High Stock Market Valuations: Why BofA Believes Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's analysis suggests that the high stock market valuation isn't necessarily a cause for immediate alarm. Their reasoning rests on several key pillars: strong corporate earnings, the low-interest-rate environment, and the continued influence of technological innovation.

Strong Corporate Earnings and Profitability

BofA's research highlights robust corporate earnings and profitability as a key justification for current stock market valuations. Many companies are demonstrating impressive financial health, supporting the current price levels.

- Examples of high-performing sectors: The technology sector, particularly software and cloud computing companies, has shown exceptional growth. Furthermore, the healthcare and consumer staples sectors have demonstrated resilience.

- Positive revenue growth projections: Numerous companies are projecting continued revenue growth, bolstering investor confidence and justifying higher valuations. BofA's analysis suggests these projections are largely grounded in solid market fundamentals.

- Robust balance sheets of major companies: Many large corporations possess strong balance sheets, providing a cushion against economic downturns and supporting their capacity for continued growth and investment. This financial strength contributes to investor confidence in the market's long-term prospects. Specific examples and data points from BofA reports could further solidify this point.

Low Interest Rates and Monetary Policy

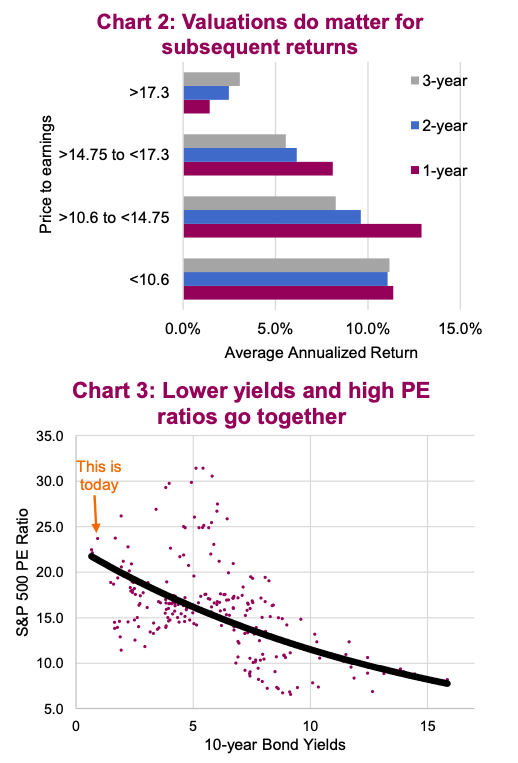

The current low-interest-rate environment significantly influences stock valuations. Lower interest rates make borrowing cheaper for companies, fueling investment and economic growth. This environment also makes bonds less attractive compared to equities, driving investors towards the stock market.

- Impact of quantitative easing: Past quantitative easing programs have injected liquidity into the market, contributing to higher valuations.

- Potential for further monetary stimulus: The possibility of continued monetary easing could further support asset prices.

- Comparison to historical low-interest rate periods: A comparison of the current low-interest-rate environment to similar periods in history helps contextualize the current market conditions and provides valuable insights into potential future trends.

Technological Innovation and Growth Sectors

Technological innovation continues to fuel significant growth in specific sectors, contributing to overall market valuations. Emerging technologies and disruptive business models are creating new opportunities and driving valuations upward.

- Examples of high-growth sectors: The technology sector (AI, cybersecurity, cloud computing), renewable energy, and biotechnology are examples of sectors exhibiting rapid growth and attracting significant investment.

- Their contribution to overall market performance: These high-growth sectors are disproportionately influencing overall market performance and justifying higher valuations for the broader market.

- Potential for future growth: The continued innovation and expansion in these sectors promise substantial future growth potential.

Addressing Potential Risks and Counterarguments

While BofA presents a positive outlook, it's crucial to acknowledge potential risks and counterarguments. A balanced perspective is necessary for informed investment decisions.

Valuation Metrics and Their Limitations

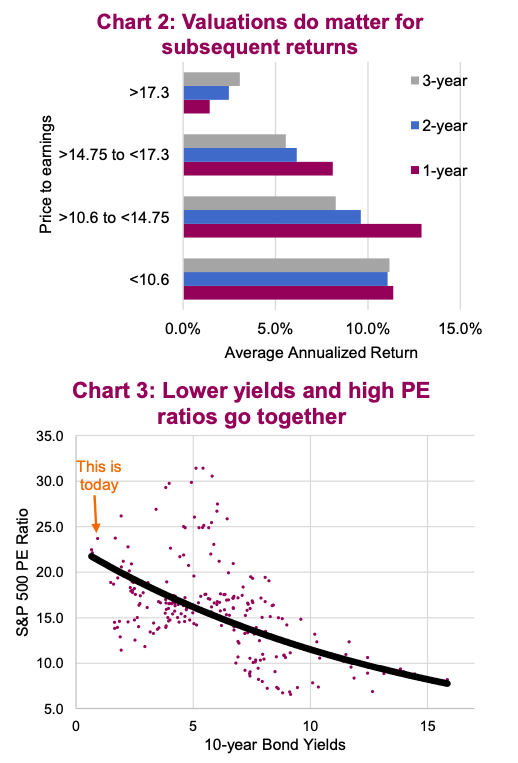

Various valuation metrics, such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio, are used to assess whether stocks are overvalued or undervalued. However, these metrics have limitations.

- Explain the nuances of interpreting valuation ratios: A high P/E ratio doesn't automatically indicate overvaluation; it needs to be considered within the context of the company's growth prospects and industry benchmarks.

- Potential for distortions: Accounting practices and one-time events can distort valuation ratios, making them unreliable indicators in isolation.

- The importance of considering other factors beyond valuation metrics: Fundamental analysis, qualitative factors, and macroeconomic conditions should all be considered alongside valuation metrics.

Geopolitical and Economic Uncertainties

Global economic and geopolitical uncertainties pose risks to the market's stability and future trajectory. These uncertainties can influence investor sentiment and potentially lead to market corrections.

- Discuss potential threats: Inflation, supply chain disruptions, geopolitical instability, and potential interest rate hikes are all significant factors to consider.

- How BofA assesses their impact on valuations: BofA likely incorporates these uncertainties into its overall risk assessment, adjusting its outlook accordingly.

Market Corrections and Volatility

Even with positive long-term prospects, market corrections and periods of volatility are inevitable. Investors should prepare for fluctuations.

- Explain the importance of risk management: Risk management, through diversification and appropriate asset allocation, is crucial to mitigate potential losses during market downturns.

- Diversification and long-term investment strategies: A diversified portfolio, spread across different asset classes and sectors, can help reduce overall portfolio volatility and protect against significant losses. A long-term investment horizon allows investors to ride out short-term market fluctuations.

BofA's Investment Strategy Recommendations

Based on their analysis, BofA likely suggests a balanced approach to investing.

Sector-Specific Opportunities

BofA might highlight specific sectors exhibiting strong growth prospects and reasonable valuations.

- Examples of sectors with strong growth prospects and reasonable valuations: Identifying these sectors requires in-depth research and analysis, which BofA presumably provides to its clients.

Long-Term Investment Horizon

BofA likely emphasizes the importance of a long-term investment horizon.

- Explain the benefits of long-term investing: Long-term investing allows investors to benefit from the compounding effect of returns and weather short-term market fluctuations.

Diversification and Risk Management

BofA will undoubtedly recommend a diversified portfolio and prudent risk management strategies.

- Suggest practical steps: This might include diversification across asset classes, sectors, and geographies, as well as establishing a clear risk tolerance level.

Conclusion

BofA's assessment suggests that while high stock market valuations exist, they aren't necessarily a cause for immediate concern. Their rationale rests on strong corporate earnings, a low-interest-rate environment, technological innovation, and a considered assessment of risks. However, acknowledging market uncertainties and implementing robust risk management strategies remain crucial. Don't let concerns about high stock market valuations deter you from a well-researched investment strategy. Understand the nuances, manage risk effectively, and consider the long-term potential. Conduct thorough research and consult with financial advisors before making any investment decisions.

Featured Posts

-

Albertas Low Oil Levy A Growing Orphan Well Problem

May 29, 2025

Albertas Low Oil Levy A Growing Orphan Well Problem

May 29, 2025 -

Ancelotti And Simeone React To Real Madrids 2 1 Victory Over Atletico

May 29, 2025

Ancelotti And Simeone React To Real Madrids 2 1 Victory Over Atletico

May 29, 2025 -

Flagowa Inwestycja Pcc Zagrozenie Opoznien I Wzrostu Kosztow

May 29, 2025

Flagowa Inwestycja Pcc Zagrozenie Opoznien I Wzrostu Kosztow

May 29, 2025 -

Perennials Vs Annuals Making The Best Choice For Your Flowerbeds

May 29, 2025

Perennials Vs Annuals Making The Best Choice For Your Flowerbeds

May 29, 2025 -

Guia Practica De Los Arcanos Menores Del Tarot

May 29, 2025

Guia Practica De Los Arcanos Menores Del Tarot

May 29, 2025

Latest Posts

-

Trump And Musk A New Chapter Begins

May 31, 2025

Trump And Musk A New Chapter Begins

May 31, 2025 -

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Vliyanie Vrkhu Klasiraneto Mu

May 31, 2025

Kontuziyata Na Grigor Dimitrov Vliyanie Vrkhu Klasiraneto Mu

May 31, 2025 -

The Truth About Donald Trump And His Friend Debunking The Elon Musk Rumors

May 31, 2025

The Truth About Donald Trump And His Friend Debunking The Elon Musk Rumors

May 31, 2025 -

15 To Uchastie Na Grigor Dimitrov Na Rolan Garos Kakvo Da Ochakvame

May 31, 2025

15 To Uchastie Na Grigor Dimitrov Na Rolan Garos Kakvo Da Ochakvame

May 31, 2025