House Tax Bill Passes: Impact On Stock Market, Bonds, And Bitcoin Today

Table of Contents

Impact on the Stock Market

The new tax bill's effect on stock prices is complex and multifaceted. Lower corporate tax rates are generally viewed as a positive catalyst, potentially boosting corporate profits and leading to higher stock valuations. However, the overall impact is far from straightforward, with several factors potentially offsetting this initial positive effect. The stock market reaction will depend on how investors weigh these competing forces. Key factors to consider include:

-

Increased Corporate Cash Flow and Stock Buybacks: Lower corporate tax rates increase after-tax profits, leading to higher corporate cash flow. This often translates into increased stock buybacks, artificially boosting stock prices in the short term. However, the sustainability of this effect depends on the long-term profitability of the companies involved.

-

Investor Sentiment and Market Confidence: A generally positive sentiment among investors, driven by the expectation of increased corporate earnings and economic growth, can fuel a stock market rally. Conversely, uncertainty surrounding specific provisions within the bill could lead to short-term market volatility and hesitation among investors.

-

Sector-Specific Impacts: The impact of the House Tax Bill will not be uniform across all sectors. Some industries may benefit disproportionately from the tax changes, while others may experience a negative effect. Analyzing sector-specific impacts is crucial for investors seeking to optimize their portfolios.

-

Uncertainty and Volatility: The complexity of the new tax code introduces an element of uncertainty. This uncertainty can translate into increased market volatility as investors try to assess the long-term implications of the tax reform for individual companies and the market as a whole.

Impact on the Bond Market

Changes in tax policy profoundly influence the bond market. Lower taxes can stimulate economic growth, potentially leading to higher inflation. Higher inflation, in turn, often prompts central banks to increase interest rates to control price increases. These interest rate hikes impact bond yields, affecting the value of existing bonds.

-

Increased Government Borrowing and Bond Yields: The tax cuts may lead to increased government borrowing to finance the resulting budget deficit. This increased demand for capital could put upward pressure on bond yields, potentially leading to lower bond prices.

-

Investor Demand and Tax Implications: Changes in the tax implications of bond ownership, such as changes to capital gains taxes, may alter investor demand for bonds, further affecting bond yields and prices.

-

Impact on Municipal Bonds and Other Government Debt: The tax bill may have specific implications for municipal bonds and other government-related debt instruments. Understanding these specific impacts is critical for investors holding these types of securities.

-

Long-Term Effects on Interest Rates and Inflation: The long-term effect of the tax bill on interest rates and inflation is a subject of ongoing debate among economists. The interaction between these variables will significantly shape the future of the bond market.

Impact on Bitcoin and Cryptocurrencies

The cryptocurrency market, especially Bitcoin, is known for its volatility. The impact of the House Tax Bill on this market is currently uncertain. The bill's provisions regarding the taxation of digital assets are crucial, influencing investor sentiment and potentially impacting Bitcoin's price.

-

Tax Treatment of Cryptocurrency Transactions: The bill's clarification (or lack thereof) on the tax treatment of cryptocurrency transactions will significantly affect investor behavior and the overall market. Clearer guidelines will likely reduce uncertainty and potentially lead to increased institutional investment.

-

Institutional Investment and Regulatory Scrutiny: The tax bill's impact on institutional investment will also play a crucial role in shaping Bitcoin's price. Increased regulatory scrutiny, whether positive or negative, will likely result in price fluctuations.

-

Historical Context and Market Reactions: Examining how previous tax bills have impacted the cryptocurrency market provides valuable context for predicting the potential effects of this new legislation. Historical data allows for a more informed analysis of possible scenarios.

Conclusion

The passage of the House Tax Bill is a landmark event with far-reaching consequences for the stock market, bond market, and the cryptocurrency space, particularly for Bitcoin. While lower corporate tax rates could stimulate stock market growth, significant uncertainty remains about the bill's broader economic impact and its specific effects on various asset classes. The implications for Bitcoin and other cryptocurrencies are particularly unclear, contingent on the interpretation and enforcement of the new regulations. Stay informed, monitor market developments, and consult with a financial advisor to make well-informed decisions regarding your investments in the wake of this House Tax Bill. Understanding the impact of this House Tax Bill on your portfolio is crucial for sound financial planning.

Featured Posts

-

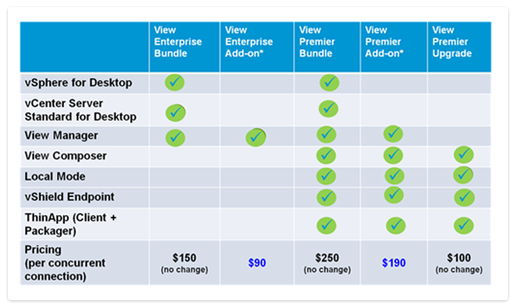

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025 -

Broadways Just In Time Jonathan Groffs Star Studded Opening Night

May 24, 2025

Broadways Just In Time Jonathan Groffs Star Studded Opening Night

May 24, 2025 -

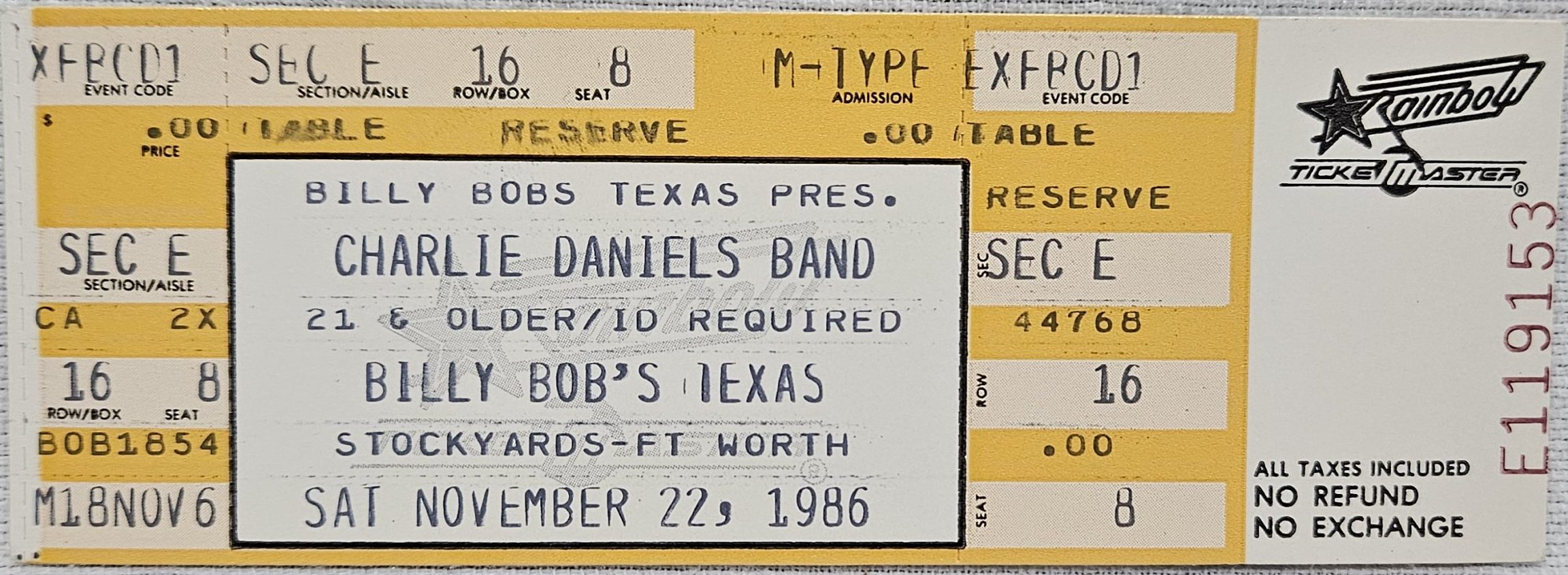

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Twist

May 24, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Twist

May 24, 2025 -

Guccis Supply Chain Leadership Change Understanding The Implications For The Brand

May 24, 2025

Guccis Supply Chain Leadership Change Understanding The Implications For The Brand

May 24, 2025

Latest Posts

-

Hilarious Etoile Scene Reunites Spring Awakening Stars Gideon Glick And Jonathan Groff

May 24, 2025

Hilarious Etoile Scene Reunites Spring Awakening Stars Gideon Glick And Jonathan Groff

May 24, 2025 -

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025 -

Jonathan Groffs Show Name A Night Of Support From Fellow Stars

May 24, 2025

Jonathan Groffs Show Name A Night Of Support From Fellow Stars

May 24, 2025 -

Broadways Best Jonathan Groff Celebrates Opening Night With Famous Friends

May 24, 2025

Broadways Best Jonathan Groff Celebrates Opening Night With Famous Friends

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Stellar Support From Broadway Friends

May 24, 2025

Jonathan Groffs Just In Time A Night Of Stellar Support From Broadway Friends

May 24, 2025