Hong Kong Monetary Authority's US Dollar Intervention: A Deep Dive

Table of Contents

The Mechanics of the Hong Kong Dollar Peg

Hong Kong operates under a currency board system, maintaining a linked exchange rate between the Hong Kong dollar (HKD) and the US dollar (USD). This means the HKD is pegged to the USD at a fixed rate of approximately HKD 7.8 to 1 USD. This linked exchange rate system, a cornerstone of Hong Kong's economic policy, ensures currency stability and fosters investor confidence.

The currency board system is underpinned by a set of strict rules:

- Full backing: The HKMA must hold sufficient US dollar reserves to cover all outstanding Hong Kong dollar banknotes and coins.

- Fixed exchange rate: The HKD/USD exchange rate remains fixed within a narrow band.

- Automatic convertibility: The HKMA is obligated to convert HKD to USD and vice-versa at the fixed rate on demand.

The HKMA utilizes several mechanisms to maintain the peg:

- Buying and selling USD: If the HKD weakens, the HKMA buys USD, increasing demand and supporting the exchange rate. Conversely, if the HKD strengthens, the HKMA sells USD.

- Adjusting interest rates: The HKMA adjusts interest rates to influence capital flows and maintain the peg. Higher interest rates attract capital inflows, supporting the HKD, and vice versa. This is crucial for the exchange rate mechanism.

The HKD is allowed to fluctuate within a very narrow band around the 7.8 HKD per USD peg. These tight bands ensure currency stability within the HKD/USD peg.

Triggers for HKMA US Dollar Intervention

Several factors trigger HKMA intervention, primarily stemming from market forces and external shocks.

- Market speculation: Speculative attacks aiming to profit from potential de-pegging can significantly impact the HKD.

- Capital flows: Large capital inflows or outflows can put pressure on the exchange rate, necessitating HKMA intervention. These flows greatly influence the currency board system.

- Economic shocks: Global economic crises or regional events can impact investor sentiment and lead to pressure on the HKD.

For example, during the Asian Financial Crisis of 1997-98, the HKMA intervened aggressively to defend the peg, successfully absorbing substantial speculative attacks and maintaining stability. The HKMA response included substantial purchases of USD and aggressive interest rate adjustments. Another period of significant HKMA intervention occurred during the 2008 global financial crisis.

The Impact of HKMA Interventions on Hong Kong's Economy

HKMA interventions have significant implications for Hong Kong's economy.

- Interest rates: Interventions directly impact interest rates, influencing borrowing costs for businesses and consumers.

- Inflation: The peg helps control inflation by linking the HKD to a relatively stable currency like the USD.

- Economic growth: Currency stability fostered by the HKMA contributes to a stable business environment, promoting economic growth and investor confidence. This stability within the linked exchange rate system is vital.

However, interventions are not without potential unintended consequences. For example, maintaining a strong HKD can impact the competitiveness of Hong Kong's exports.

Comparing HKMA Interventions with Other Central Banks

The HKMA's approach to maintaining the currency peg differs from that of many other central banks. Unlike central banks that manage floating exchange rates, the HKMA's interventions are primarily focused on defending the fixed exchange rate. The currency board system is unique, creating a different set of constraints and challenges compared to countries with floating exchange rates or other types of managed float systems. This requires a distinct monetary policy strategy.

While some countries use a managed float system, Hong Kong's rigid peg and reliance on intervention are unique. This difference highlights the unique aspects of the Hong Kong system compared to other exchange rate management strategies across central banks.

Future Outlook and Challenges for the HKMA

The Hong Kong dollar peg faces potential future challenges.

- Geopolitical risks: Geopolitical tensions and events can influence capital flows and investor sentiment, potentially impacting the HKD.

- Global economic uncertainty: Global economic slowdowns or crises could put pressure on the peg.

- Technological disruption: Developments like cryptocurrencies could potentially challenge traditional monetary policy tools.

The HKMA is actively preparing for such challenges through robust foreign reserves and refined intervention strategies. Further adjustments to the system may be considered in the future to adapt to changing global dynamics. The sustainability of the currency peg will depend on the HKMA’s adaptability and ability to anticipate and react to these emerging threats.

Conclusion: The Enduring Significance of the HKMA's US Dollar Intervention

The HKMA's role in maintaining the Hong Kong dollar peg is undeniably crucial to Hong Kong's economic stability. The complexity of the interventions and the challenges they entail should not overshadow the significant benefits of the currency peg. The HKMA's actions have consistently ensured a stable and predictable economic environment.

To further explore this vital aspect of Hong Kong's economy, delve deeper into research on Hong Kong monetary policy, analyzing HKMA interventions, examining the Hong Kong dollar's future, and researching various currency peg models. You can find valuable insights in publications by the HKMA itself and through academic research on currency peg management. The future stability of the Hong Kong dollar is a fascinating subject for continued study and analysis, so begin your research on HKMA interventions and the Hong Kong dollar today!

Featured Posts

-

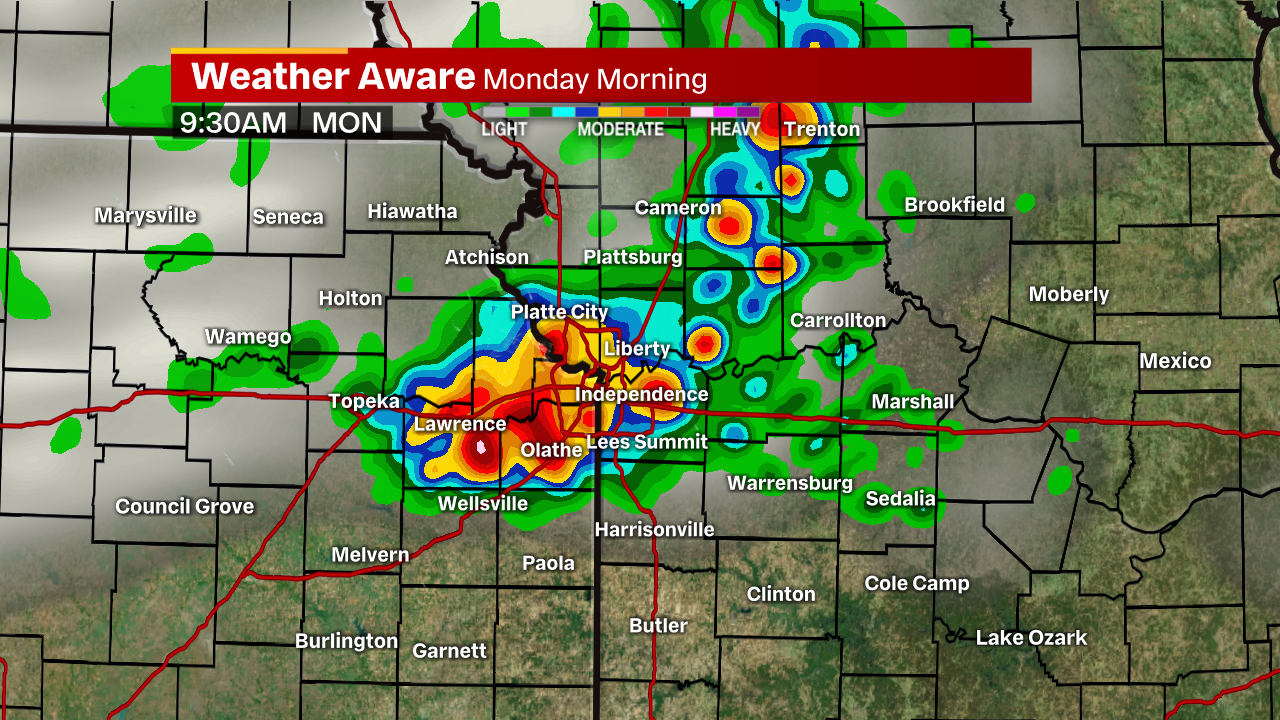

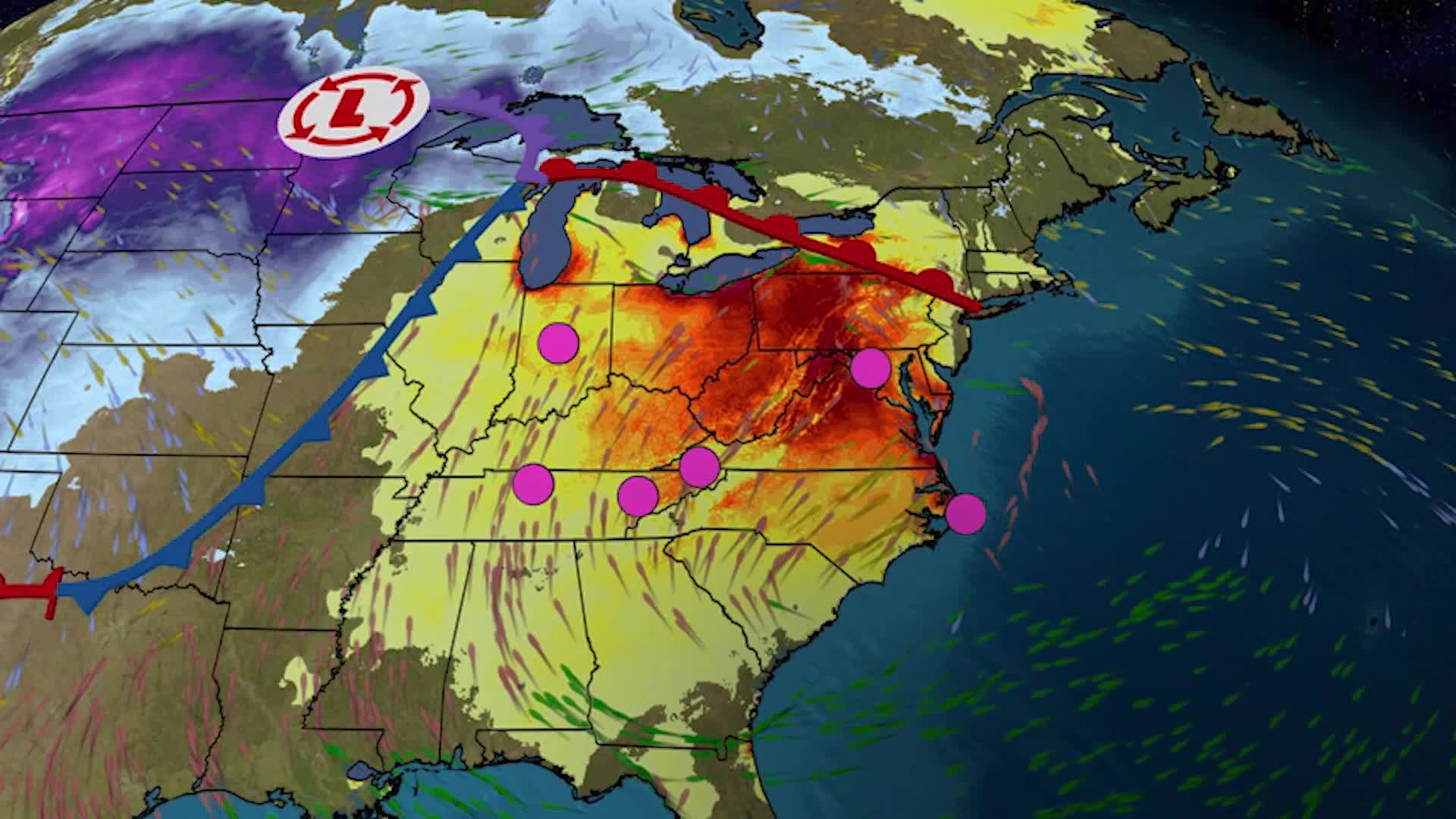

Nyc Facing Severe Weather Monday What To Expect And How To Prepare

May 05, 2025

Nyc Facing Severe Weather Monday What To Expect And How To Prepare

May 05, 2025 -

Is Marvels Thunderbolts Franchise A Viable Option

May 05, 2025

Is Marvels Thunderbolts Franchise A Viable Option

May 05, 2025 -

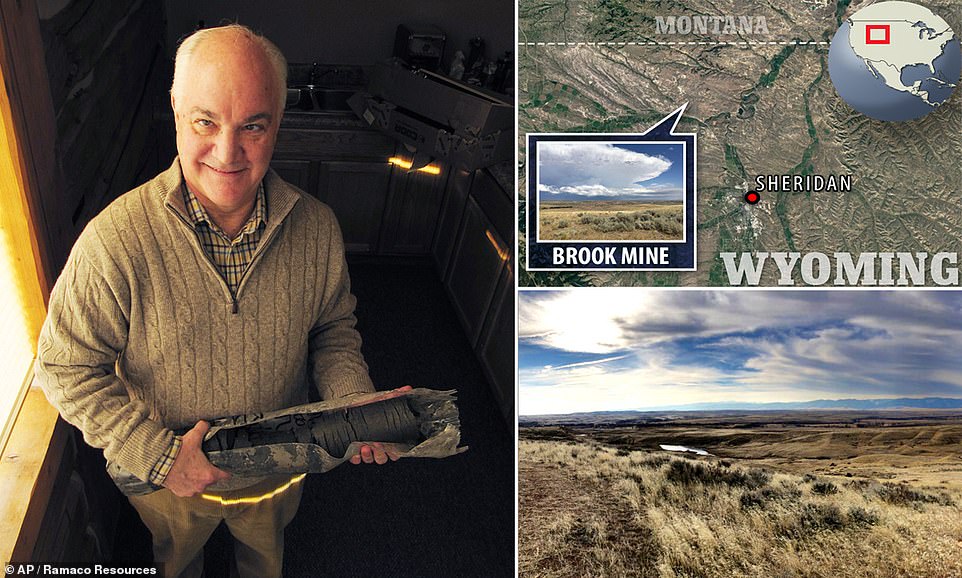

Bookstore Discovery Rare Novel Worth 45 000

May 05, 2025

Bookstore Discovery Rare Novel Worth 45 000

May 05, 2025 -

Lizzos Weight Loss Journey A Transformation That Shocked The Internet

May 05, 2025

Lizzos Weight Loss Journey A Transformation That Shocked The Internet

May 05, 2025 -

2025 Louisiana Derby Early Odds Potential Field And Kentucky Derby Picks

May 05, 2025

2025 Louisiana Derby Early Odds Potential Field And Kentucky Derby Picks

May 05, 2025

Latest Posts

-

Temperature Drop In West Bengal Weather Update And Forecast

May 05, 2025

Temperature Drop In West Bengal Weather Update And Forecast

May 05, 2025 -

Heatwave Warning 5 South Bengal Districts On High Alert

May 05, 2025

Heatwave Warning 5 South Bengal Districts On High Alert

May 05, 2025 -

West Bengal Braces For Chilly Weather Temperature Plunge Explained

May 05, 2025

West Bengal Braces For Chilly Weather Temperature Plunge Explained

May 05, 2025 -

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches

May 05, 2025

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches

May 05, 2025 -

Weather Update Sharp Temperature Drop In West Bengal

May 05, 2025

Weather Update Sharp Temperature Drop In West Bengal

May 05, 2025