House Approves Trump Tax Bill After Late-Night Negotiations

Table of Contents

Key Provisions of the Trump Tax Bill

The Trump Tax Bill encompasses a wide range of tax cuts and changes aimed at stimulating economic growth. Let's examine some of the most significant provisions.

Individual Tax Cuts

The bill significantly alters the individual income tax structure, aiming to provide tax relief for many Americans. Key changes include:

- Standard Deduction Increase: A substantial increase in the standard deduction, simplifying tax filing for many and lowering the tax burden for lower- and middle-income earners. This change reduces the number of individuals who itemize deductions.

- Tax Bracket Adjustments: Modifications to the existing income tax brackets, resulting in lower tax rates for several income levels. While exact percentages vary, many taxpayers will see a noticeable decrease in their tax liability.

- Child Tax Credit Expansion: An increase in the child tax credit, providing greater financial relief to families with children. This expansion aims to reduce the financial burden on families. For example, the credit might increase from $1000 to $2000 per child, impacting millions of households.

These changes are projected to benefit millions of American taxpayers, though the extent of the benefits will vary significantly depending on income level and family structure. Analysis suggests a disproportionate benefit for higher-income earners, a point of contention among critics.

Corporate Tax Cuts

A centerpiece of the Trump Tax Bill is the dramatic reduction in the corporate tax rate. This substantial cut aims to boost business investment and create jobs.

- Corporate Tax Rate Reduction: The bill lowers the corporate tax rate from 35% to 21%, a significant reduction intended to enhance corporate competitiveness and encourage domestic investment.

- Impact on Corporate Profits and Investment: Proponents argue this will lead to increased profits, higher stock prices, and a surge in capital investment, ultimately translating into job creation and economic growth.

- Potential Consequences: Critics, however, express concerns about the potential for increased income inequality, reduced government revenue, and the possibility that corporations might use the tax savings for stock buybacks rather than investment. The long-term effects on the national debt also remain a subject of ongoing debate.

The Late-Night Negotiations and Political Wrangling

The passage of the Trump Tax Bill was far from smooth sailing. Intense late-night negotiations and significant political maneuvering were essential to securing enough votes for its approval.

Key Players and Their Roles

Several key figures played crucial roles in the passage of the bill, navigating complex political landscapes and negotiating compromises.

- House Speaker: Played a critical role in managing the legislative process and ensuring sufficient support for the bill. Their leadership skills and ability to build consensus proved vital.

- Key Committee Chairs: Members leading relevant House committees played a central role in shaping the bill's final form, negotiating amendments, and securing support from key factions within their respective parties.

- Swing Voters: Identifying and persuading undecided members of Congress were critical. Negotiations often involved substantial compromises to attract support from swing voters.

The compromises reached involved concessions on various aspects of the bill, reflecting the diverse interests and priorities of different factions within Congress.

The Voting Process and Final Outcome

The voting process itself was closely watched. The final vote was a significant event, with every vote counted.

- Vote Counts: The final vote tally reflected the culmination of weeks of intense lobbying and negotiation. Close margins in some cases demonstrated the intense political battle surrounding this legislation.

- Procedural Maneuvers: Various procedural tactics were employed to streamline the process and expedite passage. These maneuvers were often a source of political tension.

- Notable Abstentions or Objections: Any abstentions or vocal objections from key members were closely scrutinized for their potential impact on the bill's overall success. These moments illustrated the deep divisions surrounding the legislation.

Potential Economic and Social Impacts of the Trump Tax Bill

The Trump Tax Bill's economic and social ramifications are likely to be substantial and far-reaching, with both proponents and critics offering divergent predictions.

Economic Projections

Experts offer varying predictions regarding the bill's economic impact.

- GDP Growth Projections: Some economists forecast significant increases in GDP growth, driven by increased business investment and consumer spending. Others remain skeptical, citing concerns about the potential for increased inflation and national debt.

- Inflationary Pressures: The potential for increased inflation due to increased consumer demand and corporate profits is a key concern.

- National Debt: The projected impact on the national debt is a significant point of contention, with some predicting a substantial increase in the deficit while others claim the growth will be offset by economic expansion.

These diverse projections highlight the uncertainty surrounding the bill's long-term economic impact, necessitating ongoing monitoring and analysis.

Social Implications

The bill's social consequences are equally complex and contentious.

- Income Inequality: Concerns exist that the tax cuts will disproportionately benefit the wealthy, potentially exacerbating existing income inequality. This point is frequently raised by critics of the bill.

- Impact on Specific Demographics: The impact on various demographic groups, such as low-income families, the middle class, and the elderly, are subjects of considerable debate. Further analysis is needed to determine the long-term effects.

- Social Programs: The potential impact on social safety net programs, funding for education, and other social services is a key area of concern for many.

The long-term social consequences of this legislation remain uncertain and require close observation and ongoing evaluation.

Conclusion

The House's approval of the Trump Tax Bill marks a pivotal moment in American tax policy. The bill's core provisions, including significant individual and corporate tax cuts, were achieved through intense late-night negotiations and significant political maneuvering. The potential economic and social impacts remain a subject of intense debate, with experts offering widely differing predictions regarding GDP growth, inflation, income inequality, and the national debt. Understanding the nuances of this landmark legislation and its potential effects on your personal finances and the broader economy is crucial. Stay informed on the ongoing developments regarding the Trump Tax Bill as it moves through the legislative process. Learn more about the specifics of the tax changes and how they might affect you. Understand the implications of this landmark legislation and its potential impact on your finances and the nation's economy. Follow our updates for further analysis and insights on the Trump Tax Bill and related tax reform discussions.

Featured Posts

-

Strengthening Ties Bangladesh And Europes Shared Future

May 24, 2025

Strengthening Ties Bangladesh And Europes Shared Future

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffett Steps Down

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffett Steps Down

May 24, 2025 -

Annual General Meeting Of Shareholders 2025 Philipss Latest Announcements And Plans

May 24, 2025

Annual General Meeting Of Shareholders 2025 Philipss Latest Announcements And Plans

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025 -

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025

Latest Posts

-

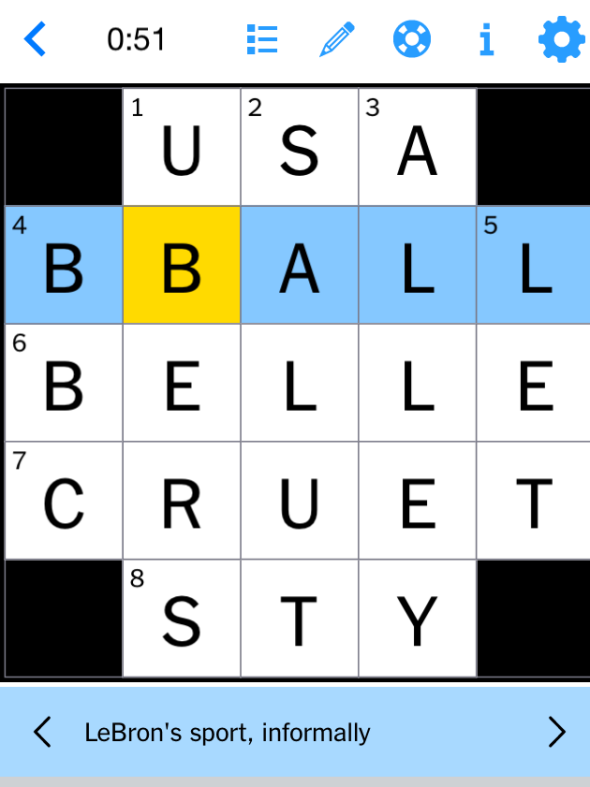

Complete Nyt Mini Crossword Answers For March 13 Hints And Strategies

May 24, 2025

Complete Nyt Mini Crossword Answers For March 13 Hints And Strategies

May 24, 2025 -

Actor Jonathan Groff Shares His Experience With Asexuality

May 24, 2025

Actor Jonathan Groff Shares His Experience With Asexuality

May 24, 2025 -

A Critical Look At Just In Time Jonathan Groff And The Music Of Bobby Darin

May 24, 2025

A Critical Look At Just In Time Jonathan Groff And The Music Of Bobby Darin

May 24, 2025 -

Jonathan Groffs Honest Conversation About Asexual Identity

May 24, 2025

Jonathan Groffs Honest Conversation About Asexual Identity

May 24, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025