High Stock Valuations And Investor Concerns: A BofA Perspective

Table of Contents

BofA's Assessment of Current Market Valuations

BofA employs various metrics to assess market valuations, providing a comprehensive understanding of the current market landscape and potential risks. These assessments are crucial for investors to make informed decisions and manage their portfolios effectively.

Metrics Used by BofA

BofA likely utilizes several key valuation metrics, including:

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially high valuations.

- Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share. It's often used for companies with negative earnings, providing another perspective on valuation.

- Shiller PE ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure.

Examples based on hypothetical BofA data (replace with actual data when available):

- The S&P 500's current P/E ratio might be 25, compared to a historical average of 15.

- Specific sectors, like technology, might exhibit even higher P/E ratios, reflecting investor optimism about future growth.

- BofA's analysis may highlight discrepancies between valuation metrics, indicating potential overvaluation in certain sectors.

Factors Contributing to High Valuations

Several factors contribute to the current high stock valuations, according to BofA's likely analysis:

- Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and investors, driving up asset prices, including stocks.

- Quantitative Easing (QE): Central banks' injection of liquidity into the market through QE programs has increased the money supply, potentially inflating asset prices.

- Strong Corporate Earnings: Robust corporate earnings, especially in certain sectors, can justify higher stock prices, although this needs to be assessed relative to historical norms.

- Technological Innovation: Breakthroughs in technology can drive significant growth and attract substantial investment, leading to higher valuations in related sectors.

Potential Impacts & Sustainability:

- The impact of these factors varies across different market sectors. For example, technology companies might benefit more from low interest rates than cyclical industries.

- The sustainability of these factors is crucial. If interest rates rise sharply or corporate earnings disappoint, high valuations could become unsustainable.

Investor Concerns Stemming from High Valuations

High stock valuations naturally raise several significant concerns among investors. BofA's analysis likely addresses these concerns, providing a framework for risk assessment and informed decision-making.

Risk of Market Correction

Given the elevated valuations, the risk of a market correction or even a crash is a primary concern.

- Historical Precedents: Market history shows that periods of high valuations are often followed by corrections. BofA might reference past instances to illustrate the potential for a downturn.

- Predicted Probability: BofA's analysis might offer a probability assessment for a market correction based on various factors.

- Potential Triggers: Triggers could include rising interest rates, geopolitical instability, or a significant decline in corporate earnings.

Inflationary Pressures

High stock valuations can contribute to inflationary pressures.

- Fueling Inflation: When asset prices rise, it can lead to increased demand and higher prices for goods and services.

- Impact on Stock Prices: Inflation can erode the real value of stock prices, impacting returns for investors.

- BofA's Inflation Predictions: BofA's forecasts for inflation are crucial in assessing the risks associated with high valuations.

Interest Rate Hikes

Central banks' potential interest rate hikes pose a significant threat to high valuations.

- Effect on Profitability: Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing stock prices.

- Impact on Stock Prices: Higher rates can also make bonds more attractive than stocks, potentially leading to a shift in investor preference.

- BofA's Interest Rate Forecasts: BofA's predictions for interest rate changes are essential for understanding the potential impact on the stock market.

BofA's Recommended Investment Strategies

Navigating high stock valuations requires a carefully considered investment strategy. BofA likely suggests a range of approaches to mitigate risk and potentially capitalize on opportunities.

Defensive Investing

For investors concerned about high valuations, a shift towards defensive stocks or sectors might be advisable.

- Examples of Defensive Sectors: Consumer staples, healthcare, and utilities are generally considered more defensive, less sensitive to economic downturns.

- Strategies for Mitigating Risk: Diversification across sectors, focusing on companies with strong balance sheets, and employing stop-loss orders are effective risk mitigation strategies.

- Asset Allocation Recommendations: BofA might recommend a higher allocation to defensive assets during periods of high valuations.

Selective Stock Picking

Even in a high-valuation market, opportunities for outperformance exist.

- Criteria for Selecting Stocks: BofA might focus on companies with strong fundamentals, sustainable competitive advantages, and attractive valuations relative to their growth prospects.

- Potential Sectors for Outperformance: Specific sectors might offer better value than others, even in a high-valuation environment.

- Risk Management Strategies: Thorough due diligence, valuation analysis, and diversification are crucial when engaging in selective stock picking.

Diversification

Diversification across various asset classes is essential for risk management.

- Different Asset Classes: This could include bonds, real estate, commodities, and alternative investments.

- Reducing Risk: Diversification reduces the impact of any single asset's underperformance on the overall portfolio.

- BofA's Recommended Asset Allocation Models: BofA might offer various asset allocation models tailored to different risk tolerances and investment goals.

Conclusion

BofA's analysis highlights the significant investor concerns surrounding high stock valuations. The potential for market corrections, inflationary pressures, and interest rate hikes are all relevant considerations. However, opportunities still exist for investors who adopt well-defined strategies. BofA likely recommends a combination of defensive investing, selective stock picking, and robust diversification to navigate these challenging market conditions. Understanding high stock valuations is crucial for effective investment planning. Consult with a financial advisor and stay informed about market trends to develop a strategy that aligns with your risk tolerance. Learn more about BofA's market analysis and investment solutions to confidently navigate these market conditions.

Featured Posts

-

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025 -

Usmnt Weekend Recap Dest Returns Pulisic Shines

May 12, 2025

Usmnt Weekend Recap Dest Returns Pulisic Shines

May 12, 2025 -

The 12 Fate Of Selena Gomezs 3 000 Benny Blanco Diamond Ring

May 12, 2025

The 12 Fate Of Selena Gomezs 3 000 Benny Blanco Diamond Ring

May 12, 2025 -

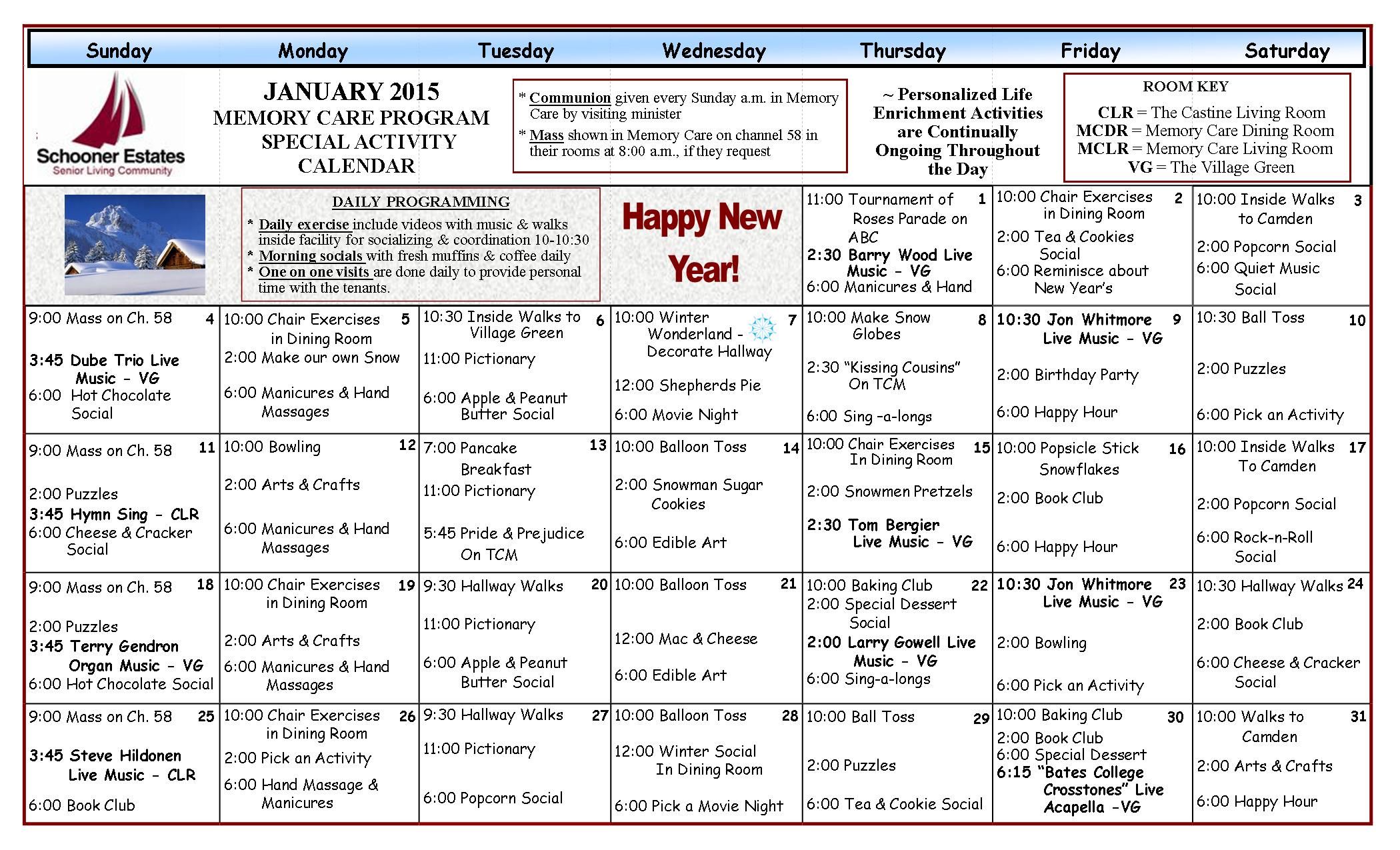

2024 Senior Calendar Trips Activities And Events

May 12, 2025

2024 Senior Calendar Trips Activities And Events

May 12, 2025 -

Uruguay Laicidad Y El Significado De La Semana De Turismo

May 12, 2025

Uruguay Laicidad Y El Significado De La Semana De Turismo

May 12, 2025

Latest Posts

-

Chicago Cubs Player Kyle Tuckers Fan Interaction Controversy

May 13, 2025

Chicago Cubs Player Kyle Tuckers Fan Interaction Controversy

May 13, 2025 -

Reaction To Kyle Tuckers Comments About Chicago Cubs Fans

May 13, 2025

Reaction To Kyle Tuckers Comments About Chicago Cubs Fans

May 13, 2025 -

Chicago Cubs Kyle Tuckers Comments On Fans Create Buzz

May 13, 2025

Chicago Cubs Kyle Tuckers Comments On Fans Create Buzz

May 13, 2025 -

Cubs Star Kyle Tuckers Controversial Remarks On Fans

May 13, 2025

Cubs Star Kyle Tuckers Controversial Remarks On Fans

May 13, 2025 -

Kyle Tucker Addresses Chicago Cubs Fan Base Reaction

May 13, 2025

Kyle Tucker Addresses Chicago Cubs Fan Base Reaction

May 13, 2025