Harvard And Yale: Proposed Endowment Tax Hike Explained

Table of Contents

Understanding the Proposed Endowment Tax Hike

Current Taxation of University Endowments

Currently, many university endowments in the US enjoy tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This means investment income generated by these endowments is typically not subject to federal income tax. These endowments often hold a diverse portfolio of assets, including stocks, bonds, real estate, and private equity. However, there are limitations on how these funds can be used; they must primarily serve the institution's educational and charitable purposes.

- Tax-Exempt Status: The significant tax advantages granted to university endowments are a key point of contention in the debate.

- Investment Portfolio Diversity: The vast wealth held in these endowments is invested in a variety of assets, generating significant returns.

- Usage Restrictions: Although tax-exempt, endowments are still subject to regulations governing their spending and investment strategies.

The Rationale Behind the Proposed Tax

The calls for increased taxation of university endowments stem from growing concerns about several key issues. Proponents argue that the vast wealth accumulated by these institutions contrasts sharply with the rising cost of higher education and the increasing financial burden on students. They believe that taxing these endowments could help address wealth inequality and fund crucial social programs or research initiatives.

- Wealth Inequality: The concentration of wealth within university endowments is seen by some as exacerbating existing inequalities.

- Affordability of Higher Education: The high cost of tuition and fees is a major concern, and taxing endowments is seen as a potential funding source to alleviate this burden.

- Funding for Social Programs and Research: Proponents argue that endowment tax revenue could be used to fund critical social programs or support vital research initiatives.

- Political Advocacy: Several politicians and advocacy groups are actively pushing for legislation to increase taxes on university endowments.

Specifics of Proposed Legislation (if available)

While specific legislation varies, several proposals suggest imposing a progressive tax rate on endowment assets exceeding a certain threshold. These proposals often include exemptions for funds designated for specific purposes, such as financial aid or specific research programs. The exact tax rate, threshold, and exemption details are still under debate and vary from proposal to proposal.

- Proposed Tax Rate: Specific tax rates vary depending on the proposal, but they are often structured as a graduated tax, with higher rates applied to larger endowments.

- Application Thresholds: Proposals typically establish a minimum endowment size before the tax applies, aiming to target only the wealthiest institutions.

- Potential Exemptions: Many proposals allow for exemptions for endowments dedicated to specific purposes, such as financial aid or scholarships. These exemptions are crucial to the debate, as they define the amount of the endowment actually taxed.

Arguments For and Against the Endowment Tax Hike

Arguments in Favor

Supporters of the endowment tax hike argue it is a necessary step to address systemic inequalities and ensure fairer distribution of resources.

- Increased Funding for Public Education: Tax revenue could significantly boost funding for public universities and colleges, making higher education more affordable and accessible.

- Addressing Wealth Inequality: Taxing large endowments is seen as a way to address the growing gap between the wealthiest institutions and the rest of society.

- Supporting Social Programs: Revenue generated could be used to fund crucial social programs and initiatives, addressing pressing societal needs.

- Increased Accessibility to Higher Education: Lowering the cost of higher education through endowment taxation is seen as a step towards creating a more equitable education system.

Arguments Against

Opponents of the tax argue it could have detrimental consequences for universities, students, and the broader economy.

- Negative Impact on University Research: Reduced endowment funds could lead to cuts in research funding, hindering scientific advancements and innovation.

- Reduced Financial Aid for Students: Universities may be forced to reduce financial aid programs, impacting students’ ability to afford higher education.

- Decreased Global Competitiveness: The tax could weaken the competitiveness of American universities on a global scale, affecting their ability to attract top faculty and students.

- Legal Challenges: The constitutionality of such a tax could be challenged in court, leading to costly and protracted legal battles.

Potential Impacts of the Endowment Tax Hike

Impact on Universities

The endowment tax hike could significantly impact university budgets, potentially leading to various changes.

- Budget Cuts: Universities may be forced to make significant budget cuts across various departments and programs.

- Reduced Financial Aid: Funding for financial aid programs could be drastically reduced, affecting access to higher education for many students.

- Decreased Research Funding: Support for research initiatives might be diminished, impacting scientific advancements and innovation.

- Potential Tuition Fee Increases: To compensate for lost revenue, universities might consider increasing tuition fees, further burdening students.

Impact on Students

The impact on students could be substantial, particularly for those relying on financial aid.

- Increased Tuition Fees: As mentioned above, tuition fees could increase, making higher education less accessible.

- Decreased Financial Aid Availability: Reduced financial aid could restrict access to higher education for many students, exacerbating existing inequalities.

- Changes to Admissions Policies: Universities might adjust their admissions policies, potentially making it more difficult for certain student populations to gain admission.

Broader Economic Impacts

The tax hike could create ripple effects throughout the wider economy.

- Changes to Investment Strategies: Universities might adjust their investment strategies, potentially impacting market behavior and investment flows.

- Decreased Philanthropy: The tax might discourage future philanthropic giving to universities, potentially hindering long-term growth and development.

- Changes to the Higher Education Landscape: The tax could reshape the landscape of higher education, potentially altering the competitive dynamics among universities.

Conclusion

The proposed endowment tax hike on institutions like Harvard and Yale presents a complex issue with significant implications. While proponents argue it could address wealth inequality and increase funding for critical programs, opponents express concerns about its potential negative impact on university operations, student access, and the broader economy. The debate highlights the intricate relationship between higher education, wealth, and societal well-being. The potential ramifications require careful consideration and a thorough understanding of the various perspectives involved.

Stay informed on the debate surrounding the endowment tax hike and learn more about the proposed legislation affecting Harvard and Yale endowments. Advocate for your position on this important issue concerning endowment tax hikes.

Featured Posts

-

Pernyataan Resmi Karding Tidak Ada Penempatan Pmi Di Kamboja Dan Myanmar

May 13, 2025

Pernyataan Resmi Karding Tidak Ada Penempatan Pmi Di Kamboja Dan Myanmar

May 13, 2025 -

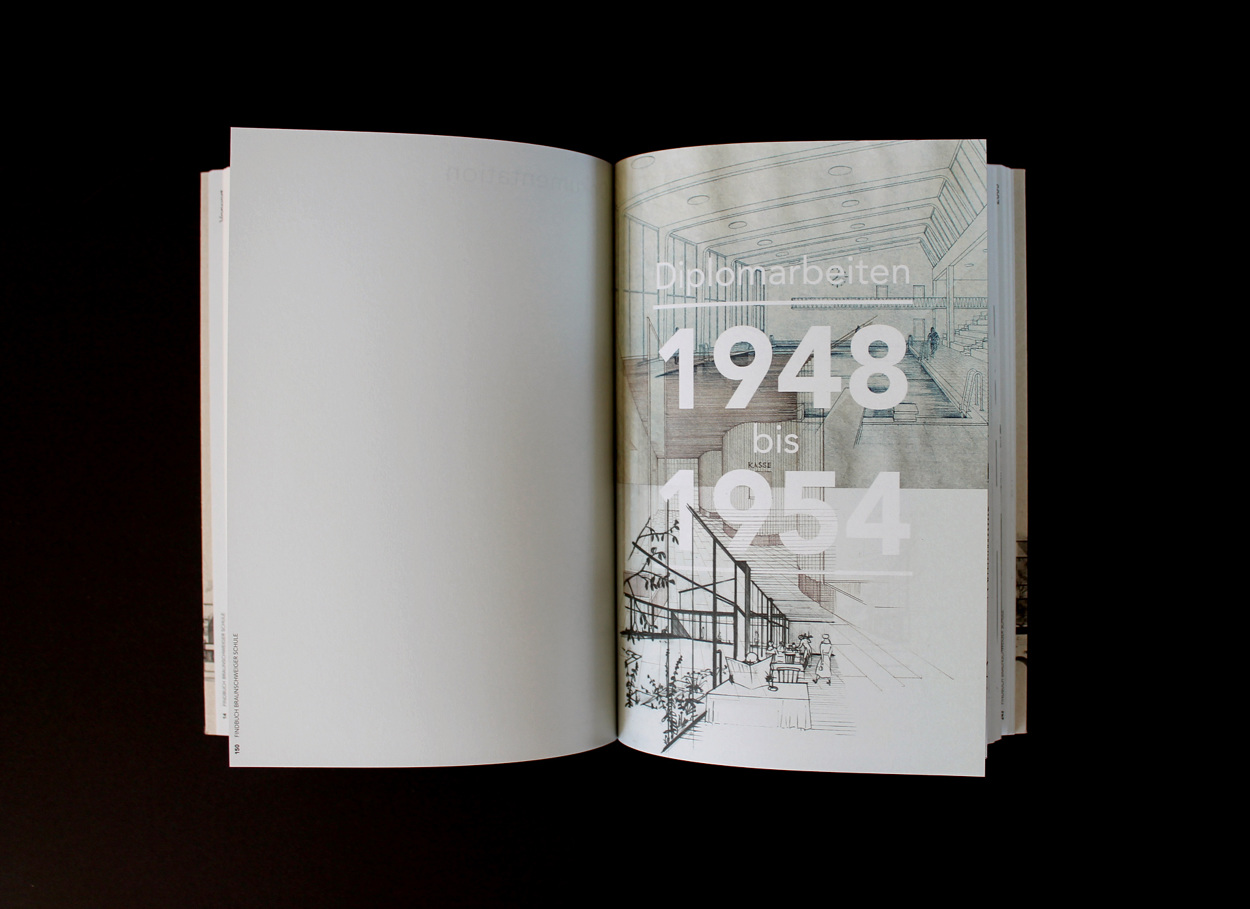

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt

May 13, 2025

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt

May 13, 2025 -

Evakuierung Braunschweiger Schule Aktuelle Informationen Zum Alarm

May 13, 2025

Evakuierung Braunschweiger Schule Aktuelle Informationen Zum Alarm

May 13, 2025 -

In Studio Draw How The Nhl Draft Lottery Changed

May 13, 2025

In Studio Draw How The Nhl Draft Lottery Changed

May 13, 2025 -

Flushed Away Characters Plot And Lasting Impact

May 13, 2025

Flushed Away Characters Plot And Lasting Impact

May 13, 2025

Latest Posts

-

Transferbomb Real Madrid Haalt Huijsen Binnen Voor E50 Miljoen

May 14, 2025

Transferbomb Real Madrid Haalt Huijsen Binnen Voor E50 Miljoen

May 14, 2025 -

Dean Huijsen Transfer News Chelseas June 14th Deadline

May 14, 2025

Dean Huijsen Transfer News Chelseas June 14th Deadline

May 14, 2025 -

E50 Miljoen Transfer Dean Huijsen Verruilt Nederland Voor Real Madrid

May 14, 2025

E50 Miljoen Transfer Dean Huijsen Verruilt Nederland Voor Real Madrid

May 14, 2025 -

Dean Huijsen To Chelsea Transfer Update June 14th Target

May 14, 2025

Dean Huijsen To Chelsea Transfer Update June 14th Target

May 14, 2025 -

Huijsen Naar Real Madrid Voor E50 Miljoen Bevestigd

May 14, 2025

Huijsen Naar Real Madrid Voor E50 Miljoen Bevestigd

May 14, 2025