Hong Kong's Interest Rate Decision: Implications For HKD/USD And The Economy

Table of Contents

Hong Kong's interest rate decisions are pivotal events shaping the HKD/USD exchange rate and the overall health of the Hong Kong economy. These decisions, intrinsically linked to US monetary policy via the currency board system, wield significant influence over borrowing costs, investment patterns, and ultimately, economic growth. Understanding the implications of these decisions is paramount for businesses, investors, and anyone invested in Hong Kong's financial landscape. This article will dissect a recent Hong Kong's interest rate decision, analyzing its repercussions on the HKD/USD exchange rate and the broader economic context.

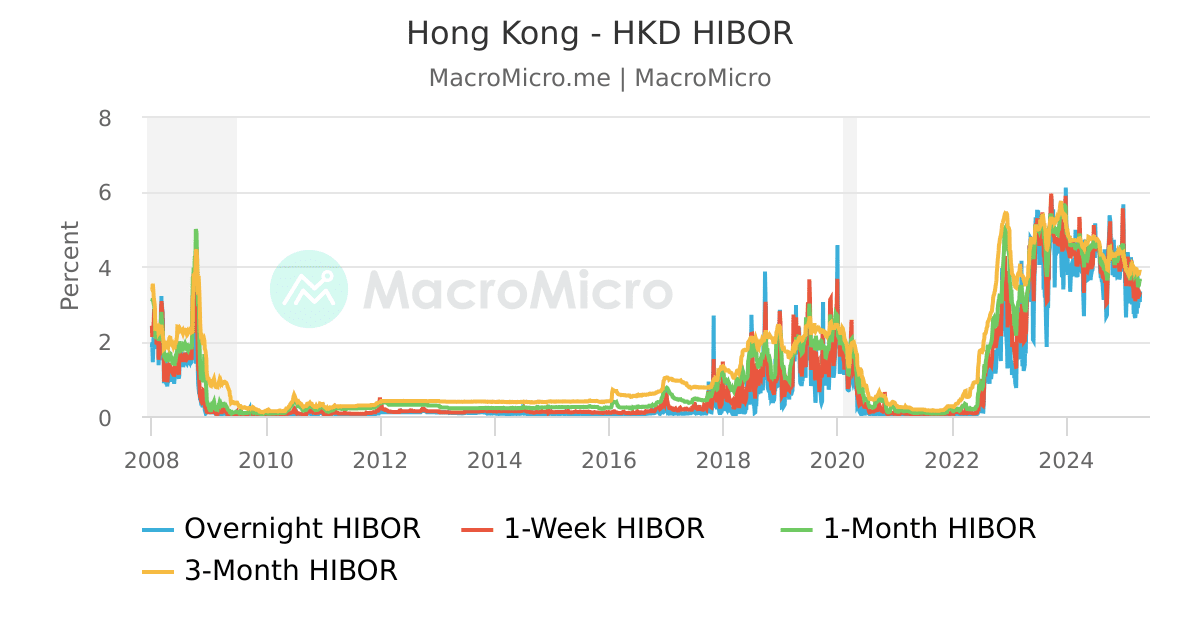

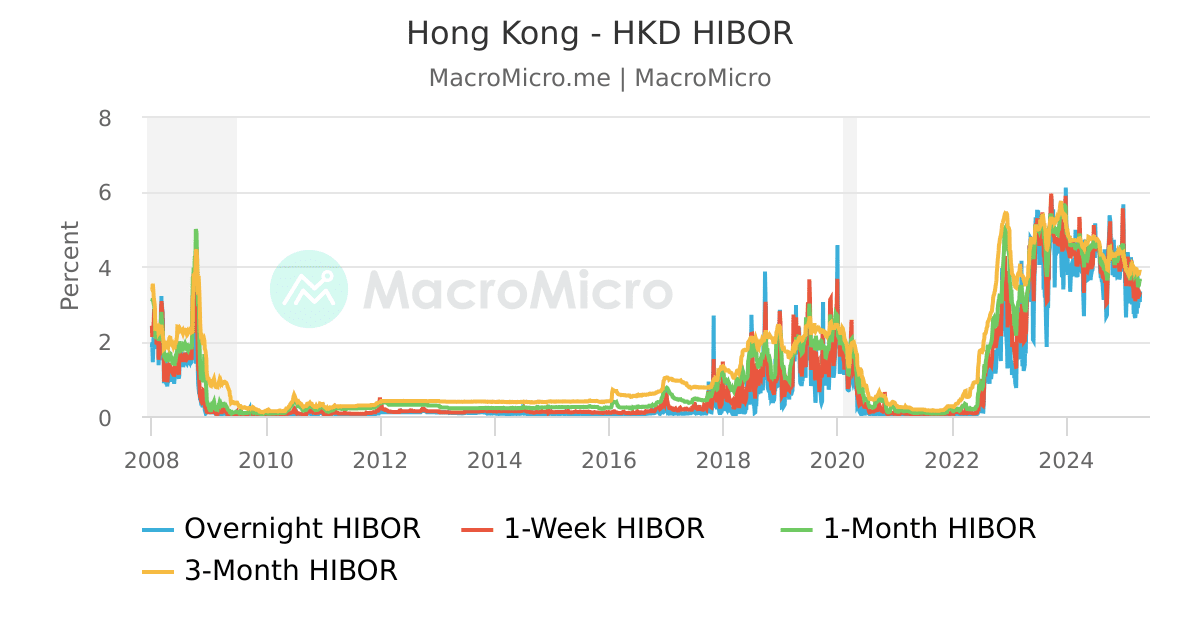

HKD/USD Exchange Rate and the Currency Board System

Hong Kong's monetary policy operates uniquely due to its linked exchange rate system. The Hong Kong Monetary Authority (HKMA) diligently maintains the Hong Kong dollar (HKD) within a narrow band against the US dollar (USD). This peg profoundly influences how interest rate changes manifest.

- The Mechanism: When the HKD weakens against the USD, the HKMA intervenes by buying HKD and selling USD, thereby increasing the money supply. Conversely, if the HKD strengthens, the HKMA implements the opposite strategy. This intervention directly impacts interest rates, influencing the HKD/USD exchange rate.

- Interest Rate Alignment: The HKMA generally mirrors the US Federal Reserve's interest rate decisions. This synchronicity ensures the HKD/USD peg remains stable. However, deviations can occur in response to specific local economic conditions.

- Impact of the Recent Decision: The recent interest rate decision on November 3, 2023, resulted in a slight increase in the base rate, mirroring the Fed's move. This led to a marginal strengthening of the HKD against the USD, largely due to the continued alignment with US monetary policy and relatively stable local economic conditions.

- Market Volatility: Fluctuations in the HKD/USD rate can sway investor sentiment and trade flows. A stable exchange rate fosters economic stability, while significant volatility can negatively impact business confidence and investment decisions. Understanding HKD/USD exchange rate dynamics is key to navigating Hong Kong's financial markets.

Impact on Hong Kong's Economy

Interest rate adjustments in Hong Kong directly influence various economic sectors, impacting borrowing costs, investment decisions, and consumer spending patterns.

- Impact on Businesses: Higher interest rates increase borrowing costs for businesses, potentially hindering investment and expansion strategies. This can lead to slower economic growth in the short term. Conversely, lower rates stimulate investment and borrowing, boosting economic activity.

- Impact on Consumers: Changes in interest rates affect mortgage rates and consumer loans. Higher rates can dampen consumer spending and investment, while lower rates can boost consumer confidence and spending power. This impacts retail sales and overall economic demand.

- Impact on Property Market: The Hong Kong property market exhibits high sensitivity to interest rate changes. Higher rates typically lead to a cooling effect in the property market, potentially lowering prices and reducing transaction volumes. Lower rates often have the opposite effect.

- Inflationary Pressures: Interest rate adjustments play a crucial role in managing inflation. Higher rates are typically implemented to curb inflation, while lower rates can stimulate economic activity but may also contribute to inflationary pressures. The HKMA carefully balances these competing factors when setting interest rates.

Analyzing the Future Trajectory of HKD/USD and the Economy

Forecasting the future trajectory of the HKD/USD exchange rate and the Hong Kong economy following an interest rate decision necessitates considering various factors.

- US Monetary Policy: The US Federal Reserve's actions remain a primary determinant of Hong Kong's monetary policy and the HKD/USD rate. Future US interest rate adjustments will directly influence Hong Kong's monetary policy decisions.

- Global Economic Conditions: Global economic uncertainty significantly impacts the HKD/USD exchange rate. Geopolitical events and global economic slowdowns can affect investment flows into and out of Hong Kong, impacting the economy.

- Local Economic Factors: Domestic economic indicators, such as inflation, unemployment, and GDP growth, also play a crucial role. The HKMA might deviate from the US Federal Reserve’s decisions based on these local economic conditions.

- Market Speculation: Speculation in the foreign exchange market can influence short-term fluctuations in the HKD/USD exchange rate. Understanding market sentiment is vital for assessing potential risks and opportunities.

Conclusion: Understanding Hong Kong's Interest Rate Decision's Impact

Hong Kong's interest rate decisions have far-reaching consequences for the HKD/USD exchange rate and the overall economic performance. The currency board system inextricably links Hong Kong’s monetary policy to that of the US, yet local economic conditions significantly influence the decision-making process. Analyzing the impact on businesses, consumers, and the property market, along with considering global and local economic factors, is crucial for comprehending the broader economic landscape. Staying abreast of future Hong Kong's interest rate decisions and their potential ramifications is crucial for making informed financial and investment decisions. Regularly monitor news and analysis concerning Hong Kong's interest rate decisions to effectively navigate the intricacies of Hong Kong's dynamic financial environment.

Featured Posts

-

Anchor Brewing Company Shuttering Impact On The Craft Beer Industry

May 08, 2025

Anchor Brewing Company Shuttering Impact On The Craft Beer Industry

May 08, 2025 -

Papal Election Cardinals Review Candidate Dossiers

May 08, 2025

Papal Election Cardinals Review Candidate Dossiers

May 08, 2025 -

Trade War And Crypto Identifying A Potential Winner

May 08, 2025

Trade War And Crypto Identifying A Potential Winner

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Next Pope Election The Conclave Process Explained

May 08, 2025

Next Pope Election The Conclave Process Explained

May 08, 2025