IMF Alert: Trump's Trade Policies Threaten Global Financial Stability

Table of Contents

Increased Trade Tensions and Retaliation

Trump's administration initiated a series of aggressive trade actions, significantly escalating trade disputes worldwide. The imposition of tariffs, particularly on steel and aluminum imports, sparked retaliatory measures from key trading partners, igniting a global trade war. This aggressive approach to trade policy, characterized by unilateral actions and a disregard for established multilateral trade agreements, has had far-reaching consequences.

-

Impact on global supply chains: The imposition of tariffs disrupted established global supply chains, forcing businesses to re-evaluate sourcing strategies and increasing production costs. This led to delays, increased prices for consumers, and reduced efficiency in global manufacturing.

-

Rise in import prices for affected goods: Tariffs directly increased the price of imported goods, impacting consumers and businesses reliant on imported materials and products. This inflationary pressure contributed to overall economic instability.

-

Retaliatory tariffs imposed by other countries: In response to Trump's tariffs, countries like China, the European Union, and Canada imposed their own retaliatory tariffs on US goods, creating a cycle of escalating trade tensions and harming global trade. This tit-for-tat approach further destabilized the global economic system.

-

Negative impact on international trade volume: The overall volume of international trade declined as a result of the increased trade barriers and uncertainty surrounding future trade relations. This reduction in trade negatively impacted global economic growth.

The IMF's reports from this period documented a significant slowdown in global trade growth directly linked to the escalating trade disputes stemming from Trump's trade policies. These reports highlighted the detrimental effects on global supply chains and the overall negative impact on the world economy.

Uncertainty and Investor Sentiment

The unpredictable nature of Trump's trade policies created significant uncertainty, profoundly impacting investor confidence. This volatility discouraged both domestic and foreign investment.

-

Reduced foreign direct investment (FDI): The uncertainty surrounding future trade relations led to a decline in foreign direct investment, as businesses hesitated to commit capital to markets facing potential trade restrictions.

-

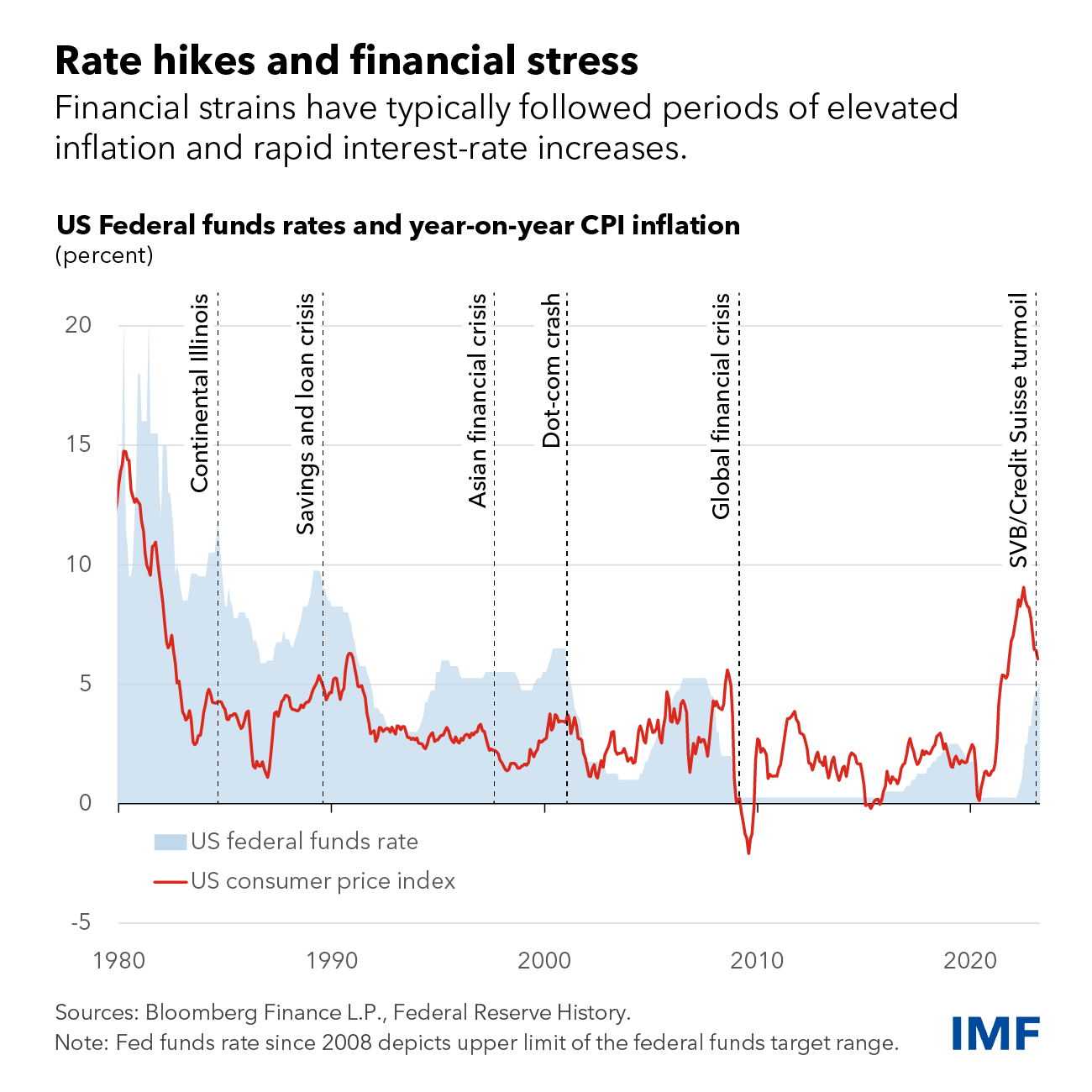

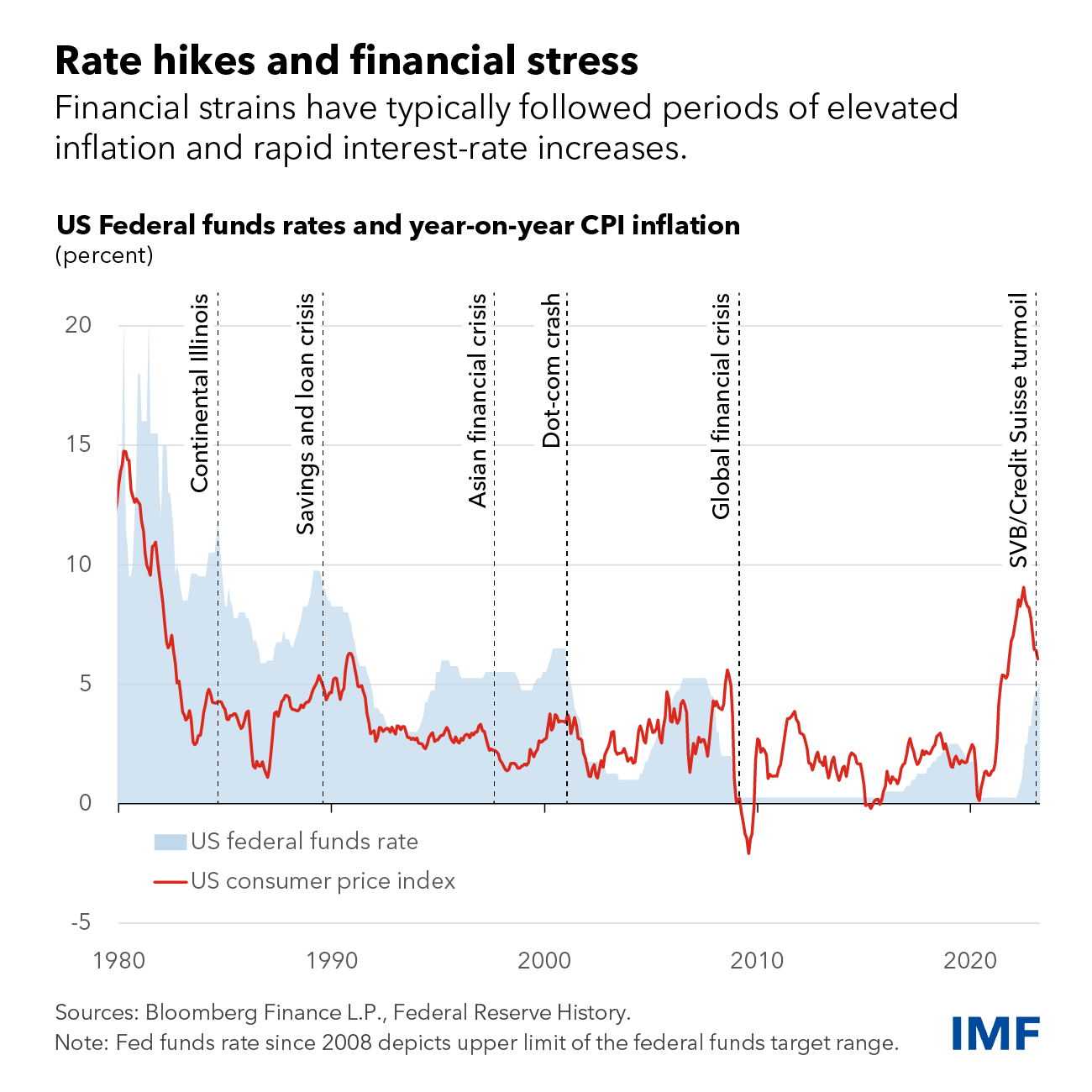

Increased volatility in financial markets: The unpredictable policy shifts caused increased volatility in financial markets, leading to sharp fluctuations in stock prices and currency exchange rates. This uncertainty made long-term investment planning difficult and risky.

-

Uncertainty about future trade relations discouraging long-term investment: Businesses require stable and predictable policy environments to make long-term investment decisions. The constant threat of new tariffs and trade restrictions created an environment of uncertainty that stifled investment.

-

Impact on currency exchange rates: Trade disputes and tariff wars affected currency exchange rates, further adding to the economic instability and uncertainty in global markets.

This uncertainty not only reduced investment but also hindered overall economic growth, as businesses delayed expansion plans and consumers held back on spending due to fear of rising prices.

Impact on Developing Countries

Trump's trade policies disproportionately impacted developing economies, exacerbating existing economic vulnerabilities.

-

Reduced export opportunities for developing nations: Developing countries, often heavily reliant on exports to developed nations, experienced reduced export opportunities due to increased trade barriers and protectionist measures.

-

Increased vulnerability to economic shocks: The trade disputes intensified the vulnerability of developing economies to economic shocks, hindering their growth trajectories and making them more susceptible to financial crises.

-

Potential for increased poverty and inequality: Reduced export revenues and economic instability stemming from Trump's trade policies resulted in increased poverty and inequality in many developing nations.

-

Impact on specific developing nations: Countries heavily reliant on exports to the US, particularly in sectors targeted by tariffs, experienced significant economic hardship. For example, [Insert specific examples of affected developing nations and their industries].

The IMF repeatedly expressed concern about the potential for global instability arising from the disproportionate impact of these policies on developing countries, warning of the increased risk of financial crises and social unrest.

The Role of the IMF in Addressing the Issue

The IMF played a crucial role in monitoring the global economic fallout from Trump's trade policies and attempting to mitigate their negative consequences.

-

IMF's surveillance and monitoring of global economic trends: The IMF closely monitored global economic trends, providing assessments of the impact of trade disputes and offering policy recommendations.

-

Provision of financial assistance to countries affected by trade disputes: The IMF provided financial assistance to countries facing economic hardship due to the trade disputes, helping to stabilize their economies and prevent crises.

-

Advocacy for multilateral trade agreements and cooperation: The IMF consistently advocated for multilateral trade agreements and international cooperation to address the escalating trade tensions and promote a more stable global trading system.

Conclusion:

The IMF's warning about the threat posed by Trump's trade policies to global financial stability remains a significant concern. The increased trade tensions, resulting uncertainty, and disproportionate impact on developing economies paint a concerning picture. The unpredictable nature of these policies continues to destabilize markets and hinder global economic growth. Understanding the far-reaching consequences of Trump's trade policies is crucial for policymakers and investors alike. It's imperative to advocate for responsible trade practices and multilateral cooperation to mitigate the risks and ensure a stable global financial system. We need to actively monitor the impact of Trump's trade policies and push for solutions to avoid a further escalation of this dangerous situation. A return to predictable and cooperative trade policies is essential for global economic stability.

Featured Posts

-

Bfm Bourse Informations Marches Du 17 Fevrier 15h Et 16h

Apr 23, 2025

Bfm Bourse Informations Marches Du 17 Fevrier 15h Et 16h

Apr 23, 2025 -

One Hit Different Outcome Dave Roberts Reflects On World Series

Apr 23, 2025

One Hit Different Outcome Dave Roberts Reflects On World Series

Apr 23, 2025 -

Dates Des Conges Scolaires Federation Wallonie Bruxelles Pour 2025 Organisation De Vos Vacances De Detente

Apr 23, 2025

Dates Des Conges Scolaires Federation Wallonie Bruxelles Pour 2025 Organisation De Vos Vacances De Detente

Apr 23, 2025 -

L Impact Du Nutriscore Sur Les Choix Morning Retail Des Consommateurs

Apr 23, 2025

L Impact Du Nutriscore Sur Les Choix Morning Retail Des Consommateurs

Apr 23, 2025 -

Harvards Legal Fight Implications For American Universities

Apr 23, 2025

Harvards Legal Fight Implications For American Universities

Apr 23, 2025