Hong Kong Uses US Dollars To Maintain Currency Peg Against Pressure

Table of Contents

The Mechanics of Hong Kong's Currency Peg

Hong Kong operates a linked exchange rate system, meaning its currency, the HKD, is pegged to the USD within a narrow band. This system is managed by the Hong Kong Monetary Authority (HKMA), the city's central bank. The HKMA's primary objective is to maintain the HKD's exchange rate within 7.75 to 7.85 HKD per USD. This tightly controlled band ensures relative stability and predictability for businesses operating in Hong Kong.

- The Band: The HKD is allowed to fluctuate within a very narrow band against the USD (7.75 - 7.85 HKD/USD). Any movement outside this range triggers intervention by the HKMA.

- Intervention Mechanisms: The HKMA intervenes in the foreign exchange market by buying or selling US dollars to maintain the peg. If the HKD weakens toward the upper limit of the band, the HKMA buys USD, increasing demand and supporting the HKD. Conversely, if the HKD strengthens towards the lower limit, the HKMA sells USD.

- US Dollar Reserves: Maintaining sufficient US dollar reserves is crucial for the HKMA's ability to effectively intervene and defend the peg during periods of market pressure. These reserves act as a buffer against significant capital flows.

Recent Pressures on the Hong Kong Dollar Peg

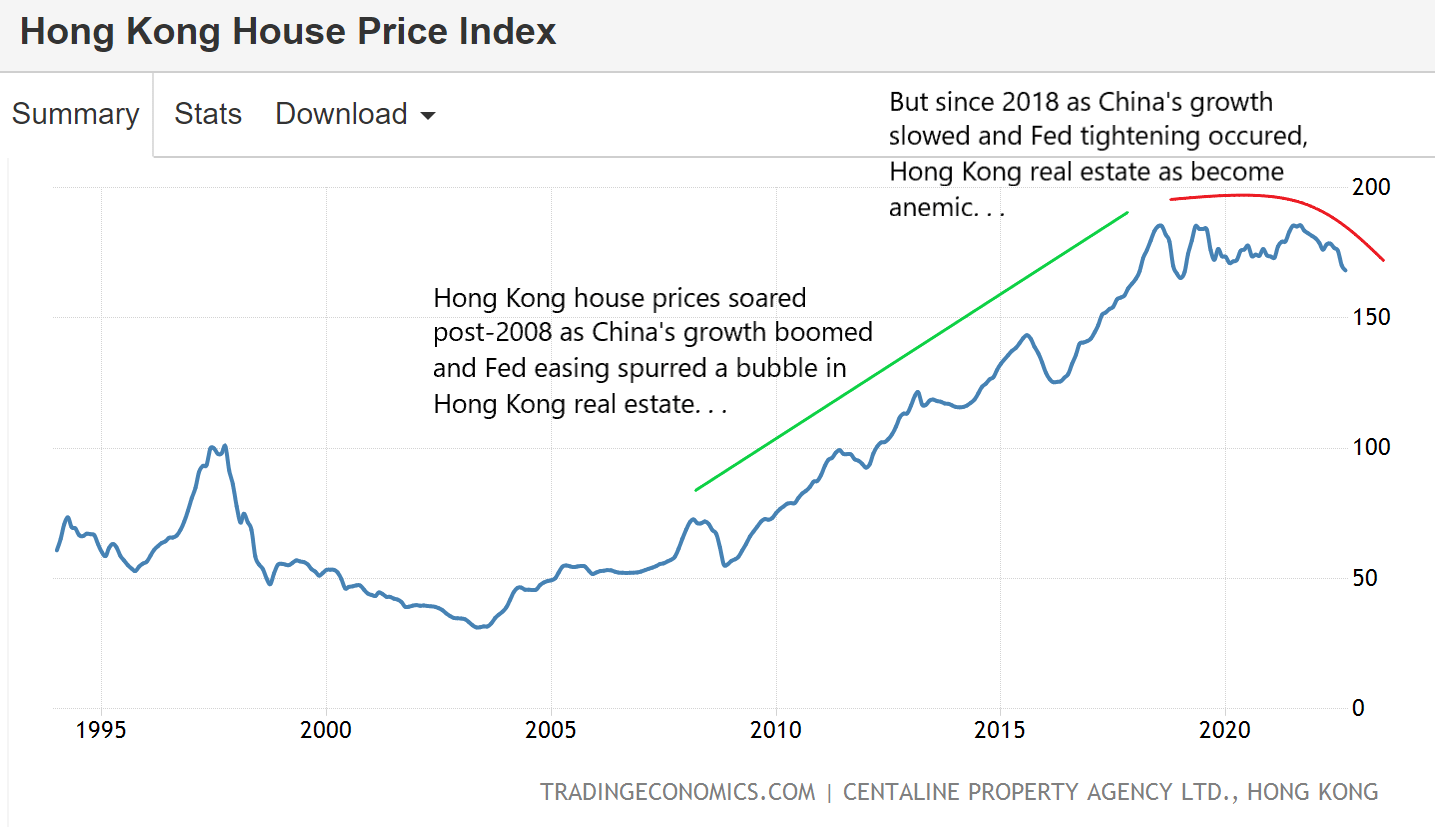

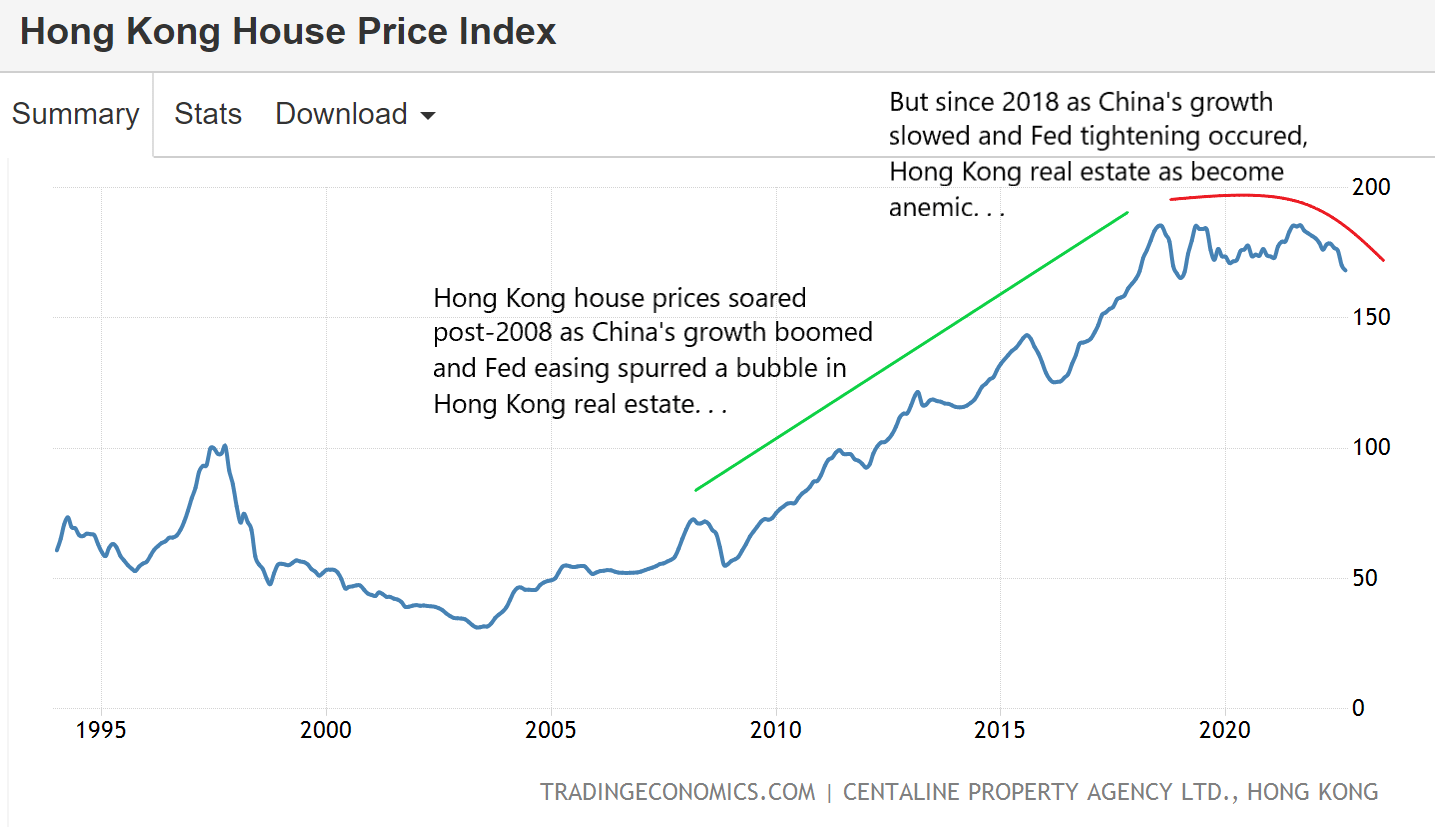

Recent years have seen several factors putting pressure on Hong Kong's currency peg. These pressures stem from both internal and external sources. Interest rate differentials between the US and Hong Kong, influenced by global monetary policy shifts, are a key factor. Furthermore, geopolitical events and shifts in global capital flows significantly impact the USD/HKD exchange rate.

- Interest Rate Differentials: Divergences in US and Hong Kong interest rates can create incentives for capital movements, potentially destabilizing the peg. Higher US interest rates can attract capital outflow from Hong Kong.

- Capital Flows: Significant capital outflows or inflows, often driven by global economic uncertainty or specific events in Hong Kong, can put pressure on the HKD.

- Geopolitical Events: Global geopolitical events, such as trade wars or political instability, can significantly impact market sentiment and put pressure on the currency peg. For example, the US-China trade tensions have had a noticeable effect on Hong Kong's economy and its currency.

The HKMA's Response to Pressure on the Currency Peg

The HKMA has a proven track record of effectively managing the currency peg. Its interventions aim to maintain stability within the designated band and to ensure confidence in the HKD. The HKMA uses a range of tools, including interest rate adjustments and open market operations, to counteract pressure on the peg.

- Interest Rate Adjustments: The HKMA adjusts its interest rate to align with US interest rate movements, helping to mitigate the impact of interest rate differentials on capital flows.

- Open Market Operations: The HKMA buys or sells government bonds to manage liquidity in the Hong Kong dollar market, supporting the currency peg.

- Market Communication: Clear communication with the market regarding the HKMA's policy intentions is crucial to maintain confidence and stability.

The Future of Hong Kong's US Dollar Peg

The long-term sustainability of Hong Kong's US dollar peg remains a subject of ongoing debate. While the peg has served Hong Kong well for many years, several potential future threats exist.

- Global Economic Uncertainty: Global economic downturns or unexpected shocks can significantly impact the peg.

- Geopolitical Risks: Escalating geopolitical tensions, particularly those involving the US and China, could put significant pressure on the HKD.

- Alternative Exchange Rate Regimes: While the benefits of the current system are clear, it's important to consider potential alternative regimes for Hong Kong in case of major shifts in the global economic landscape. Analyzing the pros and cons of a managed float, for instance, would be a crucial part of future economic planning.

Securing Hong Kong's Economic Future Through its US Dollar Peg

In conclusion, Hong Kong's currency peg with the US dollar has been instrumental in its economic success. However, the peg faces ongoing pressures stemming from global economic and geopolitical uncertainties. The HKMA's interventions have generally been effective in maintaining stability, but vigilance and adaptability remain crucial. The future sustainability of the peg depends on careful management by the HKMA, proactive responses to emerging challenges, and ongoing monitoring of global economic developments. To stay informed about this crucial aspect of Hong Kong's economy, we encourage you to continue researching topics such as "Hong Kong currency peg," "HKD exchange rate," and "US dollar reserves" to understand the ongoing complexities of this vital system.

Featured Posts

-

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 05, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 05, 2025 -

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 05, 2025

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 05, 2025 -

Ruling Partys Future At Stake Analyzing The Singaporean Election Results

May 05, 2025

Ruling Partys Future At Stake Analyzing The Singaporean Election Results

May 05, 2025 -

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025 -

The Cusma Negotiations A Pivotal Meeting Between Carney And Trump

May 05, 2025

The Cusma Negotiations A Pivotal Meeting Between Carney And Trump

May 05, 2025

Latest Posts

-

Oskar 2024 I Entasi Metaksy Emma Stooyn Kai Margkaret Koyalei Apokalypsi Tis Syzitisis

May 05, 2025

Oskar 2024 I Entasi Metaksy Emma Stooyn Kai Margkaret Koyalei Apokalypsi Tis Syzitisis

May 05, 2025 -

Emma Stooyn Vs Margkaret Koyalei Ti Pragmatika Synevi Sta Oskar

May 05, 2025

Emma Stooyn Vs Margkaret Koyalei Ti Pragmatika Synevi Sta Oskar

May 05, 2025 -

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Tis Lektikis Toys Antallagis

May 05, 2025

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Tis Lektikis Toys Antallagis

May 05, 2025 -

Emma Stoun Na Premiyi Minispidnitsya Yaka Pidkreslila Yiyi Figuru

May 05, 2025

Emma Stoun Na Premiyi Minispidnitsya Yaka Pidkreslila Yiyi Figuru

May 05, 2025 -

I Emma Stooyn Kai I Monadiki Tis Emfanisi Se Prosfati Ekdilosi

May 05, 2025

I Emma Stooyn Kai I Monadiki Tis Emfanisi Se Prosfati Ekdilosi

May 05, 2025