Indian Real Estate Witnesses 47% Investment Jump In First Quarter Of 2024

Table of Contents

Factors Driving the 47% Investment Surge in Indian Real Estate

Several key factors contributed to the impressive 47% rise in Indian real estate investment during Q1 2024. These investment drivers represent a confluence of economic improvements, supportive government policies, and evolving market sentiments.

-

Improved Economic Outlook: Positive GDP growth and increased consumer confidence are major boosters for investor sentiment in the Indian real estate market. A stronger economy translates into greater purchasing power and a more optimistic outlook for future returns on real estate investments. This positive economic climate directly impacts real estate growth in India.

-

Government Initiatives: Favorable government policies and large-scale infrastructure development projects have significantly attracted investments. Initiatives like the affordable housing schemes aim to increase homeownership, while streamlined land acquisition processes reduce bureaucratic hurdles for developers. These policy changes are crucial drivers of the real estate market in India.

-

Reduced Interest Rates: Lower interest rates on home loans have made property purchases significantly more accessible, thereby fueling demand. This affordability factor has been a critical element in driving investment across various segments of the Indian real estate market.

-

Increased Foreign Direct Investment (FDI): Foreign investors are increasingly recognizing the vast potential of the Indian real estate market, leading to substantial FDI inflows. This influx of foreign capital is further bolstering the growth trajectory of the sector.

-

Technological Advancements: Proptech innovations, such as online property portals and digital transaction platforms, are streamlining the buying and selling process. Increased transparency and efficiency are attracting more investors and improving market liquidity.

Key Investment Areas Showing Strong Growth

The 47% investment surge wasn't evenly distributed; certain areas experienced particularly robust growth. Identifying these investment hotspots is crucial for investors looking to maximize returns.

-

Tier-1 Cities (Mumbai, Delhi, Bengaluru): These major metropolitan areas continue to witness strong demand for luxury and premium residential properties, as well as prime commercial real estate. The established infrastructure and high concentration of businesses make them attractive investment destinations.

-

Tier-2 Cities (Pune, Hyderabad, Chennai): Rapid urbanization and significant infrastructure development projects are transforming these emerging markets. Investment in Tier-2 cities offers potentially higher returns compared to saturated Tier-1 markets, making them increasingly appealing.

-

Commercial Real Estate: The growth of the IT sector and other businesses is driving significant demand for office spaces and retail complexes. Commercial real estate investments offer attractive rental yields and potential for capital appreciation.

-

Affordable Housing: Government support and the ever-increasing demand for affordable housing are fueling substantial growth in this segment. This sector presents both social and economic investment opportunities.

Analyzing the Investment Landscape Across Different Property Types

Understanding the investment landscape requires analyzing trends across various property types.

-

Residential Property: The residential market encompasses apartments, villas, and other housing units. Investment strategies range from individual home purchases to large-scale apartment building projects. Risk profiles vary based on location, property type, and market conditions.

-

Commercial Property: This includes office spaces, retail properties, and industrial units. Commercial real estate generally offers higher rental yields but may require significant capital investment upfront.

-

Land Investment: Investing in land provides long-term growth potential but comes with the risk of slower returns and potential regulatory complexities. Land investment in strategic locations can yield substantial profits over time. Different strategies exist, including buying raw land and developing it later.

Future Outlook for Indian Real Estate

While Q1 2024 showcased remarkable growth, understanding the future outlook is crucial for strategic investment decisions.

-

Sustained Growth Projection: Experts predict continued growth in the Indian real estate market, although perhaps at a more moderate pace. Factors like economic stability and regulatory environments will influence the rate of growth.

-

Emerging Trends: The sector is witnessing a shift towards sustainable development practices, smart homes equipped with advanced technologies, and the increasing popularity of co-living spaces. Investors should consider these trends when making investment choices.

-

Potential Challenges: Inflationary pressures, potential regulatory changes, and interest rate hikes pose challenges to the market. A careful assessment of these potential risks is necessary for informed decision-making.

Conclusion

The 47% surge in Indian real estate investment during Q1 2024 underscores a robust and promising market. Several factors, including improved economic conditions, supportive government initiatives, and technological advancements, contributed to this significant growth. While challenges remain, the overall outlook for the Indian real estate sector is positive.

Call to Action: Capitalize on the exciting opportunities presented by the booming Indian real estate market. Explore investment options and research the latest trends in Indian real estate to make informed decisions and benefit from this promising sector. Don't miss out on this period of significant growth in Indian real estate investment. Contact a real estate professional today to discuss your investment strategy in the dynamic Indian real estate market.

Featured Posts

-

Haly Wwd Astar Tam Krwz Mdah Ka Ghyr Memwly Waqeh Awr As Ka Athr

May 17, 2025

Haly Wwd Astar Tam Krwz Mdah Ka Ghyr Memwly Waqeh Awr As Ka Athr

May 17, 2025 -

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025 -

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025 -

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025 -

Novak Djokovic Rakipsiz Performans Ve Kortlardaki Hakimiyeti

May 17, 2025

Novak Djokovic Rakipsiz Performans Ve Kortlardaki Hakimiyeti

May 17, 2025

Latest Posts

-

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025 -

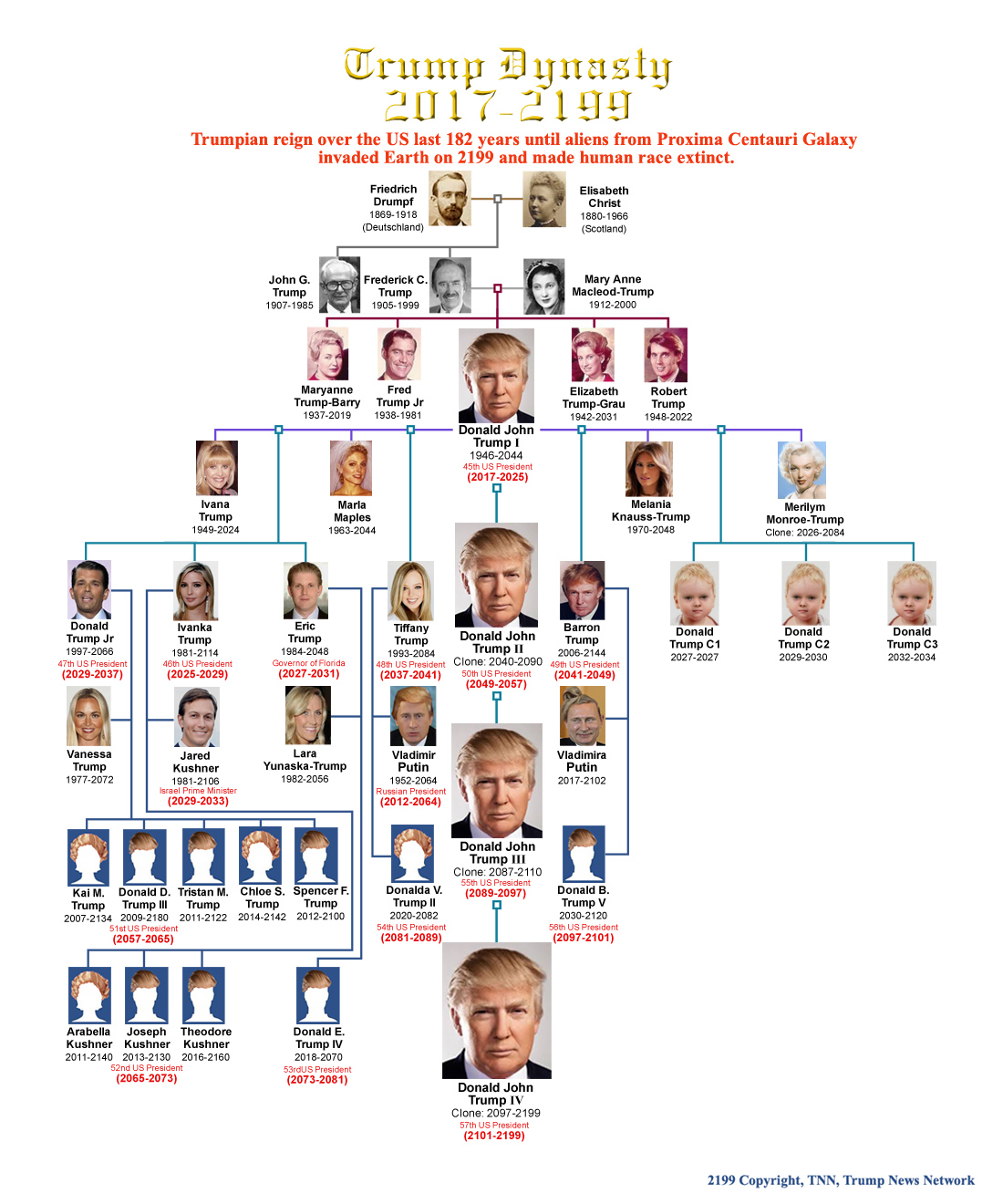

The Trump Family Tree Exploring The Presidents Lineage

May 17, 2025

The Trump Family Tree Exploring The Presidents Lineage

May 17, 2025 -

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025 -

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025 -

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025