Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations Hinder Growth

The existing bond forward regulations in India impose significant constraints on the investment strategies of insurance companies. These restrictions directly impact their ability to optimize returns and effectively manage risk. The current framework creates several hurdles for the Insurance sector:

Keywords: Bond Forward Market, Investment Restrictions, Liquidity Constraints, Regulatory Hurdles, Insurance Investments

-

High capital requirements for participation in bond forwards: The high capital requirements act as a significant barrier to entry for many insurers, particularly smaller players, limiting their access to this crucial risk management tool. This results in a less competitive market and restricts innovation.

-

Restrictions on the types of bonds that can be used in forward contracts: The limited range of eligible bonds restricts the diversification strategies available to insurers, increasing their vulnerability to specific market risks.

-

Limited hedging opportunities for insurers due to regulatory constraints: The inability to effectively hedge against interest rate risk exposes insurers to significant financial losses, impacting their profitability and long-term stability. This lack of flexibility creates operational challenges.

-

Impact on insurers' ability to manage interest rate risk: Interest rate fluctuations are a major concern for insurers, and the current regulations severely limit their ability to effectively manage this risk. This increased exposure impacts financial planning and solvency. The inflexible nature of current regulations limits the ability of insurers to tailor hedging strategies to specific needs.

Arguments for Relaxed Regulations by Indian Insurers

Indian insurers are advocating for a relaxation of bond forward regulations, arguing that the current restrictions stifle growth and limit their ability to serve policyholders effectively. The core arguments in favor of relaxed regulations focus on several key advantages:

Keywords: Portfolio Diversification, Risk Management, Return Optimization, Increased Investment, Financial Stability

-

Greater portfolio diversification leading to enhanced financial stability: Relaxed regulations would allow insurers to diversify their investment portfolios, reducing their reliance on any single asset class and significantly enhancing their overall financial stability. This diversification reduces systematic risk.

-

Improved risk management capabilities through effective hedging strategies: Access to a wider range of bond forward instruments would allow insurers to implement more sophisticated hedging strategies, mitigating risks associated with interest rate fluctuations and other market uncertainties. This allows for more effective risk mitigation and proactive management.

-

Opportunity to achieve higher investment returns through access to a wider range of instruments: Relaxed regulations would unlock access to a broader spectrum of investment opportunities, potentially leading to higher investment returns and improved profitability for insurers. The ability to optimize returns is key to long-term sustainability.

-

Increased competition and innovation within the insurance sector: A more liberalized regulatory environment would stimulate competition and encourage innovation within the insurance sector, ultimately benefiting policyholders through better products and services. A more dynamic sector would lead to improvements in service and product offerings.

Potential Economic Impacts of Regulatory Changes

Relaxing bond forward regulations could have significant implications for the Indian economy, both positive and negative. The potential effects ripple through various sectors:

Keywords: Economic Growth, Foreign Investment, Capital Market Development, Financial Sector Development, Insurance Penetration

-

Potential inflow of foreign investment into the Indian bond market: A more accessible and flexible bond market could attract significant foreign investment, boosting liquidity and supporting overall economic growth. This influx of capital could stimulate economic expansion.

-

Enhanced liquidity and depth in the Indian debt market: Increased participation by insurers in the bond forward market would enhance liquidity and depth, making it more efficient and attractive for other investors. A deeper market promotes efficiency and reduced transaction costs.

-

Increased participation of Indian insurers in global financial markets: Relaxed regulations could enable Indian insurers to participate more actively in global financial markets, enhancing their competitiveness and contributing to India's integration into the global financial system. Increased global participation allows for greater diversification and exposure.

-

Potential risks associated with increased leverage and market volatility: While potential benefits exist, it's crucial to acknowledge the potential downsides. Increased leverage and market volatility could pose risks to financial stability if not carefully managed. Careful regulatory oversight is vital to mitigate these risks.

Counterarguments and Concerns

While the arguments for relaxed regulations are compelling, concerns remain. Critics highlight potential risks associated with liberalization:

Keywords: Systemic Risk, Market Volatility, Regulatory Oversight, Financial Stability Concerns

Opponents argue that relaxing regulations could increase systemic risk, leading to greater market volatility and potential instability within the financial sector. They emphasize the need for robust regulatory oversight to mitigate these risks and ensure the stability of the financial system. Concerns exist about the potential for increased leverage and the need for adequate safeguards. A balanced approach that addresses these concerns is crucial.

Conclusion

The debate surrounding relaxed bond forward regulations for Indian insurers is crucial. The potential benefits – increased investment opportunities, improved risk management, and enhanced financial stability – are significant and could contribute significantly to the growth of the Indian insurance sector and the wider economy. However, the potential risks, including increased market volatility and systemic risk, cannot be ignored. A carefully calibrated approach, incorporating robust regulatory oversight and risk management mechanisms, is essential to ensure that the benefits of relaxed regulations outweigh the potential downsides. Further discussion and a measured approach are needed to ensure the benefits outweigh the risks, ultimately fostering growth within the Indian insurance sector and the wider economy. A balanced regulatory framework that promotes growth while safeguarding financial stability is essential for the future of Indian Insurers and their ability to leverage bond forward regulations effectively.

Featured Posts

-

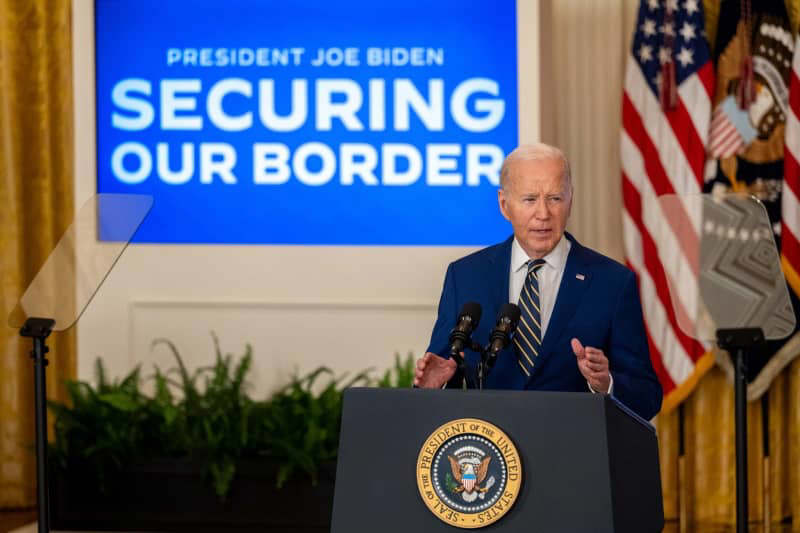

Uk Government Tightens Asylum Rules Impact On Migrants From Three Countries

May 10, 2025

Uk Government Tightens Asylum Rules Impact On Migrants From Three Countries

May 10, 2025 -

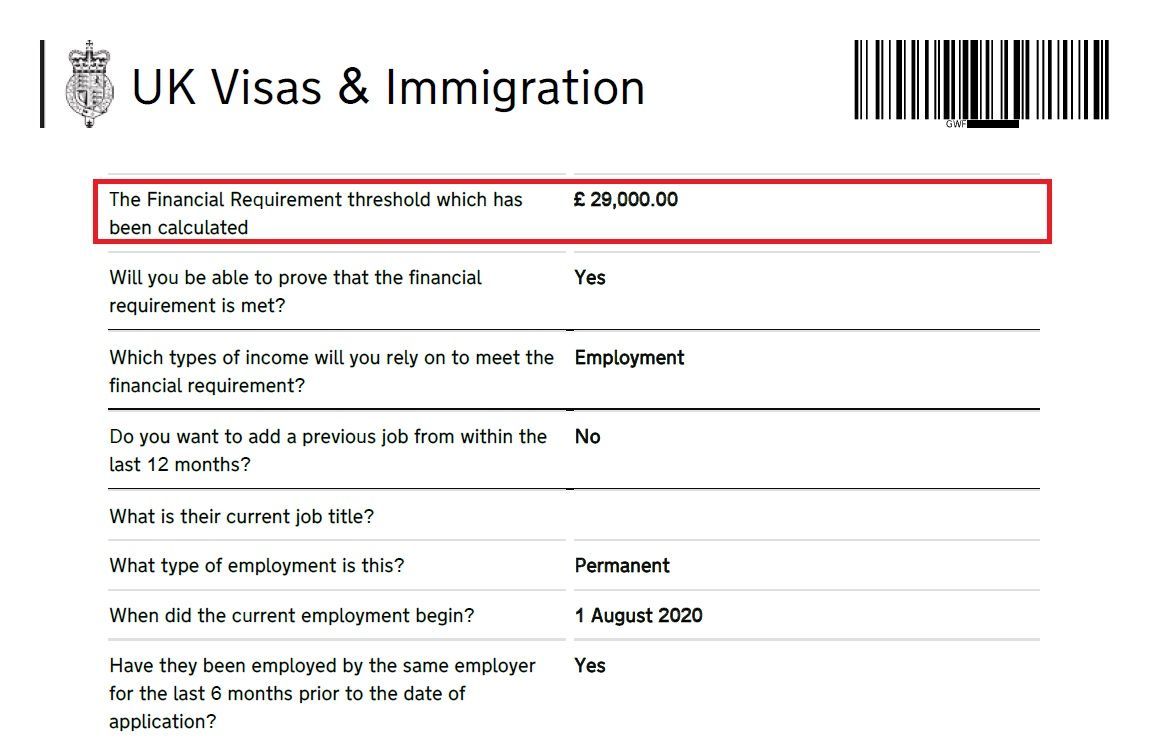

Tougher Uk Visa Rules Impact On Work And Student Visas

May 10, 2025

Tougher Uk Visa Rules Impact On Work And Student Visas

May 10, 2025 -

Harry Styles Reacts To A Critically Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Critically Bad Snl Impression

May 10, 2025 -

Military Academies Under Pentagon Scrutiny Book Review And Possible Removal

May 10, 2025

Military Academies Under Pentagon Scrutiny Book Review And Possible Removal

May 10, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025