Ignoring The Recession: Why Stock Investors Expect A Bull Market

Table of Contents

Strong Corporate Earnings Despite Economic Headwinds

While economic uncertainty casts a shadow, some sectors display remarkable resilience. Strong corporate earnings are a key reason why many believe a bull market is still on the horizon. This resilience stems from a combination of factors.

Resilience of Key Sectors

Several key sectors continue to exhibit robust performance. The technology sector, for example, shows consistent growth fueled by innovation and increasing demand for tech solutions. Similarly, the healthcare sector benefits from an aging global population and continuous advancements in medical technology.

- Examples of companies exceeding expectations: Many tech giants are reporting record sales, demonstrating the ongoing demand for their products and services. Pharmaceutical companies are also experiencing strong growth thanks to the successful launches of new drugs and therapies.

- Robust sales figures: Data consistently reveals strong sales figures across several resilient sectors, indicating a continued consumer and business appetite despite economic concerns.

- Innovative product launches driving growth: Continuous innovation and the introduction of new, high-demand products are key factors fueling growth in resilient sectors.

These resilient sectors, characterized by strong corporate earnings and recession-proof stocks, offer a compelling argument for a bullish outlook, even in the face of a potential recession.

Adaptability and Innovation

Companies are actively adapting to the changing economic landscape through innovation and cost-cutting measures. This adaptability demonstrates a remarkable capacity to navigate economic uncertainty.

- Examples of successful adaptation strategies: Many companies are streamlining operations, optimizing supply chains, and embracing automation to increase efficiency and reduce costs.

- Technological advancements: Technological disruption continues to reshape industries, creating new opportunities for growth and innovation.

- Streamlining operations: Cost-cutting measures and efficient operations are crucial for maintaining profitability during times of economic uncertainty.

This corporate innovation and focus on efficient operations are key factors contributing to the continued strong performance of many companies, further supporting the bull market prediction.

Federal Reserve Actions and Interest Rate Hikes

The Federal Reserve's actions to combat inflation play a significant role in shaping the stock market outlook. While interest rate hikes aim to curb inflation, they also have potential consequences for the economy.

Inflation Taming and its Impact

The Federal Reserve's aggressive interest rate hikes are designed to cool down inflation. However, these measures may impact consumer spending and business investment, slowing economic growth.

- Explanation of interest rate hikes: Interest rate hikes make borrowing more expensive, potentially reducing consumer spending and business investment.

- Their effects on inflation: The aim is to reduce demand and subsequently lower inflation.

- Potential impact on consumer spending and business investment: Higher interest rates can dampen consumer confidence and reduce business investment, potentially slowing economic growth.

Careful analysis of the Federal Reserve policy and its impact on inflation is crucial for understanding the broader economic picture and its effect on the stock market.

Potential for a "Soft Landing"

Despite the risks, some economists believe a "soft landing" – a controlled economic slowdown rather than a sharp recession – is possible.

- Arguments for a soft landing: Some argue that the resilience of the labor market and strong corporate earnings suggest a less severe downturn.

- Historical precedents: Examining historical precedents of controlled economic slowdowns can offer valuable insights.

- Economic indicators suggesting a less severe downturn: Careful analysis of economic indicators such as employment rates, consumer confidence, and GDP growth can help gauge the likelihood of a soft landing.

A soft landing scenario would likely support a bull market, or at least prevent a major market correction.

Investor Sentiment and Market Behavior

Investor psychology and market behavior significantly influence market predictions. Understanding these factors is vital for navigating the current climate.

The "Fear of Missing Out" (FOMO) Factor

The "fear of missing out" (FOMO) can drive investor behavior, potentially contributing to bullish predictions, even during uncertain times.

- Discussion of FOMO: Investors may rush into the market to avoid missing potential gains, pushing prices higher.

- Herd behavior: The tendency for investors to follow the crowd can amplify market trends.

- Potential for irrational exuberance: Overly optimistic sentiment can lead to inflated asset prices.

Understanding the impact of FOMO and herd behavior is vital for making rational investment decisions.

Long-Term Growth Potential

Despite short-term economic challenges, the long-term growth potential of the stock market remains a significant factor in the bullish outlook.

- Focus on technological advancements: Technological innovations continue to drive long-term economic growth and create new investment opportunities.

- Emerging markets: Emerging markets offer significant growth potential over the long term.

- Innovative industries: Industries characterized by continuous innovation often exhibit robust long-term growth.

A long-term investment strategy that focuses on these areas can help mitigate short-term economic risks.

Conclusion

Several factors suggest a bull market remains a possibility despite recessionary fears. Strong corporate earnings in resilient sectors, the potential for a soft landing orchestrated by Federal Reserve actions, and investor psychology all contribute to a more optimistic outlook than one might initially assume. While acknowledging the inherent risks in any market, especially during times of economic uncertainty, a well-informed and carefully considered long-term investment strategy can help you navigate this complex environment. Don't ignore the potential of a bull market; understand the interplay of economic indicators, corporate performance, and investor sentiment. Make informed decisions about your investment strategy, and consider consulting a financial professional before making any investment choices. Learn more about navigating a recession and investing wisely for a bull market – your financial future depends on it.

Featured Posts

-

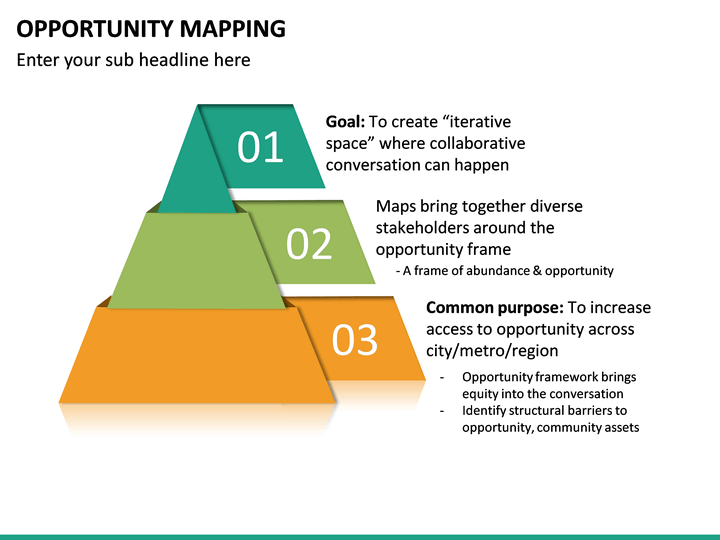

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025 -

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025 -

Novak Speaks Out Clarifying His Relationship With Mindy Kaling Following Delaney Rowe Speculation

May 06, 2025

Novak Speaks Out Clarifying His Relationship With Mindy Kaling Following Delaney Rowe Speculation

May 06, 2025 -

Princess Dianas Met Gala Gown A Risque Revelation

May 06, 2025

Princess Dianas Met Gala Gown A Risque Revelation

May 06, 2025 -

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025

Latest Posts

-

Jeffrey Goldberg And National Defense Information Benny Johnson Weighs In

May 06, 2025

Jeffrey Goldberg And National Defense Information Benny Johnson Weighs In

May 06, 2025 -

I Dont Know Why Ariana Grande And Jeff Goldblums New Song Explored

May 06, 2025

I Dont Know Why Ariana Grande And Jeff Goldblums New Song Explored

May 06, 2025 -

Charges Against Jeffrey Goldberg Benny Johnsons Response

May 06, 2025

Charges Against Jeffrey Goldberg Benny Johnsons Response

May 06, 2025 -

Jeff Goldblum And Ariana Grandes I Dont Know Why A Musical Collaboration

May 06, 2025

Jeff Goldblum And Ariana Grandes I Dont Know Why A Musical Collaboration

May 06, 2025 -

Benny Johnsons Statement On Jeffrey Goldbergs Alleged Possession Of National Defense Information

May 06, 2025

Benny Johnsons Statement On Jeffrey Goldbergs Alleged Possession Of National Defense Information

May 06, 2025