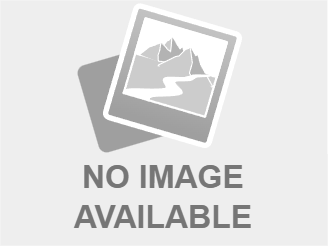

Home Depot's Financial Performance: Disappointment Despite Tariff Guidance

Table of Contents

Missed Earnings Expectations: A Deeper Dive into the Numbers

Home Depot's Q[Quarter] earnings report revealed several key areas of concern. Let's examine the revenue and profitability figures in detail.

Revenue Analysis

While Home Depot's revenue figures reached [insert actual revenue figure], this fell significantly short of analysts' predictions of [insert predicted revenue figure], representing a [insert percentage]% shortfall. A closer look at individual revenue streams reveals a mixed bag:

- Lumber: This typically strong revenue driver experienced a [insert percentage]% decrease year-over-year, likely due to [explain reason, e.g., decreased housing starts, increased competition].

- Appliances: Sales in this category showed [insert percentage]% growth, outperforming other sectors, potentially due to [explain reason, e.g., strong consumer demand for upgraded kitchen appliances].

- Hardware and Building Materials: This core segment saw [insert percentage]% growth/decline, indicating [explain reason, e.g., the impact of price increases or shifting consumer preferences].

These fluctuating revenue streams highlight the challenges Home Depot faced in maintaining consistent growth across all its product lines. The overall Home Depot revenue performance underscores the impact of broader economic factors and changing consumer behavior.

Profitability Concerns

The disappointing revenue numbers directly translated into lower-than-expected profitability. Home Depot's net income came in at [insert actual net income figure], significantly below the predicted [insert predicted net income figure]. This shortfall can be attributed to several factors:

- Increased Costs: The impact of tariffs, though partially mitigated, still resulted in higher costs for certain imported goods.

- Reduced Consumer Spending: A slowdown in the housing market and broader economic uncertainty might have led to reduced consumer spending on discretionary home improvement projects.

- Increased Operating Expenses: The company may have incurred higher operating expenses related to supply chain management and logistics in an attempt to counter the effects of tariffs and supply chain disruptions.

[Include a chart or graph visually representing the decline in profit margins and net income]. These profitability challenges underscore the need for Home Depot to implement further strategic adjustments to improve its financial performance.

The Impact of Tariffs and Supply Chain Issues on Home Depot's Performance

Home Depot proactively implemented several strategies to mitigate the impact of tariffs, but unforeseen supply chain challenges further exacerbated the situation.

Tariff Mitigation Strategies

Before the tariffs were fully implemented, Home Depot took several steps to minimize the impact on its business:

- Diversification of Suppliers: The company actively sought alternative suppliers outside of tariff-affected regions.

- Strategic Pricing Adjustments: Home Depot implemented price adjustments on some products to offset increased costs.

- Inventory Management: The company adjusted its inventory levels to minimize losses due to potential price fluctuations.

While these strategies helped, their effectiveness was limited by the scale and scope of the tariff issues and the unpredictable nature of global supply chains.

Unforeseen Supply Chain Challenges

Beyond the anticipated tariff impacts, Home Depot faced unexpected supply chain disruptions:

- Transportation Delays: Increased transportation costs and delays due to various logistical bottlenecks.

- Raw Material Shortages: Unexpected shortages of certain raw materials impacted the availability of some products.

- Geopolitical Instability: Unforeseen geopolitical events further complicated the already strained supply chains.

These challenges demonstrate the vulnerability of even large retailers like Home Depot to unforeseen disruptions in the global supply chain. Improving supply chain resilience will be crucial for future financial performance.

Future Outlook and Investor Sentiment

Following the release of the Q[Quarter] earnings report, Home Depot's stock price experienced a [insert description of stock market reaction]. Let's examine analyst predictions and Home Depot's strategic response.

Analyst Predictions and Stock Performance

Financial analysts have expressed mixed views on Home Depot's future performance. [Include quotes from analysts and links to relevant news articles]. Some analysts remain optimistic about Home Depot's long-term prospects, citing its strong brand reputation and market position. Others are more cautious, highlighting the ongoing challenges in the global supply chain and the broader economic uncertainty.

Home Depot's Response and Strategic Adjustments

In response to the disappointing results, Home Depot has announced [insert details of any strategic adjustments, cost-cutting measures, or marketing initiatives]. These strategic adjustments are aimed at improving operational efficiency, reducing costs, and stimulating demand. The success of these initiatives will be crucial in determining Home Depot's future financial performance.

Conclusion: Analyzing Home Depot's Financial Performance and What's Next

Home Depot's Q[Quarter] financial performance fell short of expectations, highlighting the complex interplay of tariffs, broader supply chain challenges, and shifting consumer behavior. While the company implemented strategies to mitigate the impact of tariffs, unforeseen supply chain disruptions and reduced consumer spending contributed to lower-than-expected revenue and profitability. To stay informed about Home Depot's ongoing financial performance and future developments, follow relevant financial news sources and subscribe to our newsletter for in-depth Home Depot stock analysis and future performance predictions. Understanding Home Depot's financial news is crucial for any investor tracking Home Depot's future performance.

Featured Posts

-

Yevrokomisar Pro Nato Ta Ukrayinu Detalniy Analiz Peregovoriv

May 22, 2025

Yevrokomisar Pro Nato Ta Ukrayinu Detalniy Analiz Peregovoriv

May 22, 2025 -

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025 -

Grocery Bills Surge Inflationary Impact On Food Costs

May 22, 2025

Grocery Bills Surge Inflationary Impact On Food Costs

May 22, 2025 -

Tdeymat Jdydt Lmntkhb Amryka Bthlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025

Tdeymat Jdydt Lmntkhb Amryka Bthlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025 -

Love Monster In Popular Culture

May 22, 2025

Love Monster In Popular Culture

May 22, 2025

Latest Posts

-

Don Song Phat Trien Phan Tich Nhung Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025

Don Song Phat Trien Phan Tich Nhung Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Nhung Du An Ha Tang Noi Tp Hcm Binh Duong Thuc Day Phat Trien Giao Thong

May 22, 2025

Nhung Du An Ha Tang Noi Tp Hcm Binh Duong Thuc Day Phat Trien Giao Thong

May 22, 2025 -

Thong Tin Moi Nhat Ve Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025

Thong Tin Moi Nhat Ve Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025 -

Cau Ma Da Giai Phap Giao Thong Hien Dai Cho Dong Nai

May 22, 2025

Cau Ma Da Giai Phap Giao Thong Hien Dai Cho Dong Nai

May 22, 2025 -

Phan Tich Chi Phi Va Tien Do Xay Dung Cau Ma Da Dong Nai

May 22, 2025

Phan Tich Chi Phi Va Tien Do Xay Dung Cau Ma Da Dong Nai

May 22, 2025