Infineon (IFX) Sales Guidance: Impact Of Trump Tariff Uncertainty

Table of Contents

Infineon's (IFX) Historical Sales Performance and Growth Projections

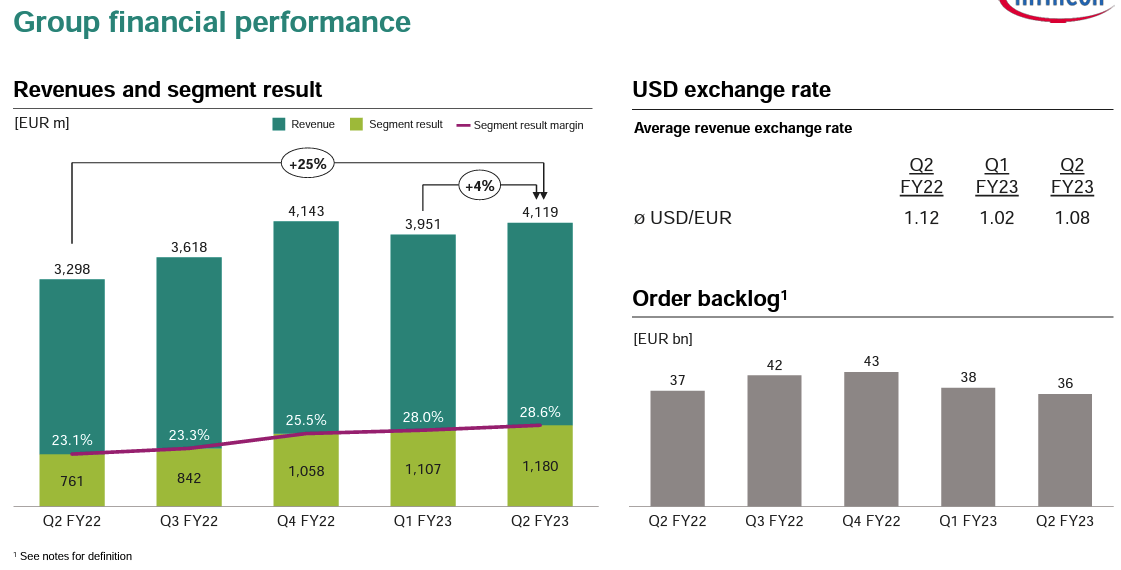

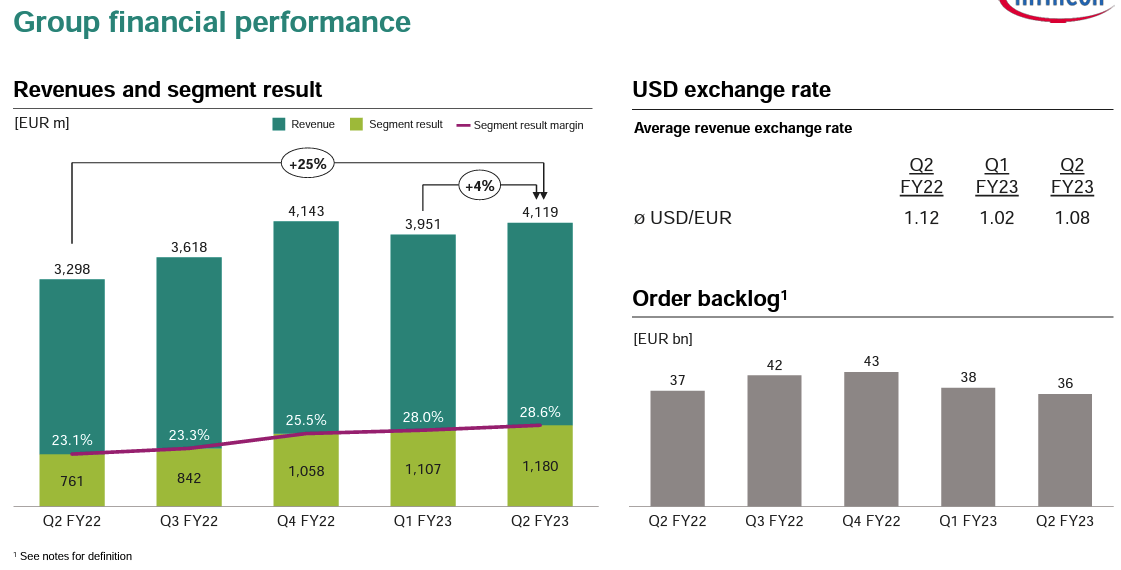

To understand the impact of the tariffs, we must first examine Infineon's historical sales performance. Analyzing Infineon's past financial results provides a crucial baseline against which to measure the effects of the trade war. (Insert chart/graph showing Infineon's revenue growth over the past 5-10 years here). Prior to the implementation of tariffs, Infineon demonstrated steady revenue growth, driven primarily by strong demand in automotive, industrial, and power management sectors. Deviations from projected sales guidance in previous years were often attributed to macroeconomic factors such as global economic slowdowns or specific regional market fluctuations.

- Key revenue streams for Infineon: Automotive electronics, industrial power control, power semiconductors, security solutions.

- Market share analysis: Infineon holds significant market share in various semiconductor segments, making it particularly vulnerable to widespread trade disruptions.

- Impact of previous economic cycles on Infineon's sales: Historical data shows Infineon's sales are correlated with overall global economic growth, indicating sensitivity to external factors.

The Impact of Trump's Tariffs on the Semiconductor Industry

Trump's tariffs, implemented as part of a broader trade war strategy, significantly disrupted the global semiconductor supply chain. The increased cost of raw materials, components, and manufacturing processes impacted profitability across the sector. The semiconductor industry, with its complex global supply chains and reliance on international trade, was particularly hard hit. Increased import costs directly translated to higher production expenses, squeezing profit margins for companies like Infineon.

- Specific tariffs impacting Infineon's products or supply chain: Identify specific tariffs affecting Infineon's key products or raw materials (e.g., tariffs on specific types of semiconductors or materials used in their production).

- Analysis of the tariff's impact on competitor companies: Compare the impact of tariffs on Infineon with that of its major competitors to gauge relative vulnerability.

- Geopolitical implications of the trade war: Discuss the broader geopolitical context of the trade war and its effects on international trade relations and investment climates.

Infineon's (IFX) Response to Tariff Uncertainty

Faced with tariff uncertainty, Infineon implemented various strategies to mitigate the negative impact on its sales guidance. These included price adjustments to offset increased costs, diversifying its supply chain to reduce reliance on tariff-affected regions, and engaging in lobbying efforts to influence trade policy. The effectiveness of these strategies varied. While diversification helped to some extent, price adjustments risked impacting market share.

- Specific examples of Infineon's actions to address tariff challenges: Detail specific examples of Infineon's actions, such as sourcing components from different countries or adjusting pricing strategies.

- Analysis of the financial consequences of these actions: Assess the financial impact of these actions on Infineon's profitability and revenue streams.

- Discussion of any public statements from Infineon regarding tariffs: Analyze any official statements or press releases from Infineon regarding their response to the tariffs.

Analyzing Revised Infineon (IFX) Sales Guidance and Future Outlook

Following the implementation of tariffs, Infineon revised its sales guidance. (Insert data comparing initial and revised guidance here). The revision reflected the challenges posed by increased costs and supply chain disruptions. Analyzing these revised projections allows for a more accurate assessment of the long-term effects of the tariffs on Infineon's growth trajectory. The future outlook for Infineon depends on various factors, including the resolution of trade tensions, global economic growth, and technological advancements within the semiconductor industry.

- Comparison of initial and revised sales guidance: Present a clear comparison of Infineon's initial projections and the revised figures after the tariffs were implemented.

- Potential risks and opportunities for Infineon going forward: Discuss the potential risks and opportunities facing Infineon in the future, considering the ongoing global economic and geopolitical landscape.

- Recommendations for investors based on the updated sales guidance: Offer investment recommendations based on the updated sales guidance and the outlook for the company.

Understanding the Implications of Infineon (IFX) Sales Guidance and Tariff Uncertainty

In conclusion, Trump's tariffs significantly impacted Infineon's sales guidance, highlighting the vulnerability of the semiconductor industry to global trade dynamics. While Infineon employed various strategies to mitigate the negative effects, the revised sales projections reflect the challenges faced. Understanding the historical performance, the impact of tariffs, and Infineon's response is crucial for investors seeking to assess the company's future performance. To stay informed about Infineon (IFX) stock performance and its future growth trajectory amidst ongoing global trade uncertainties, continue researching Infineon (IFX) sales guidance and related news. Keep an eye on future Infineon (IFX) financial results to better gauge its resilience and long-term prospects.

Featured Posts

-

Androids Updated Look A Gen Z Perspective

May 10, 2025

Androids Updated Look A Gen Z Perspective

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community

May 10, 2025 -

Perus Emergency Mining Ban And Its 200 Million Gold Price Tag

May 10, 2025

Perus Emergency Mining Ban And Its 200 Million Gold Price Tag

May 10, 2025 -

Concarneau S Impose A Dijon 0 1 En National 2 Saison 2024 2025

May 10, 2025

Concarneau S Impose A Dijon 0 1 En National 2 Saison 2024 2025

May 10, 2025 -

The Effects Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025

The Effects Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025