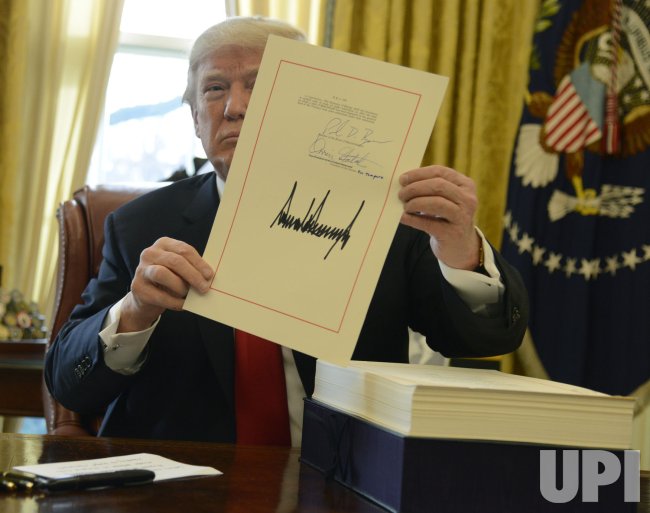

House GOP Trump Tax Cut Bill: What You Need To Know

Table of Contents

Key Provisions of the House GOP Trump Tax Cut Bill

The House GOP Trump Tax Cut Bill, if enacted, would significantly alter the US tax code. Let's examine its core components:

Individual Income Tax Changes

The bill proposed sweeping changes to individual income taxes, impacting various income brackets and family structures. Specific numbers varied depending on the version of the bill, but key proposed changes included:

- Increased Standard Deduction: The standard deduction would likely be significantly increased for both single filers and married couples, potentially simplifying tax preparation for many.

- Changes to the Child Tax Credit: The bill aimed to modify the child tax credit, potentially increasing the credit amount or altering eligibility requirements. This would directly impact families with children.

- Modified Tax Brackets: The proposed legislation suggested adjustments to existing tax brackets, potentially lowering rates for certain income levels. The exact changes were subject to debate and revisions.

The impact on different income groups was a point of contention. While some argued that lower- and middle-income families would benefit from the increased standard deduction and child tax credit, others countered that the primary beneficiaries would be high-income earners. The long-term implications for the national debt were also a major area of concern.

Corporate Tax Rate Reductions

A cornerstone of the House GOP Trump Tax Cut Bill was a substantial reduction in the corporate tax rate. The proposal aimed to decrease the rate from the existing 21% to a lower percentage (the exact target varied across different bill iterations).

- Stimulating Business Investment: Proponents argued this cut would stimulate business investment, leading to increased job creation and economic growth. They cited historical data suggesting a correlation between lower corporate tax rates and increased investment. (Sources would be cited here if available).

- Economic Growth Projections: Economic forecasts (again, sources would be cited here) varied greatly, with some predicting significant GDP growth and others expressing skepticism.

- Income Inequality Concerns: Critics argued that such a dramatic corporate tax cut would disproportionately benefit large corporations and wealthy shareholders, exacerbating income inequality.

Changes to Pass-Through Entities

The bill also included provisions impacting the taxation of pass-through entities – sole proprietorships, partnerships, and S corporations. These entities pass their income directly to their owners, who report it on their individual income tax returns. Proposed changes included:

- Modified Deductions: Specific deductions or tax rates related to pass-through income were proposed for modification.

- Small Business Impact: The impact on small business owners varied widely depending on their specific business structure and income level. Some might have seen significant tax savings, while others might have experienced little or no change.

Elimination or Modification of Tax Deductions and Credits

A significant aspect of the House GOP Trump Tax Cut Bill was the proposed elimination or modification of several popular tax deductions and credits. These changes were partly aimed at simplifying the tax code and generating revenue to offset the cost of other tax cuts. Key examples included:

- State and Local Tax (SALT) Deduction: The bill considered limiting or eliminating the deduction for state and local taxes, potentially impacting taxpayers in high-tax states.

- Medical Expense Deduction: Changes to the medical expense deduction were also considered, potentially affecting individuals with high medical expenses.

- Rationale and Impact: The rationale behind these changes was often presented as a means to simplify the tax code and control the national debt, although the impact on various taxpayers was substantial and varied depending on their circumstances.

Potential Economic Impacts of the House GOP Trump Tax Cut Bill

The potential economic consequences of the House GOP Trump Tax Cut Bill were intensely debated.

Impact on Economic Growth

Proponents argued that the tax cuts would boost economic growth through increased investment and consumer spending. However, critics questioned the magnitude of this effect and pointed to potential negative consequences.

- Short-Term vs. Long-Term Growth: Forecasts for short-term growth were generally more optimistic than those for long-term growth.

- Multiplier Effect: The extent of the "multiplier effect" – the idea that tax cuts lead to more than a one-to-one increase in economic activity – was also highly contested.

Impact on Income Inequality

The bill’s potential impact on income inequality was a central point of criticism. Critics argued that the tax cuts would disproportionately benefit high-income earners and corporations, thus widening the gap between the rich and the poor.

- Distributional Effects: Studies on the distributional effects of the tax cuts yielded varying results, depending on the methodology used and the assumptions made.

Impact on the National Debt

The long-term impact on the national debt was a major concern. The tax cuts, coupled with other government spending, were projected to significantly increase the national debt over time.

- Debt Projections: Various analyses offered different projections of the national debt's trajectory under this proposed legislation.

Criticisms and Arguments Against the House GOP Trump Tax Cut Bill

The House GOP Trump Tax Cut Bill faced considerable criticism, primarily focusing on:

- Lack of Revenue Offsets: Critics argued that the proposed tax cuts lacked sufficient revenue offsets, meaning they would significantly increase the national debt without corresponding spending cuts.

- Increased National Debt: The increase in the national debt was projected to have various long-term negative consequences, including higher interest rates and reduced government spending on other programs.

- Benefits Disproportionately Favoring the Wealthy: The critics argued the benefits of the tax cuts would disproportionately favor the wealthy, exacerbating income inequality.

Conclusion

The House GOP Trump Tax Cut Bill was a complex and highly debated piece of legislation with far-reaching potential consequences. Understanding its provisions—changes to individual and corporate tax rates, deductions, and credits—is crucial for individuals and businesses. While supporters argued for economic stimulus and growth, critics raised serious concerns about its impact on income inequality and the national debt. To stay fully informed on the implications of similar future tax legislation and related tax reform proposals, continue monitoring reputable sources for analysis and updates on GOP tax plans and other Trump tax plan developments. Further independent research is strongly recommended for a comprehensive understanding of this significant piece of proposed legislation.

Featured Posts

-

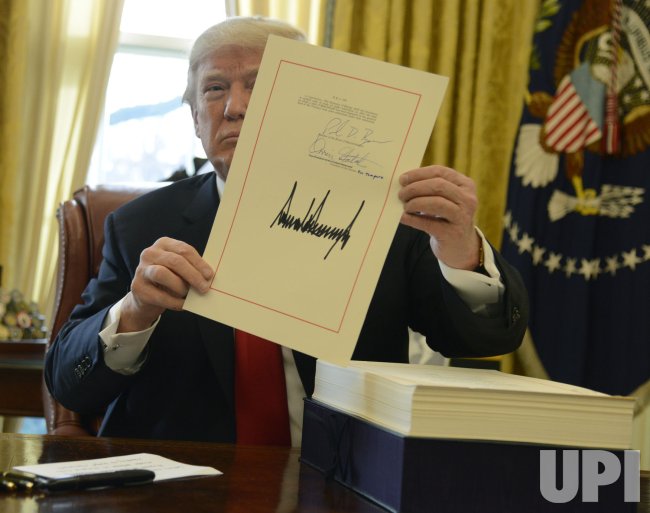

Is Byds 5 Minute Ev Fast Charging Technology The Future

May 13, 2025

Is Byds 5 Minute Ev Fast Charging Technology The Future

May 13, 2025 -

Resident Evil Afterlife Review Analyzing The Action And Story

May 13, 2025

Resident Evil Afterlife Review Analyzing The Action And Story

May 13, 2025 -

International Pressure Mounts Over Edan Alexanders Kidnapping

May 13, 2025

International Pressure Mounts Over Edan Alexanders Kidnapping

May 13, 2025 -

Blow Your Mind Incredible Feats Of Engineering And Design

May 13, 2025

Blow Your Mind Incredible Feats Of Engineering And Design

May 13, 2025 -

Sabalenka And Gauffs Smooth Sailing In Rome No Upsets For Top Seeds

May 13, 2025

Sabalenka And Gauffs Smooth Sailing In Rome No Upsets For Top Seeds

May 13, 2025