How Trump's Social Media Posts Reveal His Oil Price Preference (Goldman Sachs)

Table of Contents

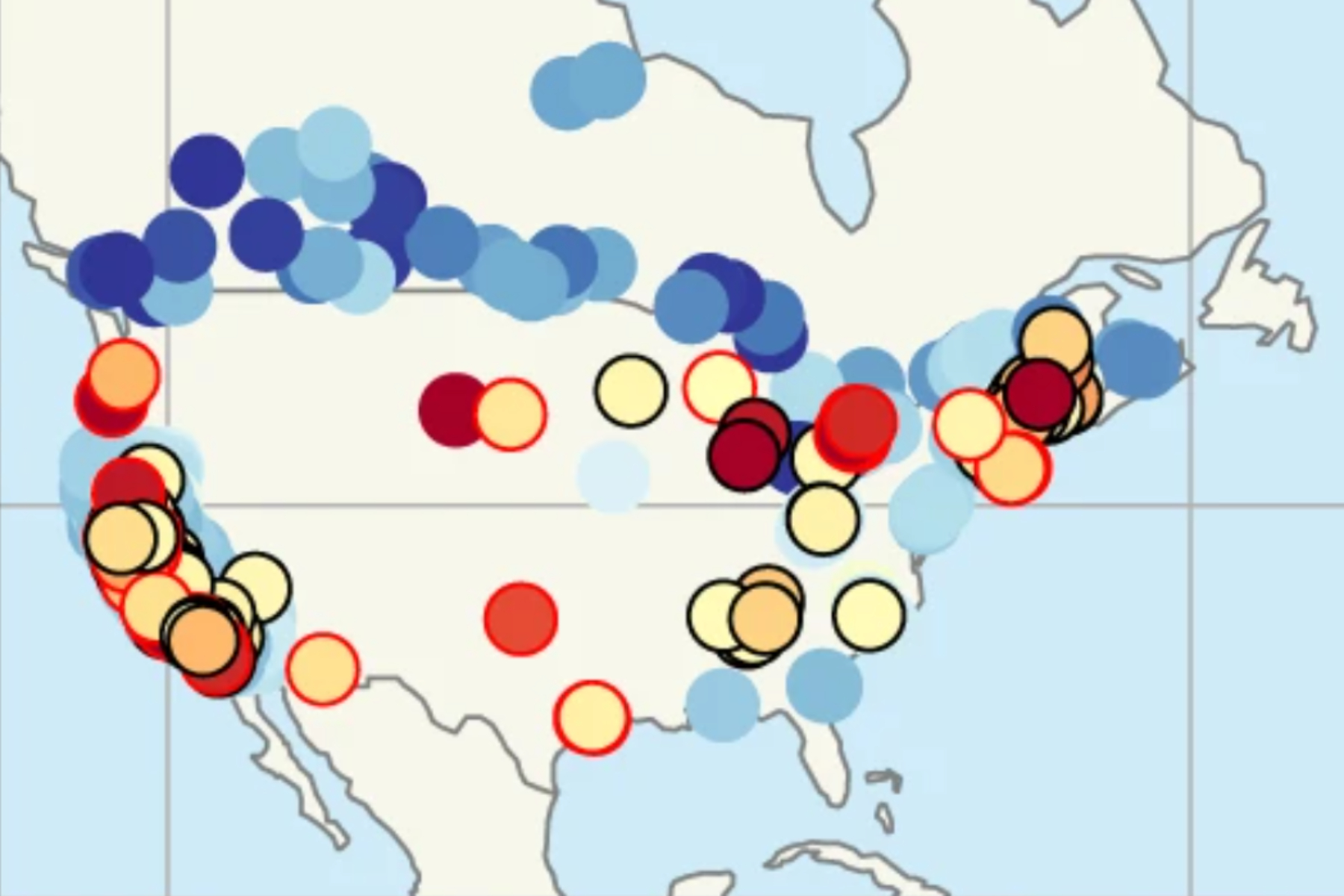

Goldman Sachs' Methodology: Analyzing Trump's Social Media for Oil Price Signals

Goldman Sachs' analysis likely employed a mixed-methods approach, combining quantitative and qualitative techniques to decipher Trump's social media clues regarding oil prices. This probably involved sophisticated sentiment analysis of his posts to gauge his emotional stance towards oil price fluctuations, coupled with correlation studies comparing his statements to subsequent market movements.

- Specific types of social media posts analyzed: Tweets, Facebook posts, and potentially other public statements made on platforms like Truth Social.

- Timeframe of the analysis: The analysis likely covered Trump's presidency, encompassing his statements and their impact on the oil market during that period.

- Data sources used: The research likely integrated data from various sources including market data from reputable financial providers, news articles reporting on Trump's statements and their market impact, and potentially archival data on OPEC decisions and international relations.

- Limitations or biases in the methodology: A crucial limitation is the inherent subjectivity in interpreting sentiment from social media posts. Furthermore, correlation does not equal causation; any observed relationship between Trump's statements and oil prices might not reflect direct causal links. The analysis could also be susceptible to confirmation bias, if pre-existing beliefs influenced the interpretation of the data.

Trump's Public Statements and Their Impact on Oil Prices (Goldman Sachs Insights)

Goldman Sachs' analysis likely highlighted instances where Trump's social media activity suggested a preference for either higher or lower oil prices. Let's consider hypothetical examples (as specific Goldman Sachs findings would require access to their proprietary research):

-

Example 1 (Hypothetical): "Oil prices are too high, hurting American consumers. We need to see them come down!" – This tweet might be interpreted as indicating a preference for lower oil prices. The subsequent market reaction could be a slight dip in oil futures prices. Goldman Sachs' interpretation might focus on the impact of this negative sentiment on investor confidence.

-

Example 2 (Hypothetical): A retweet of an article highlighting the strategic importance of American energy independence, coupled with a statement about strengthening domestic oil production. This might be interpreted as a preference for higher oil prices, supporting domestic producers. The market reaction could be a price increase, reflecting increased investor expectations for higher production.

Policy Implications: Connecting Trump's Oil Price Preference to his Administration's Actions

The analysis would likely explore how Trump's perceived oil price preferences, as gleaned from his social media, correlated with his administration's actual energy policies. This comparison could reveal congruences or discrepancies.

- Specific policy decisions: Examples include the withdrawal from the Paris Agreement, sanctions on Iranian oil exports, and policies aimed at boosting domestic oil and gas production.

- Impact on oil prices: Each policy decision would need to be evaluated regarding its effect on oil prices—did they contribute to higher or lower prices, aligning with Trump's perceived preference?

- Connection between social media sentiment and policies: The analysis would look for links between Trump's social media statements and the subsequent formulation and implementation of energy policies. Did his public pronouncements foreshadow, or influence, specific decisions?

The Role of OPEC and International Relations

Trump's social media pronouncements might have influenced his negotiations with OPEC nations and other global actors.

- Interactions with OPEC or other countries: Examples might include tweets pressuring OPEC to increase oil production or statements criticizing particular countries' energy policies.

- Influence of social media: The study likely examined whether Trump's public pronouncements on social media impacted the dynamics of these international interactions and subsequently affected oil prices.

Criticisms and Alternative Interpretations of Goldman Sachs' Analysis

It is crucial to acknowledge potential criticisms of Goldman Sachs' approach.

- Potential biases: The analysis might be criticized for potential biases in selecting specific social media posts or interpreting their meaning. The researchers' own political leanings might subconsciously influence their interpretation.

- Alternative explanations: Market movements are influenced by numerous factors besides presidential pronouncements. Alternative explanations, such as global economic trends or geopolitical events, could account for observed price fluctuations.

- Limitations of social media analysis: Relying solely on social media for policy analysis is inherently limited. It ignores crucial nuances and contextual factors, including behind-the-scenes discussions and official policy documents.

Conclusion: Decoding Trump's Oil Price Signals – A Goldman Sachs Perspective

Goldman Sachs' analysis likely offered a unique lens through which to understand the relationship between former President Trump's social media activity and his apparent oil price preference. While the study may have limitations regarding methodology and interpretation, it highlights the increasingly important role of social media in shaping public perception and potentially influencing policy decisions related to complex global issues like oil prices. The analysis serves as a reminder of the intricate interplay between political rhetoric, social media, and market forces. For a deeper dive into how Trump's social media revealed his oil price preference, explore Goldman Sachs' full report and expand your understanding of the intersection of social media, policy, and oil market dynamics.

Featured Posts

-

Petco Park Witness To Padres Clean Sweep Over Giants

May 15, 2025

Petco Park Witness To Padres Clean Sweep Over Giants

May 15, 2025 -

Draisaitl Hellebuyck And Kucherov The 2024 Nhl Hart Trophy Finalists

May 15, 2025

Draisaitl Hellebuyck And Kucherov The 2024 Nhl Hart Trophy Finalists

May 15, 2025 -

Knicks Bench Steps Up Impact Of Jalen Brunsons Absence

May 15, 2025

Knicks Bench Steps Up Impact Of Jalen Brunsons Absence

May 15, 2025 -

Jimmy Butler Playing Today Warriors Game Status Update

May 15, 2025

Jimmy Butler Playing Today Warriors Game Status Update

May 15, 2025 -

Millions Exposed Shocking Study Reveals Widespread Pfas Contamination In Us Tap Water

May 15, 2025

Millions Exposed Shocking Study Reveals Widespread Pfas Contamination In Us Tap Water

May 15, 2025