Indonesia's Foreign Exchange Reserves: Significant Drop Due To Rupiah Pressure

Table of Contents

Pressure on the Indonesian Rupiah

The weakening of the Indonesian Rupiah is the primary driver behind the decline in Indonesia's forex reserves. Several factors contribute to this pressure.

Weakening Global Demand

Increased global economic uncertainty significantly impacts export demand for Indonesian goods. This reduced demand translates directly into lower export earnings, decreasing crucial foreign currency inflows.

- Lower commodity prices: Fluctuations in global commodity markets, particularly those impacting Indonesia's key exports, directly affect export revenue and the inflow of foreign exchange.

- Global recessionary fears: Concerns about a global recession dampen international trade, reducing demand for Indonesian products and putting downward pressure on the Rupiah.

- Decreased tourism revenue: A decline in international tourism, potentially due to global economic slowdowns or other factors, reduces vital foreign currency inflows.

Capital Outflows

Rising interest rates in developed countries, particularly the US, incentivize foreign investors to withdraw investments from emerging markets like Indonesia in search of higher yields. This capital flight further weakens the Rupiah and depletes forex reserves.

- US Federal Reserve rate hikes: Aggressive interest rate increases by the US Federal Reserve attract capital away from Indonesia, impacting the Rupiah's exchange rate and forex reserves.

- Global inflation concerns: High global inflation and uncertainty lead to increased risk aversion, prompting investors to pull funds from emerging markets, including Indonesia.

- Search for higher yields: Investors seek higher returns on their investments, leading them to shift funds to markets offering higher interest rates, causing capital outflows from Indonesia.

Import Dependency

Indonesia's relatively high reliance on imports necessitates a significant demand for foreign currency. A widening trade deficit, where imports exceed exports, puts considerable pressure on the nation's forex reserves.

- Energy imports: Indonesia's dependence on energy imports requires substantial foreign currency outflows.

- Consumer goods: The import of various consumer goods adds to the demand for foreign currency, straining forex reserves.

- Intermediate goods: Imports of intermediate goods needed for manufacturing further contribute to the pressure on foreign exchange reserves.

The Role of Bank Indonesia (BI)

Bank Indonesia (BI), Indonesia's central bank, plays a critical role in managing the country's foreign exchange reserves and mitigating the impact of Rupiah pressure.

Intervention in the Forex Market

BI actively intervenes in the foreign exchange market, selling foreign exchange reserves to support the Rupiah and stabilize its value. However, this intervention directly depletes the nation's forex reserves.

- Frequency of intervention: The frequency of BI's interventions reflects the severity of the pressure on the Rupiah.

- Effectiveness of interventions: The success of BI's interventions in stabilizing the Rupiah varies depending on the market forces at play.

- Impact on reserve levels: These interventions have a direct and measurable impact on the level of Indonesia's foreign exchange reserves.

Monetary Policy Adjustments

BI utilizes various monetary policy tools, primarily interest rate adjustments, to influence the Rupiah's value and manage inflation. Balancing inflation control with supporting economic growth presents a significant challenge.

- Interest rate hikes: Raising interest rates makes Indonesian assets more attractive to foreign investors, potentially increasing capital inflows and supporting the Rupiah.

- Inflation targets: BI sets inflation targets to maintain price stability, impacting monetary policy decisions.

- Impact on investment and lending: Changes in interest rates affect investment and lending activity, influencing economic growth and the overall demand for foreign currency.

Economic Implications of the Reserve Decline

The decline in Indonesia's foreign exchange reserves carries several significant economic implications.

Impact on Inflation

A weaker Rupiah directly increases the cost of imports, leading to higher inflation. This erosion of purchasing power can negatively impact consumer spending and potentially trigger social unrest.

- Inflation rates: The rate of inflation directly reflects the impact of the weaker Rupiah on import costs.

- Impact on consumer prices: Rising import costs translate into higher consumer prices for essential goods and services.

- Government measures to control inflation: The Indonesian government implements various measures to mitigate the impact of inflation on the population.

Debt Servicing Costs

A weaker Rupiah significantly increases the cost of servicing Indonesia's foreign currency-denominated debt. This added burden puts pressure on the government's budget and fiscal policy.

- Government debt levels: The level of Indonesia's government debt, particularly the portion denominated in foreign currencies, is crucial.

- Foreign currency denominated debt: The proportion of debt denominated in foreign currencies directly impacts the cost of servicing this debt when the Rupiah weakens.

- Impact on fiscal policy: Increased debt servicing costs necessitate adjustments in fiscal policy, potentially impacting government spending and other economic priorities.

Impact on Foreign Investment

Currency volatility significantly discourages foreign direct investment (FDI). Reduced FDI hinders economic growth, job creation, and overall economic development.

- FDI inflows: The level of FDI inflows directly reflects investor confidence in the stability of the Rupiah.

- Impact on GDP growth: Reduced FDI negatively impacts GDP growth and overall economic performance.

- Government initiatives to attract FDI: The Indonesian government implements various initiatives to attract foreign investment despite the challenges posed by currency volatility.

Conclusion

The significant drop in Indonesia's foreign exchange reserves, primarily due to Rupiah pressure, poses considerable challenges for the Indonesian economy. While Bank Indonesia actively works to stabilize the situation through interventions and monetary policy adjustments, the underlying factors—global economic uncertainty, capital outflows, and import dependency—demand careful and sustained attention. Understanding the dynamics of Indonesia's foreign exchange reserves and the factors influencing the Rupiah's value is critical for investors, policymakers, and the Indonesian economy as a whole. Continuously monitoring news and reports on Indonesia's foreign exchange reserves and the Rupiah is vital for navigating this complex economic landscape and making informed decisions.

Featured Posts

-

Investigation Into Nottingham Attacks Leads To Police Misconduct Meeting

May 10, 2025

Investigation Into Nottingham Attacks Leads To Police Misconduct Meeting

May 10, 2025 -

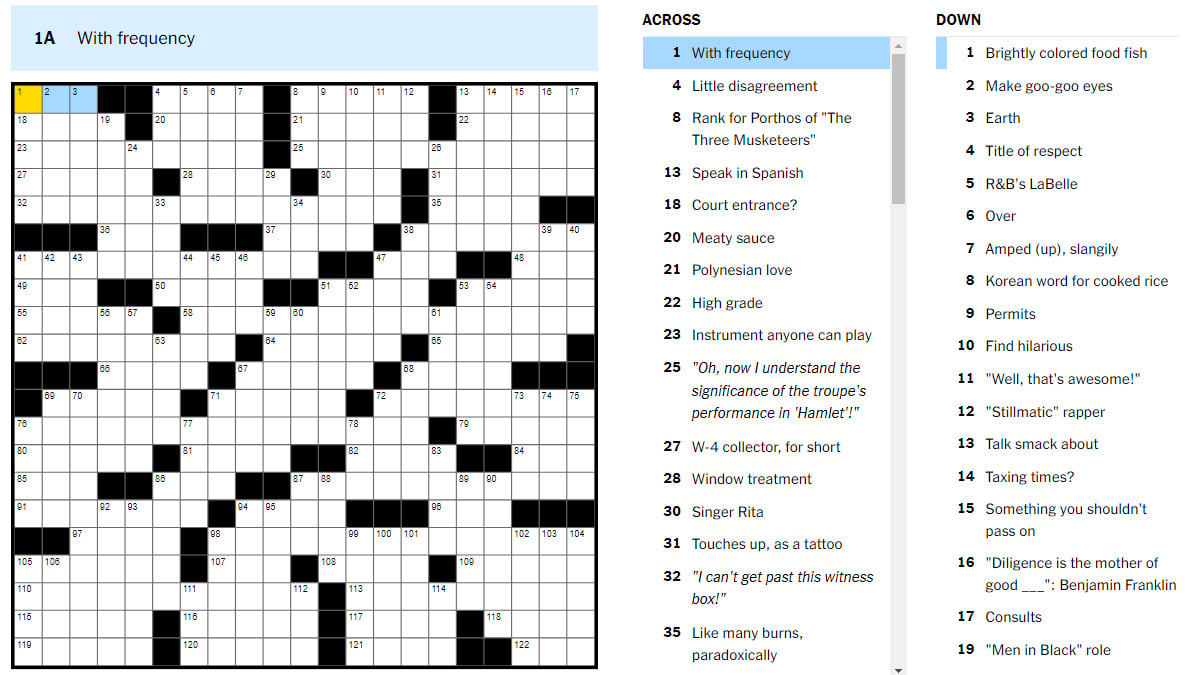

Nyt Crossword April 12 2025 Complete Guide To Solving The Saturday Puzzle

May 10, 2025

Nyt Crossword April 12 2025 Complete Guide To Solving The Saturday Puzzle

May 10, 2025 -

Analysis Pam Bondis Reaction To James Comers Epstein Claims

May 10, 2025

Analysis Pam Bondis Reaction To James Comers Epstein Claims

May 10, 2025 -

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025 -

Potential Changes To Migrant Detention Review Under Trump

May 10, 2025

Potential Changes To Migrant Detention Review Under Trump

May 10, 2025