Consider factors like market share, competitive landscape, and overall profitability).

Keywords: Market analysis, stock market, investment strategy, financial analysts, future growth, REIT performance.

Conclusion: Assessing the InterRent REIT Executive Chair and Sovereign Wealth Fund Offer

The offer involving InterRent REIT's Executive Chair and a Sovereign Wealth Fund represents a significant development in the Canadian REIT market. While the potential benefits – such as increased capital, expansion opportunities, and enhanced financial stability – are considerable, potential risks must also be carefully considered. A thorough due diligence process is critical for both InterRent REIT and its shareholders. The market reaction and expert opinions will continue to shape the narrative surrounding this offer.

To stay informed about the latest developments and explore further investment opportunities in InterRent REIT and other REITs, we encourage you to:

- Conduct thorough research on InterRent REIT and its investment prospects.

- Stay updated on financial news and announcements related to the offer.

- Consult with a qualified financial advisor to discuss REIT investment strategies tailored to your personal circumstances. Understanding the complexities of InterRent REIT investments and the potential impact of this significant offer requires careful consideration. Don't hesitate to seek professional guidance.

Keywords: InterRent REIT investment, REIT portfolio, real estate investment, sovereign wealth fund investment opportunities, executive leadership in REITs, Canadian REIT market.

Featured Posts

-

Five Year Funding Plan To Strengthen Telus Networks

May 29, 2025

Five Year Funding Plan To Strengthen Telus Networks

May 29, 2025 -

Proceso De Escolarizacion En Aragon 58 Colegios Con Riesgo De Sorteo

May 29, 2025

Proceso De Escolarizacion En Aragon 58 Colegios Con Riesgo De Sorteo

May 29, 2025 -

Schoolroof In Venlo 16 Jarige Verdachte Aangehouden Na Bedreiging Met Pistool

May 29, 2025

Schoolroof In Venlo 16 Jarige Verdachte Aangehouden Na Bedreiging Met Pistool

May 29, 2025 -

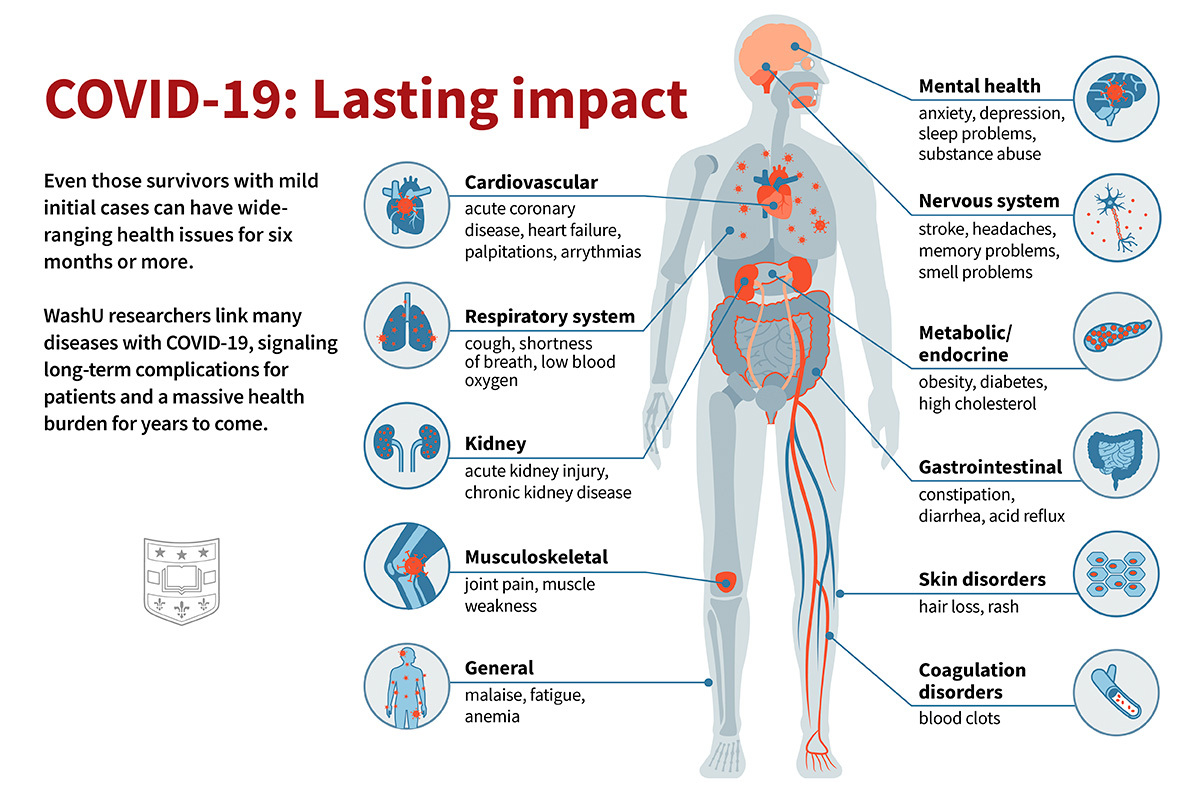

Reducing Your Long Covid Risk The Importance Of Covid 19 Vaccination

May 29, 2025

Reducing Your Long Covid Risk The Importance Of Covid 19 Vaccination

May 29, 2025 -

Male Escorts Apology To Cassie Following Diddy Sex Party Allegations

May 29, 2025

Male Escorts Apology To Cassie Following Diddy Sex Party Allegations

May 29, 2025