High-Yield Dividend Investing: Simplicity For Maximum Profit

Table of Contents

Understanding High-Yield Dividend Stocks

A high-yield dividend stock is a company that pays out a substantial portion of its earnings as dividends to shareholders. Generally, a dividend yield above average (which fluctuates but is typically around 2-3%) is considered high-yield. However, the "high" yield should be considered relative to the overall market and the specific sector. The key is not just a high yield, but a sustainable one.

The dividend payout ratio is crucial. This ratio represents the percentage of a company's earnings that are paid out as dividends. A high payout ratio (above 70-80%) might signal a generous yield but could also indicate future dividend cuts if earnings decline. Conversely, a lower payout ratio suggests more financial flexibility for the company and a higher chance of sustainable dividend payments.

Dividend stocks come in various forms:

-

Blue-chip stocks: Large, established companies with a long history of paying consistent dividends. These often offer lower yields but are generally considered less risky.

-

Growth stocks: Companies reinvesting profits to fuel rapid expansion; dividends might be smaller initially but could increase significantly over time.

-

Income stocks: Companies prioritizing dividend payouts, ideal for generating immediate income.

-

Dividend Yield: Calculated as (Annual Dividend per Share / Stock Price) x 100%. This represents the annual return based on the current dividend and share price.

-

Dividend History: A company's consistent dividend payment history indicates stability and financial health. Look for companies with a long track record of paying and increasing dividends.

-

Risks: High-yield dividend stocks aren't without risks. A company might cut or even eliminate its dividend due to financial difficulties, impacting your income stream. Thorough due diligence is essential.

Strategies for Successful High-Yield Dividend Investing

Several strategies can enhance your high-yield dividend investing success:

Diversification

Portfolio diversification is paramount for risk management in any investment strategy, including high-yield dividend investing. Spread your investments across various stocks and sectors to reduce the impact of any single company's underperformance. Proper asset allocation considers your risk tolerance and financial goals. Diversifying your portfolio minimizes potential losses and creates a more resilient investment approach.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy mitigates the risk of investing a lump sum at a market peak. By buying consistently, you average your purchase price, reducing the impact of market volatility.

Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) allow you to automatically reinvest your dividends to purchase more shares. This strategy leverages the power of compound interest, accelerating your wealth building. The more dividends you reinvest, the faster your investment grows.

- DCA Pros: Reduces risk of market timing, simplifies investing, psychologically beneficial.

- DCA Cons: Might miss out on significant price drops (opportunity cost).

- DRIPs Pros: Accelerates growth through compounding, automatic investment.

- DRIPs Cons: Requires brokerage account support, might miss out on using dividends for other expenses.

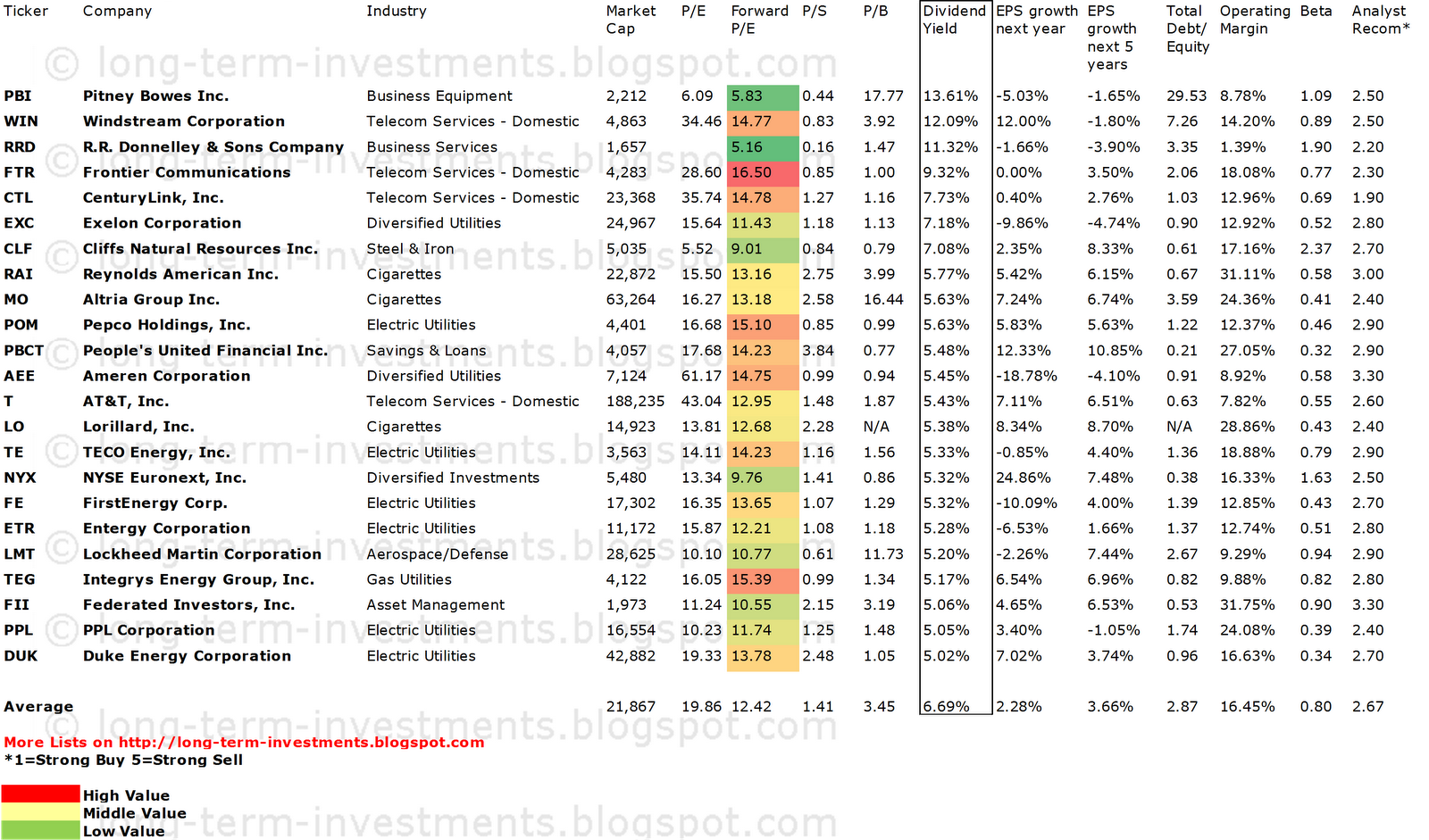

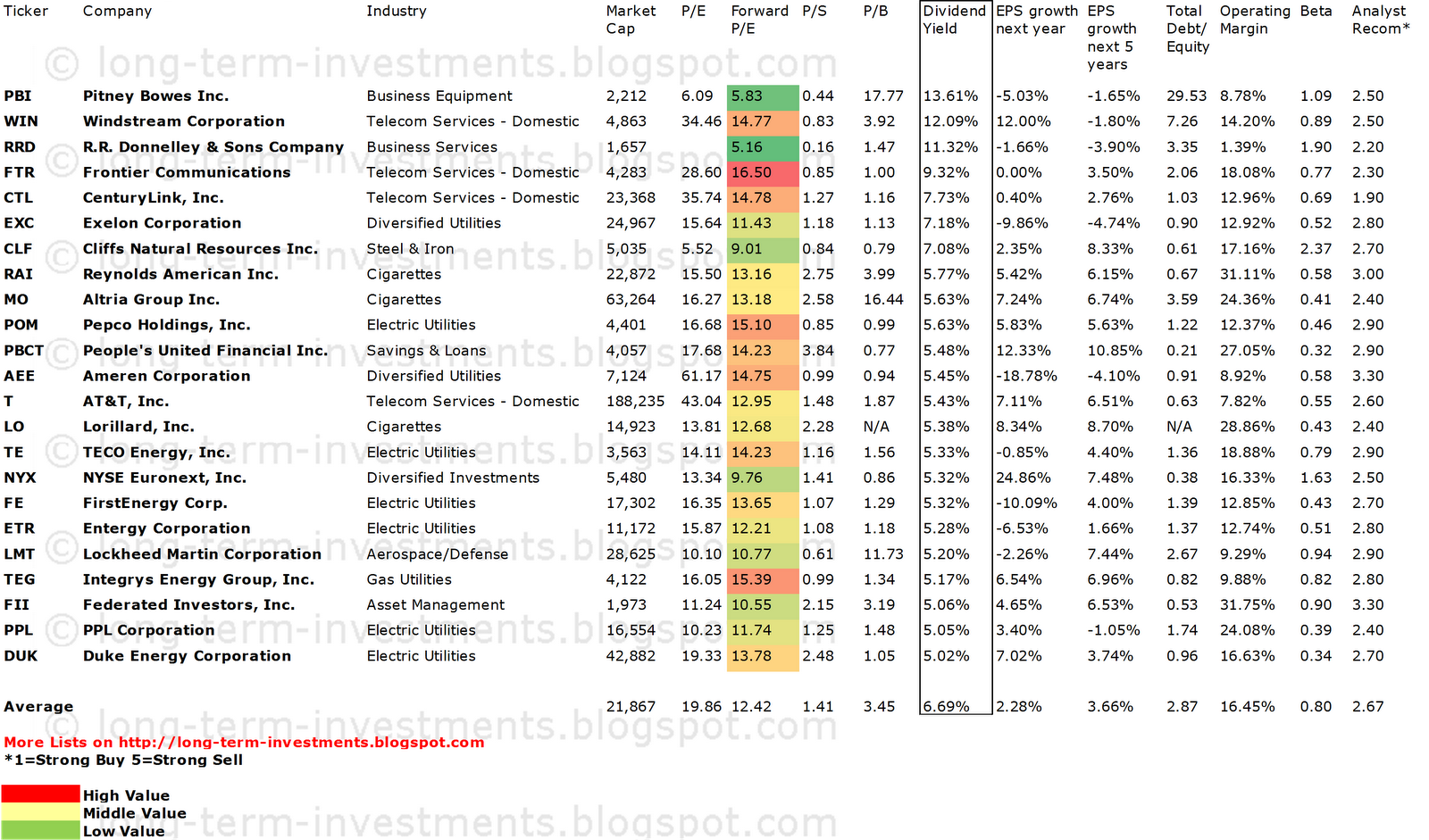

Identifying Promising High-Yield Dividend Stocks

Successful high-yield dividend investing requires diligent research. Fundamental analysis examines a company's financial health through its financial statements, including its balance sheet, income statement, and cash flow statement. This helps assess its ability to sustain dividend payments. Key ratios to analyze include the payout ratio and debt-to-equity ratio.

Technical analysis involves studying price charts and other market data to identify potential entry and exit points for your investments. This complements fundamental analysis and can help time your purchases strategically.

Several resources can aid your search:

-

Financial News Websites: Stay updated on market trends and company news.

-

Broker Platforms: Many offer stock screening tools to filter for specific criteria, such as dividend yield, payout ratio, and market capitalization.

-

Key Financial Ratios: Payout ratio, debt-to-equity ratio, return on equity (ROE).

-

Reliable Resources: Yahoo Finance, Google Finance, Bloomberg, reputable financial news sources.

Managing Risk in High-Yield Dividend Investing

While high-yield dividend investing offers potential for substantial returns, it also carries inherent risks:

- Dividend Cuts: Companies may reduce or eliminate dividends due to financial difficulties.

- Company Bankruptcy: Investment losses can occur if the company fails.

To mitigate these risks:

-

Diversification: Spread investments across multiple stocks and sectors.

-

Thorough Research: Conduct comprehensive due diligence on each company before investing.

-

Realistic Expectations: Avoid chasing extremely high yields, which often come with significantly higher risk.

-

Regular Portfolio Reviews: Monitor your investments regularly and adjust your strategy as needed.

-

Dealing with Dividend Cuts: Re-evaluate the company's financial health; consider selling if the outlook is poor.

-

Diversification's Role: Reduces the impact of losses from individual stocks.

Maximize Your Profits with Smart High-Yield Dividend Investing

Successful high-yield dividend investing hinges on a combination of strategies: diversification to manage risk, dollar-cost averaging to smooth out market fluctuations, dividend reinvestment plans to accelerate growth, and thorough research to identify promising stocks. Remember, while high yields are attractive, sustainable dividends and strong company fundamentals are far more important for long-term success. The simplicity and potential for significant passive income make high-yield dividend investing a powerful tool for building wealth. Start building your passive income stream today with strategic high-yield dividend investing!

Featured Posts

-

Mc Ilroy And Lowry Six Back In Zurich Classic Defense

May 11, 2025

Mc Ilroy And Lowry Six Back In Zurich Classic Defense

May 11, 2025 -

Sylvester Stallones Armor Action Thriller Available For Free Streaming

May 11, 2025

Sylvester Stallones Armor Action Thriller Available For Free Streaming

May 11, 2025 -

Victoria De Knicks Sobre Sixers Anunoby Brilla Con 27 Puntos Novena Derrota De Filadelfia

May 11, 2025

Victoria De Knicks Sobre Sixers Anunoby Brilla Con 27 Puntos Novena Derrota De Filadelfia

May 11, 2025 -

Mueller Annonce Son Depart Du Bayern Un Chapitre Se Ferme

May 11, 2025

Mueller Annonce Son Depart Du Bayern Un Chapitre Se Ferme

May 11, 2025 -

Ufc 315 Shevchenkos Potential Superfight With Zhang Weili

May 11, 2025

Ufc 315 Shevchenkos Potential Superfight With Zhang Weili

May 11, 2025