How Tesla's Rise And Dogecoin Distance Increased Elon Musk's Wealth

Table of Contents

Tesla's Contribution to Elon Musk's Wealth:

Tesla's Stock Market Success:

Tesla's journey is a testament to disruptive innovation. From a relatively unknown electric vehicle startup, it has transformed into a global automotive giant, profoundly impacting the automotive industry and the energy sector. This remarkable transformation is directly correlated with the dramatic increase in Tesla's stock price, a major contributor to Elon Musk's immense wealth. The stock's value has seen exponential growth over the years, directly impacting Musk's net worth as he holds a significant number of shares.

- Early Tesla investments and initial public offering (IPO): Early investors who recognized Tesla's potential reaped substantial rewards, and Musk's own early investments have significantly multiplied in value.

- Innovative technology and market disruption: Tesla's pioneering electric vehicles, advanced battery technology, and autonomous driving features have disrupted the traditional automotive industry, attracting investors and driving up demand.

- Growth in electric vehicle (EV) market share: Tesla has become a dominant player in the rapidly expanding EV market, solidifying its position and further fueling its stock price.

- Expansion into renewable energy (solar panels, energy storage): Tesla's diversification into solar energy and energy storage solutions has broadened its revenue streams and enhanced its appeal to environmentally conscious investors.

- Positive media coverage and Musk's influence: Musk's outspoken personality and innovative approach have generated significant media attention, influencing public perception and investor confidence in Tesla.

Musk's Role in Tesla's Growth:

Elon Musk's leadership style has been instrumental in Tesla's success. His visionary approach, relentless drive, and unconventional marketing strategies have built a brand recognized globally for innovation and disruption. This leadership, coupled with his significant influence on investor sentiment, has undeniably contributed to Tesla's stock price appreciation and, consequently, his own wealth.

- Visionary leadership and innovative product development: Musk's ambitious vision and commitment to pushing technological boundaries have driven Tesla's development of cutting-edge electric vehicles.

- Strong marketing and branding strategies: Tesla's marketing has focused on creating a desirable brand image, emphasizing sustainability and technological advancement.

- Direct engagement with consumers and social media: Musk's active use of social media to interact with customers and announce company updates has cultivated a dedicated following and influenced investor perception.

- Risk-taking and ambitious goals: Musk's willingness to take risks and pursue ambitious goals, such as the development of fully autonomous driving technology, has further captivated investors.

Dogecoin's Impact on Elon Musk's Wealth (and the associated Risks):

Musk's Influence on Dogecoin's Value:

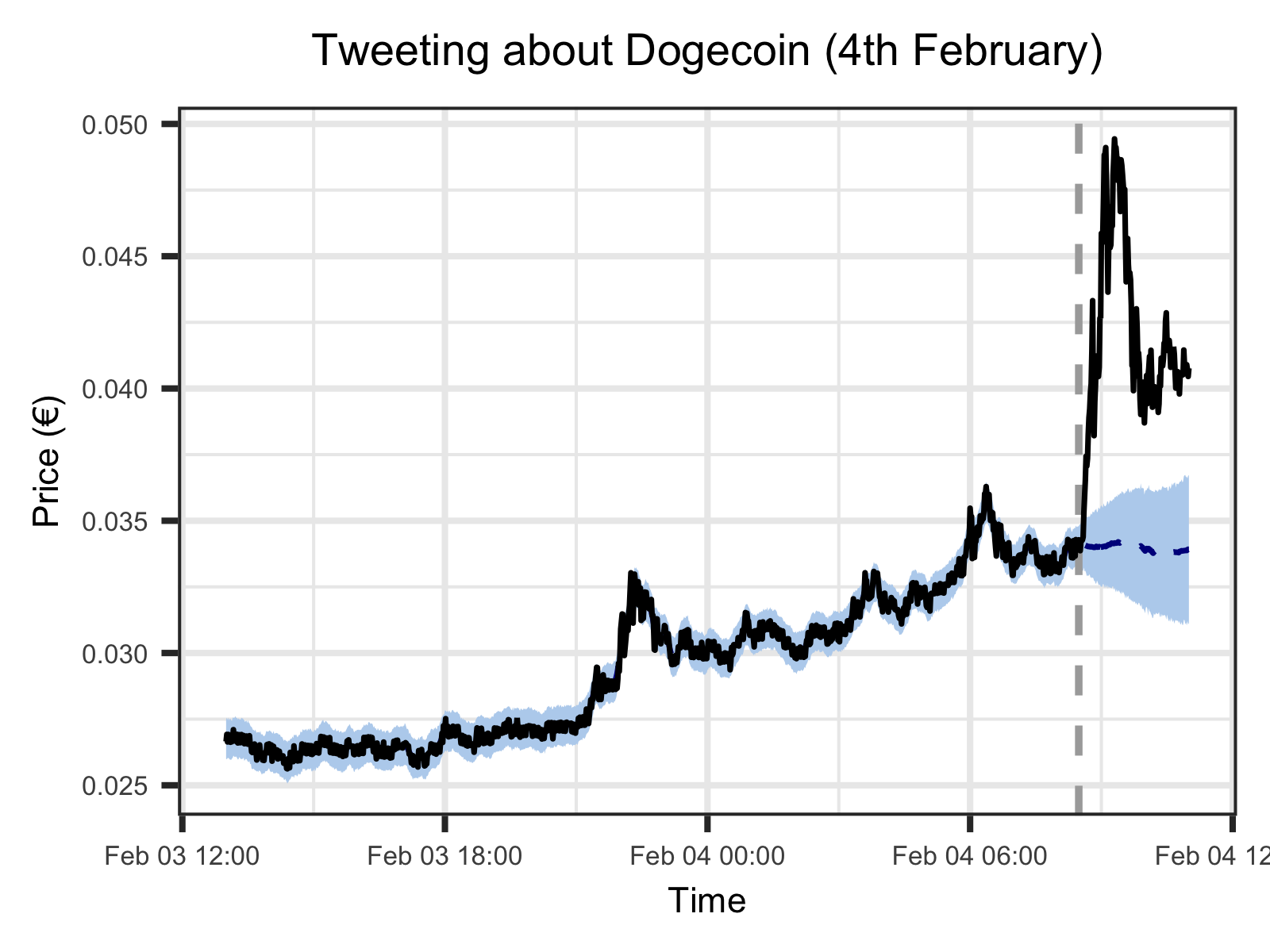

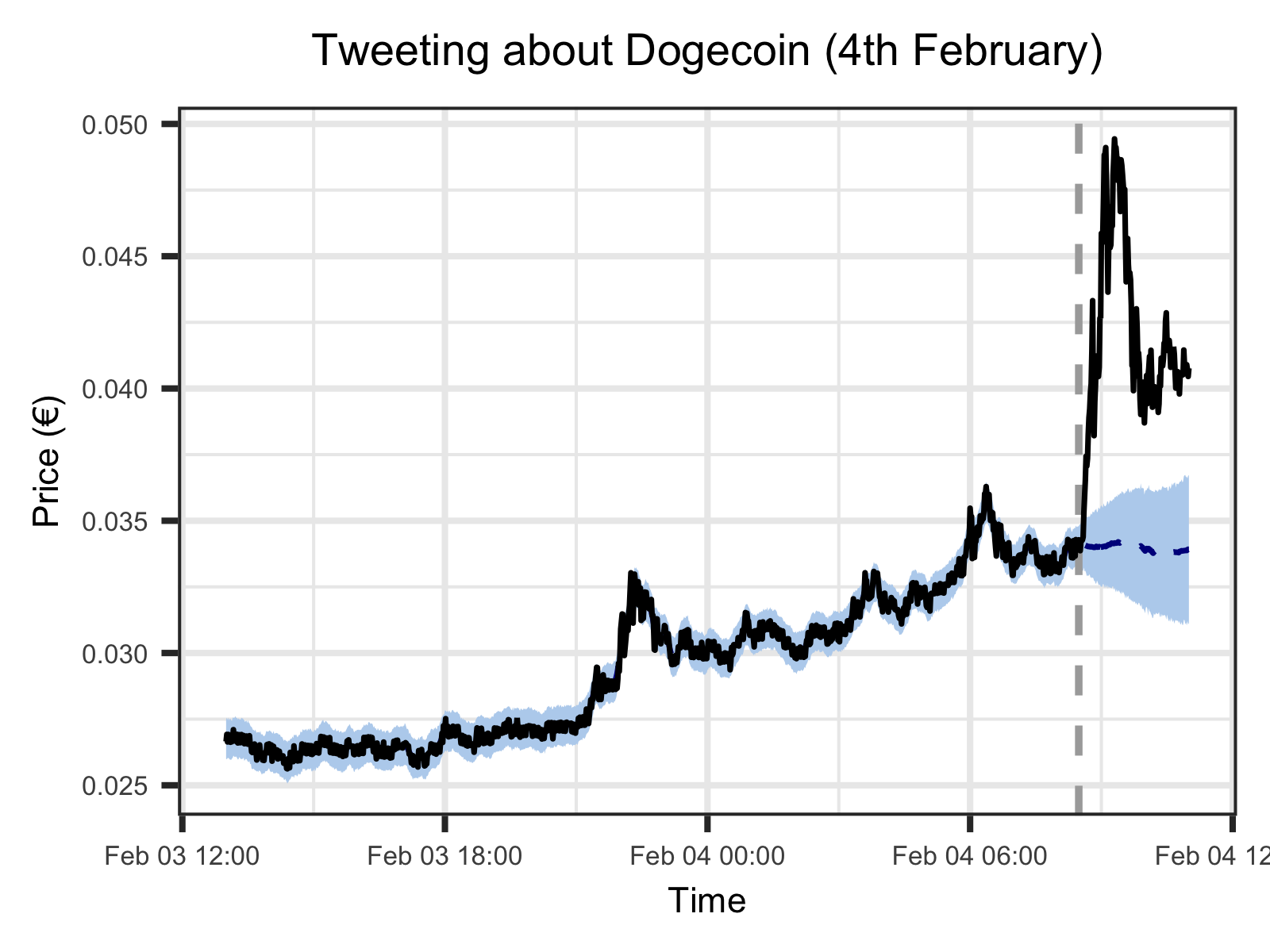

Elon Musk's public endorsements of Dogecoin, largely through tweets and social media posts, have significantly impacted the cryptocurrency's price. These actions have highlighted the inherent volatility of cryptocurrencies and raised ethical questions about the influence of prominent figures on market fluctuations. While Musk's actions have undoubtedly increased Dogecoin's value at times, it's crucial to remember the considerable risks associated with this highly speculative asset.

- Tweets and social media posts promoting Dogecoin: Musk's pronouncements on Dogecoin have sent its price soaring on numerous occasions, leading to substantial gains for those who held the cryptocurrency.

- Dogecoin's price fluctuations and market capitalization: Dogecoin's value has experienced dramatic swings, highlighting the inherent risks of investing in volatile cryptocurrencies.

- Speculative investment and the "meme coin" phenomenon: Dogecoin's popularity is partly attributed to its meme-based origins and online community, attracting speculative investors.

- Regulatory uncertainty surrounding cryptocurrencies: The lack of clear regulatory frameworks surrounding cryptocurrencies adds to the inherent risks associated with investments in Dogecoin.

The Complex Relationship Between Tesla and Dogecoin:

While seemingly disparate, Tesla and Dogecoin are linked indirectly through their association with Elon Musk. This linkage influences investor sentiment towards both assets, presenting potential conflicts of interest and inviting regulatory scrutiny.

- Brand alignment and potential synergy: The association between Musk, Tesla, and Dogecoin has created a certain brand synergy, though the extent and nature of this synergy remains undefined and potentially precarious.

- Investor perception and market sentiment: Musk's actions relating to both Tesla and Dogecoin influence investor perception and market sentiment, creating a complex interplay between the two.

- Legal and regulatory challenges: The potential conflicts of interest and regulatory scrutiny surrounding Musk's involvement in both Tesla and Dogecoin highlight the complexities of his multifaceted business empire.

Conclusion: Unraveling the Factors Behind Elon Musk's Financial Success

Elon Musk's remarkable wealth is a result of a complex interplay of factors, primarily Tesla's spectacular stock market performance and the volatile yet impactful influence he's exerted on the cryptocurrency market through his engagement with Dogecoin. While Tesla's growth represents a tangible success story built on innovation and market disruption, Dogecoin's price fluctuations showcase the inherent risks and volatility of the cryptocurrency market. Understanding the dynamics of both Tesla's stock price and the cryptocurrency market is crucial for comprehending the factors that have contributed to Elon Musk's net worth. Learn more about the factors influencing Elon Musk's net worth and the interplay between Tesla, Dogecoin, and his overall financial success. Dive deeper into the complexities of investing in Tesla and understanding the cryptocurrency market's volatility.

Featured Posts

-

Transgender Experiences Under Trump Executive Orders

May 10, 2025

Transgender Experiences Under Trump Executive Orders

May 10, 2025 -

Broadcoms V Mware Acquisition Extreme Price Hike Sparks At And T Outcry

May 10, 2025

Broadcoms V Mware Acquisition Extreme Price Hike Sparks At And T Outcry

May 10, 2025 -

Trump Administration Policies Experiences Of Transgender Americans

May 10, 2025

Trump Administration Policies Experiences Of Transgender Americans

May 10, 2025 -

Trump Administration Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025

Trump Administration Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025 -

The Trump Tariff Debate A Fox News Hosts Financial Counterargument

May 10, 2025

The Trump Tariff Debate A Fox News Hosts Financial Counterargument

May 10, 2025