How Will QBTS Stock Perform After The Next Earnings Announcement?

Table of Contents

Analyzing QBTS's Recent Financial Performance and Trends

Revenue Growth and Projections

Analyzing QBTS's revenue growth is paramount to predicting its future stock performance. We need to examine recent quarterly reports to identify trends.

- Q1 Performance: [Insert Q1 revenue data and growth rate]. This showed [brief analysis of Q1 performance – positive or negative, and reason].

- Q2 Performance: [Insert Q2 revenue data and growth rate]. A [positive/negative] trend continued due to [reason].

- Q3 Performance: [Insert Q3 revenue data and growth rate]. [Analysis of Q3 performance and reasons].

- Projections: Analyst projections for the upcoming quarter range from [lowest projection] to [highest projection], largely influenced by [mention key factors like new product launches, market expansion, or competitive pressures]. A significant deviation from these projections will likely impact QBTS stock price. Changes in the company's business model, such as [mention any changes], could also influence future revenue streams.

Profitability and Margins

Profitability is another key indicator of QBTS's financial health and future prospects. We should review gross margin, operating margin, and net income to understand the company's efficiency and earning power.

- Gross Margin: [Insert data and analysis of gross margin trends. Discuss reasons for changes].

- Operating Margin: [Insert data and analysis of operating margin trends. Highlight efficiency improvements or cost increases].

- Net Income: [Insert data and analysis of net income. Mention any one-time expenses or unusual items affecting profitability]. Significant shifts in profitability will likely have a direct impact on investor sentiment and the QBTS stock price.

Key Performance Indicators (KPIs)

Beyond the traditional financial metrics, other KPIs provide valuable insights into QBTS's performance and future potential.

- Customer Acquisition Cost (CAC): A declining CAC suggests improved marketing efficiency, potentially leading to increased profitability and a positive impact on QBTS stock. [Insert data and analysis if available].

- User Engagement: High user engagement metrics indicate a strong product and a loyal customer base, which is generally positive for long-term growth. [Insert data and analysis if available].

- Market Share: [Insert data and analysis of market share trends. Discuss implications of gains or losses]. These KPIs paint a holistic picture of QBTS's health and help predict future stock performance.

Assessing Market Sentiment and Investor Expectations

Analyst Ratings and Price Targets

Analyst ratings and price targets provide a valuable snapshot of market sentiment towards QBTS stock.

- Buy Ratings: [Number of analysts with buy ratings and reasons].

- Hold Ratings: [Number of analysts with hold ratings and reasons].

- Sell Ratings: [Number of analysts with sell ratings and reasons].

- Price Targets: The average price target currently stands at [average price target], ranging from [lowest price target] to [highest price target]. Significant changes in these ratings and targets often precede major price movements.

News and Events Affecting QBTS

Recent news and events significantly impact investor perception and QBTS stock performance.

- Positive News: [List positive news items and their potential impact on QBTS stock].

- Negative News: [List negative news items and their potential impact on QBTS stock]. Careful consideration of these events is vital for assessing the overall market sentiment.

Overall Market Conditions

Macroeconomic factors significantly influence QBTS's performance, irrespective of its earnings announcement.

- Interest Rates: Rising interest rates might negatively impact investor appetite for riskier stocks like QBTS.

- Economic Growth: Strong economic growth could boost investor confidence and positively impact QBTS stock.

- Geopolitical Events: Global uncertainties could create volatility and negatively impact the stock market, including QBTS.

Potential Scenarios for QBTS Stock Post-Earnings

Upward Movement

QBTS stock price might rise after the earnings announcement under the following conditions:

- Exceeding Earnings Expectations: Reporting revenue and earnings significantly above analyst projections is likely to boost investor confidence.

- Positive Guidance: Offering positive guidance for the next quarter or year reinforces a positive outlook and often leads to price increases.

- Successful New Product Launch: A successful product launch could signal strong future growth potential.

Downward Movement

Several scenarios could lead to a decline in QBTS stock price:

- Missing Earnings Expectations: Failing to meet analyst projections usually results in a negative market reaction.

- Negative Guidance: Providing pessimistic guidance regarding future performance dampens investor enthusiasm.

- Unexpected Challenges: Unforeseen challenges like supply chain disruptions or increased competition can negatively impact QBTS stock.

Sideways Movement

In certain cases, QBTS might experience minimal price change after the earnings announcement. This is often the case when:

- Meeting Expectations: The company meets analyst expectations, but doesn't significantly exceed them.

- Neutral Guidance: The company's guidance for the future is neither overly optimistic nor pessimistic.

- Market Indifference: The overall market conditions might overshadow the specific performance of QBTS.

Conclusion: Navigating the QBTS Stock Performance After Earnings

The QBTS stock performance after the upcoming earnings announcement will depend on a multitude of factors, including financial performance, market sentiment, and broader economic conditions. We've explored potential scenarios ranging from upward to downward movements, as well as the possibility of sideways trading. Thorough research, consideration of multiple perspectives, and an understanding of the interplay between QBTS's fundamentals and the overall market are essential before making any investment decisions regarding QBTS stock performance after earnings announcement. Continue monitoring QBTS stock, researching related news and updates, and make informed decisions regarding your investment strategy concerning QBTS Stock Performance After Earnings Announcement.

Featured Posts

-

Clean Energy Boom Faces Headwinds Understanding The Challenges And Opportunities

May 21, 2025

Clean Energy Boom Faces Headwinds Understanding The Challenges And Opportunities

May 21, 2025 -

Kahnawake Casino Dispute 220 Million In Damages Sought

May 21, 2025

Kahnawake Casino Dispute 220 Million In Damages Sought

May 21, 2025 -

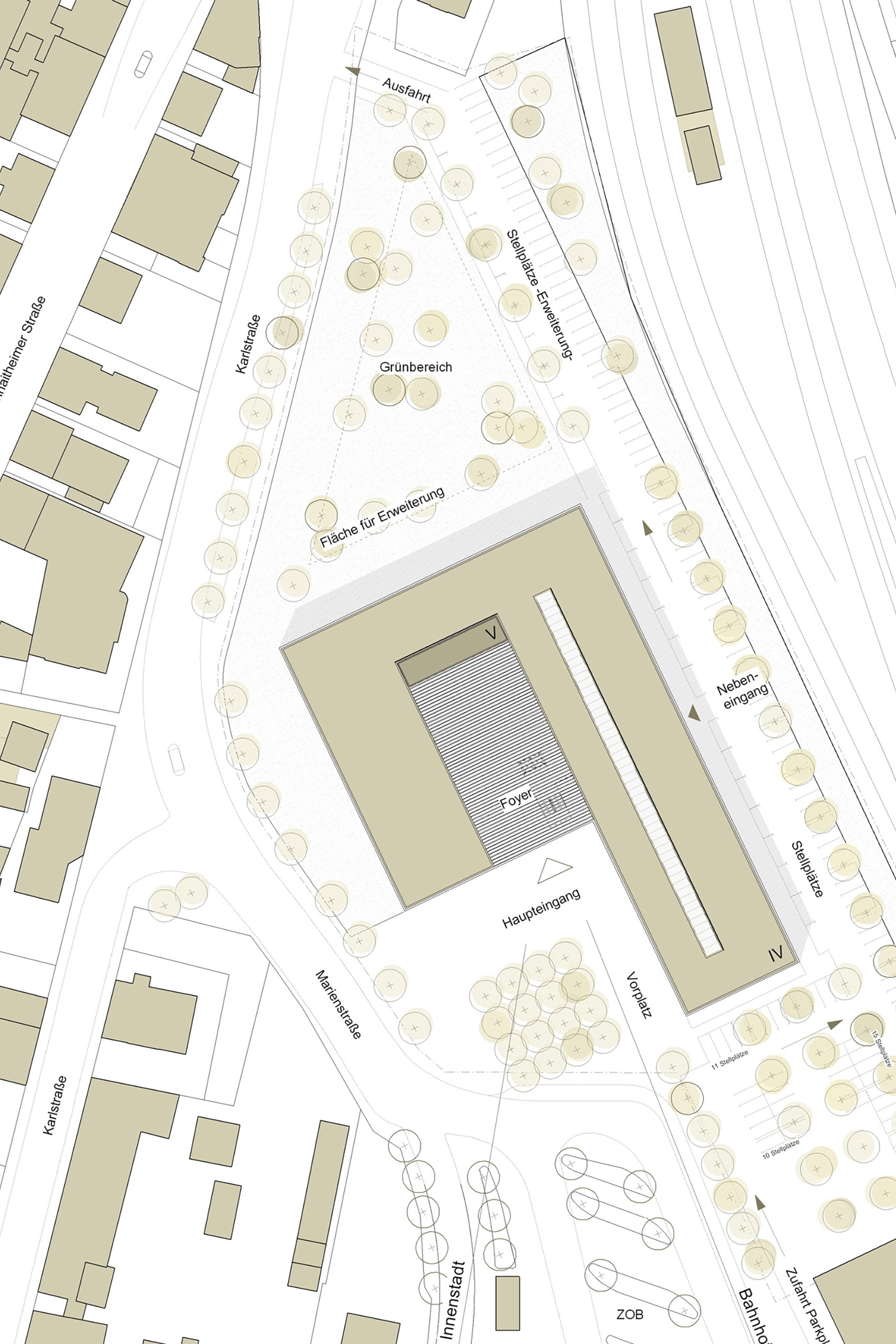

Architektin Bestimmt Endgueltige Bauausfuehrung Vor Ort

May 21, 2025

Architektin Bestimmt Endgueltige Bauausfuehrung Vor Ort

May 21, 2025 -

Record Setting Run William Goodge Conquers Australia On Foot

May 21, 2025

Record Setting Run William Goodge Conquers Australia On Foot

May 21, 2025 -

The Story Behind Peppa Pigs Little Sisters Name

May 21, 2025

The Story Behind Peppa Pigs Little Sisters Name

May 21, 2025

Latest Posts

-

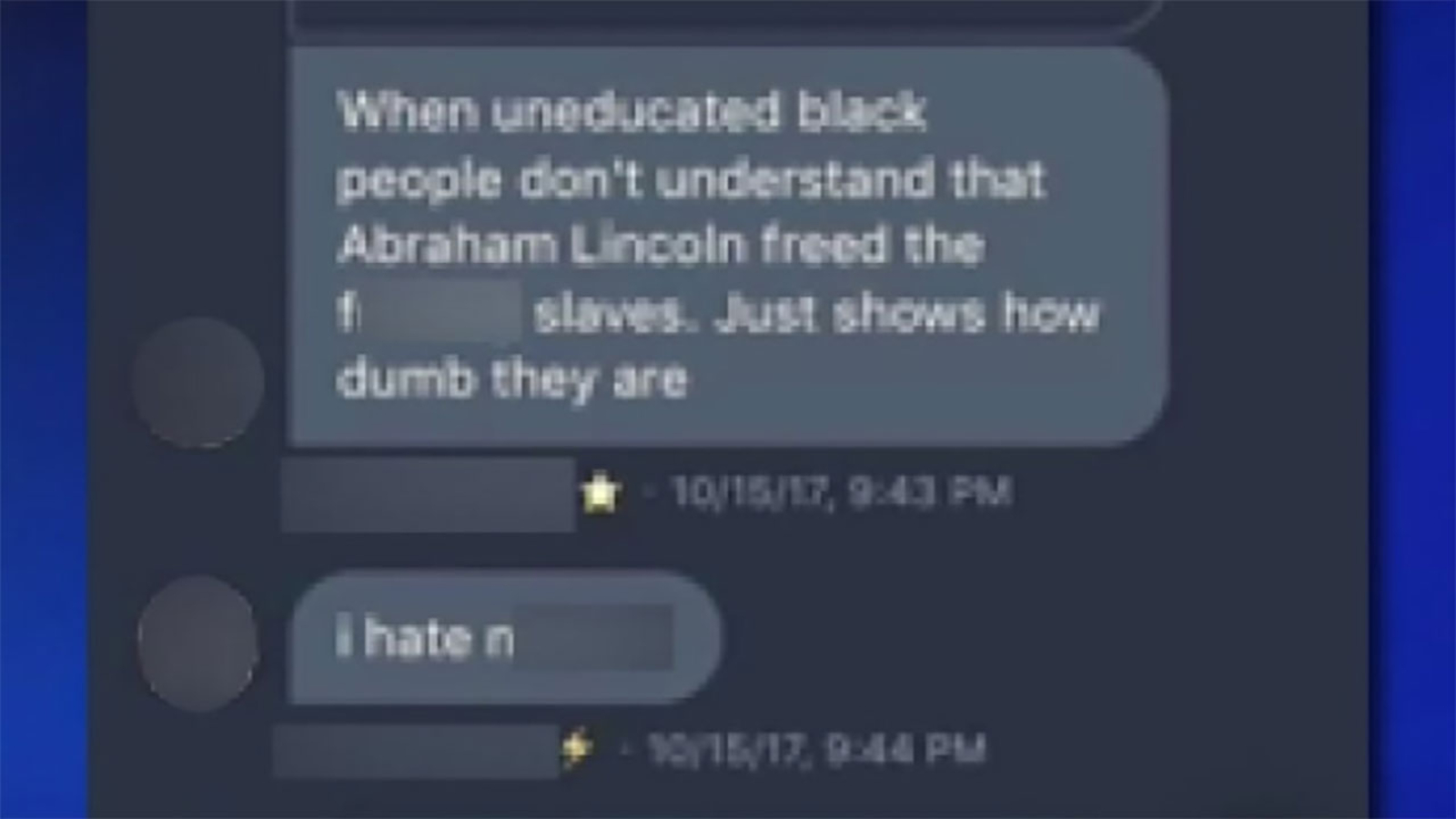

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025