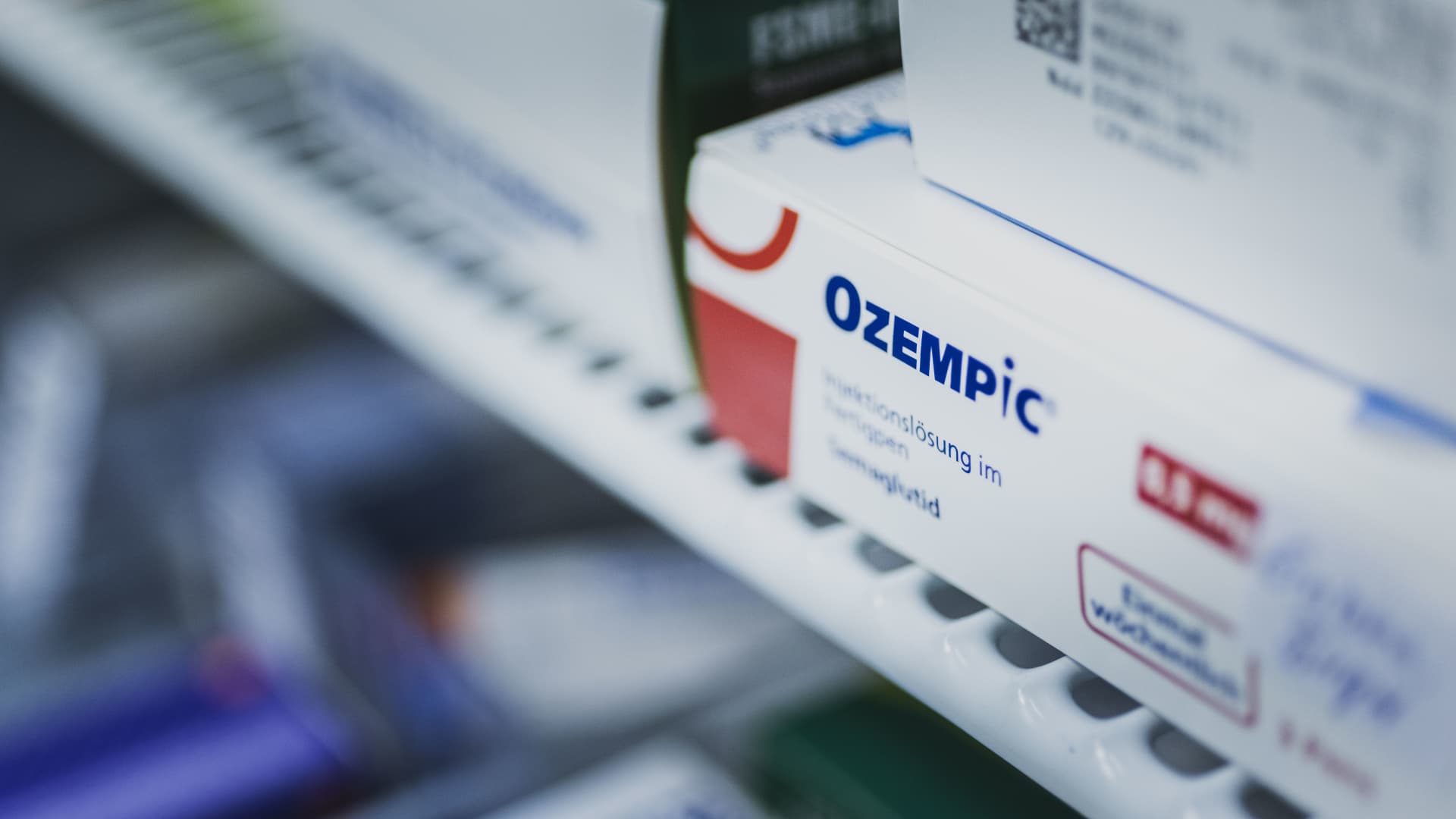

How Ozempic's Parent Company Novo Nordisk Lost Momentum In Weight-Loss Drugs

Table of Contents

Increased Competition in the GLP-1 Receptor Agonist Market

The GLP-1 receptor agonist market, once dominated by Novo Nordisk, has become increasingly crowded. The initial success of Ozempic and Wegovy attracted significant investment and research into similar drugs, leading to a surge in competitors. This intensified competition directly impacts Novo Nordisk's market share and overall revenue streams related to Novo Nordisk weight loss solutions.

-

Entry of biosimilars and generic competitors: The arrival of biosimilars – similar but not identical copies – and generic versions of semaglutide threatens to erode Novo Nordisk's pricing power and market exclusivity. This increased availability of cheaper alternatives directly impacts patient choice and market share.

-

Launch of new GLP-1 receptor agonists with similar efficacy and potentially lower prices: Rival pharmaceutical companies have launched their own GLP-1 receptor agonists, often with comparable efficacy to Ozempic and Wegovy, but at potentially lower prices. This price competition is a significant factor in Novo Nordisk's reduced market dominance. Examples include Mounjaro (tirzepatide) from Eli Lilly and Company, which has demonstrated significant success in weight loss trials.

-

Marketing strategies of competitors targeting the same patient base: Competitors are aggressively marketing their products to the same demographic as Novo Nordisk, leading to a more fragmented market and reduced brand loyalty. Targeted advertising and public relations campaigns directly impact patient preference and brand awareness.

-

Specific competitor drugs and their market impact: The success of drugs like Mounjaro, with its superior weight loss results in some trials, directly challenges Ozempic and Wegovy's position as leading weight-loss treatments. This competition forces Novo Nordisk to adapt its marketing and pricing strategies.

Production and Supply Chain Challenges

The unexpected surge in demand for Ozempic and Wegovy overwhelmed Novo Nordisk's manufacturing and supply chain capabilities. This led to significant shortages, frustrating patients and impacting the company's ability to capitalize on market demand. These production issues directly relate to the overall narrative of Novo Nordisk weight loss market performance.

-

Manufacturing capacity constraints leading to shortages: Novo Nordisk's production facilities struggled to keep pace with the unexpectedly high demand, resulting in widespread shortages of both Ozempic and Wegovy. This shortage impacted patient access and negatively affected brand perception.

-

Supply chain disruptions affecting raw material availability: Global supply chain disruptions, exacerbated by the pandemic, further hampered Novo Nordisk's ability to produce sufficient quantities of its weight-loss drugs. These external factors compounded the existing production challenges.

-

Impact of production challenges on market access and patient satisfaction: The shortages led to widespread frustration among patients, some of whom were forced to switch to alternative treatments or wait extended periods for their prescriptions. This damaged patient trust and negatively impacted brand loyalty.

-

Efforts made by Novo Nordisk to address these issues: Novo Nordisk has invested heavily in expanding its manufacturing capacity and improving its supply chain resilience. However, overcoming these challenges takes time and significant resources.

Pricing and Accessibility Concerns

The high cost of Ozempic and Wegovy presents a major barrier to access for many patients, limiting the overall market potential and contributing to the slower growth in Novo Nordisk weight loss market share.

-

High price point limiting affordability for many patients: The substantial cost of these drugs puts them out of reach for many individuals, even with insurance coverage. This price sensitivity significantly limits market penetration.

-

Insurance coverage issues and patient out-of-pocket expenses: Many insurance plans have limited or restrictive coverage for GLP-1 receptor agonists, leading to significant out-of-pocket expenses for patients. This creates affordability challenges for a substantial portion of potential users.

-

Debate surrounding the cost-effectiveness of GLP-1 receptor agonists compared to other weight-loss strategies: The high cost of these drugs has fueled debates about their cost-effectiveness compared to lifestyle interventions, bariatric surgery, or other weight-loss medications.

-

Potential for increased price competition from rival companies: The entry of cheaper biosimilars and generic alternatives puts downward pressure on Novo Nordisk's pricing strategy. This potential for increased competition directly affects the company's profit margins.

Regulatory Scrutiny and Safety Concerns

Increased regulatory scrutiny and concerns regarding the long-term safety profile of GLP-1 receptor agonists have also impacted Novo Nordisk's momentum in the Novo Nordisk weight loss market.

-

Increased regulatory scrutiny regarding the long-term safety profile of GLP-1 receptor agonists: Regulatory agencies are increasingly scrutinizing the long-term safety data of these drugs, potentially leading to stricter guidelines or warnings.

-

Potential side effects and their impact on public perception: While generally well-tolerated, GLP-1 receptor agonists can cause side effects, some of which can be significant. Negative publicity surrounding these side effects can negatively impact public perception and adoption rates.

-

Investigations or lawsuits related to the drugs: Novo Nordisk has faced several investigations and lawsuits related to the safety and marketing of its weight-loss drugs. Negative press related to legal challenges negatively affects brand reputation.

-

Impact of negative media coverage on brand reputation: Negative media coverage surrounding safety concerns and lawsuits can damage brand trust and reduce consumer confidence in Novo Nordisk's weight-loss products.

Shifting Market Dynamics and Changing Consumer Preferences

The weight-loss market is dynamic, with evolving consumer preferences and the emergence of alternative treatment options impacting Novo Nordisk's position. Understanding these shifts is critical for analyzing the trajectory of Novo Nordisk weight loss medications.

-

Emergence of alternative weight loss strategies (e.g., surgery, lifestyle interventions): The increasing popularity of alternative weight-loss strategies, such as bariatric surgery and lifestyle interventions, provides patients with more choices and reduces reliance on pharmaceutical solutions.

-

Changes in consumer preferences towards specific brands or treatment options: Consumer preferences are fluid and influenced by marketing, reviews, and word-of-mouth. Changes in these preferences directly impact market share.

-

Impact of social media and online reviews on consumer choices: Social media and online reviews play a significant role in shaping consumer perceptions and influencing purchasing decisions. Negative online sentiment can impact brand image and sales.

-

Potential for future innovation and market shifts: The weight-loss market is constantly evolving. Future innovations and market shifts will continue to impact Novo Nordisk's market position.

Conclusion

Novo Nordisk's recent slowdown in the weight-loss drug market is a complex issue stemming from a combination of increased competition, production difficulties, pricing concerns, regulatory scrutiny, and evolving market dynamics. While Ozempic and Wegovy remain significant players, the company faces a challenging environment. Understanding the intricacies of the Novo Nordisk weight loss market is crucial for investors, healthcare professionals, and patients alike. Stay informed about the latest developments in this rapidly evolving sector and continue researching the future of Novo Nordisk weight loss medications and its competitors to gain a comprehensive understanding of this dynamic market.

Featured Posts

-

Victoria Day Weekend Kee To Bala Summer Concert Series Begins

May 30, 2025

Victoria Day Weekend Kee To Bala Summer Concert Series Begins

May 30, 2025 -

Emergency Response Underway Mud And Rock Bury Swiss Village After Glacier Collapse

May 30, 2025

Emergency Response Underway Mud And Rock Bury Swiss Village After Glacier Collapse

May 30, 2025 -

Crispr Gene Editing A Breakthrough In Precision And Efficacy

May 30, 2025

Crispr Gene Editing A Breakthrough In Precision And Efficacy

May 30, 2025 -

Virtual Investor Conference Key International Companies Participating May 15 2025

May 30, 2025

Virtual Investor Conference Key International Companies Participating May 15 2025

May 30, 2025 -

New Bts Trailer Teases Major Reunion What Can Armys Expect

May 30, 2025

New Bts Trailer Teases Major Reunion What Can Armys Expect

May 30, 2025