Hong Kong Dollar Interest Rate Plunges Post-Intervention: HKD/USD Analysis

Table of Contents

The Hong Kong Dollar (HKD) has experienced a significant drop in interest rates following a recent intervention by the Hong Kong Monetary Authority (HKMA), sending ripples through the financial markets. This dramatic shift in the Hong Kong Dollar interest rate has profound implications for the HKD/USD exchange rate and requires careful analysis for investors and businesses alike. Understanding this dynamic is crucial for navigating the complexities of the Hong Kong financial landscape. This article will delve into the reasons behind this interest rate plunge and analyze its impact on the HKD/USD exchange rate.

<h2>The HKMA's Intervention and its Impact</h2>

The HKMA's intervention in the currency market was a direct response to pressures on the HKD peg against the USD. To maintain the linked exchange rate system, the HKMA intervened by buying US dollars, thus increasing the supply of HKD in the market. This action directly impacted the Hong Kong Dollar interest rate.

- Impact on HKD Liquidity: The increased supply of HKD led to higher liquidity in the market, putting downward pressure on interest rates.

- Short-Term and Long-Term Effects on Interest Rates: The immediate effect was a sharp drop in short-term interest rates. The long-term impact will depend on various factors, including future HKMA actions and global economic conditions.

- Changes in the Hong Kong Interbank Offered Rate (HIBOR): HIBOR, a key benchmark interest rate in Hong Kong, experienced a noticeable decline following the intervention, reflecting the change in the overall interest rate environment. This impacts borrowing costs for businesses and individuals.

<h2>Analysis of the Interest Rate Plunge</h2>

The HKD is pegged to the USD under a linked exchange rate system, meaning its value is maintained within a narrow band against the US dollar. This system influences the Hong Kong Dollar interest rate. While the HKMA intervention was a primary factor in the recent plunge, other factors contributed:

-

Global Interest Rate Trends: The US Federal Reserve's monetary policy plays a significant role. Lower US interest rates can influence capital flows and put downward pressure on HKD interest rates.

-

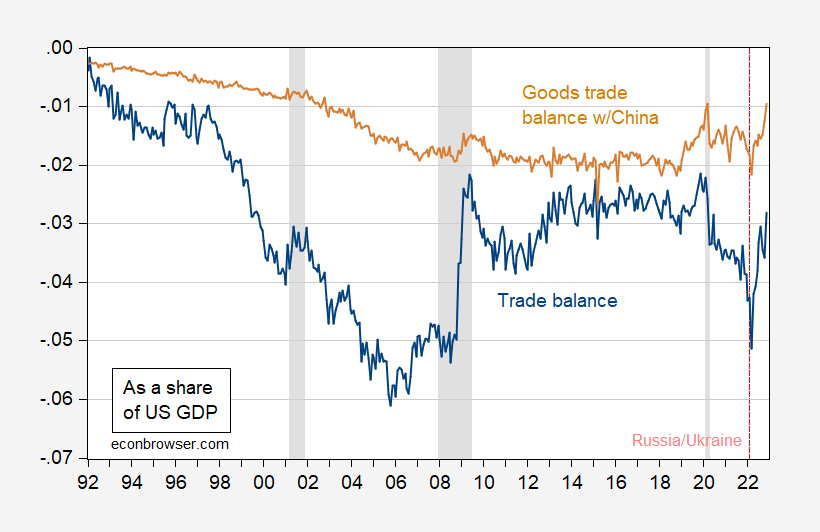

Capital Flows in and out of Hong Kong: Significant capital outflows from Hong Kong can reduce demand for the HKD, impacting interest rates. Conversely, inflows can increase demand and potentially raise rates.

-

Impact of Economic Slowdown in Hong Kong or China: Economic slowdowns in Hong Kong or mainland China can reduce demand for HKD and put downward pressure on interest rates.

-

Comparison of current interest rates with historical data: Analyzing historical data provides context for the current situation, allowing for a better understanding of the magnitude of the recent drop.

-

Analysis of the spread between HIBOR and LIBOR: Comparing HIBOR with the London Interbank Offered Rate (LIBOR) can provide insights into the relative risk and liquidity conditions in the Hong Kong interbank market.

-

Potential implications for borrowing costs in Hong Kong: The lower Hong Kong Dollar interest rate translates to reduced borrowing costs for businesses and consumers, potentially stimulating economic activity but also potentially increasing inflation.

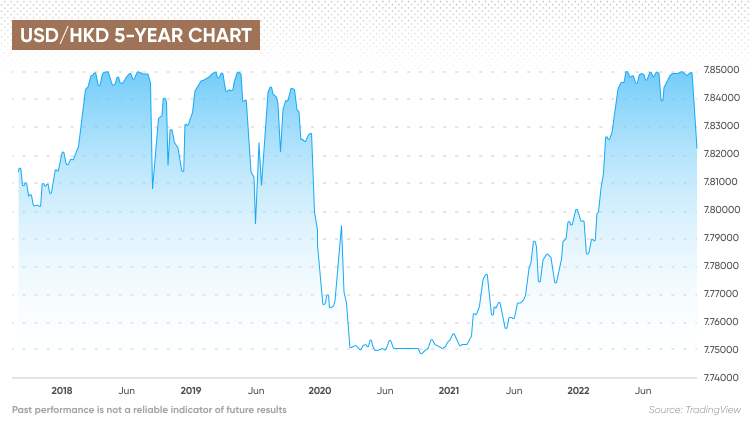

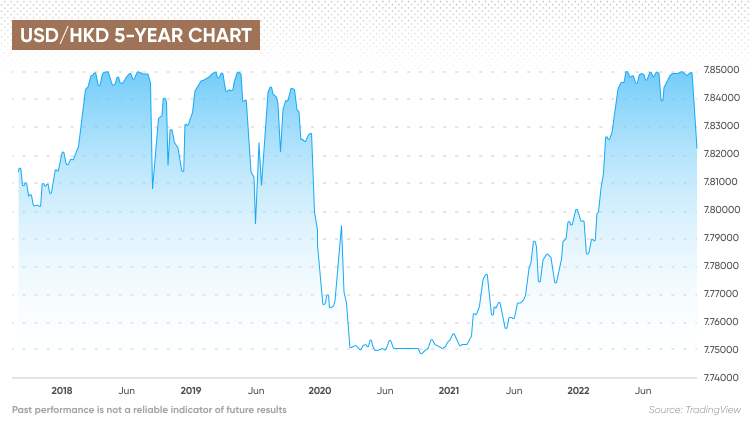

<h2>Implications for the HKD/USD Exchange Rate</h2>

The relationship between interest rates and exchange rates is inversely proportional – lower interest rates generally lead to a weaker currency. The recent plunge in the Hong Kong Dollar interest rate, therefore, has implications for the HKD/USD exchange rate.

- Potential future movements of the HKD/USD exchange rate: Given the current interest rate environment, the HKD could experience depreciation against the USD. However, the HKMA's commitment to the peg acts as a strong support.

- Potential scenarios: While depreciation is a possibility, the HKMA’s interventions usually prevent significant fluctuations. The HKD could experience limited depreciation, appreciation (if global conditions shift favorably), or remain relatively stable within the allowed band.

- Technical analysis of HKD/USD charts: Chart patterns and technical indicators can offer insights into potential short-term price movements.

- Fundamental analysis based on economic indicators: Analyzing macroeconomic data such as GDP growth, inflation, and trade balances can help predict long-term trends.

- Market sentiment and speculation about future movements: Market sentiment and speculation can significantly influence the HKD/USD exchange rate.

<h2>Opportunities and Risks for Investors</h2>

The changing Hong Kong Dollar interest rate landscape presents both opportunities and risks for various investors.

-

Implications for currency traders: Currency traders can potentially profit from HKD/USD volatility, but it’s crucial to understand the risks.

-

Implications for bond investors: Lower interest rates impact bond yields, influencing investment decisions.

-

Hedging strategies: Investors can use hedging strategies like forward contracts or options to mitigate risks associated with HKD/USD volatility.

-

Potential investment opportunities: The lower interest rate environment may open opportunities in specific sectors, but careful due diligence is essential.

-

Risks associated with short-selling HKD: Short-selling the HKD carries significant risk, particularly given the HKMA's commitment to the peg.

-

Opportunities in carry trades involving HKD: Carry trades, which involve borrowing in a low-interest-rate currency (like the current HKD) and investing in a higher-yielding currency, may offer opportunities, but these are also risky.

-

The role of derivatives in managing risk: Derivatives like options and futures can be effective tools for managing risk in the HKD/USD market.

<h2>Conclusion: Understanding the Hong Kong Dollar Interest Rate and HKD/USD Dynamics</h2>

The recent plunge in the Hong Kong Dollar interest rate, triggered by the HKMA intervention and influenced by global factors, has significant implications for the HKD/USD exchange rate. Understanding the interplay between these factors is vital for investors and businesses operating in Hong Kong. The potential for HKD depreciation exists, although the linked exchange rate system provides a degree of stability. Careful monitoring of the situation and the implementation of appropriate risk management strategies are crucial. Stay ahead of the curve by regularly checking for updates on the Hong Kong Dollar interest rate and HKD/USD analysis, and by closely following market news and conducting thorough research.

Featured Posts

-

Lahwr Myn Ahtsab Edaltwn Ky Tedad Myn Kmy 5 Edaltyn Khtm

May 08, 2025

Lahwr Myn Ahtsab Edaltwn Ky Tedad Myn Kmy 5 Edaltyn Khtm

May 08, 2025 -

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025 -

Gjranwalh Dshmny Pr Fayrng Panch Afrad Jan Bhq Mlzm Pwlys Ke Hathwn Mara Gya

May 08, 2025

Gjranwalh Dshmny Pr Fayrng Panch Afrad Jan Bhq Mlzm Pwlys Ke Hathwn Mara Gya

May 08, 2025 -

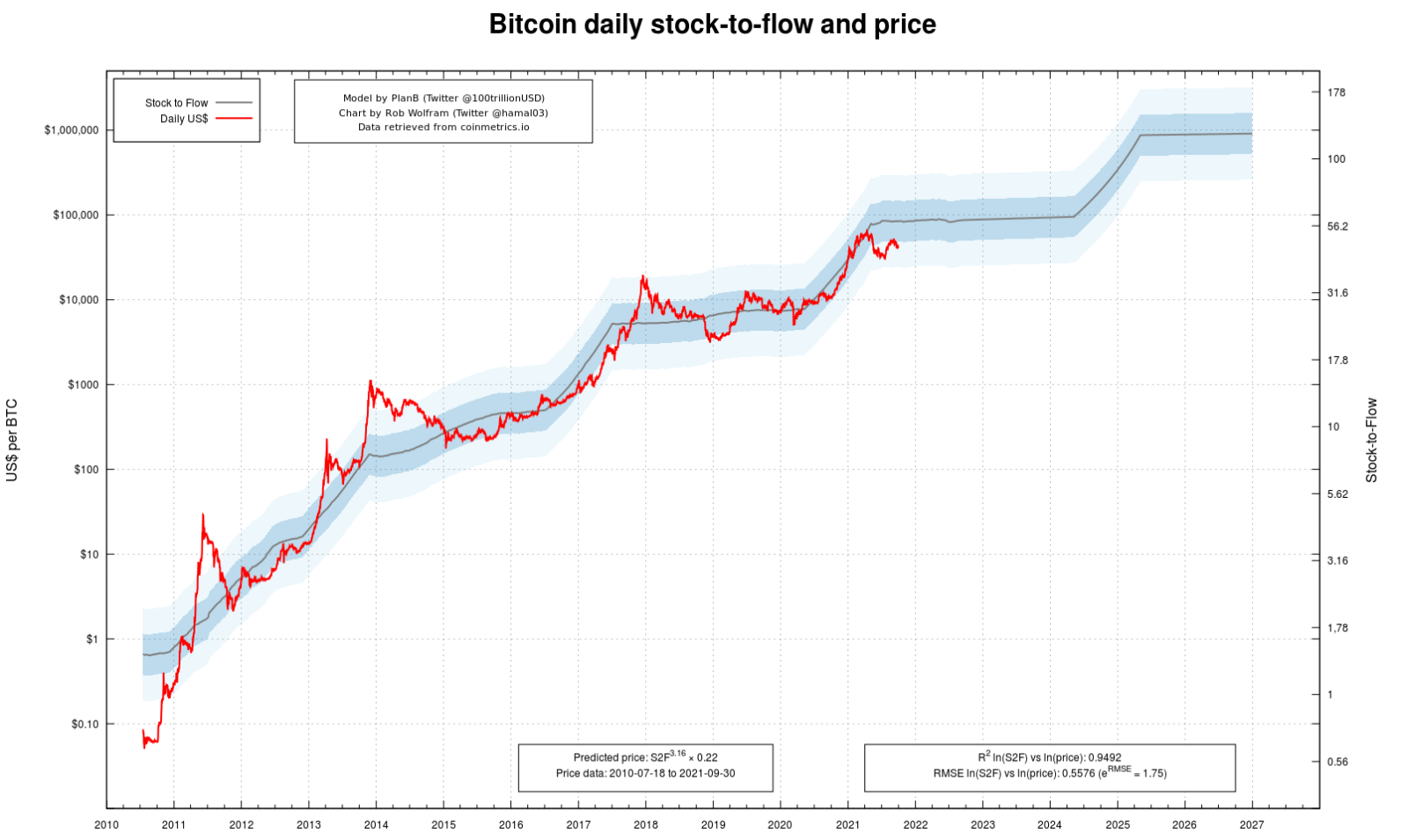

Bitcoin Price Prediction 2024 Impact Of Trumps Economic Policies On Btc

May 08, 2025

Bitcoin Price Prediction 2024 Impact Of Trumps Economic Policies On Btc

May 08, 2025 -

Thunder Vs Trail Blazers March 7th Game Details Tv Broadcast And Streaming

May 08, 2025

Thunder Vs Trail Blazers March 7th Game Details Tv Broadcast And Streaming

May 08, 2025