How The Growing Federal Debt Affects Your Ability To Buy A Home

Table of Contents

The Impact of Inflation on Home Prices & Affordability

Understanding Inflation's Role

Increased government borrowing often leads to inflation. When the government borrows heavily, it increases the money supply, driving up demand for goods and services, including housing. This increased demand, coupled with supply chain issues and material shortages, pushes home prices higher. The result? Your dream home becomes less affordable.

- Rising inflation erodes purchasing power: The same amount of money buys less, making it harder to save for a down payment and cover closing costs.

- Increased demand for homes due to economic uncertainty: Economic instability often drives people to seek the perceived safety and stability of owning a home, further fueling demand.

- Construction costs increase due to inflation: The rising cost of building materials, labor, and land directly impacts the price of new homes.

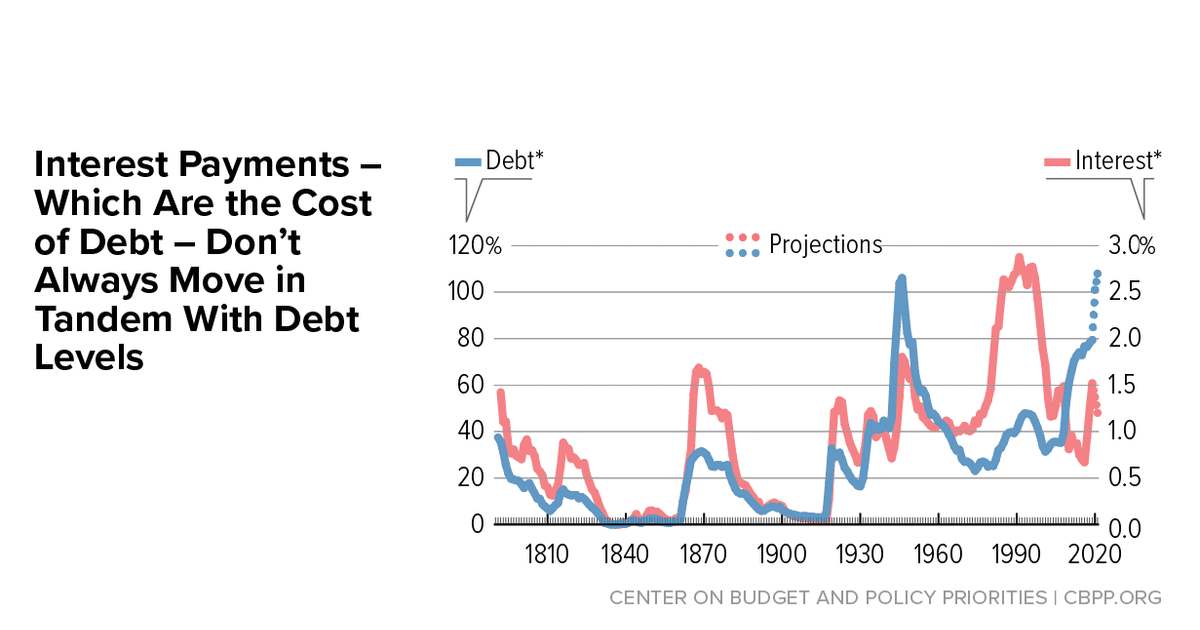

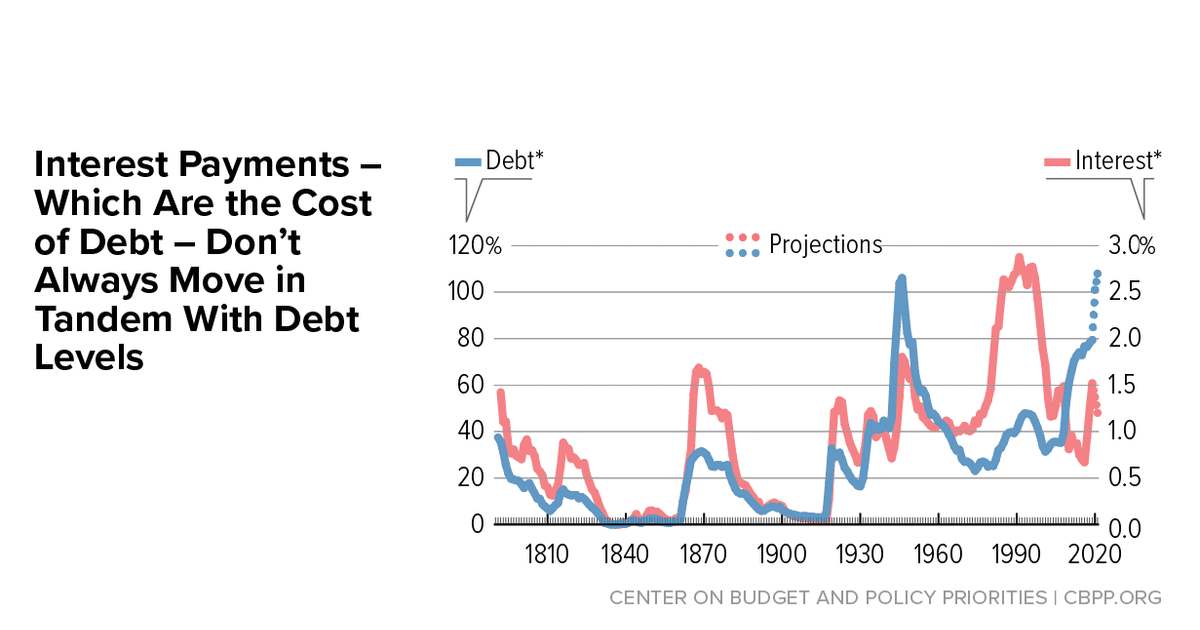

- Higher inflation leads to higher interest rates: To combat inflation, the Federal Reserve often raises interest rates, making borrowing more expensive.

How Rising Interest Rates Affect Mortgage Payments

The Relationship Between Federal Debt and Interest Rates

The Federal Reserve (the Fed) manages interest rates to control inflation. When government debt is high, the Fed might raise interest rates to curb inflation. This directly impacts mortgage rates, significantly affecting your ability to purchase a home.

- Higher interest rates mean higher monthly mortgage payments: A seemingly small increase in interest rates can translate to hundreds of extra dollars in monthly payments.

- Increased borrowing costs make it harder to qualify for a mortgage: Lenders assess affordability based on your debt-to-income ratio; higher interest rates make it harder to qualify.

- Effect on affordability for first-time homebuyers: First-time homebuyers, often with less savings and less established credit, are disproportionately affected by higher interest rates.

- The impact of different mortgage types (fixed-rate vs. adjustable-rate): Fixed-rate mortgages offer predictability, while adjustable-rate mortgages (ARMs) are riskier given the potential for rate hikes.

Economic Uncertainty and its Effect on the Housing Market

Investor Sentiment and Market Volatility

High national debt contributes to economic instability, impacting investor sentiment and creating volatility in the housing market. Uncertainty about the future can lead to reduced investment and a slowdown in the market.

- Investor uncertainty leads to market volatility: Investors may pull back from the housing market, leading to price fluctuations and making it harder to predict market trends.

- Potential impact on job security and homebuyer confidence: Economic instability can affect job security, making potential homebuyers hesitant to commit to a large purchase.

- How government policies aimed at managing debt influence the housing market: Government responses to high debt levels (tax increases, spending cuts) can indirectly impact the housing market.

- Increased risk aversion from lenders: Lenders become more cautious in a volatile economic climate, tightening lending standards and making it harder to secure a mortgage.

Strategies for Homebuyers in a High-Debt Environment

Tips for Navigating the Current Market

Even in a challenging economic climate, achieving homeownership is possible with careful planning and strategic action.

- Improve your credit score: A higher credit score qualifies you for better interest rates and better loan terms.

- Save a larger down payment: A larger down payment can reduce your monthly payments and your need to borrow as much.

- Shop around for the best mortgage rates: Compare rates from different lenders to secure the most favorable terms.

- Consider alternative financing options: Explore options like FHA loans or VA loans, which often have less stringent requirements.

- Adjust your home-buying expectations (location, size): Consider areas with lower home prices or compromise on the size of the house.

Conclusion

Rising federal debt significantly impacts your ability to buy a home. It fuels inflation, leading to higher home prices and increased interest rates, which in turn increases your monthly mortgage payments and makes it harder to qualify for a loan. This creates economic uncertainty, further complicating the home-buying process. Understanding the impact of federal debt and home buying is crucial. Stay informed about national debt levels, interest rate changes, and overall economic trends. Consult with financial professionals to develop a strong financial plan and explore strategies to navigate this complex market. By proactively addressing these factors, you can increase your chances of achieving your homeownership dreams, despite the challenges posed by the current economic climate. Remember to research further on topics like national debt and home affordability and government debt and mortgage rates to stay informed and make well-informed decisions.

Featured Posts

-

Gazze Krizi Trump Elon Musk Ve Netanyahu Nun Iliskisi Ve Skandalin Ayrintilari

May 19, 2025

Gazze Krizi Trump Elon Musk Ve Netanyahu Nun Iliskisi Ve Skandalin Ayrintilari

May 19, 2025 -

Local Principal Receives Prestigious Hillsborough Principal Of The Year Award

May 19, 2025

Local Principal Receives Prestigious Hillsborough Principal Of The Year Award

May 19, 2025 -

Jyoti Malhotra Espionage Case 10 Key Points You Need To Know

May 19, 2025

Jyoti Malhotra Espionage Case 10 Key Points You Need To Know

May 19, 2025 -

Death Of Suspect Likely In California Fertility Clinic Bombing Fbi Update

May 19, 2025

Death Of Suspect Likely In California Fertility Clinic Bombing Fbi Update

May 19, 2025 -

Succes Pour La Fete De La Marche A Parcay Sur Vienne Plus De 100 Participants

May 19, 2025

Succes Pour La Fete De La Marche A Parcay Sur Vienne Plus De 100 Participants

May 19, 2025