Improving Your Credit After Late Student Loan Payments

Table of Contents

Understanding the Impact of Late Student Loan Payments on Your Credit

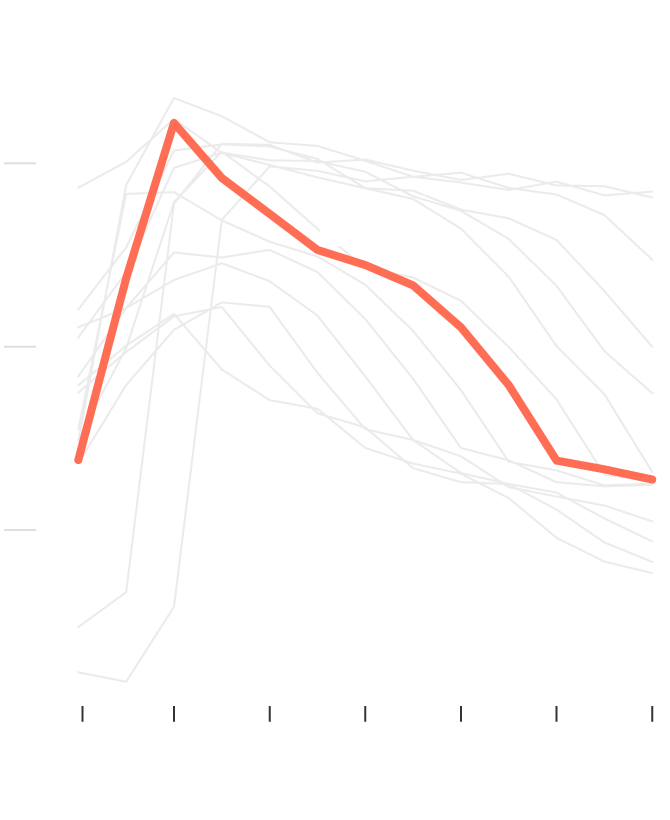

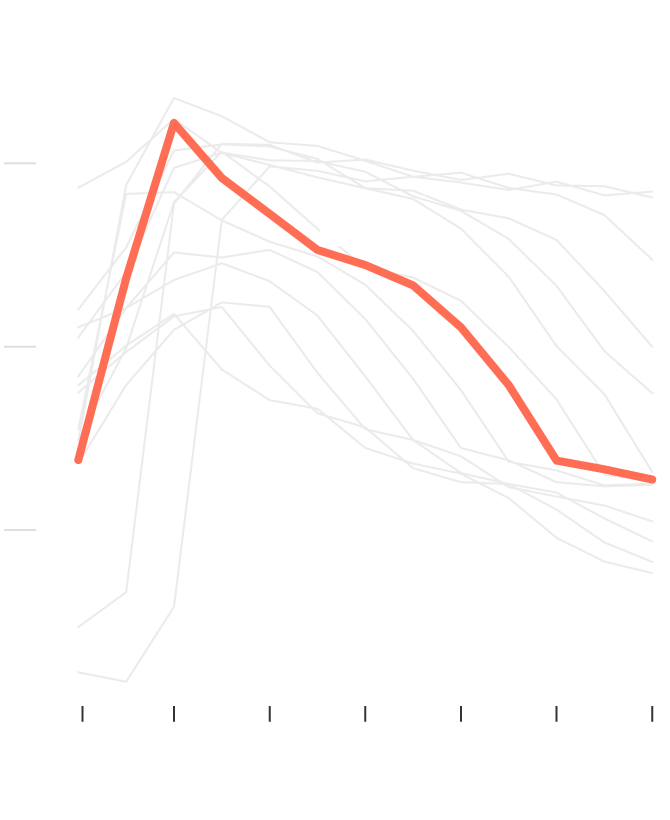

Late student loan payments significantly impact your creditworthiness, affecting both your FICO score and VantageScore, the two most widely used credit scoring models. These scores are crucial because lenders use them to assess your risk. A single late payment can lower your score, and multiple late payments can severely damage it. The negative impact of a late payment typically remains on your credit report for seven years from the date of the delinquency. This means that the blemish will affect your ability to secure favorable interest rates on loans, mortgages, and even auto financing for a considerable period. Beyond a lower credit score, the consequences of late student loan payments can include:

-

Difficulty securing loans: Lenders may deny loan applications or offer loans with significantly higher interest rates.

-

Higher interest rates: Even if approved for a loan, you'll likely face higher interest rates, increasing the total cost of borrowing.

-

Rejected rental applications: Landlords often check credit reports, and poor credit can lead to application rejection.

-

Potential employment issues: Some employers conduct credit checks, and a poor credit history could affect your job prospects.

-

Late payments significantly lower your credit score.

-

Negative marks stay on your report for a considerable period (seven years for most late payments).

-

Lenders view late payments as a high risk, leading to loan denials or unfavorable terms.

Strategies to Improve Your Credit Score After Late Student Loan Payments

Rebuilding your credit after facing late student loan payments requires a proactive and strategic approach. Here are some key strategies:

Communicate with Your Loan Servicer

Proactive communication with your student loan servicer is crucial. Don't ignore the problem; address it head-on. Explain your financial situation and explore available options to avoid further damage to your credit. These options might include:

-

Income-driven repayment plans: These plans adjust your monthly payments based on your income and family size.

-

Deferment: This temporarily postpones your payments, but interest may still accrue.

-

Forbearance: This temporarily reduces or suspends your payments, and interest may or may not accrue depending on the type of forbearance granted.

-

Negotiating a settlement: In some cases, you might be able to negotiate a settlement with your loan servicer to reduce your outstanding balance.

-

Contact your loan servicer immediately to discuss your options.

-

Explore available repayment options that fit your budget.

-

Negotiate a payment plan you can consistently afford.

Establish a Consistent Payment History

The most effective way to improve your credit score is to establish a consistent history of on-time payments. This demonstrates responsibility to lenders and helps offset the negative impact of past late payments. To ensure timely payments:

-

Pay all your bills on time, every time, including credit cards, utilities, and other loans.

-

Utilize automatic payment options offered by your bank or credit card company.

-

Set up reminders using calendar apps or budgeting tools to ensure you never miss a payment deadline.

-

Monitor your accounts regularly to avoid unexpected fees or late payment penalties.

-

Pay all bills on time, every time.

-

Use automatic payment options to avoid missed payments.

-

Monitor your accounts regularly to catch potential issues early.

Increase Your Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you're currently using. A high credit utilization ratio negatively impacts your credit score. To lower your credit utilization:

-

Pay down existing credit card balances as quickly as possible.

-

Request a credit limit increase from your credit card issuer if you have a good payment history. This will lower your credit utilization ratio, even if your balances remain the same.

-

Avoid opening new credit cards unless absolutely necessary. Opening too many accounts in a short period can also hurt your credit score.

-

Aim to keep your credit utilization ratio below 30%.

-

Keep credit utilization low (under 30%).

-

Pay down existing credit card debt aggressively.

-

Consider a balance transfer to a lower interest rate card to manage debt more effectively.

Consider Credit Building Strategies

If you have limited credit history, consider these strategies to build credit:

-

Secured credit cards: These cards require a security deposit, which acts as your credit limit, making them easier to qualify for. Responsible use of a secured credit card can help build your credit history.

-

Becoming an authorized user: With permission, you can become an authorized user on someone else's credit card with a good payment history. Their positive payment history can be reported to credit bureaus and can help boost your score (but make sure the primary cardholder has excellent credit).

-

Apply for a secured credit card to establish credit.

-

Become an authorized user on a credit card with excellent payment history (with permission and understanding).

-

Use credit responsibly and consistently to improve your score.

Monitoring Your Credit Progress

Regularly checking your credit report is essential to track your progress and identify any errors. You can obtain your free credit reports annually from AnnualCreditReport.com. Additionally, you can monitor your credit score using various apps or websites.

- Check your credit reports at least annually from AnnualCreditReport.com.

- Identify and dispute any inaccuracies or errors you find on your reports.

- Track your credit score improvement over time to stay motivated.

Rebuilding your credit after late student loan payments takes time and effort, but it’s achievable. By communicating with your loan servicer, establishing a consistent payment history, managing your credit utilization effectively, and employing credit-building strategies, you can significantly improve your financial health. Regularly monitor your progress to stay on track and celebrate your successes along the way. Remember, improving your credit after late student loan payments is a journey, not a sprint. Start improving your credit score today!

Featured Posts

-

Gobierno A Perseguir Prestamos Estudiantiles Impagados Univision Noticias

May 17, 2025

Gobierno A Perseguir Prestamos Estudiantiles Impagados Univision Noticias

May 17, 2025 -

Alkuvuoden Tappiot Elaekeyhtioeiden Osakesijoituksissa

May 17, 2025

Alkuvuoden Tappiot Elaekeyhtioeiden Osakesijoituksissa

May 17, 2025 -

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025 -

Kak Vydelitsya V Perepolnennom Industrialnom Parke

May 17, 2025

Kak Vydelitsya V Perepolnennom Industrialnom Parke

May 17, 2025 -

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025

Latest Posts

-

Improved Navigation Fortnite Item Shop Adds Player Friendly Feature

May 17, 2025

Improved Navigation Fortnite Item Shop Adds Player Friendly Feature

May 17, 2025 -

Fortnites Cosmetic Market A Refund And Its Possible Impact

May 17, 2025

Fortnites Cosmetic Market A Refund And Its Possible Impact

May 17, 2025 -

Fortnite Cowboy Bebop Crossover Event Free Items

May 17, 2025

Fortnite Cowboy Bebop Crossover Event Free Items

May 17, 2025 -

Get The Wwe Fortnite Skins A Step By Step Guide For Cody Rhodes And The Undertaker

May 17, 2025

Get The Wwe Fortnite Skins A Step By Step Guide For Cody Rhodes And The Undertaker

May 17, 2025 -

New Fortnite Icon Skin Everything We Know

May 17, 2025

New Fortnite Icon Skin Everything We Know

May 17, 2025