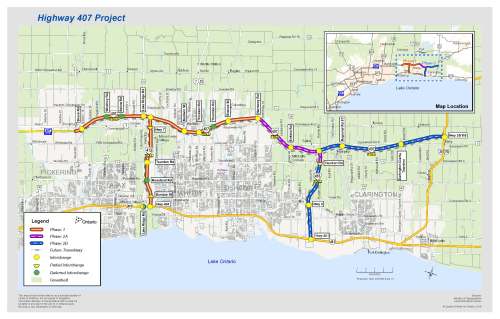

Highway 407 East Tolls & Ontario Gas Tax: A Permanent Solution?

Table of Contents

<p><b>Meta Description:</b> Are Highway 407 East tolls and Ontario's gas tax a sustainable solution for highway infrastructure? This article explores the current system, its impact on drivers, and potential alternatives, including congestion pricing and innovative funding models. Learn about 407ETR tolls, 407 toll calculator, and more.</p>

<p>The debate surrounding the financing of Ontario's highway infrastructure is complex, with Highway 407 East tolls and the province's gas tax playing central roles. This article delves into the ongoing discussion, examining whether the current system provides a sustainable and equitable solution for the long term, and exploring potential alternatives to ensure the efficient and responsible maintenance and expansion of our vital highway network.</p>

<h2>The Current State of Highway 407 East Tolls</h2>

<h3>Toll Rates and their Impact</h3>

The Highway 407 East toll structure is dynamic, varying based on time of day, traffic congestion, and distance traveled. This means that the 407ETR tolls can fluctuate significantly, impacting drivers' budgets. Using a 407 toll calculator can help commuters estimate costs, but the unpredictable nature of the tolls remains a concern. Understanding the Highway 407 cost is crucial for budget planning.

- Affordability: The affordability of 407 East tolls varies greatly depending on income levels and frequency of use. Low-income drivers may find the tolls a significant burden, impacting their daily commute and overall financial well-being.

- Comparison with other Highways: Compared to other major highways in Ontario, the 407 East often presents higher tolls, though the argument for its efficiency and reduced congestion is often presented in counterpoint.

- Revenue Allocation: The revenue generated from 407 electronic tolls is substantial. Understanding how this revenue is allocated – for maintenance, expansion, and other related projects – is essential for evaluating the effectiveness of the system.

<h3>Technological Advancements and Toll Collection</h3>

The 407 electronic toll collection system, using transponders (407 transponder) or license plate recognition, is generally efficient. Online payment options (407 online payment) offer convenience. However, challenges remain, such as occasional 407 violation notices and disputes regarding billing accuracy.

- Ease of Use: The electronic system is generally considered user-friendly, offering seamless payment options for most drivers.

- System Challenges: Issues such as inaccurate billing, difficulties in registering transponders, and the complexities of handling violations need addressing to improve the overall user experience.

- Future Technologies: The integration of automated vehicle identification (AVI) and other advanced technologies holds potential for further streamlining the toll collection process and improving accuracy.

<h2>Ontario's Gas Tax and Highway Funding</h2>

<h3>The Role of Gas Tax Revenue</h3>

Ontario's gas tax revenue plays a significant role in funding highway infrastructure maintenance and expansion. This revenue contributes to the provincial transportation budget, allocated across various highway projects and maintenance initiatives.

- Revenue Allocation: A clear understanding of how gas tax revenue is specifically allocated is necessary to assess its impact on various highway projects.

- Impact of Fluctuating Gas Prices: The volatility of gas prices directly impacts the amount of revenue generated, creating uncertainty in long-term planning for highway infrastructure.

- Potential for Increased Revenue: Advocates for increased highway funding often propose raising the gas tax to generate additional revenue.

<h3>The Sustainability of Gas Tax as a Funding Mechanism</h3>

Relying solely on the gas tax for highway funding faces significant challenges in the long term. The increasing adoption of electric vehicles and improved fuel efficiency are directly reducing gas consumption, thus decreasing gas tax revenue.

- Declining Gas Tax Revenue: The long-term implications of declining gas tax revenue require proactive measures to ensure the continued funding of highway infrastructure.

- Alternative Funding Models: Alternatives such as a carbon tax, road user charges, or other innovative financing mechanisms need to be explored to ensure long-term sustainability.

- Public-Private Partnerships: Public-private partnerships (PPPs) could offer a way to leverage private investment for infrastructure development.

<h2>Exploring Alternatives to the Current System</h2>

<h3>Congestion Pricing and its Implications</h3>

Congestion pricing, a demand-based tolling system, is a potential solution to manage traffic congestion and generate additional revenue for highway improvements. This road pricing system adjusts tolls based on real-time traffic conditions.

- Impact on Traffic Flow: Congestion pricing aims to reduce traffic congestion by incentivizing drivers to travel during off-peak hours or use alternative routes.

- Equity and Affordability: Concerns exist regarding the equity implications of congestion pricing, as it could disproportionately affect lower-income drivers.

- Public Acceptance: The political and public acceptance of congestion pricing remains a significant challenge, requiring careful planning and public engagement.

<h3>Other Potential Funding Solutions</h3>

Several alternative funding solutions for highway infrastructure exist, each with its own advantages and disadvantages.

- Increased Government Investment: Direct government investment in highway infrastructure is another potential source of funding, though this approach often faces budgetary constraints.

- Public-Private Partnerships: PPPs allow for private sector involvement in financing and managing highway projects, reducing the financial burden on the government.

- Innovative Financing Mechanisms: Exploring innovative financing mechanisms, such as green bonds or infrastructure bonds, can attract investment for sustainable highway projects.

<h2>Conclusion</h2>

The current system of financing highway infrastructure in Ontario, heavily reliant on Highway 407 East tolls and the gas tax, faces long-term sustainability challenges. The dynamic nature of 407ETR tolls, alongside the declining gas tax revenue due to factors like increased fuel efficiency and the rise of electric vehicles, necessitates a comprehensive review of funding models. Exploring alternatives such as congestion pricing, increased government investment, public-private partnerships, and innovative financing mechanisms is crucial. The debate surrounding Highway 407 East tolls and Ontario’s gas tax demands a proactive and collaborative approach to ensure the long-term viability of our highway infrastructure. Engage in the conversation, research the different proposed solutions, and contact your elected officials to advocate for sustainable and equitable solutions for highway infrastructure financing in Ontario. Let’s work together to find a lasting solution for sustainable highway infrastructure financing.

Featured Posts

-

Apple Watches And Nhl Referees A New Era In Officiating

May 16, 2025

Apple Watches And Nhl Referees A New Era In Officiating

May 16, 2025 -

San Diego Padres First To 10 Wins Defeat Oakland Athletics

May 16, 2025

San Diego Padres First To 10 Wins Defeat Oakland Athletics

May 16, 2025 -

Hyeseong Kims Mlb Debut Dodgers Report Confirms Kbo Call Up

May 16, 2025

Hyeseong Kims Mlb Debut Dodgers Report Confirms Kbo Call Up

May 16, 2025 -

Jimmy Butler Injury Update Pelvic Contusion Severity And Recovery Timeline

May 16, 2025

Jimmy Butler Injury Update Pelvic Contusion Severity And Recovery Timeline

May 16, 2025 -

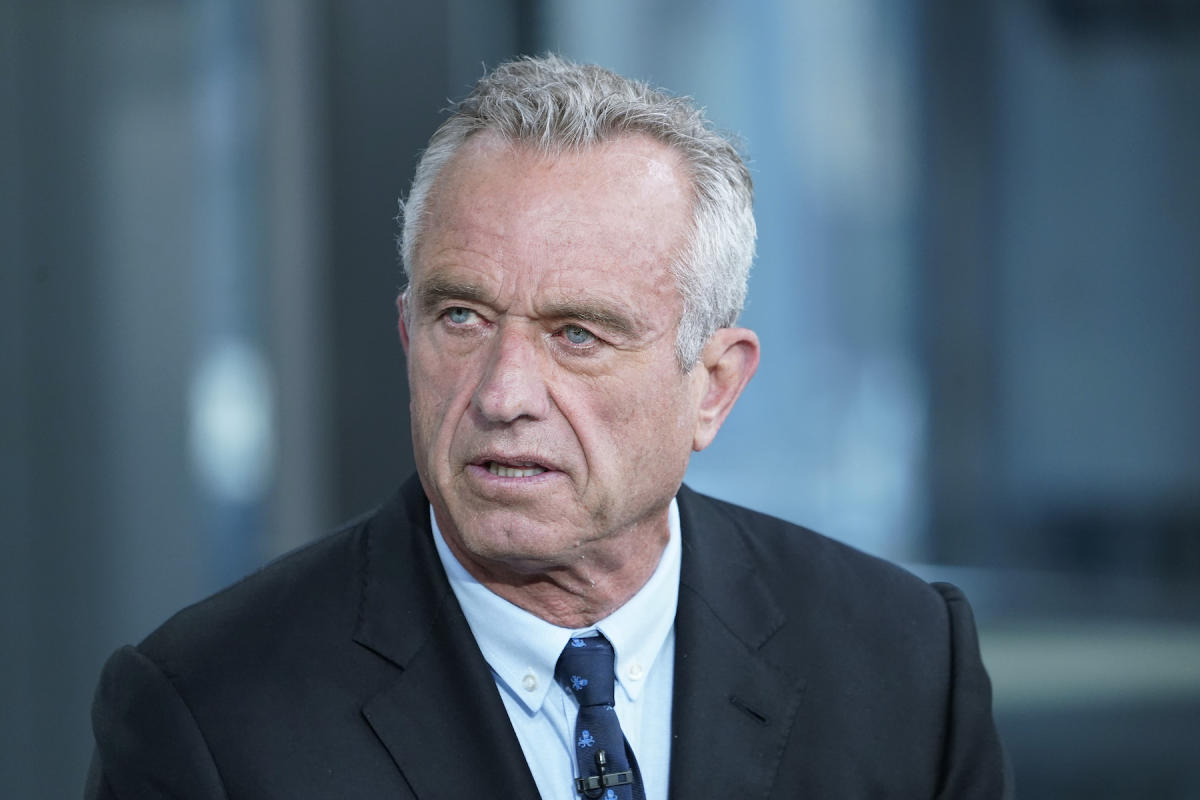

Rfk Jr Defies Bacteria Warnings Swims With Family In Rock Creek Park

May 16, 2025

Rfk Jr Defies Bacteria Warnings Swims With Family In Rock Creek Park

May 16, 2025

Latest Posts

-

Nhl Suspends Owner For Alleged Online Abuse Of Opposing Fan

May 16, 2025

Nhl Suspends Owner For Alleged Online Abuse Of Opposing Fan

May 16, 2025 -

The Impact Of Apple Watches On Nhl Referee Accuracy And Efficiency

May 16, 2025

The Impact Of Apple Watches On Nhl Referee Accuracy And Efficiency

May 16, 2025 -

Stanley Cup Playoffs The Ultimate Viewing Guide

May 16, 2025

Stanley Cup Playoffs The Ultimate Viewing Guide

May 16, 2025 -

Nhl Minority Owner Suspended Online Abuse And Condemnation Of Terrorism

May 16, 2025

Nhl Minority Owner Suspended Online Abuse And Condemnation Of Terrorism

May 16, 2025 -

Nhl Referees Embrace Apple Watch Technology Improved Performance

May 16, 2025

Nhl Referees Embrace Apple Watch Technology Improved Performance

May 16, 2025