House Plan Slaps Harvard And Yale With Steep Endowment Tax Increase

Table of Contents

Details of the Proposed Endowment Tax Increase

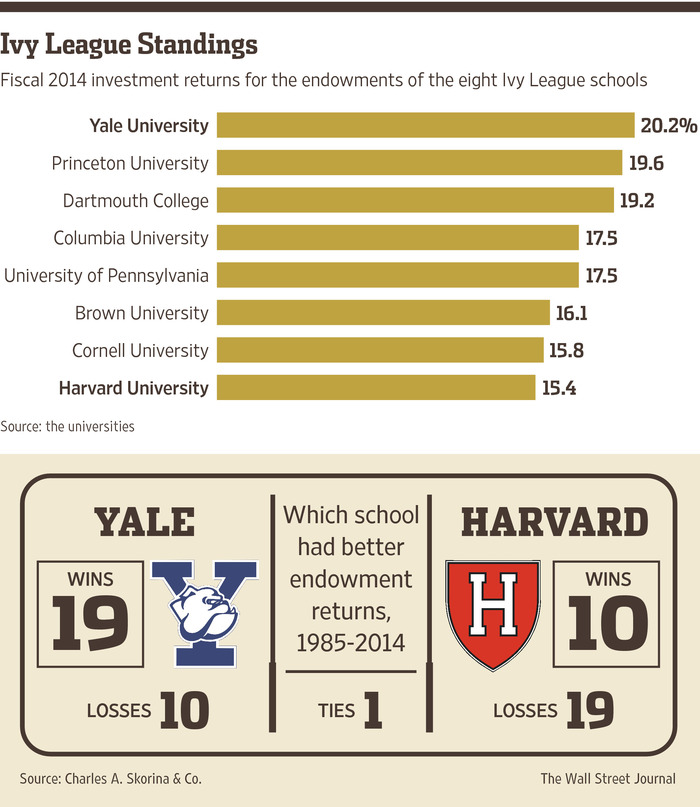

The core proposal aims to increase taxes on university endowments exceeding a certain threshold. While the exact figures are still subject to debate, current proposals suggest a substantial percentage increase – potentially reaching double digits – on the investment returns of endowments exceeding, for example, $1 billion. This means institutions like Harvard and Yale, possessing endowments in the tens of billions, would face a significant tax burden.

- Specific percentage increase proposed: While the exact percentage fluctuates in ongoing legislative discussions, a range between 10% and 20% of investment returns is frequently mentioned.

- Endowment size threshold triggering the tax: The current discussions propose a threshold of around $1 billion in endowment assets, although this figure might be adjusted during the legislative process.

- List of other universities potentially impacted besides Harvard and Yale: Other universities with substantial endowments, including Princeton, Stanford, MIT, and the University of Texas, would also be significantly affected by this proposed endowment tax increase.

- Explanation of how the tax will be calculated: The tax is generally proposed as a percentage levied on the annual investment returns of the endowment, not on the principal. This approach aims to avoid directly impacting the universities' core capital.

Arguments in Favor of the Endowment Tax Increase

Proponents of the endowment tax increase argue that it addresses crucial issues of wealth inequality and promotes greater equity in higher education. They contend that these immensely wealthy institutions should contribute more significantly to society, especially given their tax-exempt status.

- Addressing wealth inequality: The substantial endowments held by elite universities represent a significant concentration of wealth. A tax on these endowments could help redistribute this wealth, potentially funding important social programs.

- Increasing access to higher education for low and middle-income students: Increased tax revenue could be channeled towards expanding financial aid programs, making higher education more accessible to students from diverse socioeconomic backgrounds.

- Funding crucial research and development initiatives: Proponents believe that a portion of the revenue generated from the tax could be used to fund vital research initiatives in areas such as public health, climate change, and technological advancements.

- Ensuring better transparency in endowment management: The debate around the tax has also brought increased scrutiny to the management and investment practices of university endowments, pushing for greater transparency and accountability.

Counterarguments and Concerns about the Endowment Tax Increase

Opponents of the proposed tax raise significant concerns about its potential negative consequences for universities, research, and higher education as a whole.

- Potential impact on university research funding: A substantial endowment tax increase could severely curtail crucial research funding, potentially hindering scientific breakthroughs and innovation.

- Risk of reduced financial aid for students: Despite proponents’ arguments, opponents fear that the tax could ironically lead to a reduction in financial aid, particularly if universities are forced to make difficult budgetary choices.

- Potential impact on endowment investment strategies: The tax could force universities to adopt more conservative investment strategies, potentially limiting their long-term growth and ability to support students and research.

- Concerns regarding the potential for unintended consequences: Opponents worry about unforeseen negative impacts on the overall financial health of universities and the broader higher education ecosystem.

Impact on Harvard and Yale Specifically

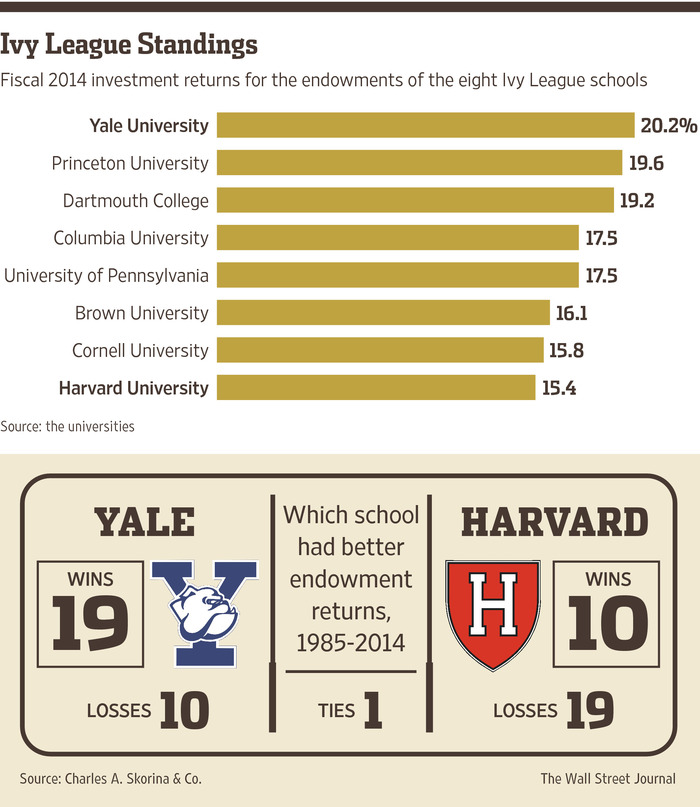

Harvard and Yale, possessing endowments among the largest globally, face unique challenges. The proposed tax would represent a significant financial blow, forcing difficult decisions regarding budget allocation.

- Potential budget cuts across different departments: Significant budget cuts across various academic departments, administrative functions, and student support services might become inevitable.

- Impacts on tuition fees and financial aid programs: The need to offset the tax burden could lead to increased tuition fees or reductions in financial aid, potentially affecting access for low-income students.

- Strategies for managing the tax burden: Harvard and Yale may need to explore new investment strategies, implement significant cost-cutting measures, and potentially increase fundraising efforts to mitigate the impact of the increased tax.

Potential Long-Term Consequences of the Endowment Tax Increase

The proposed endowment tax increase has significant implications extending far beyond Harvard and Yale. Its impact on higher education funding models, philanthropic giving, and the overall role of universities in society could be profound.

- Long-term impact on private university funding: The tax could discourage private giving to universities, potentially creating a long-term funding crisis for institutions reliant on philanthropic support.

- Effects on philanthropic donations to universities: Uncertainty about future taxation could decrease charitable giving to universities, making it harder for them to fund their missions.

- Impact on the global competitiveness of US higher education: A significant tax burden could reduce the financial resources available for research and development, potentially diminishing the global competitiveness of American universities.

- Potential for similar tax policies in other countries: The success or failure of the proposed tax in the US could influence similar policy discussions in other countries with large university endowments.

Conclusion

The proposed endowment tax increase represents a significant shift in the landscape of higher education funding. While proponents argue for increased equity and social responsibility, opponents express deep concerns about potential negative consequences for universities, research, and student access. The impact on institutions like Harvard and Yale will be substantial, forcing difficult budgetary decisions and potentially affecting their ability to fulfill their missions. It's crucial to stay informed about the ongoing debate surrounding this proposed legislation and its potential ramifications. Engage with policymakers and advocate for policies that support both accessible and high-quality education. Research the proposed changes in the endowment tax increase thoroughly to understand its full implications and participate in shaping the future of higher education funding.

Featured Posts

-

Obnovlenie Standartov Po Fizike I Khimii V Detskikh Sadakh Chto Izmenitsya

May 13, 2025

Obnovlenie Standartov Po Fizike I Khimii V Detskikh Sadakh Chto Izmenitsya

May 13, 2025 -

Espns Shift In Nba Draft Lottery Coverage Strategy

May 13, 2025

Espns Shift In Nba Draft Lottery Coverage Strategy

May 13, 2025 -

Dzherard Batler Luchshie Roli I Filmy Po Mneniyu Zriteley

May 13, 2025

Dzherard Batler Luchshie Roli I Filmy Po Mneniyu Zriteley

May 13, 2025 -

Bar Roma In Toronto Blog Tos Honest Assessment

May 13, 2025

Bar Roma In Toronto Blog Tos Honest Assessment

May 13, 2025 -

Nba Draft Lottery Odds Will Cooper Flagg Influence The Toronto Raptors Pick

May 13, 2025

Nba Draft Lottery Odds Will Cooper Flagg Influence The Toronto Raptors Pick

May 13, 2025