Impact Of G-7 De Minimis Tariff Proposals On Chinese Goods: Economic And Political Perspectives

Table of Contents

Economic Impacts of Increased De Minimis Thresholds on Chinese Exports

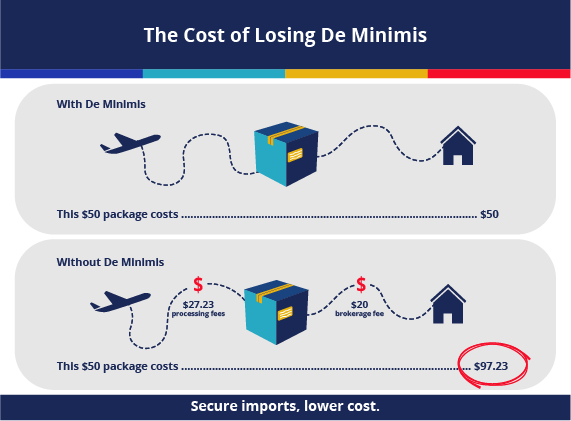

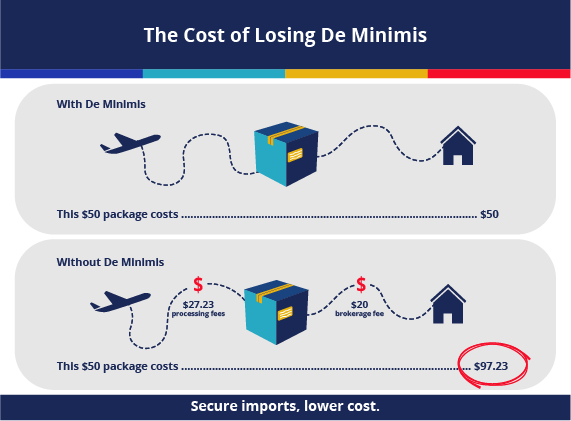

Increased de minimis thresholds – the value of goods imported duty-free – directly impact the competitiveness of Chinese exports within G-7 markets. This section explores the key economic consequences.

Increased Competitiveness of Chinese Goods

Higher thresholds mean more Chinese goods can enter G-7 countries without incurring tariffs, significantly boosting their competitiveness. This translates to:

- Increased market share for Chinese businesses: Lower import costs allow Chinese companies to offer more competitive prices, potentially capturing a larger share of the G-7 consumer market. This is particularly relevant for e-commerce and small-scale businesses.

- Potential price reductions for consumers in G-7 nations: Increased competition from cheaper Chinese imports could lead to lower prices for consumers, benefiting their purchasing power. This could lead to increased consumer spending and economic growth.

- Shift in supply chains, potentially favoring China: Businesses may find it more economically advantageous to source goods from China due to reduced tariff burdens, potentially reshaping global supply chains and further consolidating China's position as a manufacturing powerhouse.

Impact on G-7 Domestic Industries

The influx of cheaper Chinese goods poses a significant challenge to domestic industries within G-7 countries. The increased competition could result in:

- Need for government support and adaptation strategies for affected industries: Governments may need to implement measures such as retraining programs, subsidies, or tax breaks to help domestic industries adjust to the changing competitive landscape.

- Potential for increased lobbying and protectionist measures: Domestic industries facing intense competition from Chinese imports might lobby for increased protectionist measures, potentially leading to trade disputes and escalating tensions.

- Assessment of the overall economic impact through cost-benefit analysis: A thorough cost-benefit analysis is crucial to evaluate the net economic impact of the new thresholds, weighing the benefits for consumers against the potential costs for domestic producers.

Revenue Implications for G-7 Governments

Lowering tariffs through increased de minimis thresholds will inevitably reduce tariff revenues collected by G-7 governments. This necessitates:

- Need for alternative revenue streams or adjustments to budgetary allocations: Governments will need to explore alternative revenue sources or adjust their budgetary allocations to compensate for the loss of tariff income. This might involve tax reforms or cuts in public spending.

- Potential impact on public services and infrastructure investment: Reduced government revenue could impact funding for essential public services and infrastructure projects, potentially leading to trade-offs in public spending priorities.

- Exploration of alternative taxation methods to compensate for lost revenue: Governments may consider alternative taxation methods, such as value-added taxes (VAT) or digital services taxes, to offset the loss of tariff revenue.

Political Implications and Geopolitical Considerations

The G-7's de minimis tariff proposals have profound political implications, impacting both bilateral relations and the global trade order.

G-7 Relations with China

The proposals' impact on the G-7's relationship with China will depend on several factors including China's response and the overall implementation. Potential outcomes include:

- Potential for retaliatory measures from China: China could respond with retaliatory measures, such as imposing tariffs on G-7 goods or restricting access to its markets. This could lead to a trade war.

- Opportunities for diplomatic engagement and negotiation: The proposals also offer an opportunity for diplomatic engagement and negotiation between the G-7 and China to address concerns and establish a more balanced trade relationship.

- Impact on broader trade negotiations and agreements: The changes could affect ongoing and future trade negotiations and agreements, shaping the broader global trade architecture.

Impact on Global Trade Order

The changes to de minimis thresholds have the potential to significantly reshape global trade patterns and power dynamics. Key considerations include:

- Potential for increased trade imbalances: The increased flow of Chinese goods into G-7 markets could exacerbate existing trade imbalances, potentially leading to further economic and political tensions.

- Re-evaluation of existing trade agreements and regulations: The new thresholds may necessitate a re-evaluation of existing trade agreements and regulations to adapt to the evolving global trade landscape.

- Shift in global manufacturing and production hubs: The changes could influence the location of manufacturing and production hubs, potentially further consolidating China's role in global supply chains.

Domestic Political Repercussions within G-7 Countries

The proposals are likely to spark domestic political debates within G-7 countries about the balance between free trade and protectionism.

- Potential for public backlash depending on the impact on specific industries and consumers: Public opinion will be heavily influenced by the actual impact on specific industries and consumer prices. Negative impacts could trigger significant public backlash.

- Increased scrutiny of government policies related to trade and economic competitiveness: Government policies related to trade and economic competitiveness will face increased scrutiny from the public, media, and opposition parties.

- The role of lobbying groups in influencing policy decisions: Lobbying groups representing affected industries will play a crucial role in influencing government policy decisions, further intensifying political debate.

Conclusion

The G-7 de minimis tariff proposals on Chinese goods represent a significant shift in global trade, with profound economic and political consequences. Understanding the potential impacts – increased Chinese market share, challenges for G-7 industries, and geopolitical ramifications – is vital for effective policymaking. Further research and monitoring are essential to fully grasp the long-term effects. Careful consideration of the impact of G-7 De Minimis Tariff Proposals on Chinese Goods is crucial for policymakers and businesses alike. Stakeholders must engage in constructive dialogue to mitigate negative consequences and leverage opportunities presented by these changes.

Featured Posts

-

This Hollywood Legends Best Performances Debut And Oscar Win Now On Disney

May 23, 2025

This Hollywood Legends Best Performances Debut And Oscar Win Now On Disney

May 23, 2025 -

Understanding The Big Rig Rock Report 3 12 On Rock 106 1

May 23, 2025

Understanding The Big Rig Rock Report 3 12 On Rock 106 1

May 23, 2025 -

Vilius Gaubas Stunning Victory Over Denis Shapovalov At Italian Open

May 23, 2025

Vilius Gaubas Stunning Victory Over Denis Shapovalov At Italian Open

May 23, 2025 -

From Hollywood To The Rodeo Neal Mc Donough Discusses The Last Rodeo

May 23, 2025

From Hollywood To The Rodeo Neal Mc Donough Discusses The Last Rodeo

May 23, 2025 -

Bangladesh Battles Zimbabwe In First Test

May 23, 2025

Bangladesh Battles Zimbabwe In First Test

May 23, 2025

Latest Posts

-

Jonathan Groff On Asexuality Instinct Magazine Interview

May 23, 2025

Jonathan Groff On Asexuality Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff Opens Up About His Experiences With Asexuality

May 23, 2025

Jonathan Groff Opens Up About His Experiences With Asexuality

May 23, 2025 -

Jonathan Groffs Past An Open Discussion On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Discussion On Asexuality

May 23, 2025