Impact Of Ontario's Expanded Manufacturing Tax Credit On Businesses

Table of Contents

Increased Investment and Growth in Ontario Manufacturing

The Ontario manufacturing tax credit is designed to incentivize investment in the manufacturing sector. By reducing the tax burden, businesses are better positioned to allocate more capital towards crucial areas like upgrading equipment, implementing new technologies, and expanding their operations. This is particularly beneficial for small and medium-sized enterprises (SMEs), which often face greater financial constraints when it comes to modernization and growth.

- Increased capital expenditures: The tax credit directly boosts a company's ability to invest in new machinery, advanced software, and improved infrastructure. This leads to increased productivity and efficiency.

- Job creation and retention: Modernization and expansion often require a larger workforce. The Ontario business growth fostered by this credit translates into more jobs, contributing to economic development within the province.

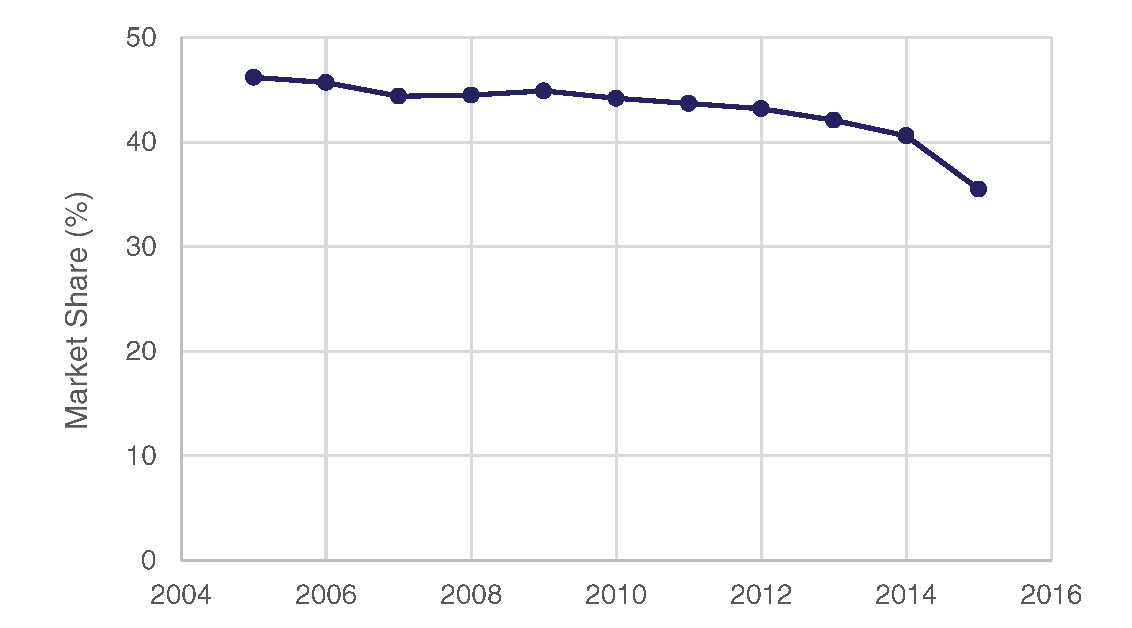

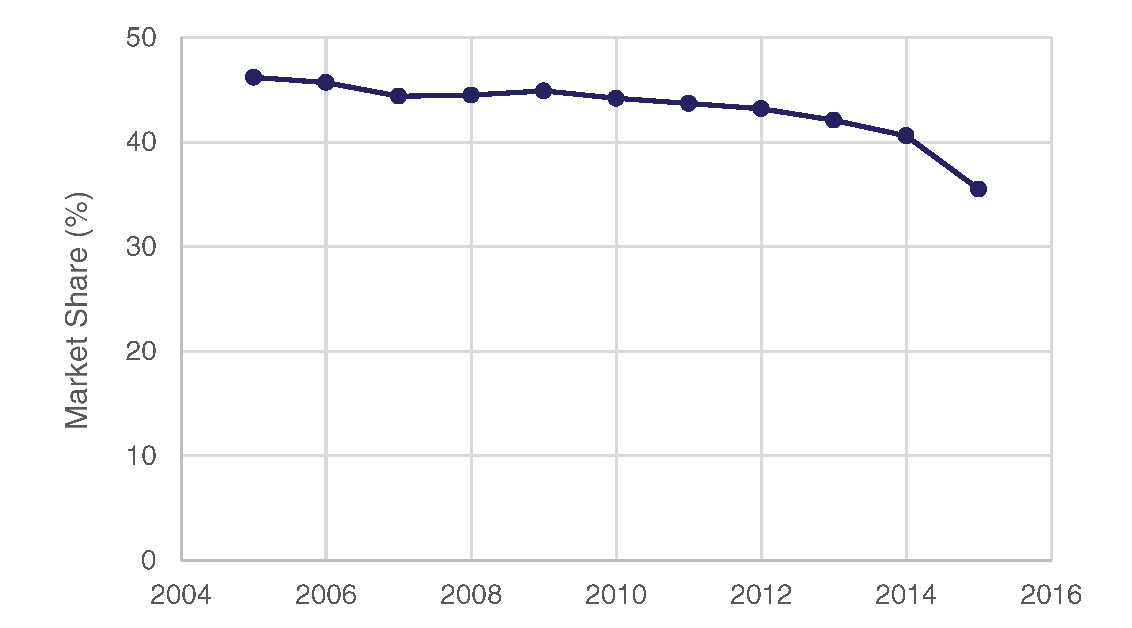

- Enhanced competitiveness: By facilitating modernization, the credit helps Ontario manufacturers compete more effectively in both domestic and international markets. This is critical in maintaining and expanding market share.

- Modernization of facilities: Investing in new technology and infrastructure improves operational efficiency, reducing waste and enhancing overall output. This is a significant advantage in a globally competitive market.

Industries such as automotive parts manufacturing, food processing, and advanced manufacturing are likely to see significant benefits from the increased manufacturing investment spurred by this credit. The resulting economic development Ontario will positively impact the province as a whole.

Impact on Employment and Wages in the Manufacturing Sector

The positive ripple effect of increased investment extends to employment and wages within the manufacturing sector. The Ontario manufacturing tax credit aims to stimulate employment growth by creating new job opportunities and increasing demand for skilled labor.

- Job creation statistics: While precise figures may vary and require further time to fully assess, early indicators suggest a positive impact on job creation within the manufacturing sector. (Note: Include specific data if available from government sources).

- Wage growth projections: Increased demand for skilled labor can also lead to upward pressure on wages, improving the financial well-being of manufacturing workers.

- Impact on skilled labor demand: The focus on modernization and technology will require a skilled workforce, potentially creating opportunities for training and upskilling initiatives.

- Potential for attracting foreign investment: A thriving and supported manufacturing sector enhances Ontario's attractiveness to foreign investors, further boosting job creation and economic growth. This makes Ontario a more competitive location for manufacturing jobs Ontario.

Challenges and Limitations of the Manufacturing Tax Credit

While the Ontario manufacturing tax credit offers substantial benefits, it's crucial to acknowledge potential challenges and limitations.

- Complexity of application process: The application process might be complex for some businesses, especially smaller ones with limited administrative resources. This could deter participation. Clearer guidelines and simplified tax credit application procedures would mitigate this challenge.

- Eligibility requirements: Specific eligibility criteria might exclude some deserving manufacturers. A careful review of these criteria is necessary to ensure the program's effectiveness and inclusivity.

- Potential for misuse or fraud: Any tax credit program requires robust monitoring and enforcement measures to prevent tax compliance issues and ensure fair distribution of funds.

- Impact on smaller manufacturers vs larger corporations: The impact of the credit may differ significantly between small and large manufacturers. Ensuring equitable access and benefits for SMEs is crucial. Strategies to support smaller manufacturers' access to business tax planning expertise should be explored.

Comparison with Other Provincial and Federal Incentives

To understand the true value of Ontario's expanded manufacturing tax credit, it's essential to compare it with similar incentives offered by other provinces and the federal government. A comprehensive analysis reveals the program's relative effectiveness and competitiveness within the broader landscape of provincial tax credits and federal tax incentives.

- Comparison table of various incentives: (Insert a table comparing key features and benefits of different incentives across jurisdictions)

- Analysis of program effectiveness metrics: (Include a discussion on relevant metrics, such as investment stimulated, jobs created, etc., to measure program effectiveness compared to others).

- Discussion of areas for improvement: Identifying areas where Ontario's program could be improved to better compete with those offered elsewhere is important. This may involve streamlining the application process, adjusting eligibility criteria, or increasing the credit amount.

Conclusion: Maximizing the Benefits of Ontario's Manufacturing Tax Credit

Ontario's expanded manufacturing tax credit presents a significant opportunity for businesses within the manufacturing sector. While it offers substantial potential for increased investment, employment growth, and enhanced competitiveness, businesses need to understand and navigate any potential challenges related to application processes and eligibility requirements. By comparing this incentive with others offered provincially and federally, companies can make informed decisions regarding their investment strategies. To maximize the benefits of the Ontario manufacturing tax credit, businesses should actively explore this program and seek assistance to ensure compliance and optimize their tax planning strategies. For more information and to begin the application process, contact [Insert relevant contact information or link to the government website]. Don't miss this opportunity to leverage the Ontario business support available and contribute to the growth of Ontario's manufacturing sector.

Featured Posts

-

Soldaat Van Oranje De Biografie Van Spion Peter Tazelaar

May 07, 2025

Soldaat Van Oranje De Biografie Van Spion Peter Tazelaar

May 07, 2025 -

Orlando Magic Snap Cavaliers 16 Game Win Streak

May 07, 2025

Orlando Magic Snap Cavaliers 16 Game Win Streak

May 07, 2025 -

71

May 07, 2025

71

May 07, 2025 -

Cleveland Cavaliers Sign G League Player For 10 Day Stint

May 07, 2025

Cleveland Cavaliers Sign G League Player For 10 Day Stint

May 07, 2025 -

Check Daily Lotto Results For Friday 18th April 2025

May 07, 2025

Check Daily Lotto Results For Friday 18th April 2025

May 07, 2025

Latest Posts

-

A Bad Monkey Movie In 2025 A Good Year For Stephen King Regardless

May 08, 2025

A Bad Monkey Movie In 2025 A Good Year For Stephen King Regardless

May 08, 2025 -

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation Of The Year

May 08, 2025

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation Of The Year

May 08, 2025 -

The Long Walk Trailer Released A Chilling Adaptation Of Stephen Kings Story

May 08, 2025

The Long Walk Trailer Released A Chilling Adaptation Of Stephen Kings Story

May 08, 2025 -

New The Long Walk Trailer A Dark And Gripping Thriller

May 08, 2025

New The Long Walk Trailer A Dark And Gripping Thriller

May 08, 2025 -

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025