Inflation And Unemployment: Driving Forces Behind Increased Uncertainty

Table of Contents

We'll start by defining our key terms. Inflation refers to a general increase in the prices of goods and services in an economy over a period of time. Unemployment, on the other hand, represents the percentage of the labor force that is actively seeking employment but unable to find it. While seemingly distinct, inflation and unemployment are intricately linked, often influencing and exacerbating each other's effects.

The Impact of Inflation on Economic Uncertainty

Inflation's insidious nature seeps into every aspect of our economic lives, creating a ripple effect of uncertainty.

Eroding Purchasing Power

Inflation diminishes the purchasing power of money. As prices rise, the same amount of money buys fewer goods and services. This forces consumers to make difficult choices, impacting their spending habits significantly.

- Rising prices for essential goods: Food, energy, and housing costs are often the first to feel the pinch of inflation, severely impacting lower-income households.

- Decreased consumer confidence: When prices continuously climb, consumers become less confident about the future, leading to a decline in overall spending.

- Reduced discretionary spending: As essential expenses consume a larger portion of income, discretionary spending on non-essential items decreases, impacting various sectors of the economy.

For instance, the inflation rate in the Eurozone reached X% in [Month, Year], while the US experienced a Y% inflation rate during the same period (replace X and Y with actual statistics). These figures highlight the widespread impact of rising prices.

Increased Business Costs and Investment Hesitation

Inflation doesn't spare businesses either. Increased production costs due to rising raw material prices, labor costs, and energy expenses force businesses to increase their prices, potentially impacting their competitiveness and profit margins. This often leads to investment hesitation.

- Rising raw material costs: Businesses reliant on imported materials are particularly vulnerable to fluctuations in global commodity prices fueled by inflation.

- Labor costs: Inflation often leads to wage demands, increasing labor costs for businesses.

- Energy prices: Higher energy prices directly impact production costs across numerous industries.

Small businesses, with fewer resources to absorb increased costs, are generally more vulnerable to inflationary pressures than larger corporations.

Impact on Interest Rates and Borrowing

Central banks typically respond to rising inflation by raising interest rates. This makes borrowing more expensive for both individuals and businesses, impacting mortgages, loans, and investment decisions.

- The relationship between inflation and interest rates: Higher inflation generally leads to higher interest rates as central banks try to cool down the economy.

- Impact on mortgages, loans, and investment: Increased interest rates make it more expensive to finance a home, start a business, or invest in new projects.

- Potential consequences of high interest rates: While aimed at controlling inflation, higher interest rates can also slow economic growth, potentially leading to a recession.

The Role of Unemployment in Heightening Economic Uncertainty

High unemployment significantly amplifies economic uncertainty. Job losses and income insecurity trigger a chain reaction with far-reaching consequences.

Job Losses and Income Insecurity

Unemployment translates directly into income loss for affected individuals and families. This reduced purchasing power impacts consumer spending and overall economic demand.

- Statistics on unemployment rates: Monitoring unemployment rates is crucial for understanding the health of the economy. High unemployment rates indicate a weakening economy.

- The impact on different demographics: Certain demographics, such as young people and minority groups, are often disproportionately affected by unemployment.

- The relationship between unemployment and poverty: High unemployment is a major driver of poverty and social inequality.

Reduced Consumer Confidence and Spending

Job insecurity and the fear of unemployment significantly reduce consumer confidence. Individuals become less willing to spend, opting to save money instead, creating a downward spiral.

- The psychological impact of unemployment: Unemployment is not merely an economic issue; it has a significant psychological impact, leading to stress, anxiety, and depression.

- Decreased willingness to spend: Uncertainty about future income leads to reduced consumer spending, hindering economic growth.

- Impact on the overall economy: Reduced consumer spending negatively affects businesses, leading to further job losses and a vicious cycle.

Increased Social and Political Instability

High unemployment can also fuel social unrest and political instability. Increased crime rates and social tensions are often observed during periods of high unemployment.

- Increased crime rates: Economic hardship can drive individuals to crime as they struggle to provide for their families.

- Social unrest: High unemployment can lead to social unrest and protests as people express their frustration and anger.

- Political instability: Economic hardship can destabilize governments and lead to political upheaval.

The Interplay Between Inflation and Unemployment: The Phillips Curve

The Phillips Curve illustrates the inverse relationship between inflation and unemployment. Traditionally, it suggests that lower unemployment is associated with higher inflation, and vice versa. However, this relationship is not always straightforward.

Stagflation, a period of high inflation and high unemployment, demonstrates the complexities of this relationship. Historical examples, such as the stagflation of the 1970s, highlight the limitations of a simple inverse relationship. Understanding these historical periods is key to anticipating future economic challenges.

Conclusion: Navigating the Uncertainties of Inflation and Unemployment

Inflation and unemployment are powerful forces shaping economic uncertainty, impacting consumers, businesses, and the overall economy. Their intricate interplay creates a complex and challenging environment. Understanding the dynamics between these two factors is crucial for making informed decisions. Staying informed about current economic trends, learning how to manage personal finances during inflationary periods, and seeking advice from financial professionals are essential steps in mitigating the effects of inflation and unemployment. Proactive strategies for understanding inflation and unemployment risks are crucial for navigating this turbulent economic climate.

Featured Posts

-

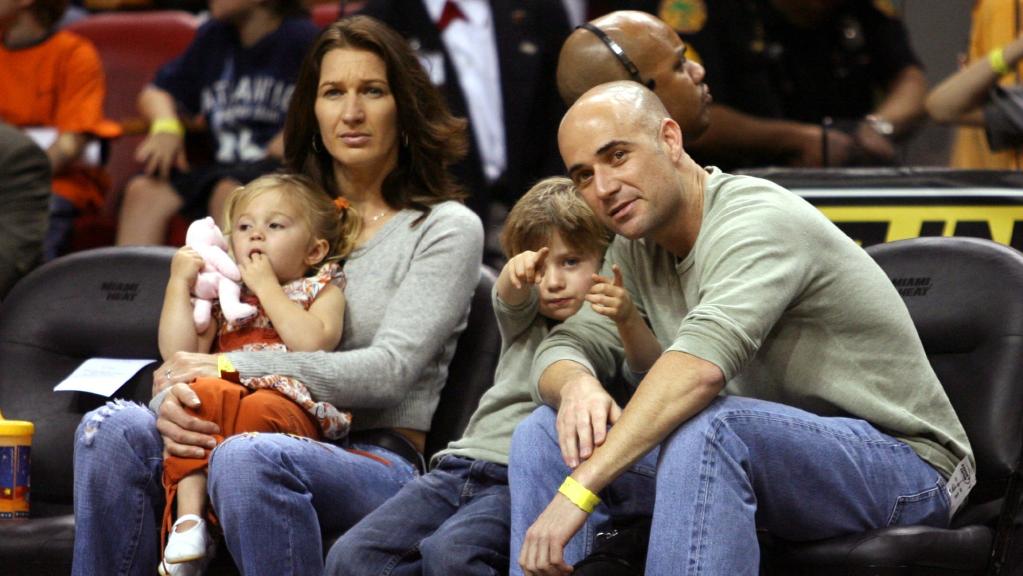

Declaratia Lui Andre Agassi Nervi Presiune Si Performanta

May 30, 2025

Declaratia Lui Andre Agassi Nervi Presiune Si Performanta

May 30, 2025 -

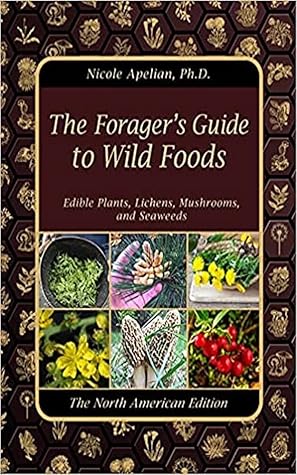

A Foragers Guide Identifying And Roasting The Carrots Wild Cousin

May 30, 2025

A Foragers Guide Identifying And Roasting The Carrots Wild Cousin

May 30, 2025 -

Amysha Ptyl Ky Tsawyr Ne Mdahwn Kw Hyran Krdya Kya Wh Hamlh Hyn

May 30, 2025

Amysha Ptyl Ky Tsawyr Ne Mdahwn Kw Hyran Krdya Kya Wh Hamlh Hyn

May 30, 2025 -

Analisis Del Episodio De Run Bts La Pelicula De Accion De Jin De Bts

May 30, 2025

Analisis Del Episodio De Run Bts La Pelicula De Accion De Jin De Bts

May 30, 2025 -

Anderlechts Fremtid Afvejning Af Et Attraktivt Tilbud

May 30, 2025

Anderlechts Fremtid Afvejning Af Et Attraktivt Tilbud

May 30, 2025

Latest Posts

-

Tallon Griekspoor Knocks Out Alexander Zverev At Indian Wells

May 31, 2025

Tallon Griekspoor Knocks Out Alexander Zverev At Indian Wells

May 31, 2025 -

Zverev Loses To Griekspoor In Indian Wells Second Round

May 31, 2025

Zverev Loses To Griekspoor In Indian Wells Second Round

May 31, 2025 -

Griekspoor Triumphs Over Top Seed Zverev In Indian Wells

May 31, 2025

Griekspoor Triumphs Over Top Seed Zverev In Indian Wells

May 31, 2025 -

Zverevs Upset Loss To Griekspoor At Indian Wells A Shocking Defeat

May 31, 2025

Zverevs Upset Loss To Griekspoor At Indian Wells A Shocking Defeat

May 31, 2025 -

Zverevs Upset Griekspoor Triumphs At Indian Wells

May 31, 2025

Zverevs Upset Griekspoor Triumphs At Indian Wells

May 31, 2025