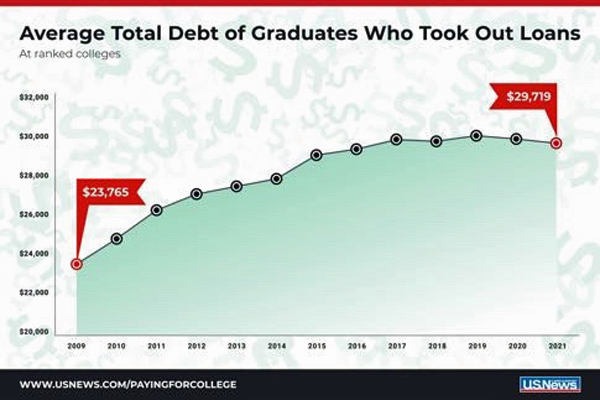

Home Buying With Student Loan Debt: Tips And Strategies For Success

Table of Contents

Assessing Your Financial Situation: The Foundation of Home Buying

Before you even start browsing property listings, a thorough assessment of your financial situation is crucial. This involves more than just checking your bank balance; it's about understanding your complete financial picture, including your student loan debt.

Keywords: Budgeting, debt-to-income ratio (DTI), credit report, credit score, student loan repayment plan

-

Create a Detailed Budget: A realistic budget is the cornerstone of any successful financial plan. List all your monthly income sources and meticulously track every expense, including your student loan payments. This will give you a clear picture of your disposable income and how much you can realistically allocate towards a down payment and mortgage payments. Use budgeting apps or spreadsheets to streamline this process.

-

Understand Your Debt-to-Income Ratio (DTI): Your DTI is the ratio of your monthly debt payments (including student loans, credit cards, and other loans) to your gross monthly income. Lenders use this ratio to assess your ability to manage additional debt, like a mortgage. A lower DTI significantly improves your chances of mortgage approval and securing favorable interest rates. Aim for a DTI below 43%, ideally lower.

-

Check Your Credit Report and Score: Your credit score is a critical factor in determining your mortgage eligibility and interest rates. Request your free credit reports annually from AnnualCreditReport.com and check for any errors. A higher credit score translates to better mortgage terms. Work on improving your credit score by paying bills on time, keeping credit utilization low, and avoiding new credit applications.

-

Explore Student Loan Repayment Options: Investigate different student loan repayment plans, such as income-driven repayment plans. These plans adjust your monthly payments based on your income, potentially lowering your DTI and making it easier to qualify for a mortgage. Contact your loan servicer to explore your options.

Strategies for Saving for a Down Payment: Building Your Financial Strength

Saving for a down payment while managing student loan repayments requires discipline and a strategic approach. Don't let student loan debt discourage you; numerous strategies can help you reach your savings goal.

Keywords: Down payment assistance programs, savings plan, high-yield savings account, investment accounts, budgeting strategies

-

Set Realistic Savings Goals: Break down your down payment goal into smaller, manageable milestones. This makes the process less overwhelming and provides a sense of accomplishment as you progress. Use online savings calculators to estimate your timeline.

-

Maximize Your Savings: Open a high-yield savings account to earn interest on your savings. Automate regular transfers from your checking account to maximize your savings potential. Explore high-yield savings accounts and CDs from different banks to find the best rates.

-

Explore Down Payment Assistance Programs: Many government agencies and non-profit organizations offer down payment assistance programs for first-time homebuyers. These programs may provide grants or low-interest loans to help cover your down payment, significantly easing the financial burden. Research programs available in your area.

-

Consider (with Caution) Investment Accounts: While potentially lucrative, investing for a down payment carries risk. Only consider this option if you have a long-term horizon, a high-risk tolerance, and understand the potential for losses. Consult with a financial advisor before investing.

Choosing the Right Mortgage: Navigating Your Options

Understanding different mortgage options is crucial for finding the best fit for your financial situation. Don't be intimidated by the terminology; various programs cater to borrowers with student loan debt.

Keywords: Mortgage types, FHA loans, VA loans, USDA loans, interest rates, mortgage lenders, mortgage pre-approval

-

Government-Backed Loans: FHA loans, VA loans (for eligible veterans), and USDA loans (for rural properties) often have more lenient down payment requirements than conventional loans, making them particularly attractive to borrowers with student loan debt. Research eligibility criteria for each program.

-

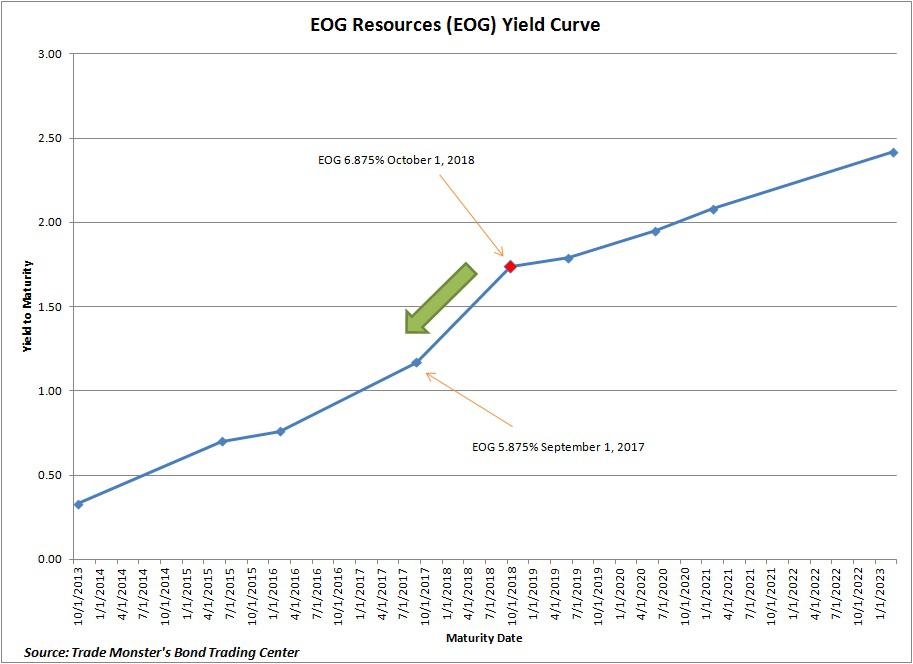

Compare Interest Rates and Loan Terms: Don't settle for the first mortgage offer you receive. Shop around, compare interest rates and loan terms from multiple lenders. A small difference in interest rates can significantly impact your total interest paid over the life of the loan.

-

Get Pre-Approved: Getting pre-approved for a mortgage will give you a clear picture of your borrowing power and help you refine your home search based on your budget. Pre-approval also strengthens your negotiating position when making an offer on a property.

-

Seek Professional Advice: A qualified mortgage broker or financial advisor can guide you through the complexities of mortgage options, helping you choose the best fit for your financial circumstances.

Negotiating a Favorable Mortgage: Maximizing Your Leverage

While not always guaranteed, negotiating a better mortgage rate or terms is possible. A strong credit score and a substantial down payment significantly enhance your negotiating leverage. Don't hesitate to discuss closing costs and other potential concessions with lenders.

Conclusion: Achieving Homeownership with Student Loan Debt is Possible!

Buying a home with student loan debt requires careful planning, but it's absolutely achievable. By assessing your financial situation, developing a robust savings plan, understanding your mortgage options, and exploring government assistance programs, you can overcome the challenges and achieve your dream of homeownership. Start planning your home buying journey today! Take control of your finances and achieve your dream of homeownership. Learn more about navigating student loan debt while buying a home by [linking to relevant resources].

Featured Posts

-

New York Knicks The Landry Shamet Conundrum

May 17, 2025

New York Knicks The Landry Shamet Conundrum

May 17, 2025 -

Stake Casino Alternatives Finding The Best Replacement Sites

May 17, 2025

Stake Casino Alternatives Finding The Best Replacement Sites

May 17, 2025 -

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025 -

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025 -

Apartment Building Demolition Approved By Davenport Council

May 17, 2025

Apartment Building Demolition Approved By Davenport Council

May 17, 2025

Latest Posts

-

Novak Djokovic In 186 Milyon Dolarlik Geliri Detaylar Ve Analiz

May 17, 2025

Novak Djokovic In 186 Milyon Dolarlik Geliri Detaylar Ve Analiz

May 17, 2025 -

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025 -

Fortnites Controversial Music Update Players Express Their Discontent

May 17, 2025

Fortnites Controversial Music Update Players Express Their Discontent

May 17, 2025 -

Fortnite Unreleased Skins And Their Potential Return

May 17, 2025

Fortnite Unreleased Skins And Their Potential Return

May 17, 2025 -

Fortnites Most Exclusive Skins Are They Truly Lost

May 17, 2025

Fortnites Most Exclusive Skins Are They Truly Lost

May 17, 2025