Honeywell To Acquire Johnson Matthey's Catalyst Business For $2.4 Billion: Deal Details And Implications

Table of Contents

Deal Details and Financial Aspects

Acquisition Price and Structure

Honeywell's acquisition of Johnson Matthey's catalyst technologies is valued at a staggering $2.4 billion. The transaction is expected to be primarily financed through a combination of cash and debt, leveraging Honeywell's strong financial position to facilitate a smooth acquisition process. The precise breakdown of the payment structure remains undisclosed, pending the finalization of the agreement. This significant investment underscores Honeywell's commitment to expanding its presence in the high-growth catalyst market.

Regulatory Approvals and Timeline

The success of the Honeywell Johnson Matthey acquisition hinges on securing the necessary regulatory approvals from various international bodies. Antitrust reviews and other compliance checks are anticipated, potentially leading to delays in the closing process. While an exact timeline remains uncertain, both companies aim for the transaction to conclude within the next 12-18 months, subject to the fulfillment of all closing conditions.

- Specific breakdown of the acquisition cost: While the total price is $2.4 billion, the exact allocation between cash and debt remains confidential.

- Expected timeline for regulatory approvals: Completion is targeted within 12-18 months, contingent upon successful regulatory reviews.

- Potential impact on Honeywell's stock price: Market analysts predict a positive, albeit potentially modest, impact on Honeywell's stock price, reflecting the strategic value of the acquisition.

- Financing methods used by Honeywell: A blend of cash reserves and debt financing is likely, utilizing Honeywell's robust financial standing.

Johnson Matthey's Catalyst Business Overview

Key Products and Technologies

Johnson Matthey's catalyst business encompasses a wide range of technologies crucial for various applications. This includes automotive catalysts— vital for emissions reduction in vehicles—and catalysts used in chemical processing, refining, and other industrial sectors. Johnson Matthey holds a strong market position, particularly in the automotive and chemical catalysis sectors, renowned for its innovative and high-performance catalyst formulations.

Market Size and Growth Potential

The global catalyst market is experiencing robust growth, driven by increasing environmental regulations and the rising demand for efficient chemical processes. Industry forecasts point to sustained expansion in the coming years, making Johnson Matthey's catalyst portfolio a highly attractive asset for Honeywell. This acquisition positions Honeywell to capitalize on this lucrative market, experiencing significant growth potential.

- Specific examples of catalyst technologies involved: Automotive catalysts (three-way catalysts, diesel oxidation catalysts), industrial catalysts (e.g., for ammonia production, petroleum refining).

- Market share held by Johnson Matthey in key sectors: Johnson Matthey's market share varies across sectors but is notably strong in automotive emissions control and certain niche chemical applications.

- Growth projections for the catalyst market: Industry analysts predict consistent growth, driven by stricter emission standards and the expanding chemical industry.

- Key customers of Johnson Matthey's catalyst business: Major automotive manufacturers, large chemical companies, and petroleum refineries constitute a significant portion of their clientele.

Strategic Implications for Honeywell

Enhanced Market Position and Synergies

The Honeywell Johnson Matthey acquisition represents a significant leap forward for Honeywell, substantially strengthening its presence in the global catalyst market. It creates strong synergies with Honeywell's existing materials science and performance materials businesses, leading to cross-selling opportunities and operational efficiencies. This integration enhances Honeywell's ability to offer comprehensive solutions to its customers.

Impact on Research and Development

Honeywell plans to significantly increase its investment in R&D following the acquisition. Access to Johnson Matthey's established R&D capabilities and expertise will accelerate the development of advanced catalyst technologies, potentially leading to breakthroughs in emission control, fuel efficiency, and chemical production.

Long-Term Growth Prospects

The acquisition is expected to propel Honeywell's long-term growth, driving revenue expansion and increased profitability within its performance materials segment. The addition of Johnson Matthey's established customer base and product portfolio will further consolidate Honeywell's position as a leader in the industry.

- Specific synergies: Integration with Honeywell's existing materials science and process technology capabilities, leading to streamlined operations and cost savings.

- Expected increase in R&D spending: Significant investment in R&D is anticipated, focused on developing new catalyst technologies and enhancing existing offerings.

- Projected revenue growth: Analysts predict substantial revenue growth for Honeywell's catalyst division following the acquisition.

- Potential for new product development: The combined expertise promises innovations in emission control, fuel efficiency, and industrial chemical processes.

Implications for Johnson Matthey

Strategic Rationale for Divestiture

Johnson Matthey's decision to divest its catalyst business reflects a broader strategic repositioning. The sale allows Johnson Matthey to focus on its core competencies and high-growth areas, including battery materials and sustainable technologies. This move allows for a more focused investment strategy and improved operational efficiency.

Future Focus and Business Strategy

Following the sale, Johnson Matthey will concentrate its efforts on its chosen strategic pillars. This includes expanding its presence in the electric vehicle battery materials market and further developing its sustainable technologies portfolio. This focused approach aligns with the company's long-term vision and market opportunities.

- Reasons for Johnson Matthey to sell: Strategic refocusing on core businesses and high-growth sectors, allowing for optimized resource allocation.

- How the proceeds from the sale will be used: The funds are likely to be reinvested in R&D and expansion efforts within Johnson Matthey's remaining business units.

- Johnson Matthey’s future business priorities: Battery materials, sustainable technologies, and other high-growth sectors will be the primary areas of focus.

Conclusion

The Honeywell Johnson Matthey acquisition, valued at $2.4 billion, marks a pivotal moment in the catalyst industry. This deal enhances Honeywell's market position, driving long-term growth and innovation. For Johnson Matthey, the divestiture allows for strategic refocusing on its core competencies. The acquisition's impact extends beyond the two companies, potentially reshaping the industry landscape and accelerating innovation in catalyst technology. To stay updated on the latest developments in this transformative Honeywell Johnson Matthey acquisition, subscribe to industry newsletters and follow leading business publications for further analysis and insights into the catalyst market. Continue to search for relevant keywords like "Honeywell acquisition news," "catalyst market analysis," and "Johnson Matthey future strategy" to stay informed.

Featured Posts

-

Zimbabwe To Host High Level International Cricket Meetings

May 23, 2025

Zimbabwe To Host High Level International Cricket Meetings

May 23, 2025 -

Experience Cambridge And Somerville Viva Central Hot Sauce Festival And Open Studios This Week

May 23, 2025

Experience Cambridge And Somerville Viva Central Hot Sauce Festival And Open Studios This Week

May 23, 2025 -

Airlift Operation In Swiss Village 96 Cows Saved

May 23, 2025

Airlift Operation In Swiss Village 96 Cows Saved

May 23, 2025 -

Siren Trailer Julianne Moore Responds To Monster Accusations

May 23, 2025

Siren Trailer Julianne Moore Responds To Monster Accusations

May 23, 2025 -

Muzarabani And Masakadza Spearhead Zimbabwes Dominant Day One

May 23, 2025

Muzarabani And Masakadza Spearhead Zimbabwes Dominant Day One

May 23, 2025

Latest Posts

-

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 23, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 23, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025 -

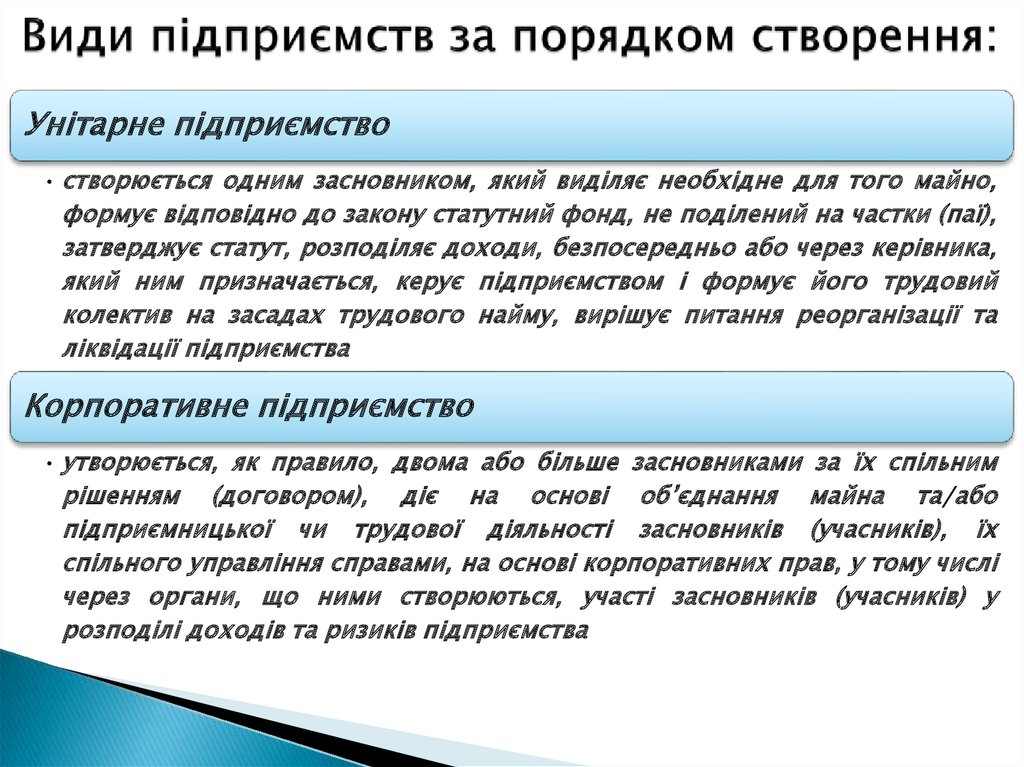

Zasnuvannya Ta Vedennya Tov Z Odnim Uchasnikom V Ukrayini

May 23, 2025

Zasnuvannya Ta Vedennya Tov Z Odnim Uchasnikom V Ukrayini

May 23, 2025 -

Gospodaryuvannya Tov Z Odnim Uchasnikom Pokrokova Instruktsiya

May 23, 2025

Gospodaryuvannya Tov Z Odnim Uchasnikom Pokrokova Instruktsiya

May 23, 2025 -

Compre Ingressos Para A Atlantida Celebration Com Nando Reis Armandinho E Di Ferrero

May 23, 2025

Compre Ingressos Para A Atlantida Celebration Com Nando Reis Armandinho E Di Ferrero

May 23, 2025