High Stock Market Valuations: A BofA Analyst Explains Why Investors Shouldn't Panic

Table of Contents

Understanding Current High Stock Market Valuations

What constitutes "high" valuations? It's a complex question, often answered by analyzing key metrics like the Price-to-Earnings ratio (P/E ratio). The P/E ratio compares a company's stock price to its earnings per share, providing insight into how much investors are willing to pay for each dollar of earnings. A high P/E ratio generally suggests that investors anticipate strong future growth. Other metrics, such as the Shiller PE (CAPE ratio), which considers inflation-adjusted earnings over a longer period, offer a more nuanced perspective.

-

Definition of key valuation metrics:

- P/E Ratio: Current stock price divided by earnings per share. A higher P/E ratio suggests higher investor expectations.

- Shiller PE (CAPE Ratio): Cyclically adjusted price-to-earnings ratio, considering 10-year average inflation-adjusted earnings. Offers a smoother picture than the standard P/E ratio.

- Price-to-Sales Ratio (P/S): Market capitalization divided by revenue. Useful for companies with negative earnings.

-

Comparison of current valuations to historical averages: BofA's analysis (hypothetical data for illustrative purposes) might show that current P/E ratios are higher than the historical average, but not necessarily unprecedented. For instance, the S&P 500 P/E ratio might be at 25, compared to a historical average of 15, indicating higher valuations. However, low interest rates and strong corporate earnings could partially justify these elevated levels.

-

Factors contributing to high valuations:

- Low interest rates: Low borrowing costs make equities more attractive compared to bonds, driving up demand and prices.

- Strong corporate earnings: Robust corporate profits support higher stock prices, justifying higher P/E multiples.

- Technological innovation: High growth potential in technology sectors often results in premium valuations.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in influencing stock market valuations. There's an inverse relationship between interest rates and stock prices.

-

Inverse relationship between interest rates and stock prices: When interest rates are low, the opportunity cost of investing in stocks is lower, making equities a more attractive investment. Conversely, high interest rates make bonds more appealing, potentially diverting investment away from the stock market.

-

Low borrowing costs incentivize investment in equities: Cheap borrowing costs allow companies to invest more readily, fueling growth and further driving up stock valuations.

-

BofA's research on interest rate impact (hypothetical example): BofA's analysts might have found that a 1% decrease in interest rates historically correlated with a 10% increase in the S&P 500 index over a 2-year period. This illustrates the significant influence of interest rate policy on stock market valuations.

Why a Measured Approach is Preferred Over Panic Selling

The fear of a market correction is understandable, but selling in panic is often detrimental.

-

Unpredictable nature of market timing: Attempting to time the market is notoriously difficult, even for seasoned professionals. Panicked selling often leads to locking in losses at the worst possible time.

-

Importance of long-term investment strategies: A long-term investment strategy that focuses on diversification and value investing can help mitigate the risks associated with market volatility.

-

BofA’s research supporting a long-term outlook (hypothetical example): BofA might show that investors who remained invested through previous market corrections historically outperformed those who tried to time the market. This reinforces the importance of a long-term perspective.

Opportunities within High Valuations

Even with high valuations, opportunities exist. Careful selection is key.

-

Sectors with strong growth potential: While overall valuations might be high, specific sectors like renewable energy or artificial intelligence might still offer attractive growth prospects, justifying their high valuations.

-

BofA's recommendations (hypothetical examples): BofA analysts might suggest focusing on companies with strong fundamentals, competitive advantages, and sustainable growth potential within these sectors.

-

Importance of due diligence and selective investment: Thorough research and due diligence are critical to identifying undervalued companies or sectors even within a high valuation environment.

BofA's Specific Predictions and Recommendations

BofA's forecast (hypothetical) might predict continued market growth, but at a moderated pace. They might anticipate that high valuations will persist but with increased volatility.

-

Projected market growth (hypothetical): BofA's analysts might project a 5-7% annual growth for the S&P 500 over the next 3 years, a slower pace than in previous years.

-

Specific recommendations (hypothetical): BofA might recommend a diversified portfolio, focusing on sectors with strong long-term growth potential and companies with sound financial performance, while maintaining a long-term investment horizon.

-

Reasoning behind BofA's predictions: Their predictions are likely based on macroeconomic factors, interest rate projections, and analysis of corporate earnings and future growth prospects.

Conclusion

High stock market valuations are influenced by factors such as low interest rates, and while they might seem alarming, panic selling is often counterproductive. A long-term investment strategy is crucial, and BofA suggests a measured approach. Don't let fear dictate your investment decisions. Instead, adopt a measured approach to investing, conduct thorough research, and consider consulting a financial advisor for personalized guidance on navigating high stock market valuations. Understanding the nuances of high stock market valuations is key to making informed investment choices.

Featured Posts

-

Jadwal Siaran Langsung Moto Gp Argentina 2025 Di Trans7 Panduan Lengkap

May 26, 2025

Jadwal Siaran Langsung Moto Gp Argentina 2025 Di Trans7 Panduan Lengkap

May 26, 2025 -

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025 -

Saksikan Balapan Dini Hari Link Live Streaming Moto Gp Argentina 2025

May 26, 2025

Saksikan Balapan Dini Hari Link Live Streaming Moto Gp Argentina 2025

May 26, 2025 -

Understanding Flood Warnings Your Guide To Safety Nws

May 26, 2025

Understanding Flood Warnings Your Guide To Safety Nws

May 26, 2025 -

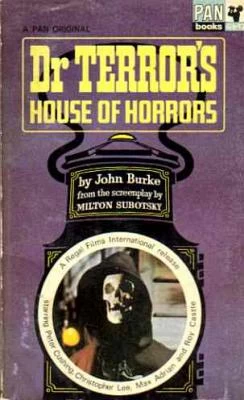

Dr Terrors House Of Horrors What To Expect

May 26, 2025

Dr Terrors House Of Horrors What To Expect

May 26, 2025

Latest Posts

-

Joint Venture Manitoba And Nunavut Develop Kivalliq Hydro Fibre Infrastructure

May 30, 2025

Joint Venture Manitoba And Nunavut Develop Kivalliq Hydro Fibre Infrastructure

May 30, 2025 -

High Rates Of Cfs Intervention Among First Nations Parents In Manitoba A 1998 2019 Analysis

May 30, 2025

High Rates Of Cfs Intervention Among First Nations Parents In Manitoba A 1998 2019 Analysis

May 30, 2025 -

Strategic Energy Corridor Manitoba And Nunavut Collaborate On Kivalliq Hydro Fibre Project

May 30, 2025

Strategic Energy Corridor Manitoba And Nunavut Collaborate On Kivalliq Hydro Fibre Project

May 30, 2025 -

Manitoba Child And Family Services First Nations Family Intervention Rates 1998 2019

May 30, 2025

Manitoba Child And Family Services First Nations Family Intervention Rates 1998 2019

May 30, 2025 -

Kivalliq Hydro Fibre Link A Strategic Energy And Economic Corridor For Manitoba And Nunavut

May 30, 2025

Kivalliq Hydro Fibre Link A Strategic Energy And Economic Corridor For Manitoba And Nunavut

May 30, 2025