Increased Endowment Taxes: Harvard, Yale, And The Future Of Higher Education Funding

Table of Contents

The Current Landscape of University Endowments

The size and scope of endowments at elite universities are truly remarkable. Ivy League institutions, including Harvard, Yale, Princeton, and Stanford, have accumulated vast financial reserves over decades. This wealth plays a crucial role in the functioning of these institutions.

The Size and Scope of University Endowments

- Harvard University: Endowment exceeding $50 billion (as of [insert most recent data]).

- Yale University: Endowment exceeding $40 billion (as of [insert most recent data]).

- Other Significant Institutions: Stanford University, Princeton University, MIT, and many others possess endowments in the billions of dollars.

- Sources of Growth: These endowments have grown significantly through a combination of generous alumni donations, successful investment strategies, and strategic fundraising initiatives.

The Role of Endowments in University Operations

University endowments aren't just idle funds; they are vital for supporting various crucial aspects of university operations:

- Tuition Subsidies: Endowments help to keep tuition costs somewhat lower than they would otherwise be, making education more accessible.

- Financial Aid: A substantial portion of financial aid for students comes from endowment funds, enabling talented students from lower-income backgrounds to pursue higher education. For instance, [cite example of percentage of students receiving endowment-funded aid at a specific university].

- Research Funding: Endowments fuel groundbreaking research across various disciplines, leading to scientific advancements and technological innovation.

- Infrastructure Improvements: Endowment funds contribute to the construction and maintenance of campus facilities, including libraries, laboratories, and dormitories.

Arguments for Increased Endowment Taxes

The immense wealth held by university endowments has sparked debate, with compelling arguments for increased taxation.

Addressing Wealth Inequality

A core argument for taxing large endowments centers on addressing the growing wealth inequality in the United States.

- Wealth Inequality Statistics: Cite statistics illustrating the widening gap between the wealthiest Americans and the rest of the population.

- Funding Public Services: Proponents suggest that taxing endowments could generate significant revenue to fund crucial public services such as affordable housing, improved healthcare, and enhanced public education – areas often underfunded.

Promoting Equitable Access to Higher Education

Increased endowment taxes could also help alleviate the affordability crisis in higher education.

- Affordability Crisis: Highlight the rising costs of tuition and the growing burden of student loan debt.

- Public vs. Private University Costs: Compare tuition costs at public and private universities to demonstrate the disparity in access. Taxing endowments could help bridge this gap by providing more financial aid to students from disadvantaged backgrounds.

Counterarguments and Potential Consequences

While arguments for increased endowment taxes are compelling, potential negative consequences warrant careful consideration.

Impact on University Research and Innovation

Reduced funding from endowment taxation could significantly hamper research and innovation.

- Groundbreaking Research: Provide examples of major scientific breakthroughs and technological advancements funded by endowment grants.

- Potential Loss of Discoveries: Explain how decreased funding could hinder future research and potentially stifle crucial discoveries in medicine, technology, and other fields.

Concerns About Discouraging Philanthropy

Higher taxes on endowments might discourage future donations.

- Importance of Philanthropy: Emphasize the crucial role of private donations in supporting universities and their various initiatives.

- Negative Feedback Loop: Explain how increased taxation could create a negative feedback loop, reducing overall philanthropic giving and potentially harming universities in the long run.

Alternative Funding Mechanisms

Exploring alternative funding models for universities is crucial to mitigate the potential negative impacts of endowment taxation.

- Increased Tuition: Discuss the implications of increasing tuition fees on student access and affordability.

- Government Grants: Explore the potential for increased government funding for higher education, including research grants and financial aid programs. Analyze the pros and cons of increased government involvement in university funding.

The Future of Higher Education Funding and Increased Endowment Taxes

The debate surrounding increased endowment taxes is complex, with valid arguments on both sides. While taxing endowments could address wealth inequality and improve access to higher education, it carries potential risks to university research, innovation, and future philanthropic support. The long-term impact on universities, students, and society requires careful consideration. We must find a balance that ensures equitable access to higher education while supporting the vital research and innovation conducted at institutions like Harvard and Yale.

To ensure a future where higher education thrives and remains accessible to all, engage in this vital discussion. Learn more about the ongoing debate on increased endowment taxes and advocate for policies that promote equitable access to higher education without undermining crucial research and innovation. Research organizations like [cite relevant organizations] offer valuable resources and further reading on this critical topic. Let's work together to secure a brighter future for higher education funding.

Featured Posts

-

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025 -

Masyarakat Papua Diminta Dukung Persipura Imbauan Kakanwil Ayorbaba

May 13, 2025

Masyarakat Papua Diminta Dukung Persipura Imbauan Kakanwil Ayorbaba

May 13, 2025 -

Gol Tunggal Kean Fiorentina Taklukkan Atalanta 1 0

May 13, 2025

Gol Tunggal Kean Fiorentina Taklukkan Atalanta 1 0

May 13, 2025 -

Zontanes Metadoseis Serie A Epiloges Gia Ellines Theates

May 13, 2025

Zontanes Metadoseis Serie A Epiloges Gia Ellines Theates

May 13, 2025 -

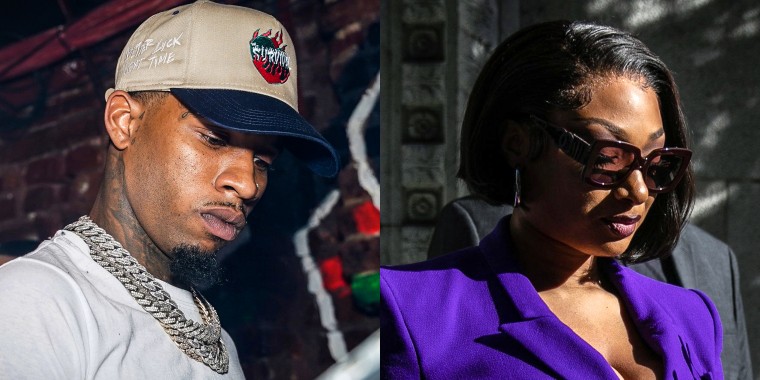

Tory Lanez And Megan Thee Stallion New Allegations Of Deposition Sabotage

May 13, 2025

Tory Lanez And Megan Thee Stallion New Allegations Of Deposition Sabotage

May 13, 2025