How JazzCash And KTrade Are Changing Stock Market Investment

Table of Contents

Increased Accessibility through Mobile Technology

JazzCash and KTrade leverage mobile technology to overcome geographical barriers and reach a vast investor base, especially in underserved areas. Traditional brokerage houses often require physical visits and significant paperwork, creating hurdles for many potential investors. These platforms eliminate these barriers:

- Ease of account opening and verification through mobile apps: The streamlined signup process, often completed entirely through a mobile phone, drastically reduces the time and effort required to begin investing. Users can verify their identities digitally, bypassing the need for in-person visits.

- Reduced reliance on traditional brokerage houses and physical branches: The accessibility of these platforms eliminates the need to travel to a brokerage office, making investing convenient for those in remote areas or with limited mobility.

- Availability to users with limited technological literacy: Both JazzCash and KTrade feature user-friendly interfaces designed for ease of navigation, ensuring accessibility even for those with limited experience using mobile applications. Simple instructions and intuitive designs cater to a wide range of technological proficiency.

- Lower transaction costs compared to traditional methods: The reduced overhead associated with mobile-based platforms typically translates to lower brokerage fees and transaction costs for investors, making investing more affordable.

Financial Inclusion and Economic Empowerment

By making stock market investment easily accessible via mobile, JazzCash and KTrade are significantly contributing to financial inclusion. This is empowering previously excluded populations, particularly women and individuals in rural areas, to participate in the formal financial system. This increased participation can lead to:

- Improved financial literacy and understanding of investment options.

- Increased household income and economic stability.

- Greater economic empowerment, particularly for women, leading to improved social outcomes.

While precise statistics on increased participation from underserved groups are still emerging, anecdotal evidence and the sheer growth in mobile-based investing strongly suggest a significant positive impact.

Simplified Investment Process

JazzCash and KTrade have dramatically simplified the process of stock market investment in Pakistan. Gone are the days of complex paperwork and lengthy procedures. The platforms offer:

- User-friendly mobile apps with intuitive interfaces: The apps are designed to be easy to navigate, even for first-time investors. Clear layouts and simple instructions guide users through the investment process.

- Step-by-step guides and tutorials for novice investors: Educational resources are readily available within the apps, offering support and guidance to those new to stock market investing.

- Real-time market data and portfolio tracking: Investors can monitor their portfolios and track market performance in real-time, allowing for informed decision-making.

- Secure and reliable transaction processing: Secure payment gateways and robust security measures ensure safe and reliable transactions.

Democratization of Investing

These platforms are fundamentally democratizing investing in Pakistan. Previously, participation was largely limited to those with the resources and knowledge to navigate complex traditional systems. JazzCash and KTrade are changing this by:

- Reducing barriers to entry, including minimum investment requirements: Lower minimum investment requirements make participation accessible to individuals with limited capital.

- Offering ease of use unparalleled by traditional methods: The simplicity and convenience of the platforms significantly reduce the time, effort, and expertise required to invest.

Challenges and Future Outlook

Despite the significant progress, some challenges remain:

- Addressing digital literacy challenges through educational initiatives: Ongoing efforts are needed to improve digital literacy and financial literacy across the country.

- Expanding network coverage and accessibility in rural areas: Improved internet connectivity is crucial to ensuring widespread access to these platforms in underserved regions.

- Continuous improvement of security features: Maintaining robust security measures is essential to protecting investors' funds and data.

- Potential future developments and innovations: Future advancements could include AI-powered investment advice or the integration of blockchain technology to further enhance security and transparency.

The Role of Regulation and Technological Advancements

The Securities and Exchange Commission of Pakistan (SECP) plays a vital role in regulating these platforms, ensuring investor protection and market integrity. Future technological advancements promise further innovation, including:

- Sophisticated AI-powered investment tools providing personalized advice.

- Seamless integration with other financial services.

- Blockchain technology for increased transparency and security.

Conclusion

JazzCash and KTrade are profoundly changing stock market investment in Pakistan, making it more accessible, convenient, and inclusive. These platforms have simplified the investment process, reduced barriers to entry, and empowered previously excluded populations to participate in the formal financial system. The positive impact on the Pakistani economy is undeniable, fostering financial growth and economic empowerment. Start your journey towards smart investing today with JazzCash and KTrade – explore the future of stock market investment in Pakistan!

Featured Posts

-

Municipales 2026 A Dijon Les Ecologistes Ambitieux

May 10, 2025

Municipales 2026 A Dijon Les Ecologistes Ambitieux

May 10, 2025 -

Wynne Evans Go Compare Future Uncertain After Strictly Incident

May 10, 2025

Wynne Evans Go Compare Future Uncertain After Strictly Incident

May 10, 2025 -

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025 -

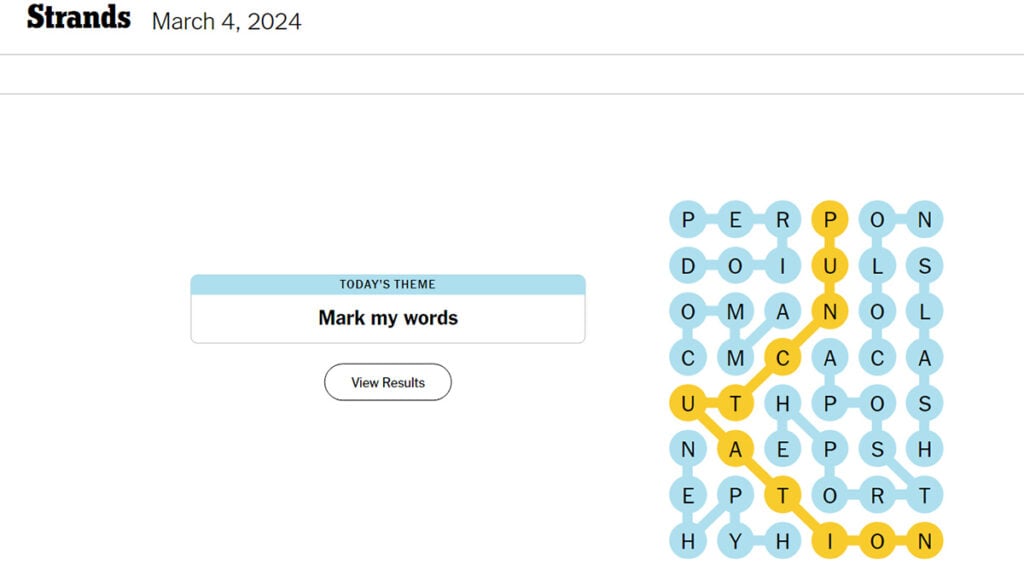

Nyt Strands Solutions Saturday March 15 Game 377

May 10, 2025

Nyt Strands Solutions Saturday March 15 Game 377

May 10, 2025 -

King Protiv Maska Pisatel Vernulsya V Sotsset X I Ne Stesnyalsya V Vyrazheniyakh

May 10, 2025

King Protiv Maska Pisatel Vernulsya V Sotsset X I Ne Stesnyalsya V Vyrazheniyakh

May 10, 2025