HMRC System Failure: Major Disruption To Online Tax Services In The UK

Table of Contents

The Extent of the HMRC System Outage

The HMRC system failure affected a broad range of online tax services, causing significant inconvenience and uncertainty. The outage, which began at approximately [Insert Start Time] and lasted until [Insert End Time], impacted millions of users across the UK. While the precise geographical reach of the disruption is still under investigation, reports suggest a nationwide impact, with no specific region or user group appearing immune.

The services affected included:

- Self Assessment portal: Completely unavailable for the duration of the outage, preventing taxpayers from filing their returns and accessing their information. This is a critical service, particularly impacting those with self-employment income or complex tax situations.

- PAYE online services: Experienced intermittent errors, making it difficult for employers to process payroll and submit PAYE information accurately and on time. This caused delays and potential administrative issues for businesses of all sizes.

- VAT return submissions: Significantly delayed, impacting cash flow for businesses reliant on timely VAT reimbursements. The disruption caused considerable stress and uncertainty for businesses managing their finances.

- HMRC helpline: Overwhelmed with calls from frustrated taxpayers and businesses seeking assistance, leading to long wait times and further exacerbating the stress associated with the outage. Many reported difficulty getting through to a representative.

Impact on Taxpayers and Businesses

The HMRC system outage had far-reaching consequences for both individuals and businesses. The disruption caused significant stress and inconvenience, particularly for those with impending tax deadlines. Missed deadlines can result in significant penalties and interest charges, creating substantial financial burdens.

The impact includes:

- Missed tax deadlines leading to potential penalties: The inability to access the HMRC portal directly resulted in many taxpayers missing crucial deadlines, potentially leading to financial penalties from HMRC.

- Disruption to payroll processing for businesses: The intermittent errors in PAYE services hampered payroll processing for many businesses, causing potential delays in employee payments and increased administrative workload.

- Increased workload for HMRC staff handling complaints: HMRC staff faced an immense increase in calls and complaints, adding to the already significant pressure on their resources.

- Negative impact on business confidence and cash flow: The disruption to VAT returns and PAYE significantly affected business cash flow and overall confidence, particularly for smaller businesses with tighter margins. This uncertainty can have long-term implications.

HMRC's Response and Official Statements

HMRC released an official statement acknowledging the HMRC system failure and apologized for the inconvenience caused to taxpayers and businesses. [Insert details of the official statement here, including any explanation of the cause]. The statement outlined the steps taken to resolve the issue, including [Insert details of actions taken].

Key aspects of HMRC's response:

- HMRC statement acknowledging the system failure: A public statement was issued accepting responsibility and apologizing for the disruption caused by the online services failure.

- Explanation of the cause (if provided): [Insert details of any explanation given regarding the cause of the outage].

- Timeline of the resolution process: [Insert details on the timeline of the resolution, including estimated restoration times and actions taken].

- Measures taken to prevent future outages: [Insert details of any measures mentioned to prevent future outages]. HMRC may have committed to increased investment in IT infrastructure or improved disaster recovery planning.

Preventing Future HMRC System Failures

Preventing future HMRC system failures requires a multi-pronged approach focused on improving system resilience, security, and disaster recovery planning. This includes:

- Investment in robust IT infrastructure: Upgrading outdated systems and implementing redundant systems to ensure service continuity during failures. This includes cloud-based solutions and improved network architecture.

- Improved cybersecurity protocols: Strengthening cybersecurity measures to protect against cyberattacks and data breaches that can lead to system outages. Regular penetration testing and vulnerability assessments are crucial.

- Enhanced disaster recovery planning: Developing comprehensive disaster recovery plans that outline clear procedures for responding to system failures and restoring services quickly and efficiently. This should include regular drills and testing.

- Regular system maintenance and updates: Implementing a robust maintenance schedule that includes regular software updates, security patches, and system upgrades to prevent vulnerabilities and ensure optimal performance.

Conclusion: Learning from the HMRC System Failure

The recent HMRC system failure highlighted the critical need for robust and reliable online tax services. The widespread disruption caused significant inconvenience, financial uncertainty, and stress for millions of taxpayers and businesses. The consequences of this outage underscore the importance of investing in robust IT infrastructure, enhanced cybersecurity, and effective disaster recovery planning.

Stay updated on the latest information regarding the HMRC system by visiting the official HMRC website. Understanding the potential for future HMRC system failures and taking proactive steps to mitigate risks is crucial for all UK taxpayers. Regularly check HMRC's announcements for updates on service availability and plan ahead to avoid last-minute rushes during peak tax periods.

Featured Posts

-

Schumacher 2010 Un Amigo Cuenta La Conversacion Que Anticipo El Fracaso

May 20, 2025

Schumacher 2010 Un Amigo Cuenta La Conversacion Que Anticipo El Fracaso

May 20, 2025 -

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025 -

Suki Waterhouses Met Gala Look A Retrospective

May 20, 2025

Suki Waterhouses Met Gala Look A Retrospective

May 20, 2025 -

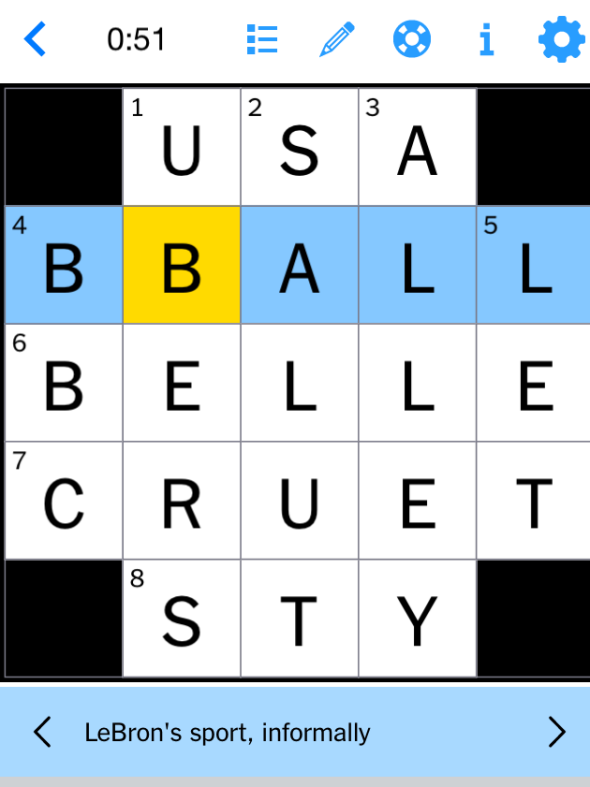

Nyt Mini Crossword March 13 2025 Complete Solutions

May 20, 2025

Nyt Mini Crossword March 13 2025 Complete Solutions

May 20, 2025 -

Tweede Kindje Voor Jennifer Lawrence Details Over De Geboorte

May 20, 2025

Tweede Kindje Voor Jennifer Lawrence Details Over De Geboorte

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025