Impact Of Trump's Tariffs On Norway's Investments: Nicolai Tangen's Perspective

Table of Contents

Direct Impact of Tariffs on Norwegian Portfolio Companies

The Trump tariffs directly impacted Norwegian companies invested in, and operating within, the US market. These trade barriers created significant challenges, impacting both profitability and supply chain dynamics.

Reduced Profitability

Tariffs increased the costs of goods and services for Norwegian companies operating in the US. This resulted in reduced profitability, potentially leading to lower dividends for the Oil Fund, a critical component of the Norwegian economy.

- Seafood Industry: Norwegian seafood exporters faced higher tariffs on their products entering the US market, reducing competitiveness and impacting export volumes. The exact financial impact is difficult to precisely quantify but reports suggested significant losses for some companies.

- Aluminum Sector: Similar challenges were faced by Norwegian aluminum producers. Increased tariffs on aluminum imports made Norwegian products less competitive, impacting profitability and potentially influencing NBIM's investment decisions.

- NBIM Divestments: While there's no public record of mass divestments directly attributed solely to Trump's tariffs, the pressure on profitability in certain sectors may have influenced NBIM's portfolio adjustments. A deeper analysis of NBIM's annual reports would be needed to fully ascertain this.

Supply Chain Disruptions

The tariffs also disrupted global supply chains, affecting Norwegian businesses reliant on US imports or exports. The increased costs and complexities associated with navigating these new trade routes significantly impacted business operations.

- Increased Transportation Costs: Companies had to explore alternative supply chains, often resulting in longer shipping routes and increased transportation costs.

- Raw Material Shortages: Some Norwegian businesses faced shortages of essential raw materials due to disruptions in the US supply chain.

- NBIM Risk Mitigation: NBIM likely implemented strategies to mitigate these risks, potentially diversifying investments and seeking out more resilient supply chains. The specifics of these strategies are not publicly available in detail but are likely to be explored in future analyses of their investment decisions.

Nicolai Tangen's Public Statements and Actions

Nicolai Tangen's leadership during this period offers a valuable insight into how NBIM navigated the challenges posed by the Trump tariffs. His public statements and actions reflect NBIM's approach to managing the uncertainty of the trade war.

NBIM's Response to Tariff Uncertainty

Tangen's public comments on the tariffs haven't been extensively documented as direct statements focusing solely on the Trump tariffs' impact. However, his general approach to investment in a volatile global market likely encompassed strategies to mitigate risk stemming from protectionist measures.

- Portfolio Diversification: To reduce reliance on any single market, NBIM likely diversified its portfolio even further, reducing exposure to potential losses arising from tariff-related challenges. This strategy is a common practice for large sovereign wealth funds during periods of economic instability.

- Long-Term Investment Strategy: NBIM likely maintained its focus on long-term value creation, rather than making reactive short-term decisions based on tariff fluctuations.

Advocacy for Free Trade

While specifics of Tangen's public advocacy for free trade aren't widely available in relation to the Trump tariffs specifically, his general support for global economic cooperation is known. His position aligns with Norway’s historical commitment to open markets and international collaboration.

- International Fora: Tangen likely participated in discussions within international forums advocating for the benefits of free trade and the reduction of trade barriers, though direct statements regarding Trump’s tariffs specifically are not yet readily found in the public domain. Further research into his appearances and speeches during that period would be necessary.

Wider Economic Impacts on Norway

The impact of Trump's tariffs extended beyond direct investments, affecting the Norwegian economy in several ways.

Impact on the Norwegian Economy

The tariffs contributed to a slowdown in global economic growth, which had repercussions for Norway's export-oriented economy.

- GDP Growth: The negative impact on global trade likely slowed Norway's GDP growth, although quantifying this impact specifically due to the Trump tariffs requires detailed econometric studies that have yet to be completed.

- Employment: Sectors heavily reliant on US trade may have experienced job losses or reduced hiring as a result of the trade war.

- Government Response: The Norwegian government likely implemented measures to support affected industries and mitigate the negative economic consequences, although the extent and specific details of these actions would require further research.

Geopolitical Implications

Trump's tariffs strained the US's relationships with many of its trading partners, including Norway. While Norway and the US maintain strong diplomatic ties, the trade war introduced an element of uncertainty into their economic relationship.

- Trade Agreement Negotiations: The trade war might have influenced negotiations surrounding trade agreements or future collaborations between the two countries, though this is an area requiring further in-depth investigation.

Conclusion

Trump's tariffs had a multifaceted impact on Norwegian investments. The direct consequences for Norwegian portfolio companies, including reduced profitability and supply chain disruptions, were significant. Nicolai Tangen's leadership at NBIM provides a crucial lens through which to understand how Norway's largest sovereign wealth fund navigated this period of uncertainty. Beyond direct investment impacts, the tariffs contributed to wider economic challenges and geopolitical complexities. Understanding the complexities of this global trade conflict is essential for shaping future investment strategies. Learn more about the impact of Trump's tariffs on Norwegian investments by exploring NBIM's annual reports for a deeper understanding of their investment decisions during this period. Understanding the complexities of global trade through the lens of Nicolai Tangen’s leadership is crucial for informed decision-making in today's interconnected world.

Featured Posts

-

Analysis Of Toxic Chemical Persistence In Buildings Following The Ohio Train Derailment

May 05, 2025

Analysis Of Toxic Chemical Persistence In Buildings Following The Ohio Train Derailment

May 05, 2025 -

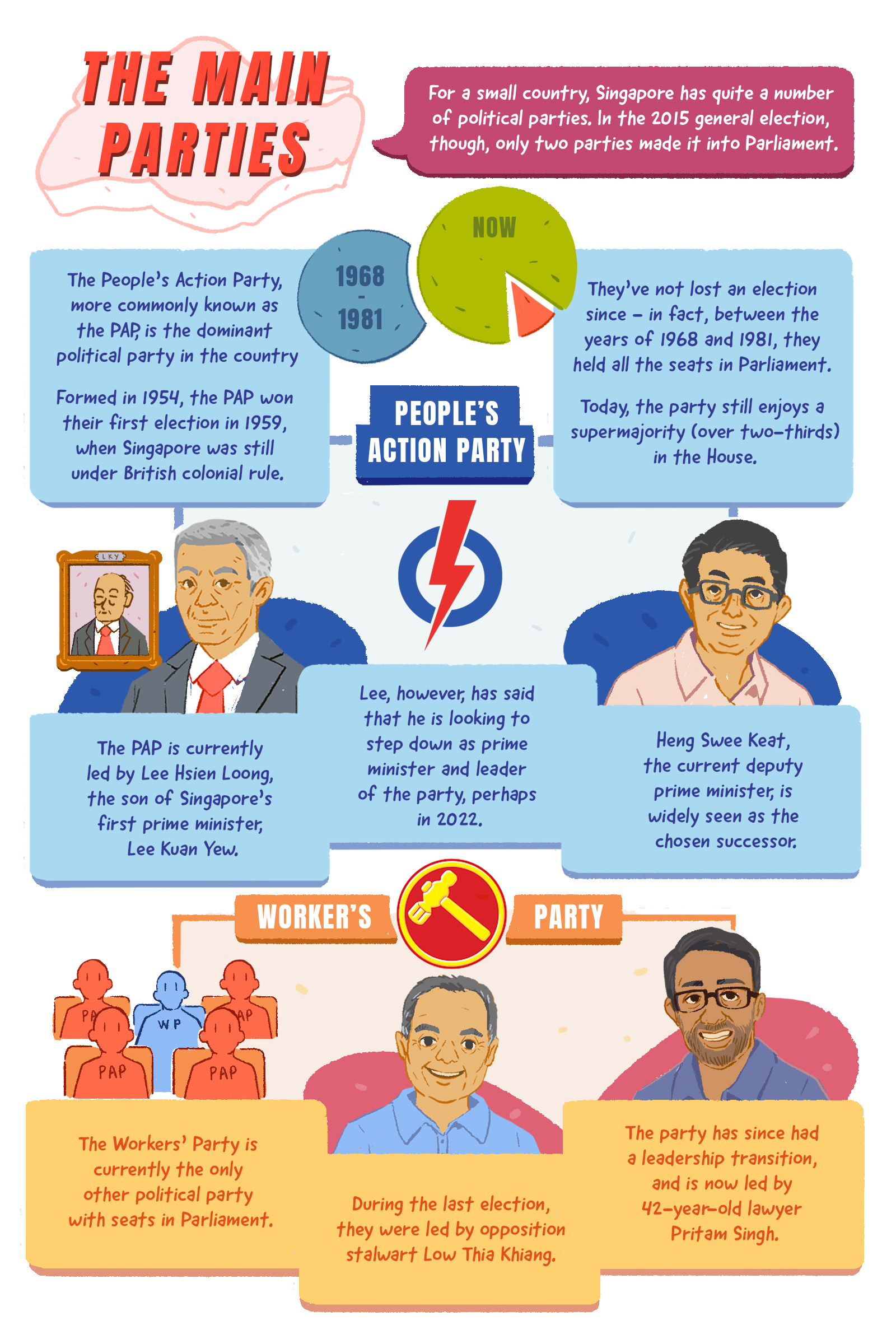

How Singapores Elections Could Shift Political Power Dynamics

May 05, 2025

How Singapores Elections Could Shift Political Power Dynamics

May 05, 2025 -

Holi Weather Alert West Bengal To Experience High Tide And High Temperatures

May 05, 2025

Holi Weather Alert West Bengal To Experience High Tide And High Temperatures

May 05, 2025 -

Analyzing The Landscape Singapores Upcoming General Election

May 05, 2025

Analyzing The Landscape Singapores Upcoming General Election

May 05, 2025 -

Blake Lively And Anna Kendrick Comparing Styles At A Recent Film Premiere

May 05, 2025

Blake Lively And Anna Kendrick Comparing Styles At A Recent Film Premiere

May 05, 2025

Latest Posts

-

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 05, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 05, 2025 -

Ufc 314 Did Jean Silva Curse At Bryce Mitchell During The Press Conference

May 05, 2025

Ufc 314 Did Jean Silva Curse At Bryce Mitchell During The Press Conference

May 05, 2025 -

Press Conference Clash Mitchell Vs Silva Accusations Fly At Ufc 314

May 05, 2025

Press Conference Clash Mitchell Vs Silva Accusations Fly At Ufc 314

May 05, 2025 -

Bryce Mitchell And Jean Silva Feud Heats Up After Press Conference Incident

May 05, 2025

Bryce Mitchell And Jean Silva Feud Heats Up After Press Conference Incident

May 05, 2025