How Trump's Tariffs Harmed Small Businesses: The Untold Story

Table of Contents

Increased Input Costs and Reduced Profit Margins

Trump's tariffs, primarily targeting steel, aluminum, and various consumer goods, significantly increased the cost of imported raw materials and components for countless small businesses. This had a devastating impact on their bottom line.

-

Higher prices for essential goods: Small businesses reliant on imported steel, aluminum, textiles, and other materials faced immediate price hikes. These increases weren't negligible; they represented substantial portions of their production costs. The sudden jump in prices for these essential inputs immediately squeezed profit margins.

-

Inability to absorb increased costs: Many small businesses lacked the economic scale to absorb these increased costs without raising their own prices. Passing these costs onto consumers risked damaging sales, as customers sought cheaper alternatives. This created a difficult balancing act: maintain profit margins by increasing prices (and risking sales) or absorb the costs and accept reduced profitability.

-

Reduced profit margins leading to decreased investment and growth: The combination of higher input costs and stagnant or declining sales resulted in significantly reduced profit margins. This, in turn, severely hampered their ability to invest in new equipment, technology, or employee training – crucial for growth and competitiveness. The immediate financial pressures meant long-term strategic investments were often sidelined.

-

Case studies of specific small businesses negatively impacted: Numerous case studies document the struggles of small businesses directly impacted by tariffs. For example, [insert example of a small business negatively affected by tariffs and cite a source]. These examples highlight the human cost behind the economic statistics.

Reduced Consumer Demand and Sales Decline

The increased costs resulting from Trump's tariffs didn't stop at the factory door. These higher input costs translated directly into higher prices for consumers. This led to a predictable outcome: reduced consumer demand.

-

Increased prices making products less competitive: American-made goods, already facing competition from lower-priced imports, became even less competitive in the global market. Consumers, faced with higher prices, increasingly opted for cheaper alternatives, whether domestically produced or from other countries.

-

Shift in consumer spending towards cheaper alternatives: This shift in consumer spending significantly hurt small businesses unable to compete on price. They found themselves losing market share to larger companies with more economic leverage or to cheaper imports.

-

Loss of market share and subsequent revenue decline: The decreased demand directly translated into a loss of market share and a substantial decline in revenue for many small businesses. This created a vicious cycle, where reduced revenue further constrained their ability to compete.

-

Data showing decreased sales in specific sectors affected by the tariffs: Statistical data from [insert source, e.g., industry reports, government data] clearly demonstrates a decline in sales across several sectors directly impacted by the tariffs, further corroborating the negative impact on small businesses.

Supply Chain Disruptions and Operational Challenges

Trump's tariffs didn't just impact costs; they also wreaked havoc on already complex global supply chains, creating unforeseen operational challenges for small businesses.

-

Difficulty sourcing raw materials and components: Tariffs created uncertainty and instability in the supply chain, making it difficult for small businesses to source the raw materials and components needed for production. Reliable suppliers became unreliable, and lead times stretched considerably.

-

Increased lead times and shipping costs: The added complexity of navigating tariffs resulted in significantly increased lead times for sourcing and shipping. This increased inventory costs and further strained already tight budgets.

-

Need for alternative suppliers, often at higher costs: Many businesses were forced to find alternative suppliers, often at significantly higher costs and with less reliable service. This further contributed to increased input costs and operational difficulties.

-

Examples of businesses forced to halt production or reduce operations: Many small businesses were forced to either temporarily halt production or significantly reduce their operations due to supply chain disruptions, illustrating the far-reaching effects of the tariffs.

The Struggle for Access to Financing and Credit

The economic uncertainty caused by the tariffs exacerbated the already precarious financial situation of many small businesses, making it significantly harder to secure loans and financing.

-

Increased risk aversion from lenders: Lenders, wary of the economic climate and the uncertainty surrounding the impact of the tariffs, became significantly more risk-averse. This made securing loans – even for existing businesses with a good track record – more difficult.

-

Higher interest rates on loans: Even when loans were approved, the interest rates were often higher, reflecting the increased risk associated with lending to businesses operating in a turbulent economic environment.

-

Difficulty meeting loan requirements due to reduced profitability: With reduced profit margins and declining sales, many small businesses found it increasingly difficult to meet the stringent financial requirements needed to qualify for loans.

The Impact on Employment and Job Losses

The cumulative effect of increased costs, reduced demand, supply chain disruptions, and financing difficulties resulted in widespread job losses within the small business sector.

-

Layoffs and reduced working hours: Many small businesses were forced to resort to layoffs or reduce employee working hours to cut costs and stay afloat.

-

Business closures and consequent unemployment: In some cases, the pressures became insurmountable, leading to business closures and significant job losses in affected communities.

-

Long-term economic consequences for affected communities: The job losses had far-reaching economic consequences for communities dependent on small businesses for employment and economic activity.

-

Statistical data on job losses in relevant sectors: [Insert statistical data supporting this point from reliable sources].

Conclusion

Trump's tariffs inflicted significant and lasting harm on American small businesses. The increased input costs, reduced consumer demand, supply chain disruptions, financing challenges, and resulting job losses paint a stark picture of the unintended consequences of protectionist policies. Understanding how Trump's tariffs harmed small businesses is crucial to advocating for sound trade policies that protect American small businesses and promote economic growth. Learn more about the impact of protectionist trade policies and support policies that foster a thriving small business environment. [Insert links to relevant resources here].

Featured Posts

-

The Next Pope Nine Cardinals Considered For The Papacy

May 12, 2025

The Next Pope Nine Cardinals Considered For The Papacy

May 12, 2025 -

100 Mtv Unplugged Episodes Now Streaming The Complete List

May 12, 2025

100 Mtv Unplugged Episodes Now Streaming The Complete List

May 12, 2025 -

The Michael Kay Interview And Its Impact On Juan Sotos Bat

May 12, 2025

The Michael Kay Interview And Its Impact On Juan Sotos Bat

May 12, 2025 -

Complete Ufc 315 Results A Look At The Muhammad Vs Della Maddalena Fight

May 12, 2025

Complete Ufc 315 Results A Look At The Muhammad Vs Della Maddalena Fight

May 12, 2025 -

These Adam Sandler Movies All Have The Same Easter Egg

May 12, 2025

These Adam Sandler Movies All Have The Same Easter Egg

May 12, 2025

Latest Posts

-

Erneuter Einsatz An Braunschweiger Schule Gebaeude Geraeumt Keine Kinder Gefaehrdet

May 13, 2025

Erneuter Einsatz An Braunschweiger Schule Gebaeude Geraeumt Keine Kinder Gefaehrdet

May 13, 2025 -

Keine Gefahr Mehr Schule Nach Alarm Wieder Geoeffnet Braunschweig

May 13, 2025

Keine Gefahr Mehr Schule Nach Alarm Wieder Geoeffnet Braunschweig

May 13, 2025 -

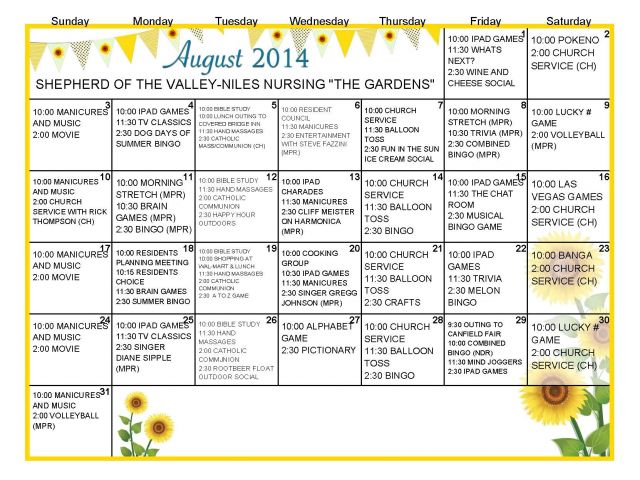

Comprehensive Calendar Of Trips And Events For Seniors

May 13, 2025

Comprehensive Calendar Of Trips And Events For Seniors

May 13, 2025 -

Braunschweiger Grundschule Entwarnung Nach Erneutem Polizeieinsatz

May 13, 2025

Braunschweiger Grundschule Entwarnung Nach Erneutem Polizeieinsatz

May 13, 2025 -

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025