Indian Stock Market: Sensex And Nifty Surge; UltraTech Decline

Table of Contents

Sensex and Nifty Surge: A Detailed Analysis

Factors Contributing to the Sensex and Nifty Rise:

The impressive rise in the Sensex and Nifty indices can be attributed to several key factors:

- Robust GDP Growth: India's consistent economic growth, fueled by strong domestic demand and government initiatives, has boosted investor confidence. Positive GDP projections for the coming quarters further solidify this optimistic outlook.

- Foreign Institutional Investor (FII) Inflows: Significant inflows of foreign investment into the Indian stock market demonstrate global confidence in the country's economic potential and future growth prospects. This influx of capital directly impacts index performance.

- Strong Corporate Earnings: Positive corporate earnings reports from various sectors, particularly IT, banking, and pharmaceuticals, have contributed significantly to the market's upward trajectory. These results signal a healthy and expanding economy.

- Positive Global Market Sentiment: A generally positive global market environment, with improving economic indicators in several key economies, has also played a role in boosting the Sensex and Nifty. This positive global sentiment spills over into emerging markets like India.

Data reveals that the Sensex climbed by X% and the Nifty by Y% in the past Z weeks/months (replace X, Y, and Z with actual figures). Specific sectors like IT (up Z%) and Banking (up A%) have been particularly strong performers.

Sustainability of the Sensex and Nifty Gains:

While the current surge is encouraging, maintaining this upward momentum depends on several factors.

- Inflationary Pressures: Rising inflation could dampen consumer spending and negatively impact corporate profits, potentially hindering further growth. Careful monitoring of inflation rates is crucial.

- Geopolitical Uncertainty: Global geopolitical events can significantly influence investor sentiment. Any escalation of international tensions could lead to market corrections.

- Interest Rate Hikes: Any increase in interest rates by the Reserve Bank of India (RBI) could impact borrowing costs for businesses and potentially slow down economic growth.

Experts suggest that while the long-term outlook remains positive, investors should remain cautious and diversify their portfolios to mitigate potential risks. The sustainability of these gains depends on the continued management of these potential challenges.

UltraTech Cement Decline: Understanding the Drop

Reasons Behind UltraTech's Performance:

The decline in UltraTech Cement's stock price can be attributed to a confluence of factors:

- Decreased Cement Demand: A slowdown in the real estate sector and infrastructure projects has led to a decrease in the demand for cement, impacting UltraTech's sales and profitability.

- Rising Input Costs: Increased prices of raw materials like coal and fuel have significantly impacted UltraTech's production costs, squeezing profit margins.

- Intense Competition: The cement industry in India is highly competitive, with several major players vying for market share. This competition puts pressure on pricing and profitability.

UltraTech's recent quarterly earnings report revealed a decline in profits compared to the previous quarter, further contributing to the stock price decrease. A comparison to other cement companies like ACC and Ambuja Cement reveals a similar trend in the sector, suggesting a broader industry challenge.

Future Outlook for UltraTech Cement:

The future performance of UltraTech Cement will depend on several factors including:

- Government Infrastructure Spending: Increased government investment in infrastructure projects could significantly boost demand for cement.

- Cost Management Strategies: UltraTech's ability to effectively manage rising input costs will be critical for its profitability.

- Innovation and Expansion: Investing in new technologies and expanding into new markets could help UltraTech maintain its competitive edge.

Analysts have offered mixed predictions, with some suggesting a potential recovery based on future government initiatives, while others remain cautious due to the persistent challenges in the sector.

Impact on Investors: Strategies and Implications

How the Market Movements Affect Different Investor Profiles:

The recent market volatility has different implications for various investor profiles:

- Long-term Investors: Long-term investors with a diversified portfolio may not be significantly affected by short-term fluctuations.

- Short-term Traders: Short-term traders are more susceptible to the market's volatility and require a higher risk tolerance.

The contrasting performances of Sensex/Nifty and UltraTech highlight the importance of diversification and risk management.

Navigating the Indian Stock Market Volatility:

Navigating the volatile Indian stock market requires a strategic approach:

- Diversification: Spread investments across different asset classes and sectors to mitigate risk.

- Risk Management: Understand your risk tolerance and adjust your investment strategy accordingly.

- Thorough Research: Conduct thorough research before making any investment decisions.

- Professional Advice: Seek professional financial advice from qualified advisors.

Conclusion: Navigating the Indian Stock Market – Sensex, Nifty, and Beyond

The recent surge in the Sensex and Nifty, juxtaposed with UltraTech Cement's decline, highlights the inherent volatility of the Indian stock market. Factors such as economic growth, foreign investment, corporate earnings, inflation, and geopolitical events all play a crucial role in shaping market trends. While the long-term outlook for the Indian economy remains positive, investors must adopt a cautious and informed approach, focusing on diversification and risk management. Stay updated on the performance of the Sensex, Nifty, and individual stocks like UltraTech Cement by consulting reliable financial news sources and, when needed, seeking professional financial advice. Successful navigation of the Indian stock market requires continuous learning and a well-defined investment strategy.

Featured Posts

-

New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025

New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025 -

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025 -

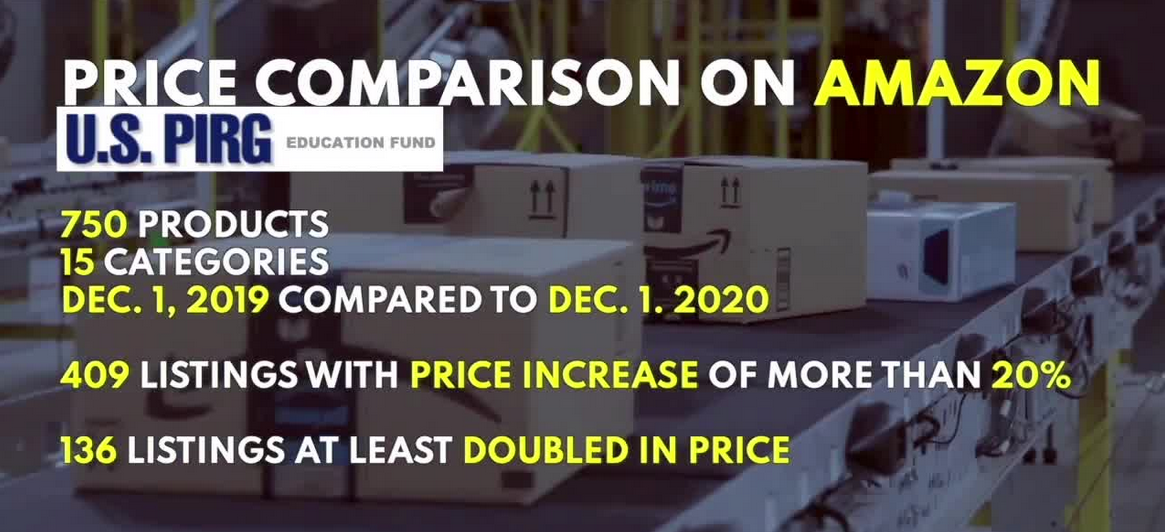

La Fire Victims Face Rental Crisis Price Gouging Concerns Rise

May 10, 2025

La Fire Victims Face Rental Crisis Price Gouging Concerns Rise

May 10, 2025 -

Harry Styles Snl Impression Backlash The Singers Response

May 10, 2025

Harry Styles Snl Impression Backlash The Singers Response

May 10, 2025 -

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025