High Stock Market Valuations: Why BofA Says Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's assessment suggests that the current high stock market valuations aren't necessarily a harbinger of doom. Their analysis points to several key supporting factors that temper the immediate concerns.

Strong Corporate Earnings and Profitability

BofA highlights the robust performance of many corporations as a significant mitigating factor. Strong earnings growth continues to underpin many stock prices, suggesting that valuations, while high, aren't entirely detached from reality.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have shown consistent earnings growth, defying broader market anxieties.

- Positive earnings growth projections: Many analysts predict continued earnings growth for numerous companies in the coming quarters, offering a counterpoint to the concerns surrounding high stock market valuations.

- Robust balance sheets of major companies: The financial health of many large corporations remains strong, providing a buffer against potential economic downturns. This financial strength helps support high stock prices, even in the face of high valuations. This strong financial performance helps justify current valuations, although not necessarily guaranteeing future growth.

Low Interest Rates and Ample Liquidity

The current low interest rate environment and abundant liquidity play a crucial role in supporting market valuations. These conditions influence investor behavior and investment strategies.

- Impact of monetary policy: The continued loose monetary policy implemented by central banks globally has injected significant liquidity into the market, making investments more attractive and supporting higher valuations.

- Low borrowing costs for companies: Low interest rates allow corporations to borrow money cheaply, funding growth initiatives and boosting profitability. This, in turn, helps support high stock prices.

- Sustained investment: Low borrowing costs stimulate investment, both in existing companies and new ventures, further fueling economic growth and supporting higher stock market valuations.

- Effect on bond yields: Low interest rates have kept bond yields comparatively low, making equities a relatively more attractive investment option for many investors.

Long-Term Growth Potential

BofA's analysis also underscores the significant long-term growth potential of the global economy as a key factor in justifying current valuations, despite their height. The outlook remains positive, and the ongoing potential for growth justifies many of the current high stock market valuations.

- Technological advancements: Rapid technological innovation across numerous sectors continues to drive productivity gains and create new economic opportunities, supporting long-term economic and market growth.

- Emerging markets growth: The continued growth and development of emerging markets present significant opportunities for investment and growth. These markets offer potential for high returns, supporting high valuations.

- Demographic shifts: Changes in global demographics will create new demands and drive further economic growth, supporting the continued growth of many sectors.

- Potential for future innovation: The continuous cycle of innovation and disruption fuels long-term economic growth and ensures that the markets are not stagnant. This justifies continued investment and supports current valuations.

Factors to Consider Before Reacting to High Valuations

While high stock market valuations are a legitimate concern, a knee-jerk reaction isn't necessarily the best course of action. Several important factors should be considered before making any drastic investment decisions.

Diversification and Risk Management

A well-diversified investment portfolio is crucial for mitigating the risks associated with high valuations. Don't put all your eggs in one basket; spread your investments across different sectors and asset classes.

- Asset allocation strategies: Develop an asset allocation strategy based on your risk tolerance and long-term financial goals. This helps manage risk and minimize the impact of market fluctuations.

- Diversification across sectors and asset classes: Don't limit your investments to one sector. Invest across various sectors and asset classes to help mitigate risk.

- Importance of risk tolerance assessment: Understanding your risk tolerance is critical in formulating an effective investment strategy. It allows for a portfolio tailored to your individual needs and risk profile.

Long-Term Investment Horizon

A long-term investment approach is vital for weathering the volatility that high valuations can bring. Avoid trying to time the market and focus on your long-term financial goals instead.

- The benefit of patience: Market fluctuations are normal. Patience will help you avoid emotional decisions and allow you to ride out the volatility.

- Avoiding short-term market timing: Trying to predict short-term market movements is often futile and can lead to significant losses. Focus on your longer-term plan.

- Focusing on long-term financial goals: Maintain a focus on your long-term goals and investment strategy. This will minimize the impact of short-term market fluctuations.

Analyzing Individual Company Fundamentals

Don't just focus on broad market indices; delve into the fundamentals of individual companies. Identify companies with strong fundamentals and growth potential, regardless of overall market valuations.

- Fundamental analysis techniques: Use fundamental analysis to assess a company's financial health, competitive position, and future prospects.

- Assessing company financials: Scrutinize financial statements, including income statements, balance sheets, and cash flow statements.

- Identifying undervalued companies: Look for companies that might be undervalued relative to their intrinsic value and growth potential.

- Due diligence: Always conduct thorough due diligence before making any investment decisions.

Conclusion

BofA's analysis suggests that while high stock market valuations are a reality, they aren't necessarily a cause for immediate panic. Strong corporate earnings, low interest rates, and long-term growth potential all offer mitigating factors. The key takeaway is that a balanced, diversified investment strategy, focused on long-term growth and thorough due diligence, is a more effective approach than reacting emotionally to short-term market fluctuations. Manage your high stock market valuation concerns by focusing on a long-term strategy and understanding the broader economic context. To further understand BofA's perspective, research their full report on high stock market valuations and develop an informed investment plan to navigate high stock market valuations effectively.

Featured Posts

-

Win Big At The B And W Trailer Hitches Heavy Hitters Tournament Smith Mountain Lake Next Week

May 11, 2025

Win Big At The B And W Trailer Hitches Heavy Hitters Tournament Smith Mountain Lake Next Week

May 11, 2025 -

Selena Gomezs Edgy Leather Outfit Movie Character Vibes

May 11, 2025

Selena Gomezs Edgy Leather Outfit Movie Character Vibes

May 11, 2025 -

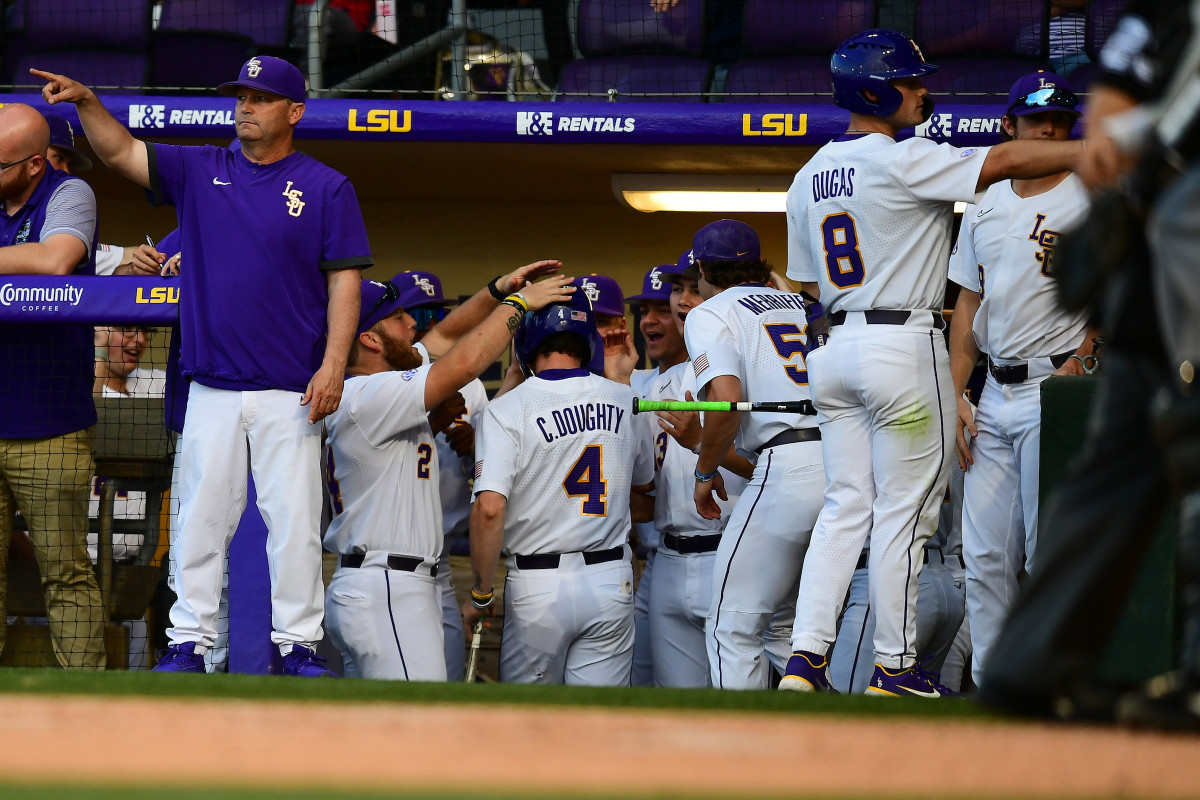

Vol Baseballs Late Surge Evens Series Against Lsu

May 11, 2025

Vol Baseballs Late Surge Evens Series Against Lsu

May 11, 2025 -

Hotel Transylvania A Complete Guide To The Monster Filled Franchise

May 11, 2025

Hotel Transylvania A Complete Guide To The Monster Filled Franchise

May 11, 2025 -

Benny Blanco Cheating Rumors What We Know About The Selena Gomez Speculation

May 11, 2025

Benny Blanco Cheating Rumors What We Know About The Selena Gomez Speculation

May 11, 2025