How Tesla Is Addressing Shareholder Lawsuits Following Musk's Pay

Table of Contents

The Nature of the Shareholder Lawsuits

At the heart of these shareholder lawsuits lies the contention that Elon Musk's compensation package is excessive, misaligned with shareholder interests, and ultimately detrimental to Tesla's value. The core arguments consistently highlight several key issues:

-

Allegations of Excessive Compensation Exceeding Market Norms: Critics argue that the compensation package far surpasses what's considered reasonable for a CEO, even one leading a high-growth company like Tesla. They point to the potential dilution of existing shareholder value through the issuance of stock options.

-

Claims of Inadequate Shareholder Approval Processes: Plaintiffs contend that the process by which Musk's compensation was approved lacked transparency and proper shareholder input, potentially violating corporate governance standards and shareholder rights.

-

Arguments Focusing on Potential Conflicts of Interest: Some lawsuits highlight potential conflicts of interest, arguing that Musk's personal interests might have unduly influenced the structuring and approval of his compensation package. This is particularly pertinent given his significant influence over Tesla's decision-making.

-

Discussions of the Impact on Tesla's Stock Price: A central argument revolves around the impact of this lavish compensation on Tesla's stock price. Lawsuits suggest the excessive pay package negatively affects investor confidence and potentially undervalues the company.

Several lawsuits have already been filed, with details available through news sources like the Wall Street Journal and court documents accessible via PACER (Public Access to Court Electronic Records). [Insert links to relevant news articles and court documents here]. These filings detail specific financial calculations and arguments about the fairness and legality of the compensation structure.

Tesla's Defense Strategies

Tesla employs several strategic defenses against these shareholder lawsuits. Their legal team emphasizes the performance-based nature of Musk's compensation, arguing it is directly tied to achieving ambitious growth targets.

-

Highlighting Tesla's Legal Arguments and Counter-Claims: Tesla's defense hinges on demonstrating that Musk's compensation is justified by his instrumental role in the company's unprecedented growth and market leadership.

-

Emphasis on Musk's Contributions to Tesla's Growth: The company's legal strategy centers on showcasing Musk's visionary leadership, groundbreaking innovations, and contributions to Tesla's astronomical rise in the electric vehicle market. They aim to prove a direct correlation between Musk's efforts and the substantial shareholder value created.

-

Mention of Settlements or Negotiations Undertaken: While specific details might be confidential, it's important to note whether Tesla has engaged in any settlements or negotiations to resolve some of the lawsuits. These actions might indicate a strategy to minimize legal costs and potential reputational damage.

-

Showcasing Shareholder Value Generated: Tesla will likely present financial data demonstrating significant shareholder value creation despite the high compensation. The argument will be that the overall returns for shareholders outweigh the costs associated with Musk's pay package.

The legal teams involved, both for Tesla and the plaintiffs, are high-profile and experienced in handling complex corporate litigation. Their strategies will likely involve detailed financial analysis, expert testimony, and extensive legal maneuvering.

The Role of the SEC and Regulatory Scrutiny

The Securities and Exchange Commission (SEC) plays a crucial role in overseeing corporate governance and executive compensation practices. Their involvement, or potential involvement, in these Tesla lawsuits is a significant factor.

-

The SEC's Role in Overseeing Corporate Governance and Executive Compensation: The SEC ensures that public companies comply with regulations related to executive compensation disclosure, shareholder approval processes, and conflict-of-interest avoidance.

-

Potential SEC Investigations or Actions Related to the Lawsuits: The SEC might launch its own investigation to determine whether Tesla violated any securities laws or regulations in relation to Musk's compensation. This could lead to significant consequences for the company.

-

Potential Impact of Regulatory Findings on Tesla: Depending on the SEC's findings, Tesla could face fines, penalties, or even mandated changes to its corporate governance structure, affecting future executive compensation decisions.

-

Fines or Penalties Imposed or Under Consideration: Any potential fines or penalties would significantly impact Tesla's financial position and could further affect investor confidence. Public disclosure of such actions will likely have immediate repercussions on the stock price.

Impact on Tesla's Stock Price and Investor Confidence

The shareholder lawsuits and the ongoing legal battles have had a palpable impact on Tesla's stock price and investor confidence. Analyzing both short-term and long-term implications is crucial.

-

Tracking Stock Price Fluctuations: Monitoring Tesla's stock price since the lawsuits were filed provides insights into the market's reaction to these legal challenges.

-

Examining Investor Sentiment and Analyst Opinions: Investor sentiment and analyst reports reflect the overall impact of the lawsuits on confidence in Tesla's future performance.

-

Potential for Reputational Damage to Tesla: Negative publicity surrounding the lawsuits can damage Tesla's reputation, potentially affecting its ability to attract investors, partners, and employees.

-

Broader Implications for Investor Relations: The handling of these lawsuits will significantly influence how investors perceive Tesla's corporate governance and transparency, impacting future investment decisions.

Conclusion

The shareholder lawsuits against Tesla regarding Elon Musk's compensation package represent a significant challenge to the company. The core arguments center around excessive pay, inadequate shareholder approval, potential conflicts of interest, and the impact on Tesla's stock price. Tesla's defense relies on highlighting Musk's contributions, the performance-based nature of the compensation, and the overall shareholder value generated. The SEC's potential involvement adds another layer of complexity, with potential regulatory consequences for Tesla. The outcome of these lawsuits will significantly affect Tesla's stock price, investor confidence, and the future of executive compensation practices within the company.

Call to Action: Stay informed about the ongoing developments in the Tesla shareholder lawsuits and their implications for the future of executive compensation and corporate governance. Follow this blog for further updates on how Tesla is addressing shareholder lawsuits and the evolving landscape of executive pay in the electric vehicle industry. Understanding these legal battles is crucial for any investor considering Tesla stock or interested in corporate governance best practices.

Featured Posts

-

Canada Posts Financial Crisis Report Calls For Phased Elimination Of Door To Door Mail Delivery

May 18, 2025

Canada Posts Financial Crisis Report Calls For Phased Elimination Of Door To Door Mail Delivery

May 18, 2025 -

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025 -

Eurovision 2025 Guest Performer Speculation Could It Be Damiano David

May 18, 2025

Eurovision 2025 Guest Performer Speculation Could It Be Damiano David

May 18, 2025 -

Wilders Pvv Internal Disputes Threaten Party Control

May 18, 2025

Wilders Pvv Internal Disputes Threaten Party Control

May 18, 2025 -

Osama Bin Ladens Downfall An In Depth Review Of American Manhunt

May 18, 2025

Osama Bin Ladens Downfall An In Depth Review Of American Manhunt

May 18, 2025

Latest Posts

-

Uncensored Snl Audience Members Caught Swearing On Air

May 18, 2025

Uncensored Snl Audience Members Caught Swearing On Air

May 18, 2025 -

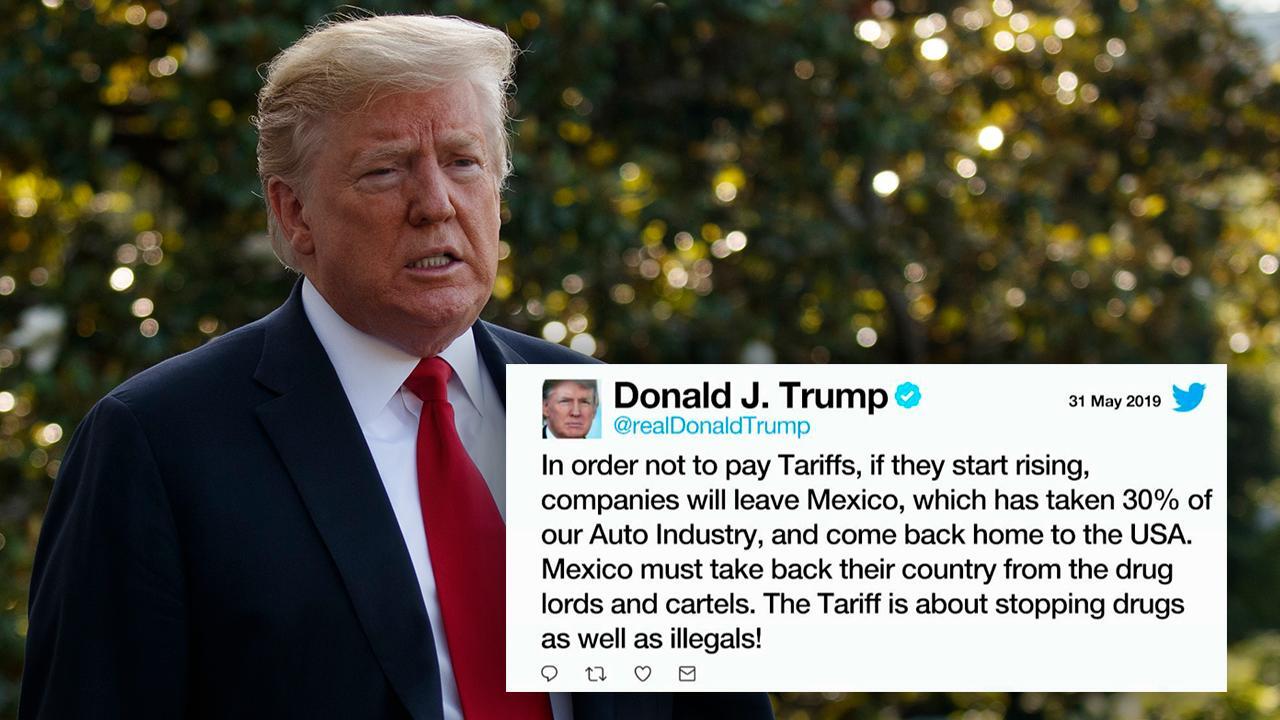

Continued 30 Tariffs On Chinese Imports Trumps Policy Until Late 2025

May 18, 2025

Continued 30 Tariffs On Chinese Imports Trumps Policy Until Late 2025

May 18, 2025 -

Snl Live Tv Controversy Unfiltered Audience Reactions

May 18, 2025

Snl Live Tv Controversy Unfiltered Audience Reactions

May 18, 2025 -

Trumps China Tariffs A 30 Levy Extended To Late 2025 According To Analysts

May 18, 2025

Trumps China Tariffs A 30 Levy Extended To Late 2025 According To Analysts

May 18, 2025 -

A Comprehensive Review Of Trumps Aerospace Deals And Their Impact

May 18, 2025

A Comprehensive Review Of Trumps Aerospace Deals And Their Impact

May 18, 2025